ERP Software Market Surges Towards USD 136 billion by 2032 | Driven by Digital Transformation and Industry 4.0

Page Contents

Introduction: ERP Software Market

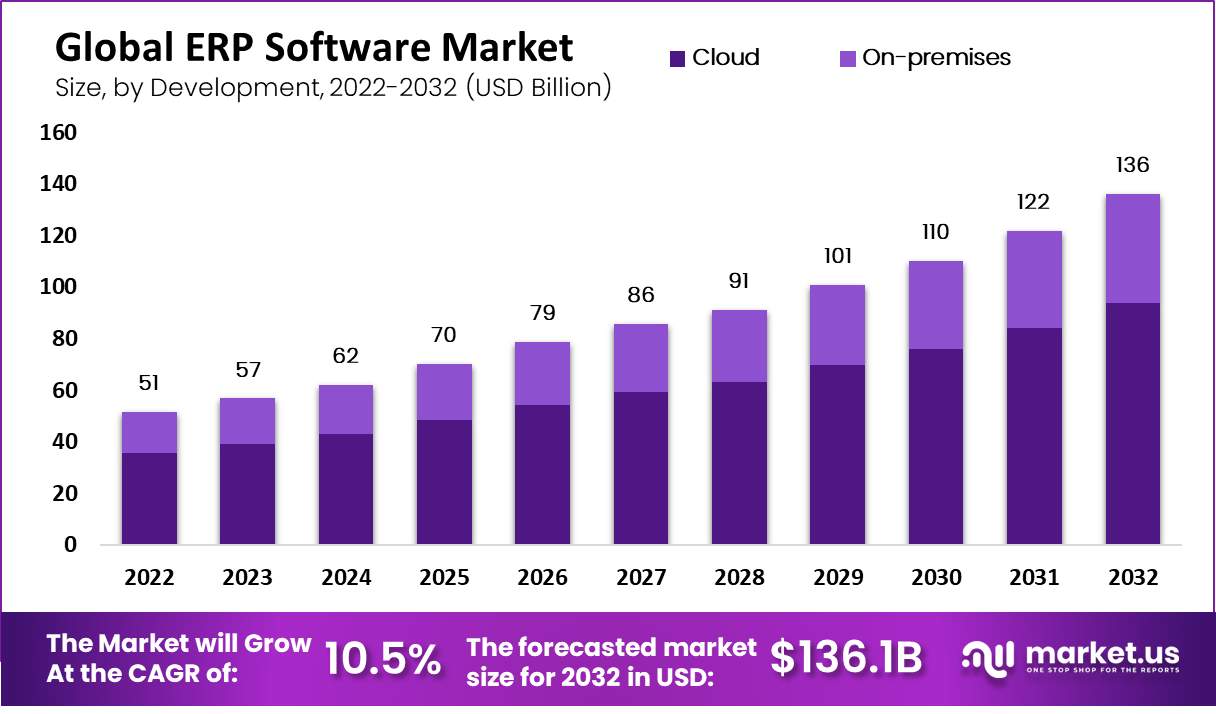

Published Via 11Press: The ERP software market is experiencing significant growth, projected to surpass USD 136 billion by 2032 with a compound annual growth rate (CAGR) of 10.5% from 2023 to 2032.

ERP (Enterprise Resource Planning) software is a comprehensive and integrated suite of applications designed to manage and streamline various business processes within an organization. It provides a centralized platform that enables companies to automate and optimize functions such as finance, human resources, supply chain, manufacturing, and customer relationship management.

The ERP software market is witnessing steady growth, driven by several factors. Firstly, organizations across sectors are increasingly recognizing the importance of integrated software solutions to manage diverse functions such as finance, human resources, supply chain, manufacturing, and customer relationship management. ERP software offers a unified platform that centralizes data and facilitates seamless communication between different departments, enabling real-time decision-making and improving organizational agility.

Tap into Market Opportunities and Stay Ahead of Competitors – Get Your Sample Report Now

Furthermore, the growing adoption of cloud-based ERP solutions is driving market expansion. Cloud-based ERP systems offer scalability, flexibility, and cost-effectiveness, making them particularly attractive to small and medium-sized enterprises (SMEs) seeking to digitize their operations without hefty upfront investments in infrastructure. Additionally, advancements in technology, such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) integration, are enhancing the functionality of ERP software, enabling predictive analytics, automation, and intelligent insights that further drive efficiency gains and competitive advantage for businesses.

Moreover, the increasing globalization of businesses and the need for standardization and compliance with regulatory requirements are fueling the demand for ERP software. Companies operating in multiple geographies require ERP solutions that can accommodate diverse regulatory frameworks, currencies, languages, and business practices, thereby fostering market growth.

Key Takeaways

- The ERP software market is expected to surpass USD 136.1 billion by 2032, with a projected CAGR of 10.5% from 2023 to 2032.

- On-premises deployment dominated the market in 2022.

- The finance segment held over 26.0% market share in 2022.

- Large enterprises accounted for 38.92% of the market share in 2022.

- Manufacturing and services segments held the largest market share in 2022.

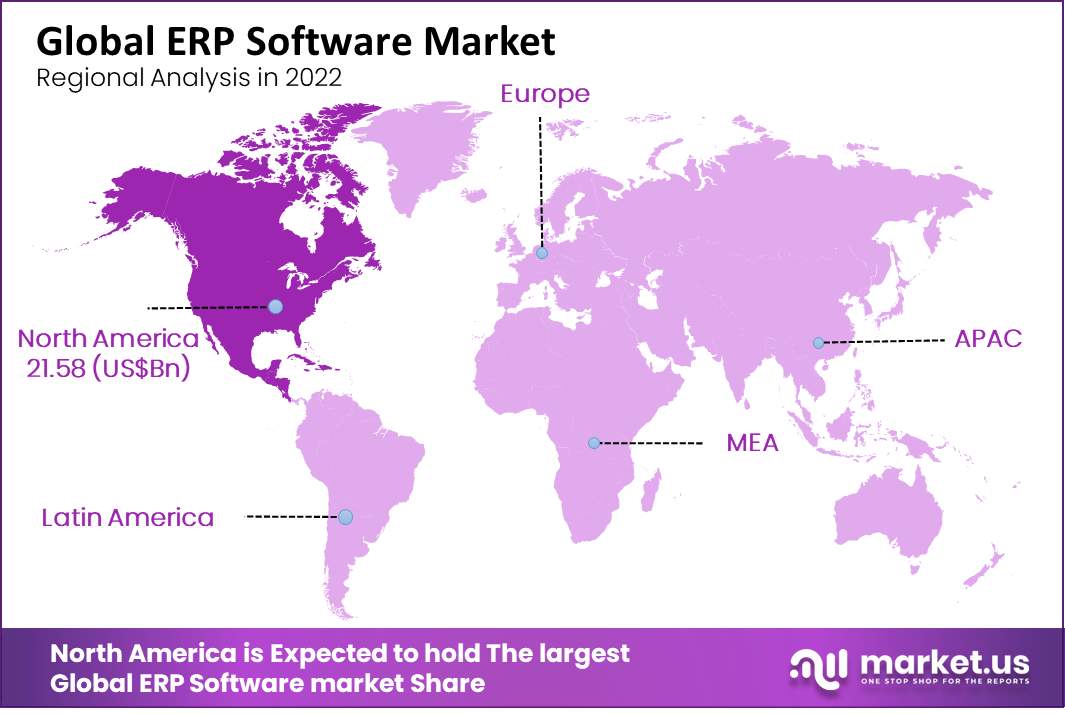

- North America led the market with a revenue share of 37% in 2022.

- According to recent estimates, SAP continues to lead the market with approximately 22% share of the total ERP applications market.

- SAP, Oracle, and Microsoft account for almost 50% of the total ERP applications market revenue.

- The cloud ERP market specifically is more fragmented, with SAP, Oracle, and Microsoft holding around 30% share, and vendors like Workday, Infor, and Sage having significant cloud presence.

- Investment Priority: 53% of IT executives identify ERP systems as a critical investment area, highlighting the technology's strategic importance (Oracle Netsuite).

- Venture Capital Influx: In 2023, ERP software companies attracted $7.7 billion in venture capital, indicating strong market confidence and growth potential (PitchBook).

- Acumatica received $100 million in Series A funding, demonstrating investor confidence in its ERP solutions.

- Workday secured $750 million through debt financing, showcasing its financial strength and market position.

- IFS was invested in with €400 million from private equity, highlighting its significant role in the ERP market.

- SAP holds the leading position in the global ERP software market with a 21.8% share in 2022, underscoring its dominance and innovation (IDC).

- Oracle is in second place with a 15.4% market share, reflecting its significant impact and presence in the ERP landscape.

- Microsoft Dynamics 365 sees rapid growth, owning an 11.4% market share, indicating increasing adoption and popularity.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=32270

Regional Snapshot

In 2022, North America held a dominant market position in the ERP software landscape, securing more than a 42% share, underscoring the region's advanced technological adoption and significant investments in software development by ERP vendors. This substantial market share reflects the region's robust infrastructure for technological innovation and the presence of key industry players committed to enhancing ERP solutions.

Europe, with its diverse industrial base and emphasis on digital transformation, also showcased a strong demand for ERP software, facilitating seamless operations across various sectors including manufacturing, healthcare, and retail. The focus on regulatory compliance and operational efficiency further propelled the adoption of ERP solutions across European enterprises.

The Asia-Pacific (APAC) region witnessed rapid growth in ERP software adoption, driven by the expanding manufacturing sector and the digitalization of businesses. Emerging economies such as China and India became hotspots for ERP deployment, fueled by government initiatives to promote technological adoption and the growing need for efficient business processes.

Latin America, though a smaller market compared to North America and Europe, showed promising growth in ERP software adoption. The drive towards modernization of businesses and the need for cloud-based solutions to support remote work trends contributed to the region's growing ERP market.

The Middle East and Africa (MEA) region, though at a nascent stage in ERP adoption, began recognizing the importance of digital transformation in driving economic diversification and improving operational efficiencies. Investments in cloud-based ERP solutions were particularly notable in sectors such as construction, manufacturing, and public services, indicating a gradual shift towards modernizing business practices.

Do Inquiry Before Buying this Report https://market.us/report/erp-software-market/#inquiry

Trends in ERP Software

- Cloud and Mobile Integration: A significant trend is the increase in cloud services and integration with mobile devices, enhancing flexibility and accessibility for businesses

- Focus on Automation: There is a growing demand for ERP solutions to automate business processes, particularly in inventory and work order management, to improve efficiency and coordination.

- Financial Management Dominance: The financial management segment continues to capture the highest revenue share in the global market, emphasizing the need for streamlined financial processes and compliance.

Report Segmentation

Type Analysis: On-Premises Segment

The on-premises segment of the ERP software market continues to hold a dominant position, largely due to its alignment with traditional business management methods. This preference stems from the segment's ability to offer heightened control over IT infrastructure, data security, and customization capabilities. On-premises ERP solutions cater to organizations seeking to maintain direct oversight of their enterprise systems, which is particularly appealing to sectors with stringent data security regulations or complex operational requirements. Despite the cloud's rising popularity, the on-premises approach remains a cornerstone for businesses prioritizing data sovereignty and bespoke system integrations.

Function Analysis: Finance Segment

In the realm of ERP software, the finance function stands out as the predominant segment, capturing over 26.0% of the market share in 2022. This prominence is attributed to the escalating adoption of ERP systems to streamline financial operations, including accounting, budgeting, and financial reporting. The finance segment's leadership underscores the critical role of ERP software in enhancing financial accuracy, compliance, and decision-making capabilities within organizations. As businesses continue to navigate complex financial landscapes, the demand for ERP solutions that offer robust financial management tools is expected to grow, further solidifying the segment's market dominance.

Enterprise Size Analysis: Large Enterprises

Large enterprises, with their intricate operational structures and extensive process networks, constitute the largest share of the ERP software market at 38.92%. The complexity and scale of operations in such organizations necessitate robust ERP systems capable of integrating diverse functional areas, streamlining data flows, and supporting strategic decision-making processes. The ERP solutions for large enterprises are designed to address the unique challenges posed by their size, including global supply chain management, multi-currency transactions, and comprehensive compliance requirements. This segment's substantial market share highlights the indispensable role of ERP systems in sustaining the operational efficiency and competitive edge of large organizations.

Industry Verticals Analysis: Manufacturing and Services Segment

The manufacturing and services sector leads the industry verticals in ERP software adoption, holding the largest market share. This leadership position is driven by the sector's inherent need for precise production planning, inventory management, quality control, and customer service enhancements. ERP systems offer integrated platforms that enable manufacturers and service providers to optimize their core operations, improve resource allocation, and enhance product and service delivery. The adoption of ERP solutions in this segment facilitates real-time visibility into operational processes, fostering agility, innovation, and responsiveness to market demands. As the backbone of economic production and service delivery, the manufacturing and services sector's reliance on ERP software is pivotal for driving growth and operational excellence.

Driver

Increasing Need for Operational Efficiency and Transparency

One of the primary drivers for the adoption of ERP software is the increasing need for operational efficiency and transparency within organizations. As businesses expand, the complexity of managing various processes and departments grows exponentially. ERP systems offer a unified platform that integrates all aspects of a business, from supply chain management and inventory to finance and customer relations, enabling real-time visibility and control. This integration not only streamlines operations but also significantly reduces the likelihood of errors and duplication of efforts, thereby enhancing overall efficiency.

Moreover, the transparency provided by ERP systems improves decision-making capabilities by offering accurate and timely information, which is crucial for strategic planning and execution. As organizations continue to seek ways to optimize their operations and gain a competitive edge, the demand for comprehensive ERP solutions is expected to rise, driving market growth.

Restraint

High Implementation Costs and Complexity

A significant restraint in the ERP software market is the high implementation cost and complexity associated with these systems. Deploying an ERP solution often requires a substantial financial investment, not only in terms of software licensing but also for hardware, consulting services, system customization, and employee training. For many small to medium-sized enterprises (SMEs), these costs can be prohibitively high, limiting their ability to adopt ERP systems.

Furthermore, the complexity of integrating ERP software with existing systems and processes can lead to extended deployment times and disrupt business operations. The necessity for significant organizational change management to adapt to new workflows and processes can also pose challenges, making the implementation process daunting for businesses without substantial IT and change management resources.

Opportunity

Cloud-based ERP Solutions

The shift towards cloud-based ERP solutions presents a significant opportunity in the ERP software market. Cloud ERP offers a more flexible, scalable, and cost-effective alternative to traditional on-premises systems. With lower upfront costs, simplified IT infrastructure requirements, and automatic updates, cloud-based ERP systems are becoming increasingly attractive to businesses of all sizes, including SMEs.

This transition to the cloud also facilitates remote access to ERP applications, enabling businesses to support mobile workforces and real-time data access from any location. As more companies prioritize digital transformation and look to enhance their agility and resilience, the adoption of cloud-based ERP solutions is expected to accelerate, opening up new growth avenues for vendors and service providers in the ERP market.

Challenge

Data Security and Privacy Concerns

One of the major challenges facing the ERP software market is addressing data security and privacy concerns. ERP systems often process and store vast amounts of sensitive business information, making them a prime target for cyberattacks. As businesses increasingly adopt cloud-based ERP solutions, the risk of data breaches and unauthorized access escalates, raising concerns about data privacy and compliance with regulatory standards such as GDPR and HIPAA.

Ensuring the security of ERP systems requires continuous investment in cybersecurity measures, including encryption, secure access controls, and regular security audits. For ERP vendors and users, maintaining high levels of data security and privacy is crucial to protect proprietary and customer information, posing a continuous challenge in an ever-evolving cyber threat landscape.

Recent Developments

1. Epicor Software Corporation:

- May 2023: Announced the release of Kinetic 2024.1, featuring enhanced financial management, supply chain capabilities, and user experience improvements.

- August 2023: Partnered with Deloitte Consulting to offer customers specialized implementation and consulting services for Epicor Kinetic software.

- October 2023: Announced the acquisition of Data Interchange, a provider of EDI integrations for ERP systems.

2. IBM Corporation:

- March 2023: Announced the release of IBM Maximo Mobile, a mobile app for managing maintenance and asset operations.

- June 2023: Partnered with Microsoft to integrate IBM Maximo with Microsoft Azure cloud platform.

- November 2023: Announced the acquisition of Bluetab, a provider of cloud-based ERP solutions for manufacturing and distribution businesses.

Read the Detailed Index of the full Study at https://market.us/report/erp-software-market

Market Segmentation

Based on Deployment

- Cloud

- On-premises

Based on Function

- Finance

- Supply Chain

- HR

- Other Functions

Based on Enterprise Size

- Small Enterprises

- Large Enterprises

- Medium Enterprises

Based on Industry Verticals

- Retail

- Aerospace & Defense

- BFSI

- Manufacturing & Services

- Government

- Telecom

- Other Industry Verticals

Market Key Players

- Hewlett-Packard Development Company, L.P.

- International Business Machines Corporation

- Epicor Software Corporation

- IBM Corporation

- SAP SE

- Sage Group Plc

- Infor Inc/Infor CloudSuite

- Unit4

- Oracle Corporation

- NetSuite Inc.

- Microsoft Corporation

- Ramco System, Sage Group

- Kronos

- Concur (SAP)

- Totvs

- YonYou

- Kingdee

- Workday

- Cornerstone

- Digiwin

- Other Key Players

Report Scope

| Report Attribute | Details |

| The market size value in 2023 | USD 57 Billion |

| Revenue forecast by 2032 | USD 136 Billion |

| Growth Rate | CAGR of 10.5% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2018-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.