Blockchain Technology Market Revenue to Cross USD 2773.17 billion by 2032

Page Contents

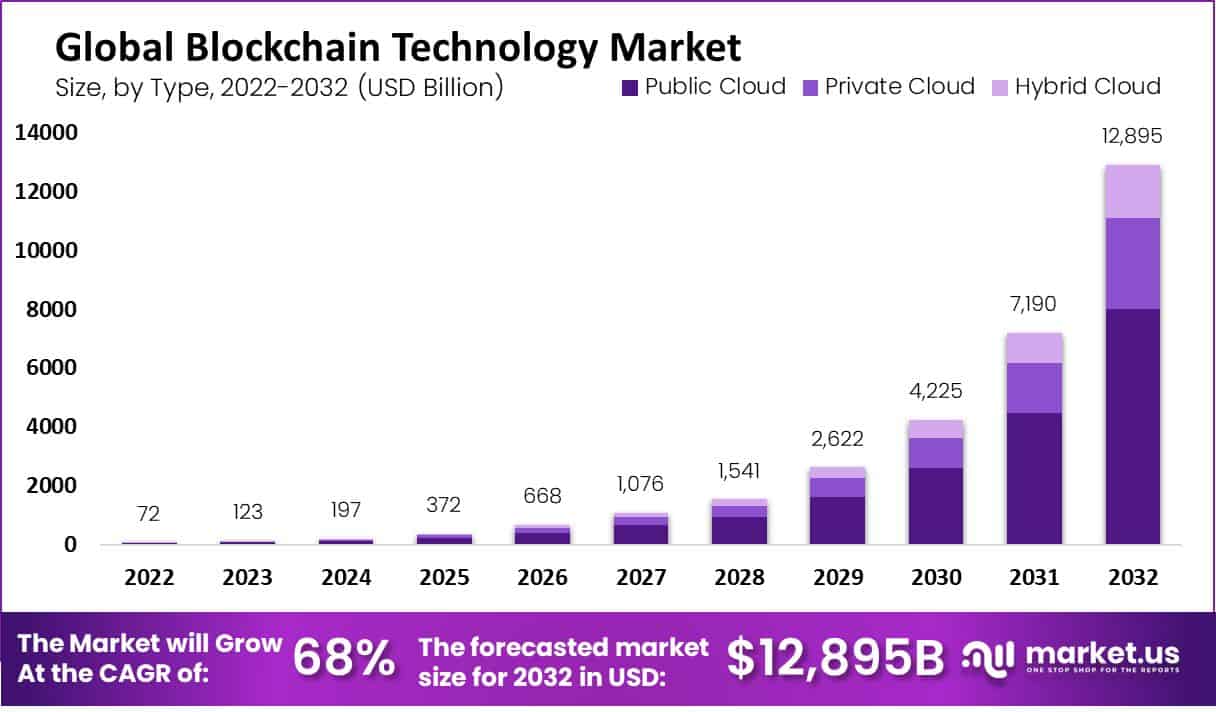

Published Via 11Press: The Blockchain Technology Market has demonstrated a remarkable trajectory, with its valuation in 2022 standing at USD 72 billion. This sector is poised for unprecedented growth, as forecasts predict the market value will surge to USD 12,895 billion by 2032. Such expansion can be attributed to a compounded annual growth rate (CAGR) of 68% over the period from 2023 to 2032. This significant growth underscores the increasing adoption and integration of blockchain technology across various industries, highlighting its transformative potential in enhancing transparency, security, and efficiency in digital transactions.

Key Takeaways

- The blockchain technology market was worth US$72 billion in 2022.

- It's estimated to grow at a rate of 68% annually.

- By 2032, it's projected to reach a whopping US$12,895 billion.

- Blockchain technology creates secure and transparent records of transactions across multiple computers.

- Cryptocurrencies like Bitcoin and Ethereum use blockchain for secure peer-to-peer transactions.

- Smart contracts, coded agreements that execute automatically, are a product of blockchain.

- The rise of decentralized finance initiatives is a significant driver of market growth.

- The legalization of cryptocurrencies encourages investment in blockchain technology.

- Cyberattacks are a significant concern impacting market growth.

- The lack of skilled professionals hampers the adoption of blockchain solutions.

- Public cloud services dominate the market due to cost competitiveness.

- Private cloud services are growing, especially in sectors like healthcare.

- The infrastructure & protocols segment holds the largest market share.

- Demand for protocols like Ethereum and Hyperledger drives this segment.

- The middleware segment is rapidly growing, especially in healthcare for data authentication.

- The payments segment leads due to cryptocurrency acceptance and efficiency in processing.

- Large enterprises are the main adopters, especially in sectors like healthcare and finance.

- Small and medium enterprises (SMEs) are seeking blockchain-based storage solutions.

- The BFSI sector dominates due to secure and efficient transactions facilitated by blockchain.

- North America leads the market currently, with increasing adoption in BFSI and retail.

- Asia Pacific is expected to grow fastest, with governments promoting blockchain.

- Companies are integrating AI with blockchain to create new market opportunities.

- There's a rising demand for cloud-based services, especially for virtual work environments.

- Blockchain-based identification platforms are gaining traction globally.

Inquire Before Buying Report: https://market.us/report/blockchain-technology-market/#inquiry

The blockchain technology market is experiencing robust growth, driven by its increasing adoption across various industries for enhancing security, transparency, and efficiency in transactions. In 2022, the market was valued at nearly USD 72 billion and is projected to witness an impressive CAGR of 68% from 2024 to 2032. It is projected to reach around USD 12895 billion by 2032. This surge is largely attributed to the digitalization in payment systems and the expansion of blockchain applications beyond financial services to sectors such as healthcare, government, retail, and transportation, showcasing the technology's versatility and potential for innovation.

Key market insights highlight the diverse applications of blockchain technology, ranging from digital identity management and smart contracts to supply chain optimization and cross-border payment facilitation. The public cloud segment, offering scalable and cost-effective infrastructure, dominates the market, emphasizing the demand for blockchain solutions that can support growing transaction volumes securely. Moreover, the payments segment within blockchain applications holds a significant market share, underscoring blockchain's role in enhancing payment system efficiency and reducing operational costs.

The market's growth is further supported by strategic partnerships and technological advancements introduced by leading companies. These include efforts to integrate blockchain with emerging technologies like artificial intelligence and the development of blockchain-as-a-service platforms to simplify adoption for businesses. For instance, collaborations such as the one between RYVYL and R3 to launch a blockchain-as-a-service platform exemplify the industry's direction towards making blockchain more accessible and applicable across various high-volume processing environments.

Regionally, North America leads the global blockchain technology market, thanks to a strong ecosystem of tech startups, venture capital investments, and a broad industrial application base. However, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period, propelled by supportive government policies and increasing technology investments by manufacturing companies.

The blockchain technology market is on a path of rapid expansion, fueled by continuous innovation, regulatory support, and the growing recognition of its benefits across different sectors. The technology's potential to address critical challenges like data security, transaction efficiency, and supply chain transparency positions it as a key driver of digital transformation in the years to come.

User Statistics

- Global Spending and Adoption: Spending on blockchain solutions is expected to rise from US$4.5 billion in 2020 to an estimated US$19 billion by 2024, reflecting the technology's increasing integration into government and corporate operations. Countries like El Salvador, Singapore, and the United Arab Emirates are at the forefront of blockchain adoption.

- Mainstream Acceptance in Financial Services: A staggering 96% of financial services pioneers believe blockchain has already achieved mainstream adoption. This sentiment is underpinned by the technology's potential to open new revenue streams and provide competitive advantages.

- Impact on Global GDP: Blockchain technology is expected to boost the global GDP by $1.76 trillion by 2030, underscoring its potential to revolutionize digital transformation, enhance security, and improve transparency in business operations.

- High Transaction Speeds: The Solana blockchain notably outperforms others in transaction speed, averaging around 4,000 transactions per second (TPS), which is significantly higher than Bitcoin and Ethereum, which process 7 TPS and 15 TPS, respectively. This highlights the trade-off between security and efficiency in blockchain networks.

- Corporate Blockchain Use: Major companies, including MicroStrategy and Tesla, have integrated blockchain into their business models and invested in cryptocurrencies, indicating the corporate world's growing confidence in blockchain's potential.

- Blockchain in Agriculture and Food: The agricultural and food sectors are also benefiting from blockchain technology, with the market value expected to reach $1.48 billion by 2026. This growth is driven by blockchain's ability to provide transparent and tamper-proof data management, crucial for food safety and supply chain integrity.

Benefits

benefits that are revolutionizing the way industries operate and how transactions are conducted. Here are some of the key advantages of blockchain technology, derived from insights across various sources:

- Increased Security and Transparency: Blockchain's distributed nature ensures that data is tamper-proof and virtually impossible to manipulate, offering a higher level of security and transparency. This is particularly beneficial in financial transactions and data management, where the integrity of the information is paramount.

- Decentralization and Distribution of Power: Unlike traditional centralized systems, blockchain operates on a decentralized network, reducing the risk of corruption and abuse of power. This distribution of control fosters a more equitable and democratic model of operations.

- Efficiency and Cost Savings: By eliminating intermediaries, blockchain allows for faster transaction processing at reduced costs. This efficiency is particularly advantageous in industries like finance and supply chain management, where quick and cost-effective operations are crucial.

- Enhanced Traceability and Accountability: Blockchain technology provides an immutable ledger, enabling the tracking of goods and transactions. This feature is invaluable for ensuring the authenticity of products and reducing fraud in supply chains.

- Better Data Management and Sharing: Offering a secure platform for data storage and sharing, blockchain technology prevents data loss or corruption and ensures that information is accessible and shareable in a secure manner.

- Interoperability and Blockchain Networks: The ability to share data and information across multiple blockchain systems enhances public access to data across different networks, making it easier for users to interact with various blockchain applications.

- Integration into Various Industries: Blockchain technology is being integrated into numerous sectors, including finance, healthcare, real estate, and energy, to streamline operations, improve security, and enhance customer service.

- Combination with Other Technologies: The convergence of blockchain with other emerging technologies like AI, IoT, and the Metaverse is creating new possibilities for innovative applications and more immersive digital experiences.

Drivers

- Necessity to Eliminate Third-Party Interference: The demand for blockchain technology is increasing as industries seek to remove intermediaries from their operational processes, enhancing efficiency and reducing costs

- Significant Growth in Healthcare: The healthcare sector's expansion is a critical driver, with blockchain being used to secure patient data, manage supply chains, and ensure the integrity of clinical trials.

- Investments in Small and Medium Enterprises (SMEs): Growing investments in SMEs are facilitating the adoption of blockchain to streamline operations, enhance security, and improve transaction transparency.

- Technological Advancements: Rapid advancements in technology, including the integration of blockchain with artificial intelligence and Internet of Things (IoT) devices, are propelling market growth. Such innovations offer new capabilities and applications for blockchain, from smart contracts to secure, decentralized data management.

- Increasing Adoption Across Various Industries: Blockchain's adoption is not limited to financial services but spans government, healthcare, retail, energy, and more. This wide applicability is due to blockchain's core attributes of security, transparency, and efficiency.

- Digital Identity Verification: The need for secure digital identity verification has become paramount in our increasingly digital world. Blockchain offers a solution by providing a decentralized and tamper-proof ledger for managing digital identities, which is driving its adoption, especially in finance, healthcare, and government sectors.

- Enhancing Payment Systems: Blockchain technology improves payment system efficiency, reduces operating costs, and offers transparency. Its ability to streamline payment processes and eliminate the need for middlemen is significantly impacting the market.

- Rising Demand for Smart Contracts and Security in Transactions: The demand for smart contracts and enhanced security measures in cross-border payments is contributing to the market's growth. Blockchain technology facilitates secure, transparent, and efficient transactions across various sectors.

Challenges

- Regulatory Uncertainty: The legal and regulatory framework for blockchain is still evolving, which creates uncertainty for businesses. Staying informed about regulatory changes and engaging with policy-makers can help mitigate this challenge.

- Security Concerns: Despite blockchain's secure nature, the technology is not immune to attacks, as seen in notable incidents like the PancakeBunny hack. Enhancing security measures and educating users on security best practices are crucial steps.

- Scalability and Performance: Blockchain networks, especially those like Bitcoin and Ethereum, face scalability issues, resulting in slow transaction speeds and high costs. Innovations such as Ethereum 2.0 and side-chain solutions like Polygon aim to address these concerns by increasing transaction throughput.

- Interoperability: The lack of standardization across different blockchain platforms hinders interoperability, making it difficult for systems to communicate with each other. Developing universal standards and protocols can improve interoperability.

- High Energy Consumption: The proof-of-work mechanism, used by networks like Bitcoin, requires substantial energy, raising environmental concerns. Transitioning to more energy-efficient consensus mechanisms, such as proof-of-stake, can reduce blockchain's carbon footprint.

- Adoption Hurdles: The complexity of blockchain technology and lack of understanding can deter adoption. Collaborative efforts, user education, and highlighting practical applications can encourage broader acceptance.

- Skills Gap: There's a shortage of skilled blockchain professionals. Leveraging Blockchain as a Service (BaaS) offerings and investing in training and development can help close this gap.

- Financial Resources: The cost of implementing and maintaining blockchain solutions can be prohibitive for some organizations. Building a strong business case demonstrating the ROI of blockchain initiatives can secure the necessary funding.

- Trust Issues: Building trust among users, especially in public blockchains, is challenging. Private blockchains and consortiums where participants are known to each other can help build trust.

- Workforce Availability: The demand for blockchain talent outstrips supply, leading to a labor market crunch. Attracting and retaining talent through competitive compensation and fostering a culture of innovation are key strategies.

Opportunities

- Decentralized Finance (DeFi) and Smart Contracts: DeFi continues to grow, utilizing blockchain to create a more open, accessible, and efficient financial system. Smart contracts automate transactions and agreements, reducing the need for intermediaries and increasing efficiency and trust in business operations.

- Web 3.0 and the Metaverse: Blockchain is at the heart of the transition to Web 3.0, providing a decentralized, user-sovereign internet. This includes the development of the Metaverse, where blockchain enables secure, immersive virtual environments for social engagement, gaming, and more. The integration of blockchain in these spaces ensures user autonomy and secure, transparent transactions.

- Ethereum's Continued Leadership: Ethereum remains the most widely adopted blockchain, with developments like the Shanghai upgrade and innovations such as EIP-4844 aiming to improve scalability and efficiency. These advancements position Ethereum as a leader in blockchain technology, encouraging greater adoption and investment.

- Increased NFT Utility: Beyond digital art, NFTs are finding new applications in commercial and personal spaces. Brands like Starbucks are exploring NFTs for loyalty programs, while the concept of “phygital” items merges physical and digital ownership, enhancing the utility and appeal of NFTs.

- Investment DAOs: Investment decentralized autonomous organizations (DAOs) offer a transparent and collaborative approach to investing. Leveraging the collective wisdom and consensus of their members, investment DAOs democratize financial decision-making and provide access to high-potential opportunities, making the investment landscape more inclusive and equitable.

Recent Developments

- Innovations in Zero-Knowledge Technology: 2023 saw the launch of several zero-knowledge (zk) rollups aimed at enhancing blockchain efficiency by reducing transaction space requirements and gas fees. Projects like zkSync Era, Polygon’s zkEVM, Linea, and the =nil; Foundation have been pivotal, although challenges regarding decentralization and upgradability risks remain to be fully addressed.

- Blockchain Interoperability Enhancements: Significant strides have been made towards blockchain interoperability, with protocols like Chainlink’s CCIP and partnerships between LayerZero and major entities such as Google Cloud and JPMorgan. These developments aim to facilitate seamless communication and liquidity transfer across various blockchain networks, enhancing the ecosystem's overall functionality.

- Tokenization of Real-World Assets (RWA): Efforts to bring more liquidity on-chain have involved exploring ways to tokenize real-world assets, allowing them to serve as collateral. Stablecoins, such as Circle’s USDC and Tether’s USDT, are examples of RWAs widely used across DeFi protocols. Protocols like Centrifuge, Maple Finance, and Goldfinch are leading the charge in on-chain financing, showcasing the potential for diverse assets to be integrated into the blockchain.

- AWS and Ava Labs Partnership: In January 2023, AWS partnered with Ava Labs to scale blockchain adoption across various sectors, supporting Avalanche's infrastructure and decentralized applications.

- RYVYL and R3 Collaboration: December 2023 marked the partnership between RYVYL and R3, resulting in the launch of ‘RYVYL Block,’ a blockchain-as-a-service platform designed to facilitate blockchain adoption in high-volume processing environments.

- DTCC's Acquisition of Securrency Inc.: In October 2023, DTCC acquired digital asset infrastructure developer Securrency Inc., aiming to embed digital assets within its existing offerings and explore new blockchain-based use cases.

- LayerZero and Google Cloud: In September 2023, LayerZero partnered with Google Cloud, designating it as the primary oracle provider to verify transactions transmitted across blockchains by LayerZero's dapps.

Blockchain Technology Market Segmentation

By Type

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Component

- Infrastructure & Protocols

- Application & Solution

- Middleware

By Application

- Exchanges

- Digital Identity

- Smart Contracts

- Payments

- Supply Chain Management

- Other Applications

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End-User

- Government

- Financial Services

- Media & Entertainment

- Transportation & Logistics

- Healthcare

- Retail

- Travel

- Other End-uses

Key Players Analysis

Analyzing the key players within the blockchain technology market reveals a landscape dominated by innovation, strategic collaborations, and a commitment to advancing the adoption of blockchain across various sectors.

- IBM Corporation is renowned for its pioneering efforts in blockchain technology, focusing on creating secure and efficient business solutions. While specific current initiatives were not accessible due to restrictions, IBM's history of innovation suggests continuous development in blockchain applications across industries such as finance, healthcare, and supply chain management.

- The Linux Foundation, through its Hyperledger project, plays a crucial role in fostering an open-source, global ecosystem for enterprise-grade blockchain technologies. Hyperledger is trusted by a significant number of the top 100 public companies, offering a suite of blockchain technologies that advance areas such as digital identity, supply chain logistics, and decentralized finance. The project's emphasis on collaboration and innovation is evident in its comprehensive range of projects, including Hyperledger Fabric, which is designed for developing solutions with a modular architecture.

- Microsoft Corporation has also been instrumental in the blockchain space, although specific details on their latest projects were not directly available through this search. Generally, Microsoft's blockchain as a service (BaaS) on Azure enables businesses to deploy blockchain applications efficiently. Their solutions often focus on transparency, security, and simplifying the integration of blockchain technology with existing systems.

- Other key players like Chain, Inc., Circle Internet Financial Ltd., and Deloitte Touche Tohmatsu Limited contribute significantly to the market's diversity and growth. These companies are known for their innovative blockchain solutions that span from financial services to global supply chain management, showcasing the technology's versatility and wide-ranging applications.

- Smaller entities like Global Arena Holding, Inc. (GAHI) and Indian Banks’ Blockchain Infrastructure Company Private Limited (IBBIC) highlight the market's depth, with efforts ranging from electoral processes to banking infrastructure development. These players underscore the technology's potential to revolutionize traditional systems and processes.

- Oracle Corporation is another titan in the field, known for its comprehensive Oracle Blockchain platform that helps organizations to increase trust and provide agility in transactions across their business networks.

This landscape is characterized by rapid innovation, with key players focusing on enhancing security, efficiency, and the interoperability of blockchain systems. Their collective efforts are geared towards solving complex business challenges, fostering transparency, and driving the adoption of blockchain technology across a multitude of sectors. The commitment to research, development, and collaboration among these companies continues to push the boundaries of what blockchain can achieve, solidifying its role as a transformative technology for the digital age.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 72 Bn |

| Forecast Revenue (2032) | USD 12,895 Bn |

| CAGR (2023-2032) | 68% |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.