Most Crucial Credit Card Statistics And Trends For 2023 To Show The Growth

Page Contents

Credit Card Statistics: Nowadays, credit cards play a crucial role in people's day-to-day financial interests. As inflation is rising across the world, more and more people appear to be depending on credit cards for their daily financial transactions. Credit card penetration differs majorly across the globe as in some countries nearly all consumers use Visa or MasterCard-issued credit cards while consumers in some nations barely use these credit cards. Here we will discuss some of the most prominent credit card statistics showing the number of people using credit cards, their preferred issuers and networks, and how often and purposes behind using these cards.

Important Credit Card Statistics:

(Source: forbes.com)

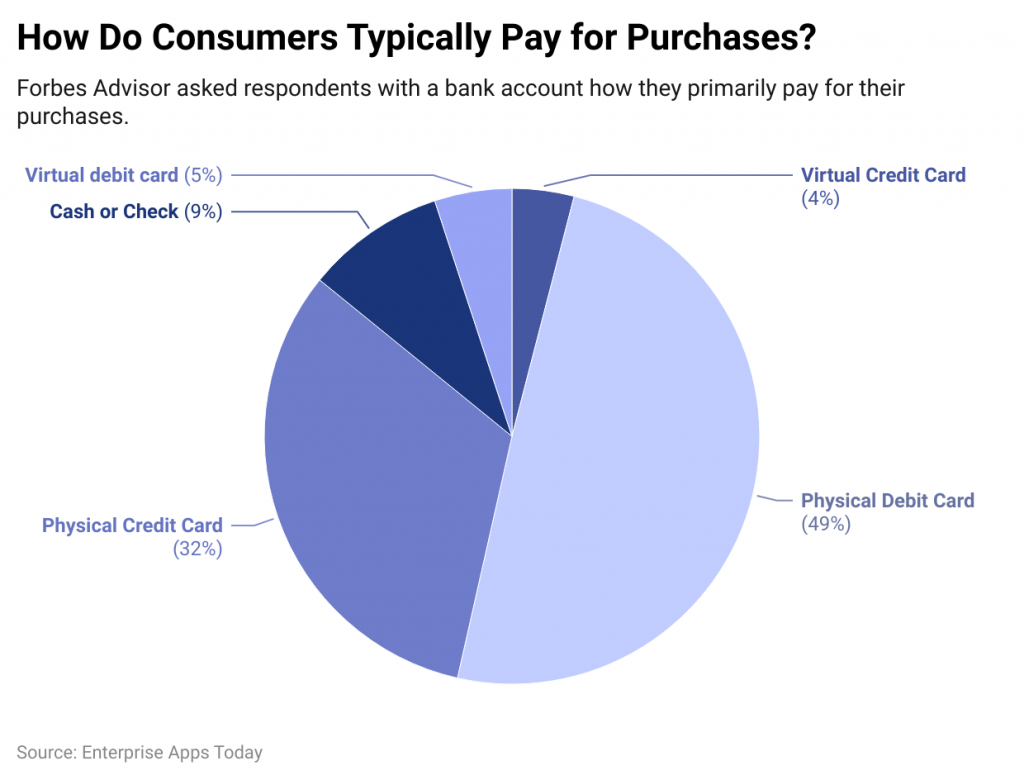

- As of February 2023, physical credit card is used by 32% and virtual credit card users (4%)which is lower as compared to debit card usage.

- Credit cards are mostly used by 96% of college graduates and 52% of users belong to school students.

- The majority of credit card holders are Asian Americans (93%) and Caucasian Americans (88%) in 2023.

- According to Forbes reports, the annual income of 98% of credit card users is more than $100,000.

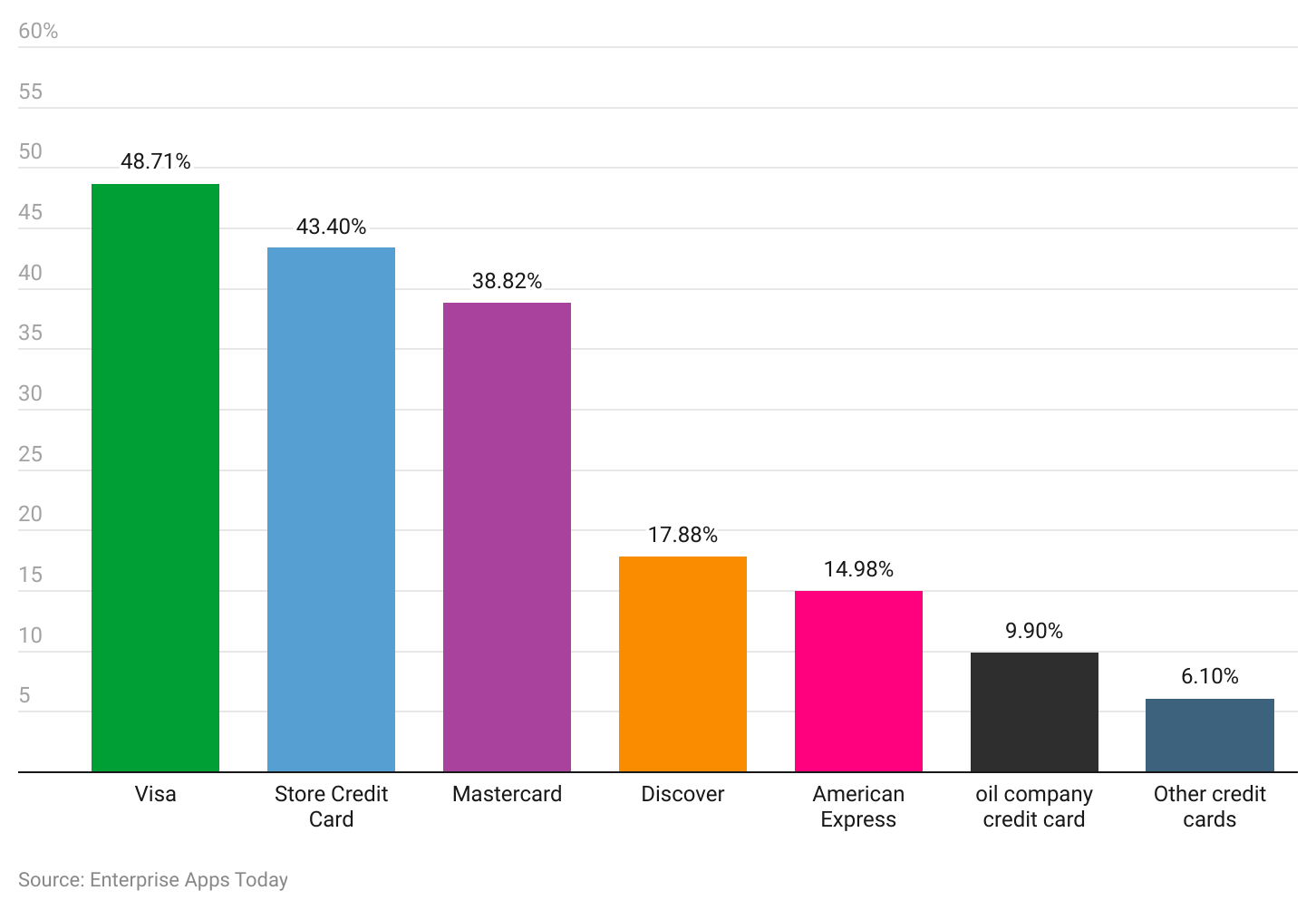

- Visa has nearly 71% of the credit card market share worldwide.

- As of 2023, MasterCard accounts for 24%of the credit card market share globally, and in the United States it resulted in 25.7%

- Visa, MasterCard, American Express, and Discover are major credit card networks.

- Gen Z accounts for the lowest average number of credit cards.

- In the United States, credit card market share is around 10.5%

- By the middle of March 2023, the average interest rate of credit cards is around 24.08%.

- In 2023, credit card utilization has been recorded at 6%.

- An average user in the US has around 3 credit cards.

- Around 1% of credit card users in the US with income below $ 100,000 are more likely to carry a month-to-month balance.

- In the 2nd quarter of 2023, credit card accounts were 578.35 million an increase by 5.2% from last year.

- On the other hand, totaled credit card debt resulted in $1.031 billion.

- 14% of people in the US utilize credit cards to pay their monthly bills.

- Nearly 49% of people in the US have not changed their primary credit card in the last five years.

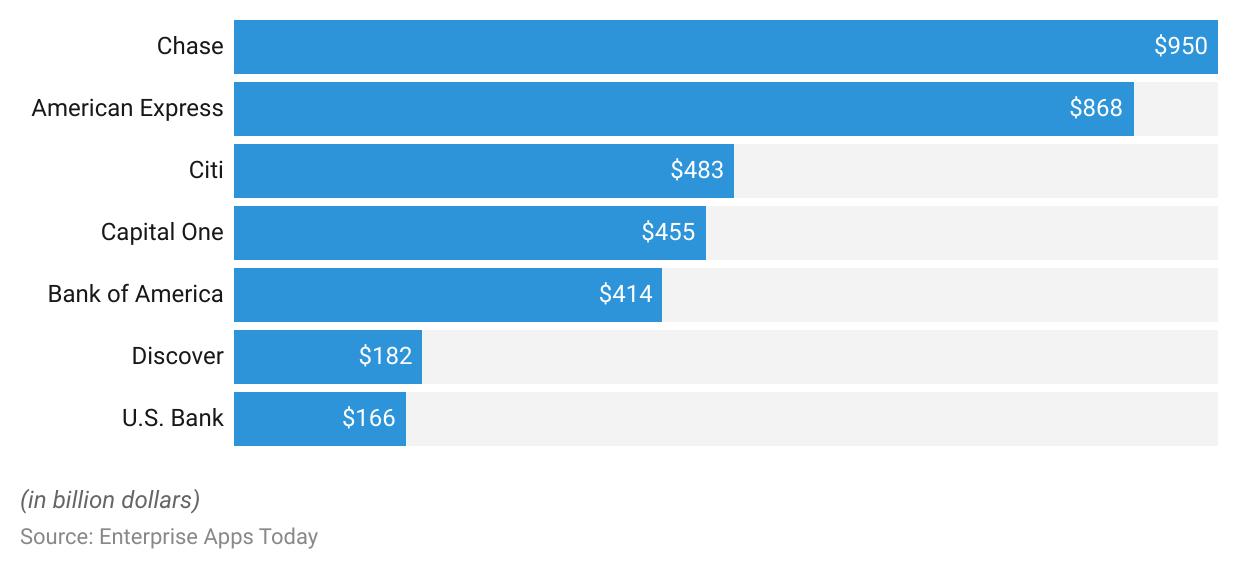

- Chase is the top issuer of general-purpose credit cards in the United States.

- Around seven leading credit card issuers made around $3.517 trillion in purchase volume last year.

- A debit card is still the most preferred type of payment accounting for 10 of the 35 payments made and a 28% share of card payments.

By age, Usage, Ethnicity, Generation, and Income

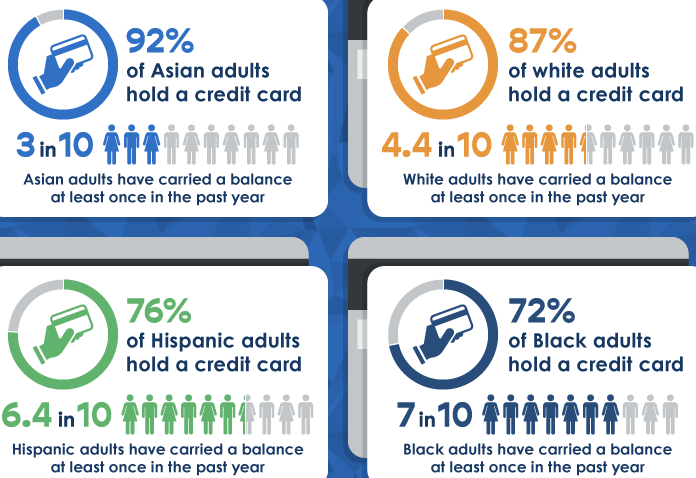

- The usage of credit cards differs by race and ethnicity. 87% of white adults own credit cards and nearly 44% of them have carried over a balance at least once in the last year. While more than 90% of Asian adults possess a credit card and only 5 out of 10 Asian adults have carried over a balance at least once in 2023.

- As of 2023, credit card users in the United States statistics by race and ethnicity are followed by Asian (93%), White (88%), Hispanic (77%), and Black (72%).

- Credit card user statistics by education are bachelor’s degree or more (96%) remained highest. On the other hand, 83% of credit card users have a college or associate's degree, 76% high school degree, and 52% have less than a high school degree.

- Gen Z accounts for the lowest average number of credit cards

- Baby boomers account for the highest average number of credit cards with 1.91.

- Millennials (3.18), Generation (4.23), Baby Boomers (4.61), and Silent Generation (3.64).

- As of 2023, almost 61% of credit card users belong to the age groups of 50 years to 64 years.

- Other user statistics are followed by 30 years – 49 years (55%), and 18 years – 29 years (44%).

#1. 92% of Asian adults, 87% of white adults, 72% of people of color, and 76% of Hispanic adults own credit cards

(Source: Federal Reserve)

#2. An average user in the US has at least 3 credit cards

As per a report on the economic well-being of US households, around 84% of adult people have a credit card. The 2021 credit card statistics show that an average person in the US has at least three credit cards.

#3. Almost all top-earning people in the US have a credit card

- A recent Federal Reserve Report has revealed that nearly 98% of US citizens earning $ 100,000 or more own a credit card.

- While 94% of people in the US earning are currently $50,000-$99,999, 84% of US citizens with $25000-$49,999, and 57% of users earning less than $25,000 income bracket per year have at least one credit card.

#4. New Jersey accounts for the most credit cards per person

- The state accounts for 3.49 credit cards per person. New Jersey is followed by New York with 3.34 credit cards per person.

- Other states statistics are followed by Rhode Island (3.26), Hawaii (3.25), California (3.23), Connecticut (3.23), Massachusetts (3.21), Florida (3.19), Nevada (3.18), and Maryland (3.16) are the highest number of credit cards per person.

#5. Nearly 49% of US citizens have not switched their credit cards in the last five years

Around 26% of them have not changed their top-of-the-wallet card. While 12% of them had done so about 5 to 10 years ago. Credit card statistics show that 11% of them had switched their primary credit cards around 10 years ago. Only 21% of US citizens changed their primary credit cards last year.

#6. Average credit card debt statistics by age

- In 2023, the highest average credit card debt of the 75 years and above age group is near about $8,100. Other average credit card balance statistics by age are followed by 45-54 years ($7,700), 65-74 years ($7,000), 55-64 years (6,900), 35-44 years ($6,000), and younger than 35 years ($3,700).

- Whereas, median credit card debt is followed by 45-54 years ($3,200), 55-64 years ($3,000), 65-74 years (2,900), 75 years and older ($2,700), 35-44 years ($2,600), and younger than 35 years ($1,900).

#7. Cashback is the most cherished feature among credit card holders in the US

A recent study has shown that around 41% of credit card holders have opted for the cashback feature of their credit cards. 14% of respondents have opted for the most widely popular credit cards. 9% of people have chosen credit cards with low interest rates and 5% of surveyed credit card holders have chosen credit cards with low fees. Around 6% of them have said that they like to choose credit cards that offer travel rewards.

#8. Nearly 62.14% of people in the US utilize their credit cards to pay their monthly expenses.

Around 52.92% of US citizens use their credit cards to pay travel bills. Around 36.5% of them utilize their credit cards to pay for their medical bills. 11.9% of people use their credit cards to pay for new car expenses. 10.21% of them pay their rent using their credit cards.

#9. In 2023, the average US credit card limit has been $6,568

The limit of the average US credit card has gone up by 0.43% in 2021. A limit of around $13000 is held in reserve for people with first-rate credit scores, no debt, and high income. While others can get a credit line with a limit closer to the national average.

#10. About 40.1% of credit card holders in the US carry over a balance month-to-month

Such credit card holders are also known as revolvers. They tend to utilize some parts of their credit lines and carry the rest of the balance over to the next month at least once in each quarter. Revolvers have contributed to 40.1% of all credit card holders in the fourth quarter of 2021. While 36.2% of credit card holders have not taken advantage of their credit lines in the 4th quarter of 2021.

#11. Alaska has the highest average credit limit in the US

By the end of the 2nd quarter of 2023, credit card holders in Alaska have received a credit limit of $7,338. Credit card owners in Connecticut have been given a credit limit of $6,825. States such as New Jersey ($6,819), Maryland ($6,668), Texas ($6,542), Florida ($6,408), Hawaii (6,343), and New York ($6,269).

#12. Wisconsin, Indiana, and Mississippi have the lowest credit limits of $11221, $11118, and $11055 respectively.

#13. Adults in the US who earn below $ 100,000 owning credit cards are more likely to utilize their credit cards to carry over balances from month to month.

#14. According to a report, 15.26% of US citizens have utilized their one credit card to pay for another one.

Credit Card Issuers And Networks Statistics

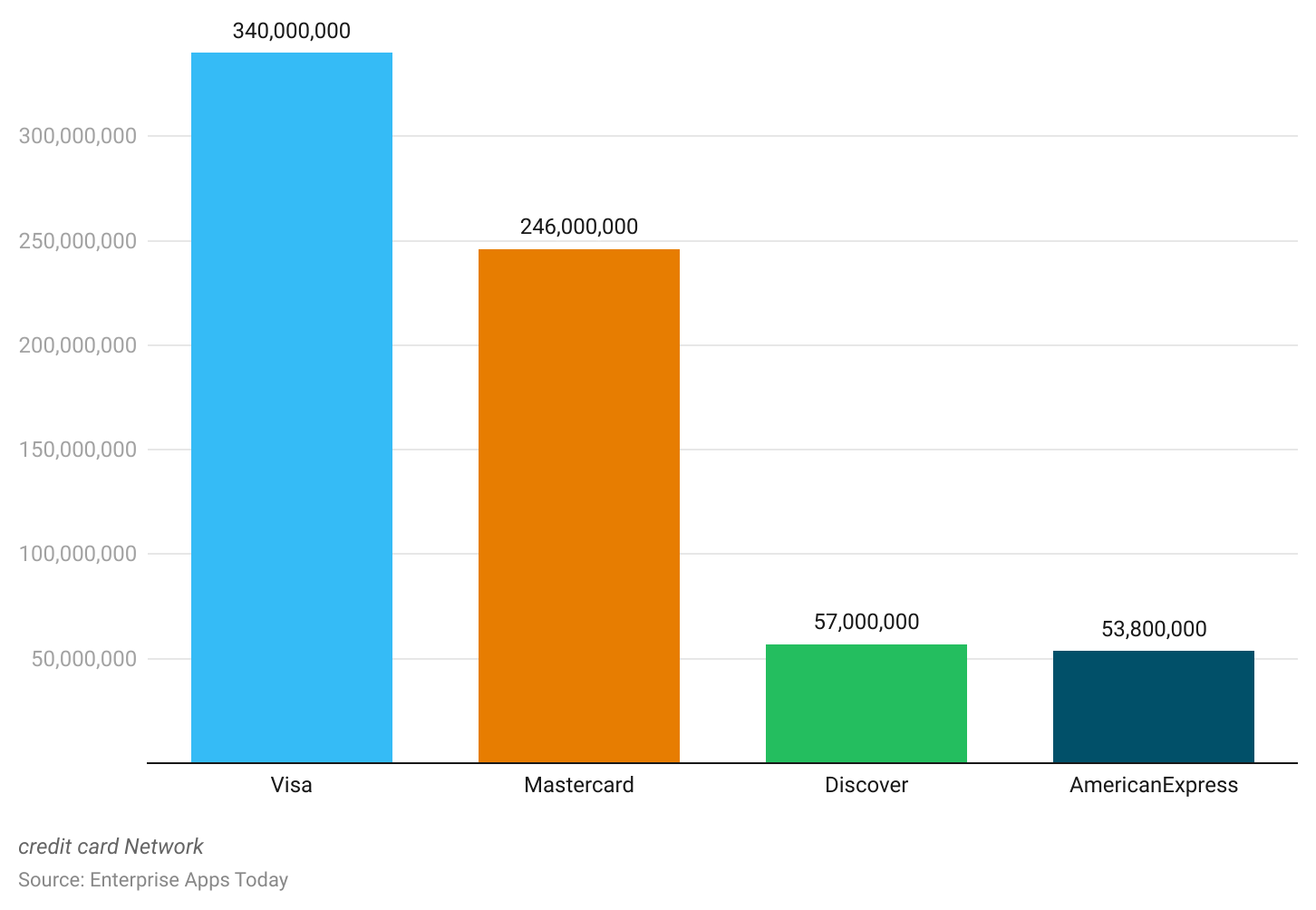

#15. Visa, MasterCard, American Express, and Discover are four major credit card networks

Credit card statistics show that Visa has around 340 million credit cards in circulation; MasterCard has 246 million credit cards in distribution. Discover contributes to 57 million credit cards and American Express accounts for 53.8 million credit cards in circulation.

(Source; Visa Inc)

#16. Chase is the top issuer of general-purpose credit cards in the US

Chase acquired a purchase value of $432.8 billion as of September 2023, making it the top issuer of general-purpose credit cards in the US. It is also the leading business credit card issuer in the US.

In the United States, Chase has issued approximately 149.3 million credit cards in 2023.

(Source: Nilson Report)

#17. Visa has nearly 52.8% of the credit card market share worldwide

This figure makes Visa the most widely used credit card in the world.

(Source: Nilson Report)

#18. The global credit card market size is expected to reach $101.98 billion in 2022

The worldwide credit card market size will be approximately $103.72 billion in 2023. It reflects a compound annual growth rate (CAGR) of 1.7%.

#19. American Express has acquired a purchase value of $499 billion by September 2023.

#20. Citibank, Capital One, Bank of America, Discover, and the US bank with purchase values of $483 billion, $455 billion, $414 billion, $182 billion, and $166 billion respectively are some leading issuers of general-purpose credit cards as well.

Credit Card Debts Statistics And Facts

#21. The median credit card debt per household in the US is $6,568

As per the latest credit card debt statistics, each household in the US has a debt of $6,568 on average in non-revolving credit by the end of September 2023.

#22. People in the US falling in the 90th and 100th yearly income have a median credit card debt of $12600

When it is broken down by household income, it shows that the higher the income, the bigger the credit card debt.

#23. An average US citizen owes around $5733 in credit card debt

As per credit card debt statistics, it is around 3% more than in the first quarter of 2023.

#24. 33% of credit card holders in the US believe it will take them over two years to pay their credit card debt

Nearly 39% of them think that they can pay off their credit card debts by the next year, while 24% of them think it will take them two years. Around 5% of people think they need five years to clear their dues while 3% of them are not sure about being able to pay off their dues.

#25. Wisconsin has the lowest credit card debt

Wisconsin ranks lowest in the chart with an average credit card debt of $4,808 by August 202.

Others are followed by Iowa ($4,811), and West Virginia ($5,005).

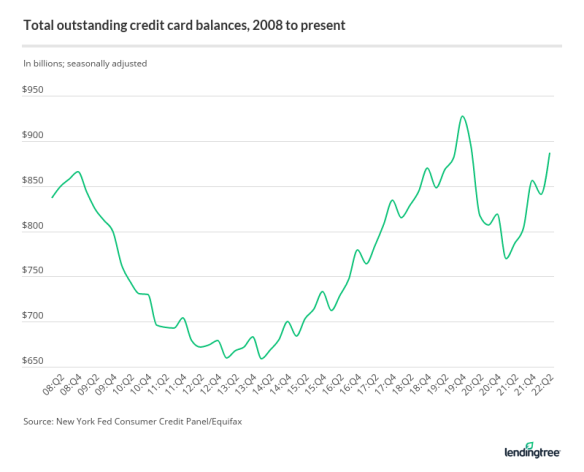

#26. Americans have a total credit card debt of $1.03 trillion

As per credit card debt statistics for the second quarter of 2023, Americans owe a total credit card debt of $1.03 trillion. In the first quarter of 2023, the figure has been around $1 trillion.

(Source; Lendingtree)

Some Interesting Facts about Credit Cards

#27. Around 16% of people in the US use credit cards to handle a $400 emergency

Although 68% of people in the US say that they have saved enough cash to cover emergencies, the rest of them still need to find other means. Around 2% of US citizens say that they need to use a bank loan or a line of credit to cover sudden expenses.

#28. A credit card scam is the second most reported kind of identity theft in America

More than 150 million cases of credit card fraud have been reported in the U.S. in 2023. The theft of federal documents is another type of most common identity theft in the US.

#29. Debit card payment is still the most preferred mode of payment

Debit card payment contributes to 10 of the 35 payments made.

#30. Many people in the US take credit cards to improve their credit scores

As per credit card statistics, by March 2023 around 84% of people in the US open credit cards to start improving their credit scores. People from Gen Z are most likely to follow this practice.

Conclusion

Many people think that credit cards play a major role in plunging into overspending, however, when used sensibly, they might become vital to reaching bigger financial goals. Nowadays, people own more credit cards than ever before. However, people are still quite skeptical about spending and use only a quarter of their credit limits. There is surely a positive change in the way people use their credit cards. In the wake of the pandemic, the average credit card balance has reduced as people are slashing their expenses. Credit card statistics show that the usage of credit cards is extensive and will continue to be a significant player in people's financial lives.

FAQ.

The minimum amount due on a credit card is almost 5% of total outstanding balance to make on or before the due date of the payment.

The interest-free period of a credit card can vary up to 50 days based on the payment due date of the credit card.

Visa is the most widely used credit card network around the world that is available in 123 countries as of 2023..

Nearly 183 million people in the United States own at least a credit card. An average user in the US has at least three credit cards.

An analysis of 161 countries across the world shows that 13% of people in the world have at least one credit card.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.