Cyber Insurance Market Is Booming at CAGR of 22.3%

Page Contents

Published Via 11Press: The cyber insurance market, valued at US$ 12.1 billion in 2023, is anticipated to undergo a significant transformation, with forecasted revenue reaching US$ 30 billion by 2032. This projection indicates a compound annual growth rate (CAGR) of 3.4% over the period from 2023 to 2032. The anticipated growth can be attributed to the increasing prevalence of cyber threats and the growing awareness among businesses regarding the critical need for cybersecurity measures.

As digital transformation accelerates across industries, the demand for comprehensive cyber insurance solutions is expected to rise, reflecting the market's response to emerging risks and the evolving landscape of cyber threats. This trend underscores the importance of cyber insurance as an essential component of risk management strategies for businesses operating in the digital age.

Key Takeaways

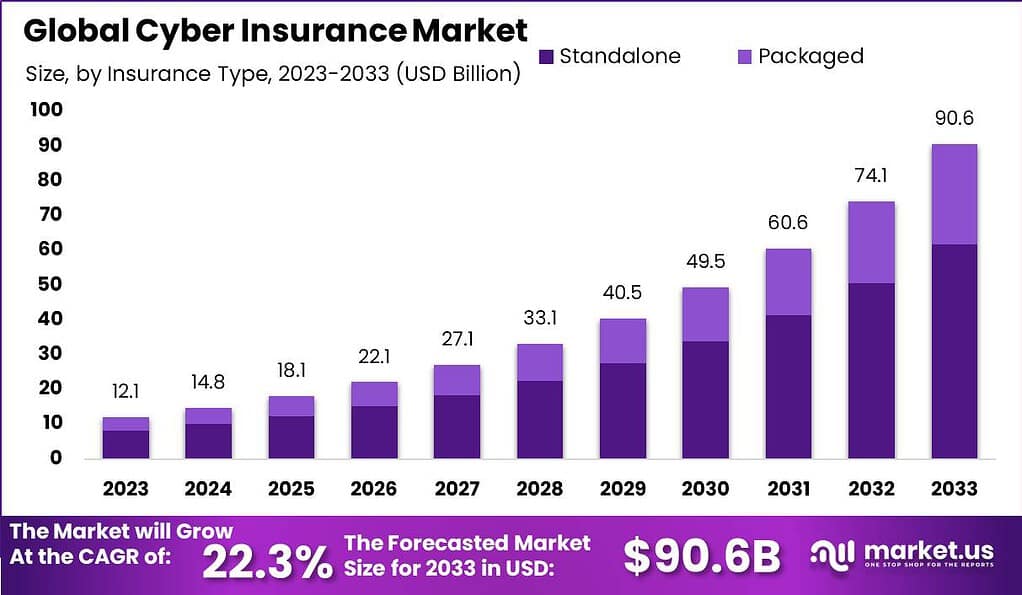

- The cyber insurance market is expected to be worth USD 90.6 billion by 2033, growing steadily at a rate of 22.3% from 2024 to 2033.

- In 2023, the market was valued at USD 12.1 billion, indicating significant growth potential in the coming years.

- Standalone cyber insurance policies accounted for over 68.2% of the market share in 2023, showing a rising awareness among organizations about specific cyber risks.

- Third-party coverage held a substantial share of over 62.1% in the market, emphasizing the importance of protecting businesses against external claims resulting from cyber incidents.

- Large Enterprises constituted the majority of the market with over 72.4% share, indicating their proactive approach to mitigating financial risks associated with cyber threats.

- The BFSI sector led the market with a share of over 28.3% in 2023, attributed to its extensive handling of sensitive financial data.

- North America commanded a significant revenue share of 37.6% in 2023, followed by Europe and the Asia-Pacific region.

- Challenges in the cyber insurance market include the lack of standardization, limited understanding of risks, and evolving cyber threats.

- Opportunities for market growth include the increasing demand for cyber insurance driven by rising cyber threats and technological advancements.

- Top key players in the market include American International Group, Inc., Aon PLC, The Chubb Corporation, and Zurich Insurance Group Ltd.

- The market is witnessing developments in advanced risk assessment tools, predictive analytics, and regulatory compliance solutions.

Do Inquiry Before Buying Here https://market.us/report/cyber-insurance-market/request-sample/

Key Statistics and Insights

- Market Growth: The global cyber insurance market, valued at USD 12.1 billion in 2023, is projected to expand to USD 90.6 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 22.3% during this period.

- North America Market Dominance: North America continues to lead in the cyber insurance sector, with a market cap of USD 4.5 billion in 2023, and is expected to drive the market's growth and adoption significantly in the coming years.

- Increasing Cyber Threats: The growth of the cyber insurance market is propelled by the rising incidence of cybercrime and the increasing cost of claims. This has led to a heightened demand for coverage against cyber-related incidents, with insurers seeing a surge in claims, particularly for ransomware and phishing attempts.

- Cyber Insurance Claims: The volume of cyber insurance claims has doubled over the past three years, with payouts increasing by 200%. In 2021, claim payouts peaked at 8,100, underscoring the escalating impact of cyber threats.

- Average Claim Costs: The average cyber insurance claim costs vary significantly, with small to medium enterprises (SMEs) facing an average total claim cost of $345,000. Ransomware claims, in particular, have shown an average cost rise to $485,000, indicating the severe financial impact of such attacks.

- Prevalence of Cyber Insurance: A survey of 450 organizations in 2022 revealed that 55% had some form of cyber insurance coverage, with only 19% having coverage for cyber events beyond $600,000. This highlights a growing but still limited penetration of cyber insurance across the business spectrum.

- Claims by Cause: Ransomware and phishing are the most common reasons for cyber insurance claims. These methods are often the initial access points for cybercriminals, leading to significant breaches and financial losses.

- Coverage and Demand: The demand for cyber insurance is increasing across various sectors, with the BFSI (Banking, Financial Services, and Insurance) sector leading the demand due to the high volume of digital transactions and data management involved. Similarly, the healthcare sector is witnessing a rise in insurance policy adoption, driven by the growing number of data breaches in the industry.

Drivers

- The surge in Cyberattacks: There's a notable rise in cyber threats, including ransomware and phishing attacks, which has heightened the awareness and need for cyber insurance solutions. This growth in cyber incidents is a major driver for the market, as businesses seek to mitigate financial and operational risks associated with these attacks.

- Mandatory Cybersecurity Legislations: Governments worldwide are implementing stricter cybersecurity and data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. These regulations mandate businesses to adopt robust cybersecurity measures and often require cyber insurance to cover potential fines and losses from data breaches.

- High Demand in BFSI and Healthcare Sectors: The Banking, Financial Services, and Insurance (BFSI) sector, along with the healthcare industry, are particularly vulnerable to cyber threats due to the vast amount of sensitive data they handle. This has led to a surge in demand for cyber insurance in these sectors to protect against data breaches and cyberattacks.

- Growth in SMEs Investing in Cybersecurity Solutions: Small and Medium Enterprises (SMEs) are increasingly being targeted by cybercriminals. Recognizing their vulnerabilities, SMEs are now more inclined to invest in cyber insurance as a risk management strategy to safeguard their operations and customer data.

- Global Market Expansion: The cyber insurance market is witnessing significant growth in regions like North America, Asia Pacific, Europe, and other parts of the world. This expansion is driven by the growing recognition of cyber threats and the need for insurance solutions to mitigate these risks. Notably, the Asia Pacific region is experiencing a surge in demand due to increasing digitalization and cyber threats, with governments investing in cyber insurance to lessen the impact of cybercrimes.

- Innovation and New Product Launches: The market is also driven by continuous innovation and the launch of new products tailored to the evolving cybersecurity landscape. Insurers are collaborating with tech companies to offer enhanced cyber insurance solutions, addressing the specific needs of businesses across different industries.

- Lack of Standardized Policies: The variability in cyber insurance policies presents both a challenge and a driving force for the market. The absence of standardized policies encourages insurers to develop tailored solutions that meet the unique needs of each business, promoting growth and innovation within the market.

- Digital Transformation and Regulatory Compliance: The rapid pace of digital transformation across sectors and the need to comply with an expanding array of cybersecurity regulations are prompting businesses to invest in cyber insurance. This not only helps in managing risks but also in ensuring compliance with legal requirements.

Benefits Cyber Insurance

- Forensic Support: Cyber insurance policies typically include provisions for forensic support to investigate and analyze the cause of a cyber incident, helping businesses understand how the breach occurred and how to prevent future incidents.

- Data Breach Coverage: This coverage handles the costs associated with a data breach, including customer notifications, credit monitoring services, and other related expenses, helping businesses manage and mitigate the impact of data breaches on their operations and reputation.

- Cyber Extortion Defense: As ransomware attacks become more common, cyber insurance can provide defense against these types of cyber extortion, covering the costs associated with ransom payments and negotiations.

- Business Interruption Loss Reimbursement: In the event that a cyber attack disrupts business operations, this benefit offers compensation for lost income, helping businesses recover from financial losses due to operational downtime.

- Legal Support and Compliance: Cyber insurance can offer legal support to help businesses navigate the legal complexities following a cyber incident, including litigation and regulatory compliance issues. This is especially valuable given the increasing number of regulations around data protection and privacy.

- Recovery for Funds Transfer Fraud (FTF): Some policies offer recovery services for funds lost due to fraudulent transfer requests, leveraging partnerships with financial institutions and government agencies to recover stolen funds.

- Coverage for Errors and Omissions: Third-party liability coverage included in cyber insurance policies protects businesses from claims made by customers or partners due to a failure to provide adequate security or data protection, covering legal fees, settlements, and judgments.

The rising costs associated with cyber incidents, along with the growing complexity of cyber threats, underscore the importance of cyber insurance as a critical component of an organization's risk management strategy. With the median cost of a cyber attack now reaching nearly $17,000 and the potential for even greater financial consequences, businesses of all sizes, particularly small and medium-sized enterprises, are recognizing the value of investing in cyber insurance policies.

Furthermore, as digital transformation accelerates and regulatory requirements become more stringent, cyber insurance not only helps businesses manage the financial risks associated with cyber incidents but also supports compliance with industry standards and legal obligations.

Challenges

- Geopolitical Cyber Risks: The geopolitical landscape, highlighted by events such as the Russian invasion of Ukraine, is driving increased cyber insecurity. This situation is expected to escalate the frequency and sophistication of cyberattacks, targeting critical infrastructure and employing advanced tactics like the use of AI and deep fakes for disinformation campaigns.

- Ransomware: Ransomware remains a primary cause of cyber insurance losses, with projections suggesting costs could reach US$265 billion annually by 2031. Trends indicate a shift towards data destruction rather than encryption and an increasing focus on cloud infrastructure by attackers.

- Supply Chain Vulnerabilities: The supply chain is a preferred target for cyber threats, with critical bottlenecks and systemic risk targets rising due to digital interconnectedness. The expected attacks on software supply chains could increase threefold by 2025, emphasizing the need for transparency and cybersecurity investments.

- Data Breaches and Liability: The volume of data created is skyrocketing, increasing opportunities for malicious actors. Legislation and heightened customer expectations regarding data protection will likely make privacy breaches and violations due to wrongful data collection more prominent.

- The Connected World: The proliferation of connected IoT devices is set to generate vast amounts of data by 2025, enhancing efficiency but also expanding the landscape for cyberattacks. This trend underscores the convergence of IT and operational technologies (OT), placing critical infrastructure in jeopardy.

- Market Conditions: The cyber insurance market has faced steep pricing increases, tighter terms and conditions, and intensified scrutiny from underwriters. However, recent trends indicate a moderation in price increases and an increase in organizations purchasing coverage as the market stabilizes.

- Coverage Complexity: More than half of organizations lack any form of cyber insurance, and among those insured, a significant portion has coverage that falls short of potential needs. This disparity is partly due to the challenge insurers face in understanding the nuanced risks of today's security landscape and formulating policies that reflect these risks.

Opportunities

- Growing Demand in SMEs: Small and Medium Enterprises (SMEs) are increasingly being targeted by hackers, recognizing the need for cybersecurity solutions. This segment is expected to see significant growth in cyber insurance investment, as small businesses seek to mitigate financial and reputational risks associated with cybersecurity breaches.

- Expansion in BFSI and Healthcare Sectors: The Banking, Financial Services, and Insurance (BFSI) sector, along with the healthcare industry, are projected to experience substantial growth in the demand for cyber insurance. This is attributed to the vast amount of sensitive data they manage and the increasing digitalization of their operations, making them prime targets for cyberattacks.

- Global Market Expansion: The cyber insurance market is witnessing significant growth globally, with North America leading the charge due to strong government regulations and the presence of dominant solution providers. However, the Asia Pacific region is expected to witness substantial growth, driven by increasing digital connectivity and government investments in cyber insurance to counteract the rising threat of cyberattacks. Europe, South America, and the Middle East & Africa are also expected to see notable market growth.

- Strategic Collaborations and Partnerships: Key players in the cyber insurance market are focusing on expanding their operations and global presence through strategic collaborations and partnerships. This approach not only enhances their cybersecurity offerings but also broadens their customer base. Recent partnerships and product launches are aimed at providing comprehensive and innovative cyber insurance options in response to the evolving digital risk landscape.

- Innovation in Products and Services: The cyber insurance market presents opportunities for innovation, especially in creating new coverage options that address emerging cyber threats. Insurers are extending cyber liability to supply chains and exploring coverage for risks related to Internet of Things (IoT) devices, cloud services, and artificial intelligence (AI). This expansion of products and services opens up new avenues for cyber insurance providers to cater to the diverse needs of businesses across various industries.

- Increasing Importance of Cybersecurity Legislation: The rise in mandatory legislations regarding cybersecurity across the globe is driving the demand for cyber insurance. As countries adopt new data privacy regulations and enforce compliance standards, organizations are increasingly seeking cyber insurance coverage to mitigate the financial impact of non-compliance and data breaches.

Recent Developments

- New Entrants and Product Launches: March 2023 saw the launch of Intangic MGA, a managing general agent based in London offering cyber parametric coverage. This is indicative of new players entering the market with innovative solutions designed to meet the growing demand for cyber insurance.

- Strategic Collaborations and Partnerships: Key players in the cyber insurance market are expanding their operations and global presence through strategic collaborations and partnerships. For instance, Beazley Group and Cytora partnered in April 2022 to streamline insurance for clients and brokers. Similarly, Cowbell, a cyber-insurance provider, partnered with Millennial Shift Technologies in February 2023 to deliver Cowbell’s cyber insurance programs.

- Sector-Specific Growth: The BFSI (Banking, Financial Services, and Insurance) sector is expected to hold the largest share in the cyber insurance market due to the vast data generation and increased digitalization in the financial sector. Meanwhile, the healthcare industry is projected to grow at the highest CAGR during the forecast period, driven by a rise in data breaches.

Key Players and Strategic Moves

- American International Group, Inc., Zurich Insurance Co. Ltd, The Chubb Corporation, Aon PLC, and Lockton Companies Inc. are recognized as leaders in the cybersecurity insurance market. These companies have been instrumental in shaping the market through strategic partnerships, innovative product offerings, and global expansions to cater to the diverse needs of their clients across various industries.

- Beazley Group partnered with Cytora in April 2022 to enhance insurance solutions for clients and brokers. This collaboration aims at modernizing underwriting operations and reducing manual processes, thereby streamlining insurance for clients.

- QBE North America launched a new cyber insurance program with Converge in July 2023. This program aims to provide businesses with tailored insurance solutions to mitigate the risks associated with cyber threats and data breaches.

- AXA XL has made significant developments by launching an incident response team in the Americas and announcing cyber insurance roles and regional management appointments in the U.S. to address complex cyber and technology risks.

Conclusion

The cyber insurance market is on a trajectory of rapid growth, fueled by the increasing prevalence of cyber threats, regulatory requirements, and the introduction of innovative insurance solutions. As businesses and governments continue to navigate the complexities of the digital age, the demand for cyber insurance is expected to rise, offering protection against the financial impacts of cyber incidents. With key players and stakeholders poised to capitalize on this burgeoning market, the future of cyber insurance looks promising, offering new opportunities for risk management in an increasingly interconnected world.

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.