Cell Counting Market size is projected to grow at a CAGR of 7.1%

Page Contents

Market Overview

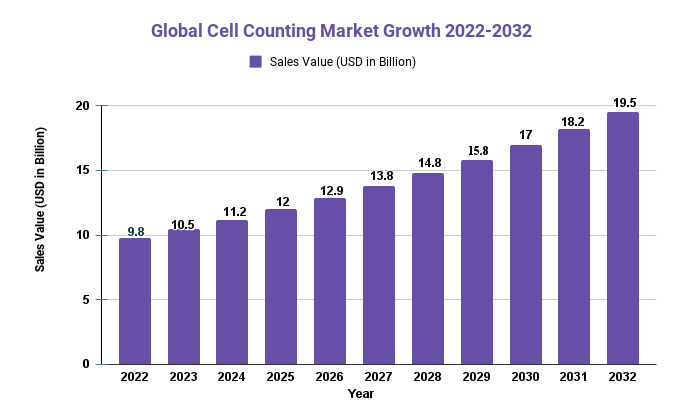

Published Via 11Press : Global Cell Counting Market is valued at USD 9.8 Bn and is expected to reach USD 19.5 Bn in 2032, with a CAGR of 7.1% from 2022 to 2032.

The global cell counting market is projected to experience substantial expansion over the coming years, driven by growing demand for cell-based assays in drug discovery and development and by chronic illnesses like cancer and HIV/AIDS that require cell testing for accurate diagnoses.

The market can be broadly classified by product, end-user, application and region. By product type, the market can be divided into consumables, instruments and software with consumables accounting for most market shares due to their wide array of uses in research, diagnosis, and treatment applications; the instruments segment is expected to experience substantial growth due to rising demand for automated and high throughput cell counting systems.

By end users, the market can be divided into academic and research institutes, hospitals and diagnostic laboratories, pharmaceutical and biotechnology companies and others. Pharmaceutical and biotechnology companies account for the greatest market share due to the increasing need for cell-based assays in drug discovery and development processes.

By application, the market can be divided into research, diagnostic and therapeutic uses. Of these segments, research accounts for the largest market share due to increasing cell counting demand from research applications such as stem cell research, cancer research and drug discovery.

Geographically, North America holds the largest share of the cell counting market due to the large presence of pharmaceutical and biotechnology companies and increased adoption of advanced cell counting technologies. Europe ranks second, followed by Asia-Pacific which is expected to experience rapid growth thanks to increased investments in healthcare infrastructure investments as well as chronic diseases being prevalent there.

Key players in the market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Merck KGaA, Becton Dickinson and Company, Agilent Technologies Inc., Danaher Corporation PerkinElmer Inc. GE Healthcare Sysmex Corporation Promega Corporation are among them.

For further details on major revenue-producing segments, request a pricing optimization software market Request for PDF sample report

Key Takeaways

- The global Cell Counting Market was estimated at USD 9.8 Bn in 2022 and projected to experience an expected compound annual growth rate of 7.1% between 2022-2032.

- This market is driven by rising demand for cell-based assays in drug discovery and development, coupled with rising chronic diseases such as cancer and HIV/AIDS.

- Consumables hold the largest market share due to their wide-ranging applications in research, diagnosis and treatment.

- Pharmaceutical and biotechnology companies comprise the highest market share in terms of end user, while research holds the greatest application share. North America holds the largest portion of this market share, followed by Europe and Asia-Pacific regions.

Regional Snapshot

- North America leads the global cell counting market due to the presence of numerous pharmaceutical and biotechnology firms as well as an increase in adoption of advanced cell counting technologies.

- Europe is the second-largest market, driven by research and diagnostic applications of cell counting.

- Asia-Pacific is projected to experience rapid expansion, due to an escalating investment in healthcare infrastructure and rising chronic disease prevalence rates across its borders.

- Due to growing investments in healthcare and increased awareness about advanced cell counting technologies, the Middle East and Africa markets for cell counting devices are projected to experience steady expansion.

- Latin America market is projected to experience moderate growth due to an increasing adoption of cell-based assays for research and the prevalence of chronic diseases.

Drivers

- rising demand from drug discovery and development, rising incidence of chronic diseases such as cancer and HIV/AIDS and technological advancements in cell counting techniques.

- Increased government funding for cell research; awareness about personalized medicine and regenerative medicine; higher adoption of high-throughput cell counting systems; expanding applications of cell counting in research, diagnosis, and treatment are just a few examples of trends driving cell-counting research today.

- Growing interest in cell-based therapies and personalized medicine; growing demand for biologics and biosimilars; improvements in cell imaging and analysis technologies; as well as research in stem cell therapy and cancer immunotherapy are driving advances.

- Steadily increasing adoption of 3D cell culture models

Restraints

- High cost of advanced cell counting systems; lack of skilled professionals and awareness regarding cell counting technology in developing regions; limited awareness about cell counting technologies

- Assertive regulatory requirements and ethical considerations related to using human and animal cells for research; limitations of cell counting techniques in terms of accuracy and precision; difficulties with integration into existing laboratory systems and workflows are just some of the challenges cell counting companies must contend with.

- Complex and time-consuming cell counting procedures

Opportunities

- abound with increasing demand for automated and high-throughput cell counting systems

- increasing adoption of cloud-based cell counting software solutions

- rising adoption of portable and handheld cell counting devices

- emerging markets in Asia Pacific and Latin America as potential destinations

- The emergence of novel cell counting techniques and technologies

- increasing demand for cell counting in veterinary diagnostics

- the growing use of flow cytometry for immunology/oncology research, as well as an increase in food and beverage industry cell counts are some key drivers behind cell counting trends.

Challenges

- Limited accuracy and precision of some cell counting techniques, competition from alternative technologies such as flow cytometry and spectrophotometry as well as limited awareness and access of cell counting technologies in developing regions present several obstacles for their adoption.

- Ethical concerns over using human and animal cells for research; regulatory challenges related to cell counting products; difficulty standardizing cell counting protocols across laboratories are some of the major barriers.

- Skilled professionals must operate advanced cell counting systems. Additionally, there can be significant costs associated with advanced cell counting systems and consumables.

Recent Developments

- In March 2021, Beckman Coulter Life Sciences launched the Vi-CELL BLU cell viability analyzer, which provides fully automated cell counting and viability measurements using trypan blue staining and image analysis.

- In February 2021, Nexcelom Bioscience launched the Celigo PRISMA, an automated imaging system for cell counting and analysis, which allows users to analyze up to six samples at a time.

- In January 2021, Thermo Fisher Scientific acquired Henogen, a leading cell counting and analysis software provider, to enhance its portfolio of cell culture media and reagents.

- In November 2020, Merck launched the CellStream flow cytometer, which offers high sensitivity and versatility for cell analysis, including counting, viability, and cell cycle analysis.

Key Market Segments

By Product

- Instruments

- Spectrophotometers

- Hematology Analyzers

- Cell Counters

- Flow Cytometers

- Microscopes

- Consumables and Accessories

- Media, Sera, and Reagents

- Assay Kits

- Microplates

- Accessories

- Other Consumables

By Application

- Research

- Cancer

- Immunology

- Neurology

- Stem Cell

- Other Research

- Industrial

- Clinical and Diagnostic

By End-User

- Hospitals & Diagnostic Laboratories

- Research Institutes

- Pharmaceutical & Biotechnology Companies

Market Key Players

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Bio Tek Instruments

- GE Healthcare Technologies, Inc.

- DeNovix Inc.

- Merck KGaA

- Becton Dickinson and Company

- Logos Biosystems Inc.

- Nexcelom Bioscience LLC

- Olympus Corporation

- Tecan Trading AG

- Beckman Coulter Inc.

- Sysmex Corporation

- Other Key Players

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 9.8 Bn |

| Revenue forecast by 2032 | USD 19.5 Bn |

| Growth Rate | CAGR Of 7.1% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

FAQs

Q: What is cell counting?

A: Cell counting is the process of determining the number of cells in a sample, which is important for various research, diagnostic, and treatment applications.

Q: What are the different methods of cell counting?

A: The most commonly used methods of cell counting include hemocytometer counting, automated cell counting using instruments such as flow cytometers and image analysis systems, and spectrophotometry.

Q: What are the applications of cell counting?

A: Cell counting is used in various applications, including drug discovery and development, cancer research, regenerative medicine, immunology, and stem cell research.

Q: What are the major factors driving the growth of the cell counting market?

A: The major drivers of the cell counting market include the increasing demand for cell-based assays in drug discovery and development, the rising incidence of chronic diseases, technological advancements in cell counting techniques, and increasing government funding for cell-based research.

Q: What are the major challenges facing the cell counting market?

A: The major challenges facing the cell counting market include limited accuracy and precision of some cell counting techniques, competition from alternative technologies, limited awareness and access to cell counting technologies in developing regions, and regulatory challenges associated with the approval of cell counting products.

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.