Market.us: Insulin Market To Hit USD 28 Bn By 2033

Page Contents

Market Overview

Published Via 11Press : The insulin market is a lucrative industry that plays a critical role in managing diabetes, a chronic disease affecting millions of people worldwide. Insulin is a hormone produced by the pancreas that helps regulate blood sugar levels. However, for individuals with diabetes, their bodies either do not produce enough insulin or are unable to use it effectively.

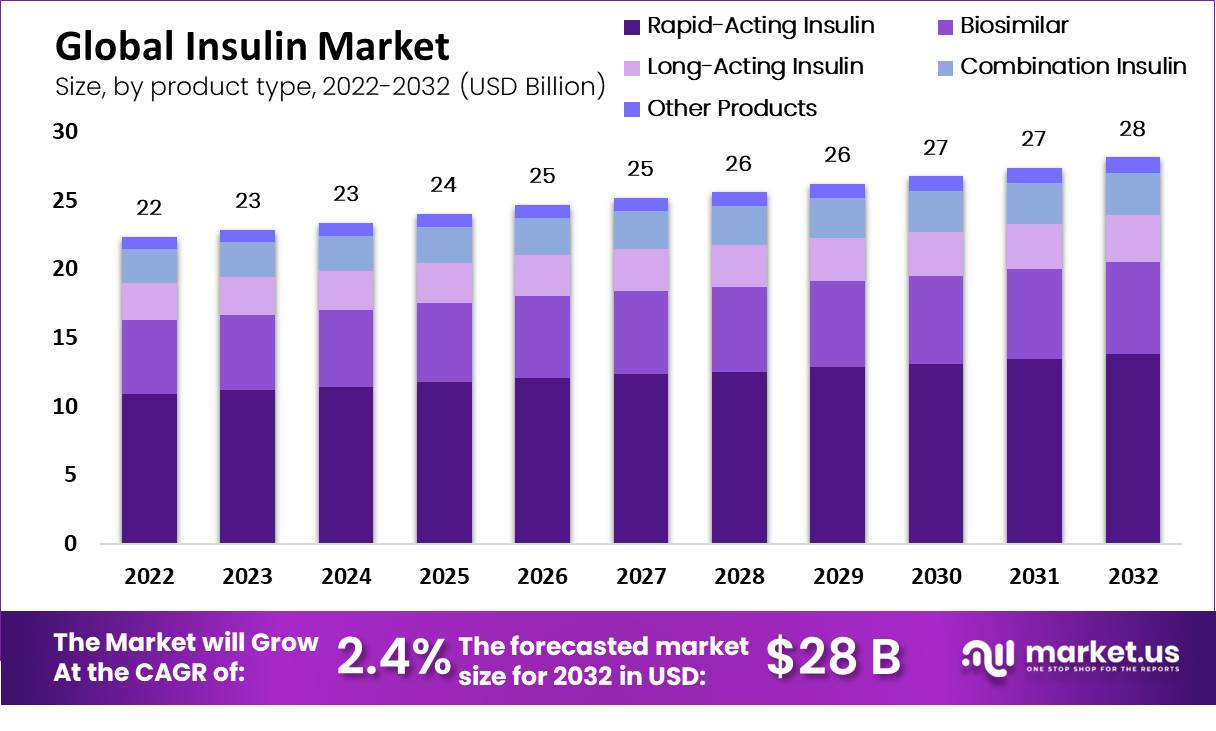

The insulin market size is expected to be worth around USD 28 Bn by 2032 from USD 23 Bn in 2023, growing at a CAGR of 2.4% during the forecast period from 2022 to 2032

The global insulin market has experienced significant growth over the years due to the rising prevalence of diabetes and an aging population. According to reports, around 463 million adults were living with diabetes in 2019, and this number is projected to increase in the coming years. As a result, there is an increasing demand for insulin products to help manage this chronic condition.

Several major pharmaceutical companies dominate the insulin market, including Eli Lilly and Company, Novo Nordisk A/S, and Sanofi S.A. These companies continuously invest in research and development to improve existing products and develop innovative forms of insulin delivery. The market offers various types of insulin formulations such as rapid-acting, short-acting, intermediate-acting, and long-acting insulins, as well as combination products for better glycemic control.

Despite its growth potential, the insulin market faces challenges related to affordability and accessibility. Insulin prices have been a subject of controversy due to significant increases in recent years. This has led to concerns about patients' ability to afford life-saving medication and sparked discussions regarding price regulation.

Request For Sample Report Here: https://market.us/report/insulin-market/request-sample/

Key Takeaway

- The Insulin market is expected to be worth approximately USD 28 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 6.2% from 2022 to 2032.

- Insulin is a critical medication for diabetes treatment, a chronic condition characterized by high blood sugar levels.

- Major players in the insulin market include Novo Nordisk, Sanofi, and Eli Lilly and Company.

- The U.S. Food and Drug Administration (FDA) actively monitors the safety and effectiveness of insulin products.

- The insulin market has seen a notable increase in usage due to the growing prevalence of diabetes and an increased focus on effective diabetes management.

- Long-acting insulin commands a significant market share of 49% in terms of product type.

- Insulin analogs dominate the market with an impressive 84% market share among insulin types.

- Type 1 Diabetes Mellitus holds a substantial 75% market share in terms of application.

- Retail pharmacies are the primary distribution channel, accounting for 48% of the market share.

- The escalating prevalence of diabetes and the focus on better healthcare management are driving market growth.

- High costs associated with insulin and the need for precise dosage management are significant challenges.

- Technological advancements in insulin delivery systems and research for improved insulin formulations present growth opportunities.

- North America is expected to dominate the market by 2022, with a substantial market share of approximately 38.2%, driven by high diabetes prevalence.

- Key players include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, and others actively engaged in research and development.

- Long-acting insulin helps maintain a constant level of insulin in the body for an extended period, reducing the risk of diabetic complications.

AI Insights: Generative AI's Impact on the Insulin Market

Here are some of the ways that generative AI could impact the insulin market:

- Reduce the cost of insulin. Generative AI could be used to design new, more efficient ways to produce insulin. This could lead to lower production costs, which could in turn lead to lower prices for insulin.

- Make insulin more accessible. Generative AI could be used to develop new delivery methods for insulin that are more convenient and easier to use. This could make insulin more accessible to people who have difficulty injecting it, such as children and the elderly.

- Improve the effectiveness of insulin. Generative AI could be used to develop new forms of insulin that are more effective at controlling blood sugar levels. This could improve the quality of life for people with diabetes.

Facts About Insulin

- Prevalence of Diabetes: In 2021, an estimated 38.4 million Americans, accounting for 11.6% of the population, were living with diabetes. This includes around 2 million Americans with type 1 diabetes, among which approximately 304,000 are children and adolescents. The diagnosed cases of diabetes among adults were 29.7 million, with an additional 8.7 million adults undiagnosed

- Undiagnosed Diabetes: It was found that 8.5 million adults aged 18 years or older had undiagnosed diabetes, representing 23% of adults with the condition.

- Prevalence by Race/Ethnicity: Diabetes prevalence varies significantly by race and ethnicity. The highest rates were observed among American Indian and Alaska Native adults at 13.6%, followed by non-Hispanic Black adults at 12.1%, and adults of Hispanic origin at 11.7%.

- County-Level Prevalence: Across the United States, the county-level prevalence of diagnosed diabetes among adults aged 20 years or older in 2021 ranged from 4.4% to 17.9%, with the median county-level prevalence increasing from 6.3% in 2004 to 8.3% in 2021.

- Prediabetes Statistics: Prediabetes, a condition indicating higher than normal blood glucose levels but not high enough for a diabetes diagnosis, affected more than 1 in 3 U.S. adults (96 million) in 2019. Prediabetes prevalence was similar across racial and ethnic groups and education levels, adjusted by age.

- Cost of Diabetes: The economic impact of diabetes is substantial, with the total estimated cost of diagnosed diabetes in the United States reaching $327 billion in 2017, including $237 billion in direct medical costs and $90 billion due to reduced productivity.

Recent Developments

Recent developments in insulin therapy and diabetes care have shown remarkable progress in 2023, with significant advancements aimed at enhancing treatment effectiveness and patient convenience. Here are some of the key developments:

- Once-Weekly Insulin: Innovations in insulin formulations, such as icodec and efsitora alfa, are demonstrating effectiveness in managing type 2 diabetes with only once-weekly injections. These insulins offer potential advantages in reducing the frequency of injections and improving adherence to treatment regimes. The ongoing studies show promising results in terms of A1C reduction and lower instances of hypoglycemia, especially during nighttime.

- Automated Insulin Delivery for Pregnant Women: Research has highlighted the potential of automated insulin delivery technology as a game-changer for pregnant women with type 1 diabetes. This hybrid closed-loop technology aims to simplify diabetes management during pregnancy, enhancing both maternal and fetal outcomes.

- Oral Insulin Tablet Development: A team at the University of British Columbia has made breakthroughs in developing an oral insulin tablet, a significant step toward providing a more convenient insulin administration method. This could revolutionize insulin therapy, making it easier and less invasive for millions of people with diabetes.

- Smart Insulin Pens: Bigfoot Biomedical has developed the Bigfoot Unity smart insulin pen system, integrating with continuous glucose monitoring (CGM) devices to provide real-time blood sugar information and personalized dosing recommendations. This advancement takes smart insulin pens to a new level by automating dose calculations based on continuously monitored glucose levels.

- Continuous Glucose Monitors (CGM) Improvements: Dexcom plans to introduce the Dexcom G7, a fully disposable CGM with a faster warm-up period and a redesigned app for more comprehensive glucose monitoring. Senseonic is also advancing its Eversense CGM technology with an extended-wear 365-day sensor, pending clinical trial results and regulatory approval.

- Insulin Delivery Technology: Medtronic has received CE mark approval for its Simplera CGM and is integrating it with the InPen smart insulin pen for real-time dosing guidance. Medtronic also covers its MiniMed 780G insulin pump system under Medicare, signaling broader accessibility to advanced insulin delivery solutions.

- GLP-1 Impact and Therapeutic Class Advancements: The GLP-1 therapeutic class, including medications like Ozempic and Wegovy, has seen increased attention for its role in blood sugar control and weight loss. Innovations in this area include long-term implants for GLP-1 delivery, with potential implications for insulin pump technology and CGM adoption.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.