Some Crucial BHIM App Statistics to Scale Its Expansion In The Online Payment Market

Introduction

BHIM App Statistics: Bharat Interface of Money (BHIM), a mobile app, offers a reliable, fast, and secure way to make online payments via mobile phones. It uses UPI (Unified Payment Interface) platforms or the Mobile app with USSD (Unstructured Substrate Service Data). The Prime Minister launched BHIM on 30 Dec 2016. Within 10 days, the BHIM app had been downloaded 10 million times from Android Play Store. It also received more than 2,000,000 UPI transactions and USSD data (Unstructured Supplementary Data). BHIM is compatible with other Unified Payment Interfaces (UPI), apps, and bank account accounts. National Payment Corporation of India (NPCI) has created the BHIM App. Traders can now get payments directly into their bank account via BHIM. This is a significant benefit. After signing up with the BHIM mobile app, traders as well as users receive a VPA and a ready-to-print QR Code. Here are some important BHIM-app statistics that will demonstrate how the app is helping to navigate the country into the digital economy.

(Editor’s Choice)

- NPCI has created the BHIM app, which is a new generation of e-wallets.

- BHIM is the adapted version of UPI and USSD in India.

- As per BHIM app statistics, within 10 days of its release, BHIM reported 10 million downloads from Android Play Store.

- It recorded more than 2 million UPI transactions and USSD (Unstructured Supplementary Service Data) platform.

- As per the report, the BHIM app is the tiniest size mobile application.

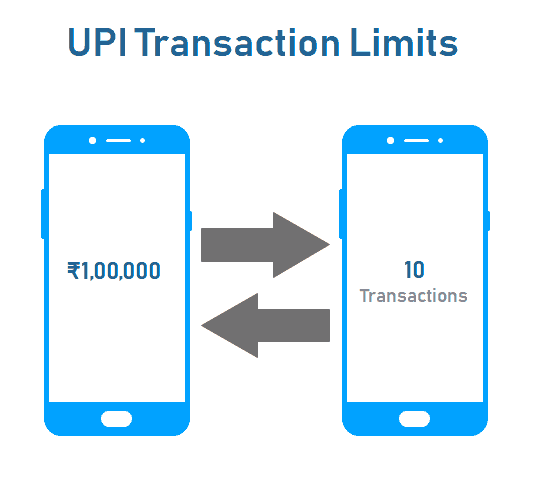

- A user can transact up to INR 100,000 per transaction and INR 100,000 maximum per day for one bank account.

- Bharat Interface for Money (BHIM) app offers a fast, secure, and dependable medium to make online payments via mobile phone devices.

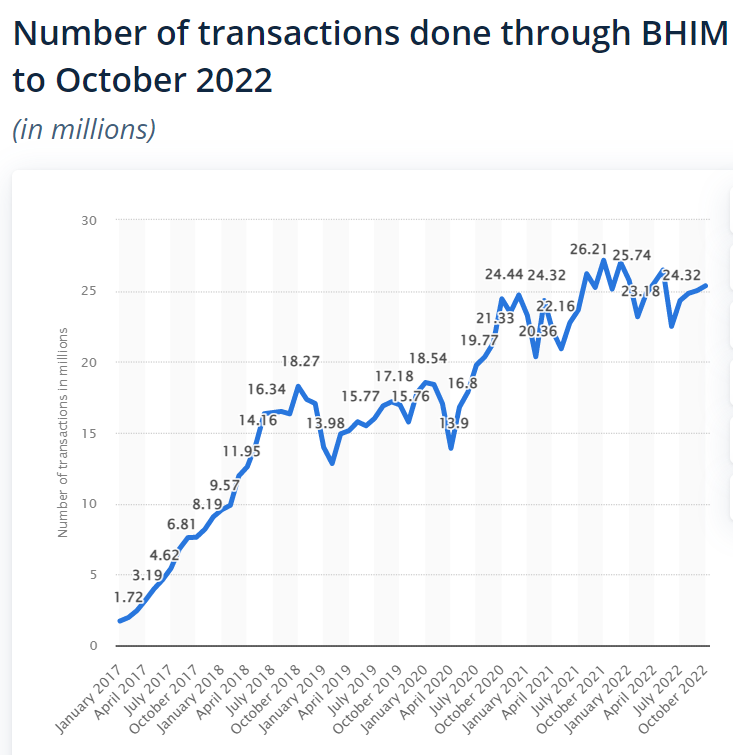

- As per 2022 BHIM app statistics, the BHIM app was reported to have processed around 25.3 million transactions as of October 2022.

- The BHIM app has been downloaded nearly 204.34 million times on Android devices in 2022.

- As per the statistics, Bhutan was the first nation to allow UPI transactions via BHIM app in 2021.

- The BHIM app accounts for 0.4 percent of the UPI market share currently.

- The BHIM app has been downloaded around 5.39 million times on the iOS platform.

General BHIM App Statistics and Trends

#1. The BHIM app was reported to have processed around 25.3 million transactions as of October 2022

The number of transactions processed via the Bharat Interface for Money (BHIM) app accounted for more than 25 million as of October 2022. As per the data, the number of transactions through the BHIM app had been changing to a reasonably high level over 20 million transactions.

(Source: Statista)

#2. NPCI has created the BHIM app, which is a new generation of e-wallet

The BHIM application has been developed by the National Payments Cooperation of India (NPCI). It was unveiled by the Prime Minister on 30th Dec 2016.

#3. The BHIM app accounts for 0.4 percent of the UPI market share currently

Due to the rise of PhonePe and Google Pay as the two biggest players in the UPI market, the market share of BHIM in overall UPI transactions has dropped to a new low of 0.4 percent as of January 2023.

#4. The BHIM app has been downloaded nearly 204.34 million times on Android devices in 2022

As of December 2022, the BHIM app has been installed nearly 204.34 million times on Android devices. While it has been downloaded around 5.39 million times on the iOS platform.

#5. As per the statistics, Bhutan was the first nation to allow UPI transactions via BHIM app in 2021

Unified Payments Interface (UPI) was made accessible to the Royal Monetary Authority of Bhutan on July 13, 2021.

#6. Bharat Interface for Money (BHIM) app offers a fast, secure, and dependable medium to make online payments via mobile phone devices

The BHIM app can be linked to users’ bank accounts. It means that transactions made through the BHIM app are secure and the money transacted to users’ registered numbers or any payment address will reflect directly to their bank accounts.

#7. A user can transact up to INR 100,000 per transaction and a maximum of INR 100,000 each day for one bank account.

This limit applies per bank account that is linked to the BHIM app. Users can transact a minimum of INR 1 through the BHIM app.

(Source: upipayments.co.in)

#8. As per the report, the BHIM app is the tiniest size mobile application

The BHIM app is a quite mobile-friendly payment application that takes up only 1.98 MB of your mobile storage memory. It is the smallest mobile payment app.

#9. As per BHIM app statistics, within 10 days of its release, BHIM reported 10 million downloads from Android Play Store

While the BHIM app reported nearly 2 million UPI (Unified Payments Interface) and USSD (Unstructured Supplementary Service Data) transactions within just 10 days of its release in 2016.

#10. BHIM is the adapted form of UPI and USSD

We know that UPI (Unified Payment Interface) and USSD (Unstructured Supplementary Service Data) have been designed on top of Immediate Payment Service (IMPS), and the transaction via BHIM takes place within seconds.

#11. Users can win prizes for making payments via the BHIM app

Each day nearly 15000 users might have a chance to win prizes via a lucky draw for making transactions through the BHIM app.

#12. The BHIM app registration can be done through easy and simple steps

After installing the BHIM app, users require to register their bank account details and set the UPI pin. Users will also be asked to fill last 6 digits of their Debit/ATM card number and the expiry date.

#13. Users can save the fee payment to card companies by using the BHIM app

The app does not require users to pay fees to service providers that give financial services such as Visa or Master cards. It has been the biggest barrier for merchants in switching to cashless payments.

#14. In 2020, the BHIM app BHIM accounted for merely 19.49 million transactions

The transaction value of the BHIM app was merely INR 6668.02 Cr in 2020.

#15. In 2021, India declared a cap of 30 percent on the total volume of the UPI market share for all third-party app providers (TPAPs)

However, in December 2020, the NPCI prolonged the deadline for Unified Payments Interface (UPI) market players such as PhonePe, Paytm, and Google Pay to follow a market cap of 30 percent by two years to December 2024. At present PhonePe, Google Pay, and Paytm lead 97 percent of the UPI market share.

#16. In 2019, the BHIM app had around 1.29 percent of the overall UPI market

As per the BHIM app statistics, the payment app started facing a downfall in 2018.

#17. In October 2021, The BHIM app recorded more than 4.2 billion digital transactions

It led to a total transaction value worth $100 billion.

Conclusion:

With the Jan Dhan program inspiring more and more people to have bank accounts, India is determined to not only attain a cashless economy status but to achieve superior financial inclusion as well. The launch of RuPay is considered a step towards the same. RuPay is a more reasonable debit, and credit card system as compared to international entities like Visa and MasterCard, which are used predominantly by India’s urban population. Users need a smartphone, a mobile number that is linked to a bank account, and a RuPay, Visa, or Maestro card to open a BHIM account.

It shows that people living in tier 2 and 3 cities, along with rural areas of the country, can have access to UPI-based transactions. The BHIM app statistics show that the payment app has been struggling to find its presence in the market, however, with the launch of RuPay, the BHIM app plans to reach a wide variety of consumers.

Sources

FAQ.

A user can transact up to INR 100,000 per transaction and a maximum of INR 100,000 each day for one bank account. This limit applies per bank account that is linked to the BHIM app. Users can transact a minimum of INR 1 through the BHIM app

BHIM is a different mobile wallet app while UPI is a payment mode that is utilized to accept or send money using mobile phone devices. Any of the UPI-assisted banks can be linked to the BHIM app, which is a combined app based on the Unified Payments Interface.

At present, the BHIM app allows only one bank to be linked to it. While setting up the account, users can sync their choice of the bank account as the default account. In case they like to sync another bank account, they need to go to the Main menu, select Bank Accounts and choose their default account.

The BHIM app has been developed by the National Payment Corporation of India (NPCI) under the guidance of the Reserve Bank of India (RBI).

The BHIM app is a unique payment system that can be utilized without internet connectivity. Users can dial *99# from any mobile device and have access to features of the BHIM app on their mobile phone devices. Users can also sign up for the BHIM app by dialing *99#.

Michael Singer is a career coach, podcast host, and author to help you step into a career you're excited about. Currently, He is a coach and trainer helping entrepreneurs and executives achieve business and leadership success. He is also an award-winning business journalist focused on the intersection of technology, Big Data, Cloud, SaaS, SAP, and other trending technology.