Global GaN Power Devices Market to Witness Steady Growth during the Forecast Period 2019-2028

Page Contents

Market Overview

Published Via 11Press: Gallium Nitride (GaN) is a wide-bandgap semiconductor material that has gained momentum in recent years as an alternative to Silicon (Si) in power devices. GaN Power Devices boast several advantages over their Si counterparts, such as higher breakdown voltage, lower on-resistance, faster switching speed and wider operating temperature range.

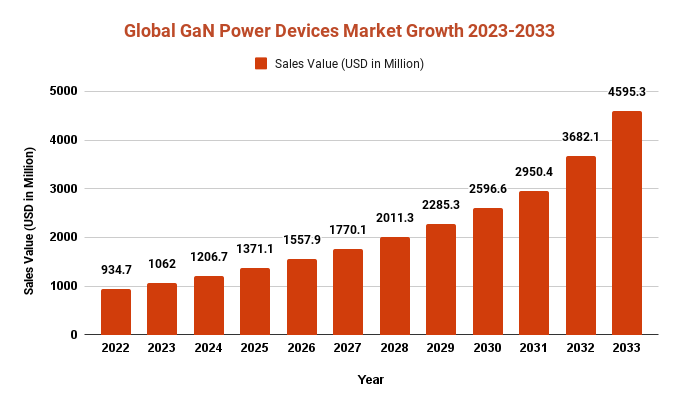

GaN Power Devices market size is forecast to reach USD 4595.3 million by 2033 from its current value of USD 934.7 million in 2022, rising at an annual compound growth rate (CAGR) of 17.49% between 2023 and 2033.

GaN HEMTs are the most commonly used power devices. Their high electron mobility enables faster switching speeds and lower on-resistance, making them suitable for applications such as power electronics, RF amplifiers, and DC-DC converters. GaN Schottky diodes are commonly employed as rectifiers in power electronics systems due to their low forward voltage drop that reduces power losses and enhances efficiency. Furthermore, these diodes have a higher operating temperature range than Si diodes which makes them ideal for high temperature applications. GaN VETs, similar to GaN HEMTs but featuring a vertical structure for higher current density and breakdown voltage. GaN VETs are being developed for high-power applications such as electric vehicles and renewable energy systems. GaN ICs (Integrated Circuits) are being created for power electronics uses; they combine GaN power devices with other electronic components like gate drivers and controllers to create efficient power management systems.

Key Takeaways

- The GaN power devices market expected to reach USD 934.7 million in 2022.

- Forecasted compound annual growth rates between 2022 and 2032 is 17.49%.

- By 2033, the GaN power devices market is projected to reach USD 4595.3 million.

- GaN power devices boast several advantages over traditional Si-based options, such as higher breakdown voltage, lower on-resistance, faster switching speed and a greater operating temperature range.

- GaN HEMTs are currently the most commonly used GaN power device type; they find applications in power electronics, RF amplifiers and DC-DC converters. GaN Schottky diodes can also be employed as rectifiers within these applications due to their low forward voltage drop and high temperature operation.

- GaN VETs are being developed for high-power applications like electric vehicles and renewable energy systems, featuring a vertical structure that allows higher current density and breakdown voltage. GaN ICs, on the other hand, integrate GaN power devices with other electronic components to create highly efficient power management systems.

- As this field continues to progress, we can expect continued improvements in performance and efficiency – leading to their increased adoption across various applications.

Request For Sample Report Here: https://marketresearch.biz/report/gan-power-devices-market/request-sample/

Regional Snapshot

- North America: North America has a prominent position in the GaN power device market, with several companies such as Efficient Power Conversion (EPC) and Power Integrations based there. North America has become an important hub for research and development related to GaN power devices, boasting numerous research and development centers dedicated to improving this technology.

- Asia-Pacific: The Asia-Pacific region is the leading market for GaN power devices, with countries such as China, Japan, South Korea and Taiwan dominating manufacturing and production. This region's large electronics industry and growing interest in energy-saving solutions make it an attractive market for GaN power devices.

- Europe: Europe boasts a significant presence in the GaN power device market, with companies such as Infineon and STMicroelectronics based here. Furthermore, the European Union has invested heavily in research and development of GaN power devices with several initiatives designed to enhance this technology and boost adoption rates.

- Rest of World: Other regions such as South America, the Middle East and Africa have shown interest in GaN power devices; however their markets remain relatively small compared to other regions. As technology continues to advance and become more widely adopted, we can expect increased demand for GaN power devices in these locations as well.

Enquire Here & Query for report: https://marketresearch.biz/report/gan-power-devices-market/#inquiry

Drivers

- GaN power devices boast higher efficiency compared to their Si-based counterparts, leading to lower power losses, reduced energy consumption and improved performance across various applications. GaN devices feature higher power density which enables them to handle higher loads in smaller form factors for smaller and more compact designs. Moreover, GaN power devices have faster switching speeds than their Si-based counterparts which makes them suitable for high-frequency applications requiring rapid power switching at higher frequencies.

- GaN power devices boast a wider temperature range than their silicon-based counterparts, making them suitable for high temperature and harsh environments like aerospace and defense applications. Emerging uses such as electric vehicles, renewable energy systems and 5G communication networks require high performance yet energy-efficient power management systems – thus the demand for GaN power devices. Furthermore, with the increasing need for data centers and cloud computing comes an increased requirement for efficient power management systems which has further encouraged their adoption by GaN power providers.

Restraints

- GaN power devices are more expensive than their Si-based counterparts, which may restrict their application in certain circumstances. Furthermore, production and availability of GaN power devices remain limited compared to what's available from Silicon-based suppliers, making it difficult for some businesses to acquire enough quantities in a timely manner. Furthermore, manufacturing GaN power devices requires more complex techniques than those employed with Si-based products, leading to higher production costs overall.

- GaN power devices are still relatively new technologies, and their long-term reliability and durability need further study and testing.

- Standards and regulations regarding GaN power devices have yet to be developed and implemented, making it challenging for companies to comply with them. Furthermore, the industry lacks the expertise required to design and implement GaN power devices effectively, which may make it difficult for some firms to adopt and utilize this innovative technology.

Opportunities

- GaN power devices are becoming increasingly important in emerging applications such as electric vehicles, renewable energy systems and 5G communication networks that require high-performance yet energy-efficient power management systems.

- Data centers and cloud computing have also seen an uptick in need for more effective power management systems that could further drive demand for these devices. Furthermore, automotive OEMs are increasingly turning towards GaN power solutions for electric vehicle applications – further fuelling growth within the GaN power device market.

- GaN power devices have seen an exponential rise in adoption due to their ruggedness and reliability in solar and wind energy applications.

- Their reliability also makes them ideal for aerospace and defense projects where reliability and durability are essential. As more investment is put into research and development of GaN power devices, new innovations and improvements to the technology may occur, further propelling their adoption and growth within the market place.

Challenges

- GaN power devices are currently more expensive than their silicon-based counterparts, which may limit their application in certain scenarios. Furthermore, the manufacturing process for these devices is more complex than that of Si-based alternatives, leading to higher production costs and supply chain difficulties.

- Standards and regulations specific to GaN power devices are still in development and implementation phases which makes it difficult for companies to comply with them. Furthermore, industry expertise required to design and implement GaN power devices remains scarce which further hampers adoption by some businesses.

- GaN power devices are still relatively new technology, and their long-term reliability and durability have yet to be fully established. Furthermore, production and availability of GaN power devices is much smaller compared to Si-based alternatives, making it difficult for some companies to obtain them in sufficient quantities.

Market Segmentation

GaN Power Devices Market, by Component

- GaN Power Discrete Devices

- GaN Power RF Devices

- GaN Power Non-RF Devices

- GaN Power IC’s

- MMIC

- Hybrid

- GaN Power Modules

GaN Power Devices Market, Industry Vertical

- Consumer Electronics

- IT & Telecommunications

- Automotive

- Aerospace & Defense

- Others

Key Players

- Efficient Power Conversion Corporation

- NXP Semiconductors N.V.

- GaN Systems Inc

- Texas Instruments

- Infineon Technologies AG

- Fujitsu Limited

- Transphorm Inc.

- Cree Incorporated (Wolfspeed)

- OSRAM Opto Semiconductors GmbH

- Qorvo, Inc

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 934.7 million |

| Revenue forecast by 2033 | USD 4595.3 million |

| Growth Rate | CAGR Of 17.49% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

Check Growing Demand => Purchase Market Report

Recent Developments

- GaN Systems and ON Semiconductor have announced a strategic collaboration to accelerate the adoption of GaN-based power systems in automotive and industrial markets.

- Infineon Technologies AG recently announced the acquisition of Cypress Semiconductor Corporation and its GaN power business, to expand their product portfolio across automotive, industrial and consumer markets.

- Navitas Semiconductor recently unveiled their GaNFast power ICs, designed for use in fast chargers for mobile devices and consumer electronics.

- GaN Systems recently unveiled their 650 V GaN power transistor range, designed for use in high-power applications such as electric vehicles and data centers.

- Transphorm has announced the availability of their new range of 650 V GaN power transistors, designed for use in power supplies and inverters for renewable energy systems.

Key Questions

1. What are the advantages of GaN power devices over traditional Si-based ones?

– GaN power devices boast lower switching losses and faster switching rates than their Si-based counterparts, leading to greater efficiency and reduced power dissipation. This makes them ideal for high-speed, high-frequency applications.

2. What are the major end-use industries for GaN power devices?

– GaN power devices are utilized in electric vehicles (EVs) and hybrid electric vehicles (HEVs) to improve efficiency, reduce size and weight, and boost power density.

3. What are the different types of GaN power devices available on the market?

– HEMTs are the most prevalent GaN power device. They find applications in power converters, amplifiers, and RF devices. HEMTs boast fast switching rates and high power density which makes them perfect for high-frequency or high-power tasks.

4. What are the primary factors driving growth in the GaN power device market?

– GaN power devices boast higher efficiency compared to their silicon-based counterparts due to the wider bandgap of GaN, which enables it to operate at higher voltages and frequencies with lower switching losses and conduction losses.

5. What are the challenges associated with adopting and growing GaN power devices?

– GaN power devices still lack a reliable supply chain compared to traditional silicon-based ones, making it difficult for some manufacturers to source large volumes of these components.

6. How is the GaN power device market segmented?

GaN power devices come in various forms, such as diodes, transistors and integrated circuits. Each type has its own advantages and drawbacks depending on what application they serve.

7. What are the recent developments in the GaN power device market?

– GaN power devices are seeing rapid adoption across various applications such as electric vehicles, data centers and renewable energy systems due to their superior efficiency levels, higher power density and faster switching speeds. This trend can be attributed to higher efficiency levels, power density benefits and faster switching speeds of these devices.

8. What is the future outlook for the GaN power device market?

– As technology continues to advance in manufacturing GaN power devices, customers are expected to see improved performance and reliability from these products, making them increasingly attractive.

9. How do GaN power devices stack up against other emerging power device technologies?

– GaN power devices offer several advantages over other emerging technologies, such as higher efficiency, greater power density, and faster switching speeds.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.