CRM Market Leaders? It’s Complicated

CRM is the hottest area in enterprise applications today, with sales in excess of $23 billion in 2014, according to Gartner. The research firm predicts the CRM market will reach $36.5 billion by 2017. But there is some debate over which vendors command the largest market share.

Ten CRM vendors account for over 60 percent of the CRM market, according to Joanne Correia, an analyst at Gartner. Salesforce is top of the class at 18.4 percent, followed by SAP (12.1 percent), Oracle (9.1 percent), Microsoft (6.2 percent) and IBM (3.8 percent).

Even within the Gartner universe, there is some divergence concerning who the leaders really are. When you dive into any of the various CRM components, sub-categories and niches, the results vary to some degree.

A recent Gartner CRM Magic Quadrant (MQ), for instance, focused on sales force automation. Within that sphere, Salesforce retained pole positon while Microsoft (Dynamics CRM and Dynamics CRM Online) joined it in the Leaders Quadrant. Visionaries included Oracle, SugarCRM and SAP Cloud for Sales. Gartner named only two challengers (SAP CRM and NetSuite), with the rest named as niche players.

CRM Market: Different Views

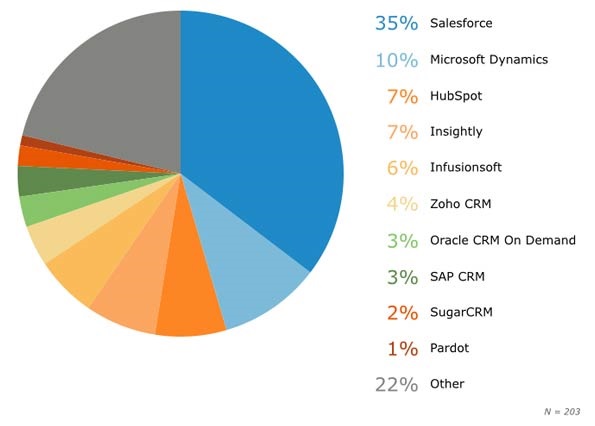

Once you step outside of the Gartner world, you end up with more differences in view. Software Advice offers a somewhat different take, as it gives more emphasis to CRM systems used mainly for sales and marketing. Based on Software Advice surveys, the most popular CRM products in terms of user adoption level, brand awareness and social media presence are Salesforce, Microsoft Dynamics CRM, HubSpot, Insightly, Infusionsoft, Zoho, Oracle CRM on Demand, SAP, SugarCRM and Pardot.

Capterra surveys show a somewhat different picture: Salesforce CRM was used by 33 percent of respondents, with Microsoft, SAP and Oracle accounting for another 42 percent of the market. Other notable performers were Zoho and ACT!. Capterra ranks CRM software based on how many customers and users there are on the system, in addition to some social media factors.

However, that ranking doesn't take into account revenue and the overall size of the companies they serve, which are the main metrics valued by Gartner. Capterra also surveyed 500 users to come up with its findings, so it offers a different perspective from more revenue-driven viewpoints.

There are hundreds of smaller CRM providers, many of which provide CRM software geared toward specific vertical markets such as health care.

A key Capterra finding: More than half of companies adopt CRM within their first five years of business. In other words, those selling CRM have to get in the door early. Another key finding: Just 38 percent of companies did more than two product demos when purchasing CRM.

Most users value CRM because they believe it has a strong impact on customer retention and satisfaction. Perhaps not surprisingly, retail was by far the biggest user of CRM, according to the Capterra survey. This makes sense when you realize that retail is all about tracking purchasing behavior, up sales, retaining loyalty and customer involvement.

Why Buy CRM?

Yet loyalty doesn’t always extend to the CRM provider. Katie Hollar, Capterra’s director of Marketing, said about 40 percent of CRM buyers switch from an existing CRM system. Feature set, end of life for an aging platform and rising costs were the most commonly stated reasons for making a change.

While social CRM, mobility and social collaboration are frequently stated reasons for buying or switching CRM, when you dig down into how the software is actually being used, these features don’t score that highly, Hollar pointed out.

More mundane tasks such as calendar management, email marketing and quote/proposal management are the most used features of installed CRM systems. This means there is a disconnection between why top management and department heads are driven to buy CRM compared to how those systems are actually being used.

No matter which system you elect to purchase, the CRM won’t immediately solve all your sales, marketing and customer service woes. In fact, it may add to your problems if you select the wrong system, take a purely tactical view of CRM or fail to obtain input and buy-in from the sales and marketing teams most intimately affected by the purchase.

“Many companies purchase a CRM system thinking it will be a magic bullet,” said Luke Wallace, CRM Market Research associate at Software Advice. “An emerging trend is companies thinking holistically about adoption and integration, and seeking a system that acts as more of a blueprint for their operations than merely being a tactical tool. These companies are taking time to get employee buy-in for their new system, as well as making sure to select features that both match and model their business processes.”

Drew Robb is a freelance writer specializing in technology and engineering. Currently living in Florida, he is originally from Scotland, where he received a degree in geology and geography from the University of Strathclyde. He is the author of Server Disk Management in a Windows Environment (CRC Press).

Drew Robb is a writer who has been writing about IT, engineering, and other topics. Originating from Scotland, he currently resides in Florida. Highly skilled in rapid prototyping innovative and reliable systems. He has been an editor and professional writer full-time for more than 20 years. He works as a freelancer at Enterprise Apps Today, CIO Insight and other IT publications. He is also an editor-in chief of an international engineering journal. He enjoys solving data problems and learning abstractions that will allow for better infrastructure.