Top 10 Most Expensive Stocks In The World

Page Contents

Most Expensive Stocks – Equities, also known as stocks or shares, represent partial ownership in publicly traded companies. Those who invest in company stocks become shareholders and are entitled to a portion of the corporation's assets and profits. Trading of shares takes place on stock exchanges such as NASDAQ or NYSE, where shares are bought and sold at predetermined prices. Stock prices are influenced by various factors such as a firm's financial performance, market trends, and macroeconomic conditions. While stock investing can lead to long-term wealth growth, it also involves the risk of potential losses.

History of Stocks

In the 1600s, the Dutch East India Company paved the way for the history of stocks by being the first organization to offer the general public shares of stock. This innovative strategy allowed people to invest in the business and receive a portion of the profits, which proved crucial in funding operations and expansion.

In the nascent days of stock trading, transactions took place in London's cafes and on its streets. But as stock trading gained prominence, legitimate stock exchanges like the London Stock Exchange arose, with construction beginning in 1801. In the United States, the New York Stock Exchange (NYSE) was established in 1792, with traders gathering under a buttonwood tree on Wall Street to trade in securities. Today, the NYSE remains the world's largest stock exchange and a vital representation of American finance.

Stocks were an effective means of raising capital and financing industrial expansion during the late 19th and early 20th centuries when railways and oil firms required substantial expenditures to set up operations and grow. Stock market collapses such as 1929's Great Depression-causing crash occurred frequently at this time; excessive speculation, stock manipulation practices, economic fluctuations, as well as sudden shifts all contributed to its disastrous effect.

As a response to the Great Depression; the US government took steps to regulate the stock market and prevent the recurrence of such calamitous events. Among these measures was the formation of the Securities and Exchange Commission (SEC) in 1934. It was entrusted with developing regulations that would safeguard investors from fraudulent and deceitful practices. Thanks to electronic trading platforms; the stock exchange arena has undergone tremendous innovation. This has led to faster and more efficient transactions than ever before, with a global impact that has cemented equities' importance in the world economy. Share trading on international markets has now become accessible to millions of individuals.

Types of Stocks

- Common stock is the preferred investment option for most people. With its purchase, you become a shareholder in the company, granting you voting rights in crucial decisions like key executive appointments. Common stocks also offer potential dividends and capital gains. Nonetheless, they're often considered riskier than preferred stocks due to their volatility and susceptibility to significant price fluctuations.

- When compared with ordinary shareholders, those holding preferred stocks take precedence when collecting dividends and asset distributions. Unlike common stockholders, preferred stock investors don't normally have voting rights. Instead, they receive a pre-determined dividend payment that is established when the stock is issued. Although preferred stocks are less prone to volatility than common stocks, their growth potential over time is comparatively low.

- “Blue chip stocks” are shares of reputable corporations that have established a reputation for reliability, stability, and consistency. These stocks are often considered less risky than other types of stocks and can provide consistent returns over an extended period.

- When investors purchase growth stocks, they are buying a stake in companies that are expected to experience revenue and earnings growth above the norm. These businesses may not offer dividends, and their price-to-earnings (P/E) ratio may be high. Nevertheless, investing in them has the potential to yield significant capital growth over an extended period.

- Investors commonly identify value stocks as shares of businesses that are trading below their true value. These companies are often perceived to be undervalued by the market, making it an opportunity for investors to purchase stocks at a lower cost. Should the actual worth of the company be realized, investors may stand to gain significantly

- Stocks belonging to companies with market capitalization falling between $300 million and $10 billion are classified as small and mid-cap stocks. Although they may harbor greater risks than those with larger market values, they also present a greater potential for long-term profits.

Uses of Stocks

- Businesses can generate funds by offering stocks to finance their operations and growth. Companies can raise capital by selling shares to investors, without incurring debt or taking out loans.

- Investing in stocks can be advantageous for those seeking extended financial growth. Stocks offer the potential for capital appreciation, dividend yield, and diversification of portfolios.

- Many people opt to invest in stocks as a means of saving for their golden years. By investing in a diverse array of equities and other assets, individuals can cultivate a portfolio that promises growth and income over time.

- Stocks can serve as a hedge against economic risks such as inflation. Both individuals and businesses can use stock investments to mitigate the loss of purchasing power during times of high inflation.

- Additionally; stocks can be incorporated into a company's employee compensation plan, enabling employees to have a vested interest in the company's success, thus aligning their goals with those of the company.

Economic Reference

- Stocks can be an essential source of capital creation, helping businesses raise funds for projects such as R&D or any endeavor that might spur economic expansion. Companies can gain cash via issuing shares without incurring debt or borrowing money – thus lowering financial risks while encouraging long-term growth.

- Stocks may also be an effective strategy for building wealth as they allow individuals to invest in businesses and gain from their success. Investors could see considerable increases in portfolio value as the value of equities increases – this in turn may increase consumer spending and help spur economic development.

- Companies may invest in new initiatives, expand operations and add jobs by issuing stocks to raise capital. Lowering unemployment and encouraging economic growth may have positive repercussions for the entire economy.

- The stock market, as an arena for businesses to raise cash and investors to participate in these companies, is essential in maintaining market stability and efficiency. Investors need access to informed decisions regarding investment choices; businesses meanwhile benefit from receiving access to liquidity and transparency offered by stock markets.

The Popularity of Stocks

- Investors seeking long-term wealth growth may find stocks appealing due to their potential for high returns. Throughout history, stocks have consistently outperformed numerous asset classes, making them an attractive option for those looking to see significant financial gains over time.

- Incorporating stocks into an investment portfolio can be advantageous due to their exposure to a variety of businesses and industries. By diversifying with a range of equities, investors may be able to increase profits while simultaneously reducing overall investment risk.

- The advent of Internet trading platforms and the abundance of investment information have made stock research and investment considerably easier for the average investor. As a result; a larger number of people can now access the stock market, facilitating the process of trading for regular investors.

- Given that numerous companies offer shares at an affordable price point; the threshold to enter the stock market is relatively low. This makes it easier for individual investors to initiate stock market investments, even with a small amount of money.

Interesting Statistics

- As of April 15, 2023; the S&P 500 index measured 5,138.61 points.

- Simultaneously, the NASDAQ Composite index registered at 15,259.20 points.

- As of April 15, 2023, the Dow Jones Industrial Average hit a nadir of 28,652.74 points.

- On April 15, 2023, Apple Inc. was ranked as the top publicly listed company in the world, with a market value of almost $3.3 trillion.

- In recent years, technology firms such as Apple; Microsoft, Amazon, Facebook, and Alphabet (Google) have seen a surge in stock value due to strong profit growth and high demand for their products and services.

- The energy sector has faced challenges due to a decrease in oil prices and a shift towards renewable energy alternatives.

- Aging populations; and rising demand for healthcare services have allowed the healthcare sector to operate efficiently.

- The COVID-19 pandemic has had a profound effect on the stock market; prompting dramatic drops in certain sectors (airlines and hotels) while prompting noticeable increases elsewhere (tech; e-commerce).

Why Stocks Are Expensive?

- Price fluctuations of stocks tend to increase when there is strong demand for them, such as favorable press about their business, impressive financial results or advantageous market circumstances.

- Investors seeking greater returns often look towards stocks as a potential alternative investment when interest rates decline, leading to greater demand and consequently higher prices.

- An organization's stock may be considered cheap if its earnings are increasing more quickly than its share price; conversely, overpriced stocks would have their price increase faster than their earnings.

- Investor sentiment has an effect on the stock market and can be altered by political developments, economic data, and social trends. Even if fundamentals do not support an increase in stock prices, positive emotions could increase profits through greater enthusiasm from shareholders.

- Quantity plays a significant role in determining a stock's price on the market; more shares available leads to increased demand and therefore an increase in price.

Mentioned below are the world’s top 10 most expensive stocks

- Berkshire Hathaway Inc

- Lindt And Sprungli Ag

- Next Plc

- Nvr.Inc

- Amazon. Inc

- Seaboard Corporation

- Booking Holdings Inc.

- Alphabet Inc.

- Markel Corporation (Mkl)

- MRF

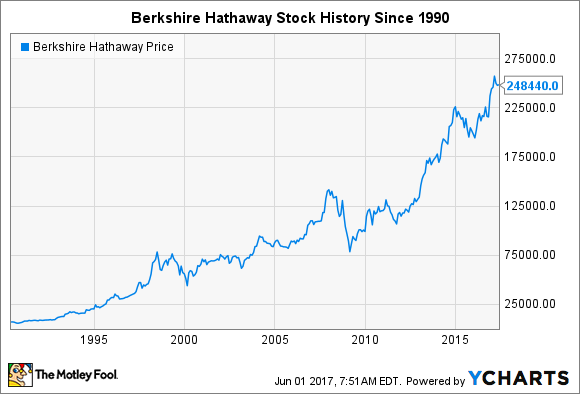

#1. Berkshire Hathaway Inc

In the global market; one stock had reigned supreme with an exceptionally high price for many years. The volatility of the stock market and the specific stocks purchased could greatly affect its value. As of 2022; this stock has seen a range in value from £248,624 to £420,791. Despite the variance, these amounts are still substantial. Berkshire Hathaway, a company in the United States, is the current top brand. Consumer goods; media; insurance, and real estate may not be the first industries you associate with them; but don't be surprised to bump into them there. They have a reputation for catering to affluent clients and managing valuable assets.

This fund has become a popular choice for hedge funds due to its affordable price. Berkshire Hathaway, with a rich history dating back to 1839, has prospered for well over a century. The company has had ample time to grow and evolve throughout its 182-year legacy. It all began with a simple textile manufacturing business, but look how far they've come. Although they still produce consumer items, they have since expanded much beyond only textiles. No other pricey stock even comes close to dethroning this corporation.

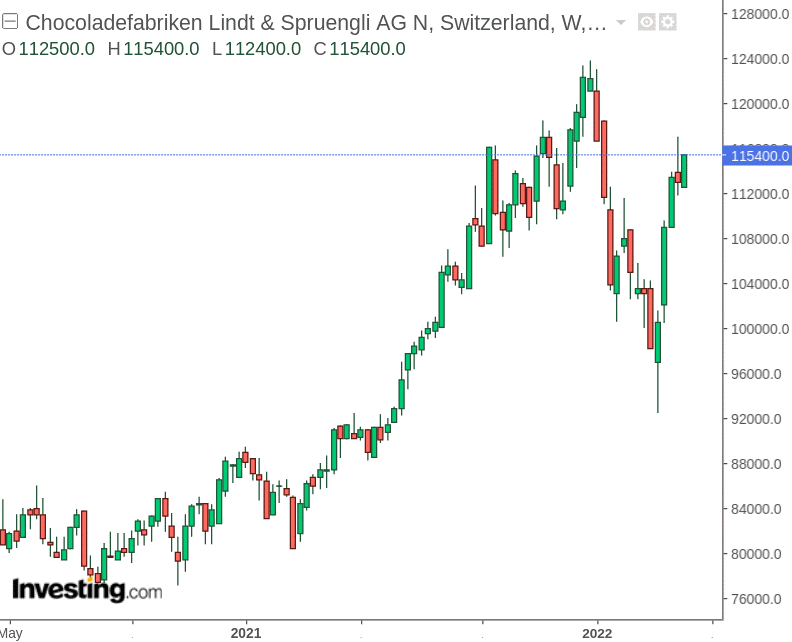

#2. Lindt And Sprungli Ag

Following Bitcoin; which shocked the globe; is the sole additional stock in the entire globe to have surpassed the £100k threshold. In the year 2022; Lindt and Spruengli often close slightly over or below that £80,000 threshold.

This business sells candies and is situated in Switzerland. This is where the Lindt chocolates originate from if you see them in your local grocery shop. Those are some very decadent, exquisite chocolates. In addition to owning the bulk of Russell Stover Candies; this corporation also owns the Lindt brand. They are additionally around for a very long time; this year marks 177 years for them. Originally established in 1845; they are obviously succeeding now. More information about this business reveals that they are the owners of more than 410 confectionery shops worldwide. Despite having its origins in Switzerland, they now have assets in several other nations. They also sell a lot of their own candies all around the world.

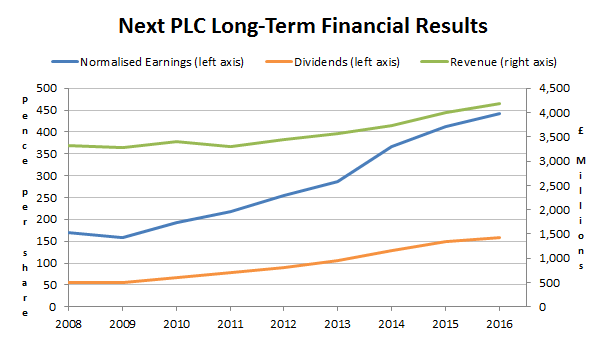

#3. Next Plc

In the district of Enderby, Leicestershire, you'll find the main base of operations for this retail enterprise. Spread throughout Europe, Asia, and the Middle East, it boasts a tally of 700 locations when you account for all its stores. This number soars past its 500 outlets in the United Kingdom and Ireland. While its stock's value has swayed considerably through the months, expert projections pinpoint it to lie within the £4,500 – £7,000 range come 2022.

Branches of this beloved British company are abundant in this region, garnering a loyal following for their clothing, shoes, and household goods. Against the backdrop of a competitive retail industry, this business has faced rivals time and time again, yet they continue to thrive. In 2012, they surpassed Marks & Spencer in both sales and popularity and have maintained their success ever since. Thanks to their widespread presence across multiple platforms, they remain easily accessible to shoppers.

#4. Nvr.Inc

NVR and Starboard share similar stock pricing. However, as previously discussed, their order on our list can change depending on both firm performance and market factors at that particular moment in time. NVR Inc. traded in 2022 between PS2,000 and PS4,200 per share. NVR is an American house construction-oriented business known for its various brands such as NVHomes, Ryan Homes, and Heartland Homes. Though they rank fourth-largest homebuilder in the US, no other construction companies come close to matching their success in building over 4 million homes since their founding.

Additionally, NVR Inc can be found on the Fortune 500 list at position 380; founded under Ryan Homes but changed to NVR Inc in 1980. NVR Inc. only became publicly traded in 1993. They quickly established their trademark, Ryan Homes being one of them. NVR has been operating for decades; however, only offering public shares since 1987 makes their inclusion on our list even more noteworthy. Although their offerings span a range of houses across the US – single-family homes, duplexes, townhouses, and condominiums.

#5. Amazon. Inc

Amazon Inc is currently the fifth-most expensive stock on the global market, hailing from Seattle, Washington as an American multinational technology corporation specializing in e-commerce, cloud computing, digital streaming, and artificial intelligence. Along with Apple, Google, and Facebook – which form the “Big Four” technological firms – Amazon has become one of the biggest online marketplaces and largest brands worldwide since founder Jeff Bezos started the business as an online bookseller back in 1994 before eventually expanding to software, electronics, video games, and other areas as it flourished further over time.

Since going public in 1997, Amazon's stock has steadily increased over the past 10 years. Amazon Inc. recently reported total revenues for 2019 of $280.522 billion.

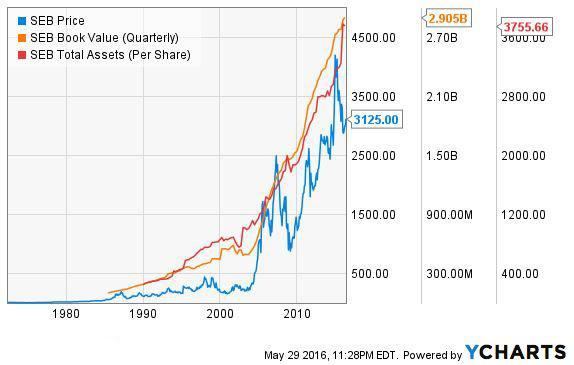

#6. Seaboard Corporation

Seaboard Corporation; may not top your typical list, but its stock trades between PS 2,000 and PS 3,700 per share – it specializes in shipping and freight transport and boasts annual revenues exceeding $5 billion! Seaboard Corporation excels at both producing and processing pork while being recognized for its maritime shipping capabilities; two markets that form the heart of its operations. Seaboard Industries produces sugar; corn and electricity among many other commodities; and their cargo ship division offers over 30 shipping containers as paid import/export assistance services.

Seaboard Corporation is one of the five most expensive stocks worldwide – yet their headquarters are situated in Merriam; Kansas despite operating both interactive and freight businesses! Seaboard Corporation; employs over 20,000 individuals and takes great pride in treating each one as part of the family. Though large scale, they understand the importance of community. Since 1983 – when Seaboard was first founded! – their operations have spread into 45 nations around the globe!

#7. Booking Holdings Inc.

Do you remember Priceline? It used to be one of the premier travel agencies online. Though their name no longer appears online, the business still exists under Booking.com (Priceline was no longer their original name). Prior to becoming Booking Holdings in 2018; Priceline Group existed for almost 20 years as a name-your-price booking service but recently has begun emphasizing hotel reservations – hence their rebrand in 2018. Booking Holdings Inc has now changed to Booking Holdings and their share price fluctuates between PS1,640 and PS1,650 depending on market forces. They still specialize in reservation services for various areas but now specialize more specifically.

Booking Holdings makes travel arrangements in over 220 nations; constantly expanding platforms and capabilities. There are hotel and rental home accommodations to select from for lodging arrangements. Used to have more influence and focus on travel and planes, but no longer. Although Priceline Group has since changed to Booking Holdings, encompassing numerous businesses; while their primary affiliation is Booking.com, Booking Holdings includes websites like Agoda.com, rentalcars.com, Kayak, and OpenTable as well. Similar to other stocks listed here for the priciest stocks in 2022.

#8. Alphabet Inc.

Alphabet Inc. may not currently boast one of the highest share prices, but in 2022 its share prices achieved immense heights; their peak for all of 2022 came close to PS2,460 per share. Alphabet Inc. made headlines back in 2004 for going public at an astonishing price: PS41 per share. Though Alphabet may not seem familiar to you now, we trust you are familiar with their holdings. Alphabet Inc, formed to encompass Google and all its subsidiaries including AdWords; Maps, Fiber Network, and Capital Calico Calico Ventures in 1998 was officially unveiled and officially established as an international firm under American ownership.

Inc. is now the eighth-largest corporation worldwide and by 2022 its market capitalization will likely top $1 trillion – this feat alone should make you take notice! Let's discuss its implications. Alphabet Inc has been operating for decades but only changed its structure significantly in 2015 by consolidating all of its subsidiaries under one umbrella. After this event, the stock performance began to surge, propelling it onto our 2022 list. Alphabet shares have experienced major declines at times throughout 2022 – as with any company.

#9. Markel Corporation (Mkl)

Markel Corporation is another prominent company on this list; acting mainly as a holding company for businesses ranging from investments to insurance – boasting an expansive portfolio. Since 1986; they have been traded publicly on the market and their share prices remain relatively consistent; their average fluctuation ranged between PS985 and PS1,085 per share during 2022, placing them among the most costly companies of that year. Markel Corporation has built its name through acquisitions across numerous industries while remaining focused on investments and insurance services. They even made it onto the Fortune 500 list in 2016 and remain there currently.

Markel Corporation was originally established in the US; however; today its businesses and assets span across 20 nations. He made this decision after failing to find an insurance provider who truly met his requirements. His own mutual insurance firm was therefore established. While their primary business may be insurance, you'll see they fulfill an unmet market need: helping those having difficulty finding coverage rather than other firms making it impossible for them to acquire it. They specialize in riskier coverage such as yachts; motorcycles; ATVs and pollution – this gives you an idea but there are more surprises up their sleeve!

#10. MRF

Madras Rubber Factory Limited (MRF Limited); is India's premier tire producer. Established as K.M. Mammen Mappillai's factory of toy balloons in 1946; MRF now employs 16,200 workers worldwide and holds 24% market share within India; MRF became public on 1 April 1961 and currently ranks 10th worldwide among tire producers.

MRF Limited's stock price has seen steady increases over the past five years and currently exports products to 65 countries from its 10 production facilities across India.

Bottom Line

In conclusion, anyone looking to build their wealth over time may find investing in stocks a worthwhile option. Stock prices may fluctuate depending on various variables including business performance, market sentiment, and economic data. Stocks represent ownership in a corporation and while investing in stocks is always risky, equity investments have historically provided superior long-term returns than other asset classes.

Before investing, it is crucial to remember that making informed choices requires research. When selecting stocks to purchase, investors should carefully consider factors like the company's financial situation, market trends and management team before selecting which to buy. Diversifying one's portfolio to reduce risks can help in this pursuit; stocks offer investors a great way of building wealth over time but should always be approached with caution and extensive due diligence before making any definitive decisions.

FAQ.

To maximize profits while minimising losses, traders can employ the 50/80 Rule with great frequency in their trades. A stock has a 50% probability of falling by 80% when making significant highs while it has an 80% chance of falling by 50% when reaching significant highs - this should serve as a warning when losses first appear on the horizon

Dividing 70 by the growth rate of an individual variable allows us to calculate its timetable for doubling, while using an annual rate of return as our reference point, the rule of 70 can also help predict when an investment's total return would double.

In order to increase your odds of long-term financial success, trading when there is the potential of making three times as much as you are risking can increase profitability significantly. Offering yourself a 3:1 reward-to-risk ratio increases your chances of long-term success significantly.

As long as a company's shares are listed for purchase on an open market, anyone may purchase as many as they choose from any given company's shares they wish. Once an individual holds more than a specific percentage of its total shares they must report their purchase publicly.

Aruna Madrekar is a vibrant author who delves into the fascinating world of the most expensive things, presenting her discoveries in a manner that speaks to both aficionados and the everyday reader. Her commitment to making luxury and opulence accessible to all is evident in her easy-to-understand writing style. Aruna believes that behind every pricey tag lies a story worth telling, and she has dedicated her craft to unraveling these tales for her audience. When she's not immersed in her latest find, Aruna enjoys traveling and tasting unique cuisines from around the globe. Join her on her explorative journey and discover the true value behind the world's most coveted items.