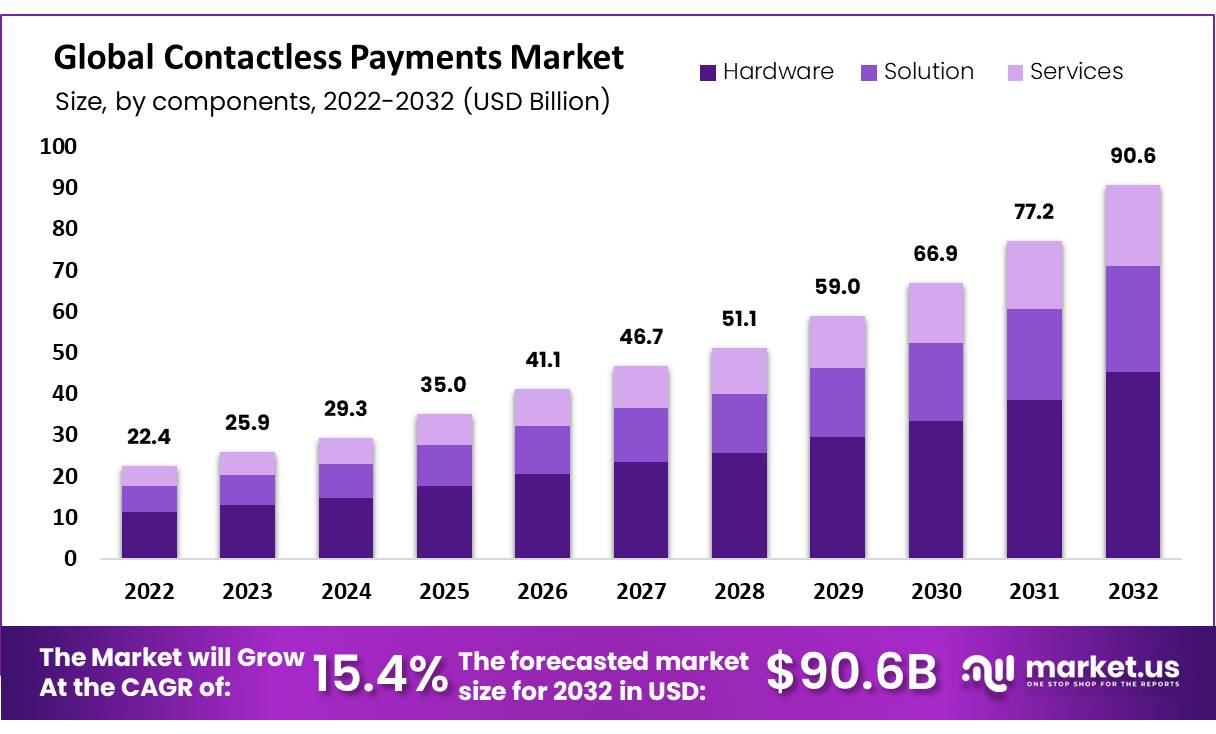

Contactless Payments Market Predicted To Reach USD 90.6 Bn by 2032 with a CAGR Of 15.4%

Page Contents

Market Overview

Published Via 11Press : The Contactless Payments Market refers to an industry that facilitates transactions without physical contact between payment devices and terminals, using near-field communication (NFC) technology or similar solutions in order to enable secure and seamless transactions.

The Contactless Payments Market Size Was To Reach USD 22.4 Billion In 2022 And Is Projected To Reach a Revised Size Of USD 90.6 Billion By 2032, Growing At A CAGR of 15.4%

Recently, the contactless payments market has experienced tremendous expansion due to several factors. Smartphones, wearables, and other connected devices with NFC capabilities have proliferated contactless payment services while consumer demand has surged due to fast transactions combined with the convenience and security offered by these forms of payment.

To Get Additional Highlights On Major Revenue-Generating Segments, Request the Contactless Payments Market Sample Report At – https://market.us/report/contactless-payments-market/request-sample/

Contactless payments have quickly become popular across a range of sectors, including retail, transportation, hospitality, and healthcare. Their benefits include improved transaction speeds, shorter waiting times for transactions, and enhanced customer experiences – as well as tokenization and encryption security increases for enhanced protection against fraud and credit risk.

Key Takeaways

- Rapid Expansion: In recent years, contactless payments have experienced tremendous expansion, driven by the rising adoption of NFC devices and transactions as well as a global shift toward cashless societies.

- Adoption in All Industries: Contactless payments have quickly gained adoption across industries such as retail, transportation, hospitality, and healthcare. Businesses within these fields use contactless payments to improve customer experiences while speeding transactions faster while strengthening security measures.

- Mobile Payment Solutions: Apple Pay, Google Pay, and Samsung Pay have played an instrumental part in driving contactless payments adoption. Utilizing NFC technology embedded within smartphones and wearables for secure transactions with ease and convenience are just three platforms leading the charge in driving this trend forward.

- Hygiene and Safety Benefits: With the COVID-19 pandemic fast approaching, contactless payments have experienced rapid adoption due to their hygienic nature. Consumers and businesses are choosing them over cash transactions as a safe means of transaction.

- Increased Security Measures: Contactless payments use security measures like tokenization, encryption, and biometric authentication to guarantee safe transactions. Furthermore, contactless payment companies continue investing in advanced security technologies in order to combat fraud and protect user data.

Regional Analysis

- North America: North America has long been seen as an innovative market for contactless payments, driven by smartphone use and widespread acceptance of mobile payment solutions such as Apple Pay and Google Pay gaining significant user adoption rates. North American investments include significant contactless payment infrastructure investments with retailers accepting contactless payments such as restaurants and transportation systems throughout.

- Europe: Europe has emerged as an established and rapidly developing market for contactless payments, leading the world in adoption with countries like Britain, Germany, and Nordic nations leading the charge in adoption through government initiatives, favorable regulations, and an abundant infrastructure that facilitates these forms of transaction.

- Asia Pacific: Contactless payments have experienced explosive growth across the Asia Pacific region due to increasing smartphone penetration rates, an unbanked population, and government initiatives encouraging digital payment options. Countries like China, India, South Korea, and Japan are seeing rapid adoption of mobile payment solutions such as Alipay WeChat Pay and Paytm in retail stores, transit systems, and public venues.

- Latin America: Latin America is an emerging market for contactless payments, with increasing adoption in countries like Brazil, Mexico, and Argentina. Mobile payment solutions and infrastructure have proliferated rapidly thanks to an ever-increasing smartphone user base demanding convenient yet secure payment methods.

- Middle East and Africa: Countries such as United Arab Emirates, Saudi Arabia, and Kenya have rapidly adopted contactless payment platforms with mobile wallet apps becoming widespread and NFC-enabled cards becoming popular forms of contactless payment options.

Drivers

- Convenience and Speed: Contactless payments provide both convenience and speed when transacting transactions, enabling users to quickly make payments by tapping contactless-enabled cards or smartphones on payment terminals, eliminating cash or manual card insertion costs altogether. Contactless payments have gained popularity both with consumers as well as businesses alike due to their simplicity.

- Expanded Smartphone Penetration: Smartphone penetration, which frequently incorporates NFC technology, has been one of the driving factors of contactless payments. Since most consumers now carry mobile phones equipped with NFC capabilities, infrastructure for contactless payments has become readily accessible allowing consumers to make transactions using mobile payment apps.

- Rise of Mobile Payment Solutions: Apple Pay, Google Pay, and Samsung Pay have become extremely popular and are leading the contactless payments market. Users are now storing payment card info securely on smartphones before tapping them on terminals for contactless payments.

- Shift toward Cashless Transactions: There has been a global shift toward cashless transactions driven by convenience, security, and digitalization of payment methods. Governments, financial institutions, and businesses alike are encouraging electronic payment options while simultaneously decreasing cash dependency by creating an environment conducive to contactless payment growth.

Market Segmentation

Based on Component

- Hardware

- POS

- Cards

- Others

- Solution

- Payment Terminal Solution

- Device Management Solution

- Contactless Mobile Payment Solution

- Transaction & Data Management

- Security and Fraud Management

- Services

- Consulting

- Integration & Deployment

- Support & Maintenance

Based on Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Other Applications

Key Players

- Gemalto

- Infineon

- Ingenico

- Wirecard

- Verifone

- Giesecke+Devrient

- IDEMIA

- On Track Innovations

- Identiv

- CPI Card Group

- Bitel

- Seomatic Systems

- Valitor

- PAX Global Technology

- MYPINPAD

- Mobeewave

- Alcineo

- Castles

- SumUp

- PayCore

- Other Key Players

Opportunities

- Expanding Globally: The contactless payments market offers significant growth potential globally, particularly in regions with lower adoption rates. Emerging markets across Asia, Latin America, and Africa present great potential as smartphone penetration rates and digital payment infrastructure improve further.

- Small and Micro Business Adoption: There exists an immense opportunity to increase contactless payment usage among small and micro businesses such as local retailers, food vendors, and service providers. Facilitating the adoption of contactless payment solutions among these enterprises can fuel market expansion while offering consumers greater convenience.

- Integration With IoT and Smart Devices: Integrating contactless payment capabilities with Internet of Things (IoT) devices and smart home devices opens up new avenues. Connected cars, wearables, and home gadgets could all become equipped with contactless payments allowing seamless and secure transactions in various environments.

- Contactless Cards and Wearables: While mobile payment apps have seen tremendous growth, contactless card adoption still holds substantial promise for growth. Promoting their use by financial institutions as well as encouraging wearable contactless technology such as smartwatches or fitness bands could expand this payments market further.

Challenges

- Infrastructure Readiness: Emerging markets present unique challenges when it comes to contactless payment infrastructure readiness, particularly contactless-enabled terminals in retail stores, transportation systems, and other key locations that enable contactless-enabled payments terminals – the availability of which is integral in driving adoption rates forward.

- Consumer Adoption and Awareness: While contactless payments have gained in popularity, more consumer education may still be needed in order to encourage the adoption of this form of payment. Some consumers may hesitate to adopt contactless payments due to concerns related to security or privacy or due to an unfamiliarity with the technology involved – it is, therefore, crucial that they are made aware of both their benefits and safety so as to drive adoption forward.

- Compatibility and Standardization: Incompatibilities between contactless payment technologies can present a formidable obstacle, limiting users and potentially leading to confusion or limitations for them. Establishing interoperability standards could improve user experiences as well as facilitate wider adoption rates.

- Security and Fraud Concerns: While contactless payments offer increased security measures, there remain risks related to fraud or unauthorized transactions that compromise consumer confidence in this payment option. Card skimming, data breaches, and hacking attempts threaten this consumer trust – continuously investing in robust security solutions as well as education on security best practices are crucial solutions in combatting these security threats.

Recent Development

- Increased Adoption Due to COVID-19 Pandemic: Due to COVID-19's global pandemic, contactless payments have experienced rapid adoption as both consumers and businesses seek safe payment methods without physical contact during transactions. Merchants and financial institutions alike have implemented contactless payment solutions as an efficient payment alternative that reduces physical contact while transacting business.

- Mobile Wallet Adoption Increase: Mobile wallets like Apple Pay, Google Pay, and Samsung Pay have seen dramatic adoption rates over time. These mobile payment apps enable consumers to securely store payment card data on their smartphones for use at NFC-enabled terminals for contactless payments with convenience and ease of use in mind.

- Increase in Contactless Payment Infrastructure: Over the years, contactless payment infrastructure has seen exponential growth. More merchants such as retailers, restaurants, and transportation systems have adopted contactless payment terminals to meet rising consumer demand for contactless transactions.

Report Scope

| Report Attribute | Details |

| The market size value in 2023 | USD 22.4 Bn |

| Revenue Forecast by 2032 | USD 90.6 Bn |

| Global Market Growth Rate (2023 to 2032) | CAGR Of 15.4% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

FAQs

Q1: What are contactless payments?

A1: Contactless payments are transactions made by tapping or waving a contactless-enabled card or mobile device near a payment terminal, allowing for quick and convenient payments without physical contact.

Q1: How big is the Contactless Payments Market?

A1: The global Contactless Payments Market size was estimated at USD 22.4 billion in 2022 and is expected to reach USD 90.6 billion in 2032.

Q2: What is the Contactless Payments Market growth?

A2: The global Contactless Payments Market is expected to grow at a compound annual growth rate of 15.4%.

Q3:Who are the key companies/players in the Contactless Payments Market?

A3:Some of the key players in the Contactless Payments Markets are Gemalto, Infineon, Ingenico, Wirecard, Verifone, Giesecke+Devrient, IDEMIA, On Track Innovations, Identiv, CPI Card Group, Bitel, Somatic Systems, Valitor, PAX Global Technology, MYPINPAD, Mobeewave, Alcineo, Castles, SumUp, PayCore, Other Key Players

Q2: How does contactless payment technology work?

A2: Contactless payment technology uses near-field communication (NFC) or similar technology to securely transmit payment information between a payment device (such as a card or smartphone) and a payment terminal when they are held close together.

Q3: What are the advantages of contactless payments?

A3: Contactless payments offer several advantages, including faster transactions, convenience, improved hygiene, increased security through tokenization, and the ability to make payments without the need for physical cash or card insertion.

Contact

Global Business Development Team – Market.us

Market.us (Powered by Prudour Pvt. Ltd.)

Send Email: [email protected]

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us/

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.