Important MobiKwik Statistics and Trends to Understand Its Popularity In The Digital Payment Market

Introduction

MobiKwik Statistics: Founded in April 2009, MobiKwik is a payment service provider in India that offers a cell phone-based payment method and a digital wallet. Through MobiKwik, users can easily add money to their digital wallet, which can be utilized for online payments. The Reserve Bank of India approved the company's use of the MobiKwik wallet in 2013. MobiKwik began offering small loans to customers as part of its service in May 2016. The company has more than 325 employees. MobiKwik deals in three sections majorly such as fintech, consumer payments, and payment gateway. Here we will dive into some crucial MobiKwik statistics and trends that will help understand the growth and prevalence of this payment method across the country

Key MobiKwik Statistics

- Initially, MobiKwik was launched as a website with a secure wallet facility in April 2009.

- In 2012, the company unveiled a digital wallet system that helped customers pay their utility bills, phone bills, and other requirements.

- The Reserve Bank of India approved the company's use of the MobiKwik wallet in 2013.

- As per the latest MobiKwik statistics, MobiKwik has more than 100 million certified users at present.

- In 2021, around 3.45 million merchants were using MobiKwik services across the country.

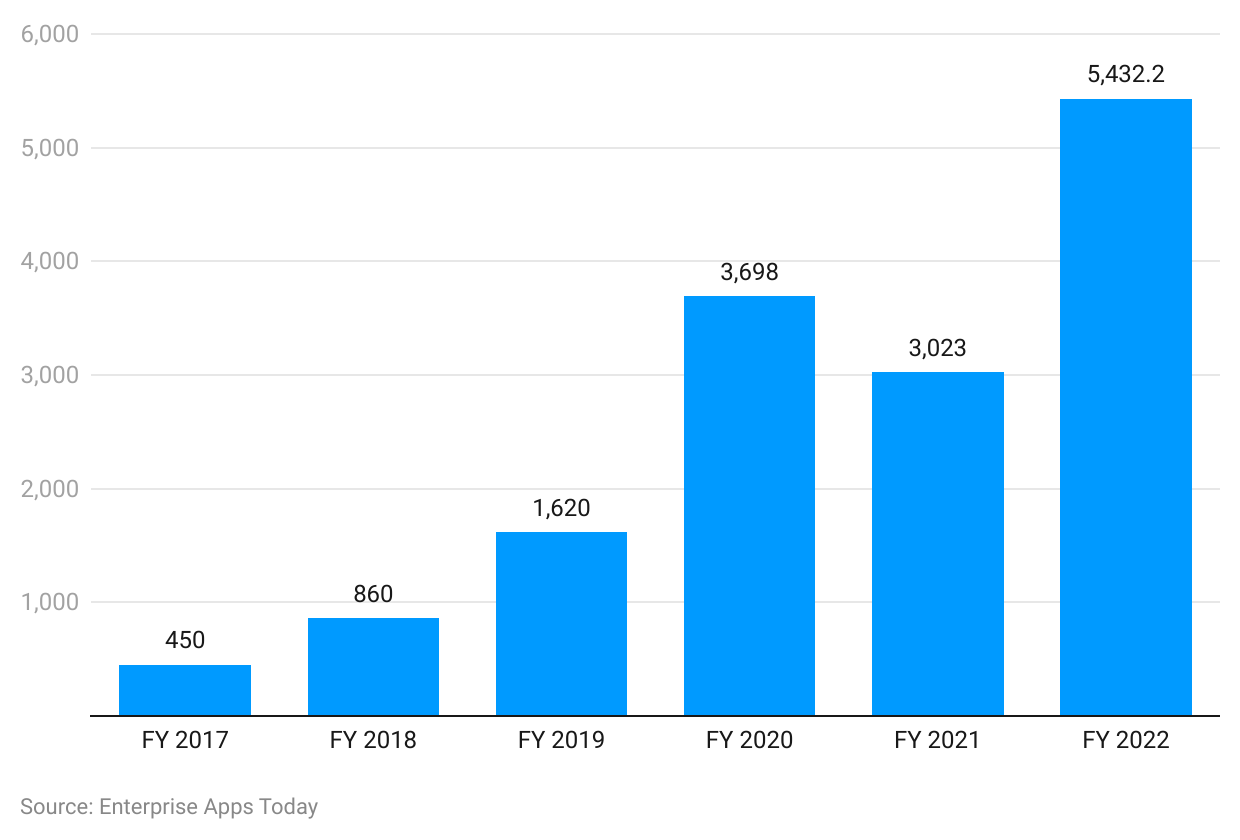

- MobiKwik showed significant growth in the financial year 2022 and surpassed the 5.25 billion revenue mark.

- MobiKwik has other sources of income as well such as the interest from non-current investments that also saw an increase of 22% amounting to INR 16.6 crore in the financial year 2022.

- MobiKwik deferred its e-wallet services from all major crypto exchanges in the country in April 2022.

- There were around 140 MobiKwik billers in 2020.

- In 2019, MobiKwik reported around 1 million transactions per day.

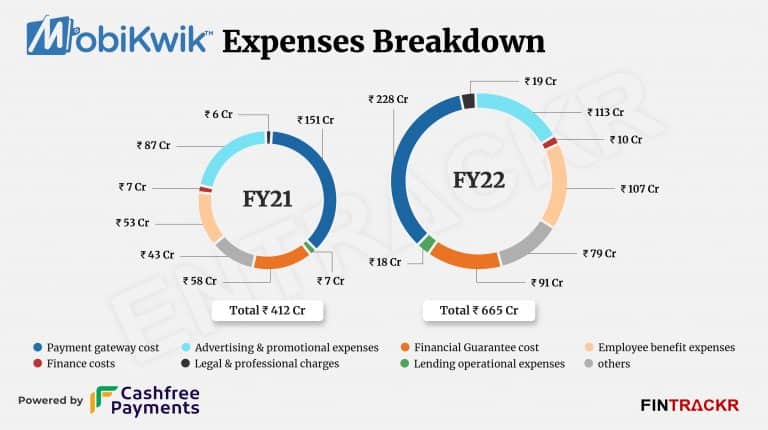

- With 34% of the overall expenditures, the payment gateway expenditure turned out to be the biggest cost center for MobiKwik in the financial year 2022.

- Customers can easily get instant loans and purchase gold, mutual funds, and insurance as well through MobiKwik.

General MobiKwik Statistics And Trends

#1. MobiKwik showed significant growth in the financial year 2022 and surpassed the 5.25 billion revenue mark

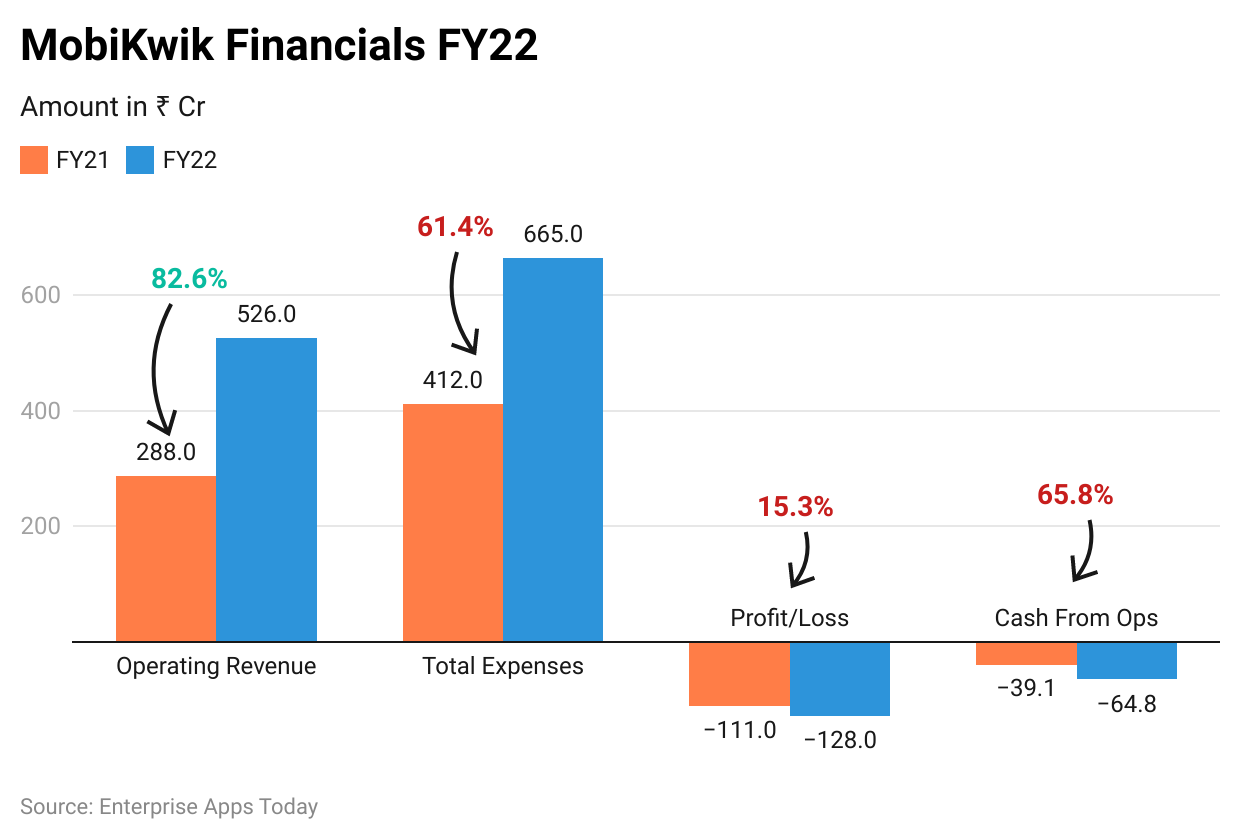

Though the COVID-19 pandemic minimized the scale of the company with only 20% growth in revenue in the financial year 2021, The revenue of MobiKwik saw an 82.6% growth in the fiscal year 2022.

(Source: Statista)

#2. There are three primary segments that contribute to MobiKwik’s revenue generation.

MobiKwik makes its revenue mainly from three sections that are consumer payments, payment gateway services, and Buy Now Pay Later (BNPL) financial products.

#3. In 2021, around 3.45 million merchants were using MobiKwik services across the country

As per 2021 MobiKwik statistics, one of the biggest digital wallets operating in India had more than 3.45 million traders including biller partners, e-commerce, and physical retailers using the wallet system.

#4. As per the latest MobiKwik statistics, MobiKwik has more than 100 million certified users at present

As per the latest stats, over the year, MobiKwik has been able to amass more than 100 million registered users across the country.

#5. In 2019, MobiKwik reported around 1 million transactions per day

One of the major mobile wallets available in India, MobiKwik saw a 400% increase in the rate of transactions since the demonetization of high-value currency by the Centre took place in November 2016 in India.

#6. MobiKwik deferred its e-wallet services from all major crypto exchanges in the country in April 2022

MobiKwik e-wallet was one of the methods that investors in India utilized to transact money on a crypto exchange. However, the company withdrew support for its services in India for crypto exchanges in April 2022. Especially when at least six cryptocurrency exchanges in the country were providing the MobiKwik e-wallet option.

#7. Customers can easily get instant loans and purchase gold, mutual funds, and insurance as well through MobiKwik

MobiKwik began offering small loans to customers as part of its service in May 2016. MobiKwik mobile app is considered the safe and easy platform to buy gold online. It offers a unified experience for online gold purchases. MobiKwik as an initiator guarantees 24K digital gold with 99.5% purity.

#8. MobiKwik is considered one of the biggest Buy Now Pay Later (BNPL) players in the country

The company unveiled its flagship BNPL product known as MobiKwik Zip in May 2016. It is a Fintech firm, that has been witnessing rapid growth in the number of online paying customers in the last 10 years in India.

#9. MobiKwik Zip has been designed to offer the first experience with credit cards to the disadvantaged Indian population

With MobiKwik Zip, the middle-class population of the country has been able to make payments online for their daily life requirements.

#10. With 34% of the overall expenditures, the payment gateway expenditure turned out to be the biggest cost center for MobiKwik in the financial year 2022

This expense shot up by 51% amounting to INR 228 crore in the fiscal year 2022. Advertisement & employee benefit costs as well were other crucial expenses that made up nearly 17% and 16% of the total expenses. These expenses as well shot up by 30% and 102% respectively amounting to INR 113 crore and INR 107 crore in the fiscal year 2022.

(Source: Entracker.com)

#11. As per the data, MobiKwik also earns interest through non-current investments

The firm has other sources of income as well such as earning interest from non-current investments. It also saw an increase of 22% amounting to INR 16.6 crore in the financial year 2022.

#12. MobiKwik offers financial pledges for bank loans on its BNPL platform and books-related expenses

Such costs shot up by 57% amounting to INR 91 crore in the fiscal year 2022.

#13. MobiKwik Zip accounts for an active user base of 2.8 million

As per MobiKwik statistics, the BNPL product Zip says it has more than 25 million pre-approved BNPL consumers.

#14. The total expenditure of MobiKwik shot up to INR 665 Cr in the financial year 2022

The latest MobiKwik stats show that the firm led by Bipin Preet Singh and Upasana Taku used INR 19 crore and INR 18 crore on legal professional fees and lending operational costs that increased the total cost by 61.4% amounting to INR 665 crore in 2022.

(Source: FINTRACKR)

(Source: FINTRACKR)

#15. Although MobiKwik has shown strong growth with good management of costs, it is yet to be close to break-even

Though the company has estimated to turn itself into a profitable firm in the fiscal year 2024, it needs to deal with many challenges on the regulatory front.

#16. The Reserve Bank of India (RBI) vetoed its payment aggregator app as the fintech firm did not fulfill the net-worth standards

However, the company filed a fresh application later.

#17. MobiKwik reported a data breach in 2021 where the personal records of 100 million users were compromised

In March 2021, a website on the dark web revealed that it had 8.2 terabytes of MobiKwik customer data. The record of users included their email ids, partial card payment numbers, phone numbers, transaction logs, and scrambled passwords. The site also claimed to have the Aadhar numbers and PAN details of around 3.5 million MobiKwik users.

#18. The company claims to have more than 325 employees across the country

As per the latest MobiKwik statistics, around 325 employees are working under the company in three different sections fintech, consumer payments, and payment gateway.

Conclusion

Online transactions and the usage of digital wallets are trending nowadays. Digital wallets offer multiple benefits to their users such as hassle-free and easy money transactions. Although there are many global players that offer digital wallet services in India, MobiKwik is one of the first Indian mobile wallet firms, that has been able to earn a name for itself despite the raging competition in the sector.

The company reported major growth in the first quarter of the financial year 2021. As per the report, MobiKwik has been able to boost its revenue and keep a tab on the cost. It is expected that the company will be able to cover its losses in the next two years. MobiKwik announced its Initial Public Offering (IPO) in 2021. However, due to heightened volatility in the market led by geopolitical tensions and macroeconomic issues, the company postponed its IPO. These MobiKwik statistics reveal that the fintech firm might have a promising future ahead in the digital payment industry.

Sources

FAQ.

MobiKwik is a safe digital wallet that can be utilized as a payment method. The e-wallet has a multilayer security system and it uses fraud deterrence codes as well. The money stored in your MobiKwik wallet is absolutely safe and authentically accounted for.

Users can open a MobiKwik account without paying any fee and there are no registration charges levied by the company for the wallet account.

MobiKwik starts initiating the refund as soon as a request is registered by a user. It takes about 24 to 48 hours to process the refund. As per the bank rules, the refund might take 3 to 15 days to reflect in the user’s account.

MobiKwik is a cell phone-based digital payments service that provides consumers with efficient digital wallets as a capable substitute for physical wallets.

As per RBI guidelines, it is compulsory to have the KYC completed for the MobiKwik account.

MobiKwik ZIP is one of the special Pay later alternatives in which the credit allowance surges as the usage rises.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.