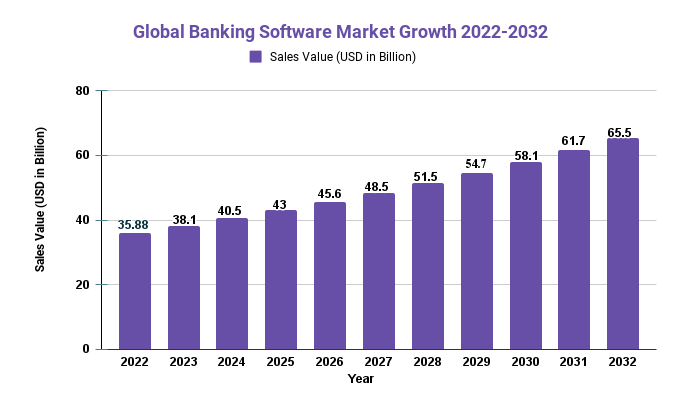

Banking Software Market to Reach USD 65.5 Billion by 2032, Says Market.us Research Study

Page Contents

Market Overview

Published Via 11Press: The Banking Software Market size is expected to be worth around USD 65.5 Bn by 2032 from USD 35.88 Bn in 2022, growing at a CAGR of 6.2% during the forecast period from 2022 to 2032.

The banking system software market is a rapidly growing sector of the finance industry. It deals with innovative financial technology solutions that help banks operate more efficiently, securely, and profitably. The increasing demand for these software solutions is driven by the need for better customer service, higher productivity, and compliance requirements.

In recent years, there has been a significant rise in technology adoption among banks worldwide. They are leveraging technologies like artificial intelligence (AI), blockchain, cloud computing, and data analytics to streamline their operations and improve their services. This trend has led to a surge in investments in the banking system software market as providers seek to develop cutting-edge solutions that meet the needs of modern-day banks.

As more customers turn towards digital banking channels due to convenience and accessibility concerns, software providers will continue to innovate and offer better products.

Request For Sample Report Here: https://market.us/report/banking-software-market/request-sample/

Key Takeaways

- Growing Demand: The banking system software market is experiencing significant expansion due to an increasing need for efficient and effective banking operations, enhanced customer experiences, and the rising adoption of digital technologies.

- Cloud-Based Solutions: Cloud-based banking system software solutions are becoming increasingly popular due to their flexibility, scalability, and cost-effectiveness. Many banks and financial institutions are turning towards cloud-based solutions to reduce IT infrastructure expenses and boost operational efficiency.

- Mobile Banking: With the growing adoption of smartphones and mobile devices, mobile banking has become an integral part of banking system software. Banks are investing in solutions for improved customer engagement and convenience for their users.

- Security Concerns: Security has become a top priority in the banking system software market. Due to an increase in cyber threats, banks, and financial institutions are investing heavily in security solutions to safeguard customer data and prevent financial fraud.

- Regulatory Compliant: Complying with regulations such as GDPR and PSD2 is essential for banks and financial institutions. Banking system software providers offer solutions that abide by these rules, helping their customers avoid fines and penalties.

- Consolidation: The banking system software market is seeing consolidation as larger players acquire smaller firms to expand their offerings and strengthen their position in the market. This trend is expected to continue as competition intensifies within this space.

Regional Analysis

- North America is expected to dominate the banking system software market due to the presence of major players, increasing demand for digital banking solutions, and favorable government regulations. The United States accounts for most of this region's market share.

- Europe is expected to hold a large market share in the banking system software market due to the increasing adoption of digital banking solutions, regulatory compliance requirements, and increasing investments in technology infrastructure. Countries such as Germany, the UK, and France are major markets within this region.

- Asia Pacific is expected to be the fastest-growing region in the banking system software market due to the rising adoption of digital banking solutions, investments in technology infrastructure, and an increasing number of mobile and internet users. China, India, and Japan are major markets within this region.

- The Middle East and Africa region is expected to experience tremendous growth in the banking system software market due to the increasing adoption of digital banking solutions and investments in technology infrastructure. Major markets in this region include UAE, Saudi Arabia, and South Africa.

- Latin America The banking system software market in Latin America is expected to experience moderate growth due to the increasing adoption of digital banking solutions and investments in technology infrastructure. Brazil, Mexico, and Argentina are major markets within this region.

Drivers

- Increasing Demand for Digital Banking Solutions: With the growing adoption of digital technologies, customers are expecting more efficient and convenient banking services. Banking system software providers offer solutions that allow banks and financial institutions to offer digital banking services such as online banking, mobile banking, and digital payments fueling market growth in this space. Banks and financial institutions are prioritizing improving their customer experience to stay ahead of the competition in the market. Banking system software solutions offer personalized, seamless experiences to customers, propelling demand for these solutions.

- Increased Investments in Technology Infrastructure: Banks and financial institutions are investing heavily in technology infrastructure to boost operational efficiency, cut costs, and enhance service offerings. This has resulted in an increasing demand for banking system software solutions.

- Government Regulations Favoring Digital Technologies in Banking: Governments around the world are passing regulations to encourage digital technology adoption within banking. This has spurred demand for banking system software solutions that abide by these rules.

- Rising cybersecurity worries: With the increasing frequency and severity of cyber threats, banks, and financial institutions are investing in security solutions to safeguard customer data and prevent financial fraudulence. Banking system software providers are offering advanced security features which are fuelling growth within this market. Competition Increased The banking industry is becoming more intensely competitive, with new players entering the market and traditional banks expanding their offerings. Banks and financial institutions are investing in banking system software solutions to differentiate themselves from their rivals and offer better services to customers.

Restraints

- High Implementation Costs: Implementing banking system software solutions requires substantial investments in terms of hardware, software, and personnel. This can be a major deterrent for small and medium-sized banks and financial institutions, thus hindering their adoption of these solutions.

- Data Privacy and Security Concerns: Banks and financial institutions store vast amounts of sensitive customer data, creating a potential risk for data breaches and cyber-attacks. Customers are becoming increasingly worried about the safety of their information, which could pose an obstacle to adopting banking system software solutions.

- Lack of Skilled Personnel: Implementing and administering banking system software solutions necessitates highly experienced personnel, such as IT pros, software developers, and cybersecurity specialists. Unfortunately, there is a shortage of qualified personnel in the market which may act as an obstacle to the adoption of these solutions. Integration Challenges Banks and financial institutions often have complex legacy systems that may be challenging to integrate with new banking system software solutions. This can pose a barrier to adoption, leading to higher implementation costs and longer lead times.

- Regulatory Complying: With Regulations Banks and financial institutions are subject to numerous regulations, such as GDPR and PSD2, that can be complex to comply with. While banking system software providers offer solutions that comply with these rules, ensuring compliance remains a hurdle for adoption.

- Resistance to Change: Banks and financial institutions tend to be slow in adopting new technologies, with resistance from both employees and customers. This could pose a barrier for banks and financial institutions when it comes to adopting banking system software solutions that require significant alterations in business processes and customer behavior.

Opportunities

- Adoption of Artificial Intelligence (AI) and Machine Learning (ML): Banks and financial institutions are increasingly turning to AI and ML solutions in order to boost their operational efficiency and enhance customer experience. Banking system software providers can offer solutions that use AI/ML techniques for automating processes, analyzing data, and offering personalized services.

- Growth of Mobile Banking: With the increasing use of smartphones and other mobile devices, mobile banking is becoming more commonplace. Banking system software providers can provide solutions that enable banks and financial institutions to provide seamless mobile banking experiences to their customers.

- Increased Demand for Cloud-Based Solutions: Cloud-based banking system software solutions are becoming more and more popular due to their flexibility, scalability, and cost efficiency. Banks and financial institutions can take advantage of cloud-based solutions that allow them to access their systems remotely at any time while cutting down on IT infrastructure costs.

- Adoption of Blockchain Technology: Blockchain technology holds the potential to revolutionize banking by providing secure and transparent transactions. Banking system software providers can offer blockchain-based solutions that empower banks and financial institutions to provide efficient transactions to their customers.

- Integration with Third-Party Solutions: Banks and financial institutions are increasingly seeking ways to integrate their systems with third-party solutions, such as payment gateways or accounting software. Banking system software providers can offer integrated solutions that make this possible, allowing banks and financial institutions to easily integrate with external services and provide more options for customers.

- Expansion into Emerging Markets: Emerging markets like Asia-Pacific and Latin America offer significant expansion prospects for the banking system software market due to increasing investments in technology infrastructure and the rising adoption of digital banking solutions. Banking system software providers can capitalize on these opportunities by developing solutions specifically tailored to these regions' requirements.

Challenges

- Competition in the banking system software market: As more vendors offer solutions, differentiation among them and pricing competition are becoming increasingly challenging for vendors.

- Complex Regulatory Environment: Banks and financial institutions are subject to numerous regulations, such as GDPR and PSD2, that can be difficult and time-consuming to meet. Banking system software providers must guarantee their solutions adhere to these rules – an enormous task!

- Cybersecurity Threats: Banks and financial institutions are vulnerable to a range of cybersecurity risks, such as hacking, phishing, and ransomware attacks. Banking system software providers must ensure their solutions have strong security features and are updated regularly in order to combat these dangers.

- Legacy Systems, Banks: and financial institutions often have complex legacy systems that may be challenging to integrate with new banking system software solutions, leading to higher implementation costs and longer implementation timelines.

- Resistance to Change: Banks and financial institutions often take their time implementing new technologies, leading to resistance from both employees and customers alike. Banking system software providers must address this resistance by creating user-friendly solutions that are easy for customers to adopt.

- Data Privacy Concerns: As banks and financial institutions store vast amounts of sensitive customer data, there is an increased risk of data breaches and cyber-attacks. Customers have become increasingly anxious about the security of their information something banking system software providers must address to address customer worries.

Browse the summary of the report and Complete Table of Contents (TOC): https://market.us/report/banking-software-market/table-of-content/

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 35.88 Bn |

| Revenue forecast by 2032 | USD 65.5 Bn |

| Growth Rate | CAGR Of 6.2% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Key Market Segments

Type

- Core Banking Software

- Multi-Channel Banking Software

- BI software

- Private Wealth Management Software

Application

- Risk Management

- Information Security

- Business Intelligence

- Training and Consulting Solutions

Key Market Players

- IBM Corporation

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited.

- Infosys Limited

- Capgemini

- Accenture.

- NetSuite

- Deltek

- Misys

- Microsoft Corporation

- Comarch

- Temenos Group

- Sopra Banking

- Turnkey Lender

- Strategic Information Technology

Frequently Asked Questions

What is the market study period?

The Banking Software Market is studied from 2017 – 2032.

What is the growth rate for the Banking Software Market?

The Banking Software Market is growing at a CAGR of 6.2%

Who are the major players in the Banking Software Market?

IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite, Deltek, Misys, Microsoft Corporation, Comarch, Temenos Group, Sopra Banking, Turnkey Lender, Strategic Information Technology

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.