Cloud Based Payroll Software Market Set for Rapid Growth, To Reach Around USD 15.73 Bn by 2033

Page Contents

Market Overview

Published Via 11Press: Cloud-based payroll software Market is an online solution designed to simplify and automate payroll processes for businesses. It provides a centralized platform for managing employee data, calculating wages/salaries, generating pay slips, and handling tax compliance. As it's hosted in the cloud, it can be accessed anytime from any device with an internet connection.

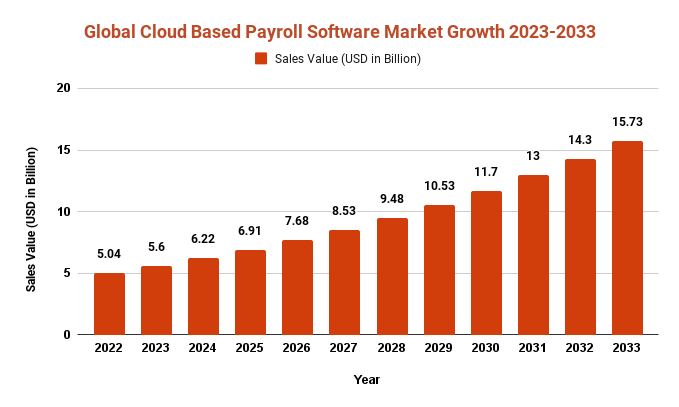

The Cloud Based Payroll Software Market size is expected to reach USD 15.73 Bn by 2033, up from its current value of USD 5.04 Bn in 2022, growing at an annual compound growth rate (CAGR) of 10% from 2023-2033.

Key Features

- Payroll Processing: The software automates the calculation of employee wages, taxes and deductions. It can also generate pay slips and reports.

- Time and Attendance Tracking: The software can integrate with time tracking tools to monitor employee work hours and attendance.

- Tax Compliance: This software automates the calculation and withholding of taxes, produces tax forms, and files taxes with the relevant authorities.

- Employee Self-Service: This software enables employees to view their pay slips, tax forms and other important documents online.

- Reporting and Analytics: The software offers a suite of reports and analytics to help businesses monitor payroll expenses, employee attendance, and other key performance indicators.

Benefits:

- Time-saving: The software automates time-consuming payroll tasks, saving users both the effort and time required to manage payroll processes.

- Cost-Effective: Utilizing this software eliminates the need for paper-based processes, cutting down on expenses associated with printing, mailing and storing paper documents.

- Scalability: The software's easy scaling capability allows it to grow along with your business.

- Accessibility: The software can be accessed remotely, at any time, on any device with an internet connection.

- Compliance: The software helps guarantee compliance with tax laws and regulations, decreasing the likelihood of penalties or fines.

Key Takeaways

- Cloud-based payroll software is an online solution that automates and simplifies payroll processes for businesses.

- It provides a centralized platform for managing employee data, calculating wages and salaries, creating pay slips, and handling tax compliance.

- The software is hosted in the cloud, meaning it can be accessed anytime and from any device with an internet connection.

- Cloud-based payroll software offers several key benefits, such as payroll processing, time and attendance tracking, tax compliance, employee self-service options, reporting capabilities and analytics.

- Cloud-based payroll software offers numerous advantages, such as timesaving, cost efficiency, scalability, accessibility and compliance.

- Popular cloud-based payroll software options include Gusto, ADP, Paychex and QuickBooks.

Request Sample Copy of Cloud Based Payroll Software Market Report at: https://marketresearch.biz/report/cloud-based-payroll-software-market/request-sample/

Regional Snapshot

- Cloud-based payroll software is becoming increasingly popular around the world, with adoption rates varying by region.

North American organizations are leading in using cloud-based payroll software adoption rates. The market is dominated by major players like ADP, Paychex, Gusto, QuickBooks and Zenefits. - The adoption of cloud-based payroll software is increasing rapidly across Europe. Some major players in this space include Sage, Xero, Workday, and SAP.

- As more businesses embrace cloud-based payroll software in Asia-Pacific, local players such as Ramco Systems, Greytip Software and ZingHR are seeing increased adoption rates.

- The adoption of cloud-based payroll software is on the rise in Latin America. Some major players include ADP, SAP and Kronos.

- Adoption of cloud-based payroll software is still in its early stages in the Middle East and Africa, though the market is expected to expand rapidly over the coming years.

Drivers

Cloud-based payroll software market has seen a meteoric rise due to several factors.

- Cost Savings: Cloud-based payroll software eliminates the need for on-premise infrastructure, software licenses and IT support – leading to substantial cost savings for businesses.

- Scalability: Cloud-based payroll software allows businesses to easily expand their payroll systems according to changing business needs without needing extra infrastructure or software.

- Accessibility: Cloud-based payroll software can be accessed anytime, from any device with an internet connection – making it ideal for businesses that have remote workers or multiple locations.

- Compliance: Cloud-based payroll software helps businesses ensure compliance with stringent payroll regulations and tax laws, decreasing the risk of penalties or fines.

- Automation: Cloud-based payroll software streamlines many manual payroll processes, eliminating the potential for errors and giving HR professionals more time to focus on other important tasks.

- Integration: Cloud-based payroll software can easily integrate with other HR and accounting programs, giving businesses the power to streamline their entire payroll process.

- Security: Cloud-based payroll software providers typically offer high levels of data security, including data encryption, backups and disaster recovery plans.

Restraints

Cloud-based payroll software offers many advantages to businesses, but there are also drawbacks that businesses should be aware of.

- Internet Connectivity: Cloud-based payroll software requires a reliable internet connection to function properly. Poor connection can cause delays or interruptions when accessing the program, impacting its accuracy and timeliness of processing payrolls.

- Data Security: While cloud-based payroll software providers typically offer high levels of data security, businesses should still take appropriate precautions to protect their sensitive payroll information. This includes using strong passwords, restricting user access and regularly backing up data.

- Implementation Timeframe: Implementing cloud-based payroll software requires significant IT resources to set up and configure, so businesses should plan ahead for this requirement and allocate enough personnel to manage the implementation process effectively.

- Integration with Legacy Systems: Cloud-based payroll software may have difficulty integrating with legacy payroll systems, creating data migration challenges and necessitating additional configuration and testing.

- Vendor Lock-in: Once a business has adopted cloud-based payroll software, switching to another provider may prove challenging due to the time and resources needed for data migration and setting up a new system.

Opportunities

Cloud-based payroll software presents several advantages for businesses. Here are some of the key benefits:

- Increased Employee Engagement: Cloud-based payroll software enables employees to access their payroll information, such as pay stubs and W-2 forms, online. This promotes greater transparency and engagement within the workplace.

- Business Insights: Cloud-based payroll software offers real-time data insights, such as labor costs and turnover rates, that can assist businesses in making data-driven decisions to enhance their payroll and HR processes.

- International Payroll Management: Cloud-based payroll software simplifies the process of managing payroll across multiple countries and adhering to different regulatory requirements, such as tax laws and labor standards.

- Mobile Accessibility: Cloud-based payroll software can be accessed from any mobile device, allowing businesses to manage payroll on-the-go and employees the freedom to manage their information anytime they please.

- Artificial Intelligence and Automation: Cloud-based payroll software providers are increasingly incorporating artificial intelligence (AI) and automation technologies, such as chatbots and machine learning, into their processes to increase efficiency and accuracy during payroll processing.

- Integration with Other Systems: Cloud-based payroll software can easily integrate with other HR and accounting programs, giving businesses a more streamlined and efficient payroll process.

Challenges

Cloud-based payroll software presents several challenges to businesses that they should be aware of.

- Data Security: Cloud-based payroll software providers typically offer high levels of data security, however there remains the potential risk of data breaches if businesses do not take appropriate steps to safeguard their sensitive payroll information.

- Internet Connectivity: Cloud-based payroll software requires a reliable internet connection to function properly. Any issues with connectivity can cause delays or interruptions when accessing the program, impacting its accuracy and timeliness for payroll processing.

- System Downtime: Cloud-based payroll software providers may experience system downtime, which could hinder a business' ability to access its payroll data and process payroll timely.

- Implementation Time: Implementing cloud-based payroll software requires considerable time and IT resources to set up and configure. This could cause delays in getting the system up and running, potentially impacting a business's ability to process payroll on schedule.

- Integration with Legacy Systems: Cloud-based payroll software may have difficulty integrating with legacy payroll systems, leading to data migration challenges and additional configuration and testing.

- Vendor Lock-in: Once a business has committed to cloud-based payroll software, switching may prove challenging due to the time and resources necessary for data migration and setting up a new system.

Market Segmentation

Application

- Government

- Defense

- Education

- Banking

- Financial Services

- Insurance (BFSI)

- IT

- Others

size

- Small- and Medium-Sized Enterprises

- Large Enterprises

product

- Free and Open-Source Software

- Subscription-Based Software

Key Players

- Paycor Inc.

- Paychex Inc.

- Personnel Data Systems Inc.

- Criterion Inc.

- Sage Group

- Lucerna

- Accentra Technologies Limited

- Workday Inc.

- The Ultimate Software Group Inc.

- Oracle Corporation

- Zenefits Software

- SAP Success Factors

- Ascentis HR Software

- FinancialForce Software

- Kronos Software

- IRIS Software Group Ltd.

- ADP

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 5.04 Bn |

| Revenue forecast by 2033 | USD 15.73 Bn |

| Growth Rate | CAGR Of 10% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

Request Customization Of The Report: https://marketresearch.biz/report/cloud-based-payroll-software-market/#request-for-customization

Recent Developments

Cloud-based payroll software is rapidly advancing, and several key developments have recently taken place within this field. Here are some of the key highlights:

- Increased Utilization of Artificial Intelligence and Automation: Cloud-based payroll software providers are increasingly incorporating artificial intelligence and automation technologies , such as chatbots and machine learning, into their processes to enhance efficiency and accuracy in payroll processing.

- Mobile Accessibility: Cloud-based payroll software providers are working hard to enhance the mobile experience, making it simpler for businesses to manage payroll on-the-go and giving employees access to their information from any location.

- Enhancing Security Features: With the growing threat of data breaches, cloud-based payroll software providers are continuously upgrading their security measures to protect sensitive payroll information.

- Integration with HR and Accounting Systems: Cloud-based payroll software providers are making it simpler for businesses to integrate their payroll data with other HR and accounting programs, creating a more streamlined and efficient payroll process.

- Global Payroll Solutions: Cloud-based payroll software providers are expanding their offerings to include global payroll solutions, making it simpler for businesses to manage payroll across multiple countries and satisfy various regulatory requirements.

Key Questions

What is cloud-based payroll software Market?

A: Cloud-based payroll software is a type of application hosted remotely and accessible through the internet, enabling businesses to manage their payroll processes more efficiently and securely while also getting real-time data insights. It offers businesses many advantages over traditional methods for processing payroll payments: efficiency and security are enhanced, plus there's less risk involved when processing transactions online.

What are the advantages of cloud-based payroll software Market?

A: Cloud-based payroll software offers several advantages, such as increased efficiency, enhanced data accuracy, real-time insights into employee activities and compliance with regulations; plus greater accessibility.

What are the primary challenges associated with cloud-based payroll software?

A: The major difficulties include data security, internet connectivity, system downtime, implementation time, integration with legacy systems and vendor lock-in.

How can businesses select the ideal cloud-based payroll software solution?

A: Businesses should assess their payroll needs, budget and features offered by different cloud-based payroll software providers. They should also take into account factors like data security, customer support and integration with other systems when making their decision.

What is the future of cloud-based payroll software Market?

A: Cloud-based payroll software will likely see increased use of artificial intelligence and automation, improved mobile accessibility, as well as an expansion into global payroll solutions. Moreover, providers of this type of solution will continue to strive towards improving user experience and security features.

Contact us

Contact Person: Mr. Lawrence John

Marketresearch.Biz (Powered By Prudour Pvt. Ltd.)

Tel: +1 (347) 796-4335

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.