Forget Omni-channel; Retailers Move to Unified Commerce Model

Page Contents

In Macy's latest annual report, the company refers to itself as an “omni-channel retail organization operating stores and websites.” It also no longer breaks out its sales by channel. While this shift represents an improvement over a not-so-distant past in which online and offline retail sales channels operated more or less independently of each other, it still fails to deliver a seamless shopping experience for customers.

To do that, retailers must strive to deliver a unified commerce experience. A recent Boston Retail Partners (BRP) blog post notes that unified commerce “goes a step beyond omni-channel, putting the customer experience first, breaking down the walls between internal channel silos and leveraging a single commerce platform.”

To do that, retailers must strive to deliver a unified commerce experience. A recent Boston Retail Partners (BRP) blog post notes that unified commerce “goes a step beyond omni-channel, putting the customer experience first, breaking down the walls between internal channel silos and leveraging a single commerce platform.”

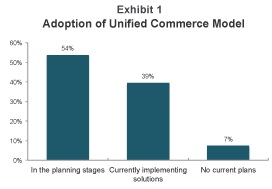

Retailers certainly appear to be moving in this direction. According to BRP's recently published 2014 Supply Chain Benchmark Survey, 93 percent of retailers intend to adopt a unified commerce model, with 39 percent already implementing supply chain solutions to support it. A February news release about technology investments at Whole Foods quoted that company's co-CEO Walter Robb: “We remain focused on improving and extending the customer experience and the integral first step is moving toward a unified commerce platform.”

Real-time and contextual marketing efforts, customer-based pricing and product availability across all channels and locations are some of the key features of a unified commerce strategy, said Ken Morris, a principal at Boston Retail Partners. “If I need a size 11 brown boot and you only have a size 10, you can tell me where that boot is and deliver it to my house, maybe the same day,” he said.

‘Good Customer Moments'

Unified commerce can help smaller retailers level the playing field against giants like Walmart, Morris said. “One way to beat folks like Walmart is with customer service. Retailers have an opportunity to get intimate with their customers. If you give them good customer moments, they will keep coming back and shopping with you.”

A BRP client that uses technology to promote and schedule free delivery of products to its customers in certain zip codes in inclement weather sees a 30 percent response rate, Morris said.

BRP's survey includes both promising and scary statistics regarding retailers' progress in attaining a unified commerce model. For example, while three-quarters of retailers said they can fulfill inventory across multiple channels, 46 percent still use spreadsheets to manage their supply chain planning. The latter stat is “completely crazy,” Morris said, noting the difficulty of offering a unified customer experience without a “single version of the truth.”

Centralization and Real-time Business Rules

To deliver unified commerce experiences, retailers will require technology that can enhance supply chain visibility and create what Morris calls “a glass pipeline,” as well as a network infrastructure that is “rock solid, redundant and never out.” This is currently a challenge, he said, because many retailers continue to rely on a decentralized architecture in which each store location is an “island of automation.”

Retailers need to follow the lead of banks that “woke up to the network” and connected their ATMs in the 1980s to “change the way we do banking,” Morris said. While cost-conscious retailers do not want to rip-and-replace existing infrastructure, he said layers of middleware can help them offer a customer experience that seems to be based upon a common platform even though many platforms are in use.

Retailers will also need a real-time business rules engine that allows them to sift through large volumes of data and deliver relevant and targeted offers to customers at the point of sale. While these are often available online, they are not yet found in brick-and-mortar stores.

While e-commerce software vendors are eager to become suppliers to retailers with unified commerce plans and provide products for physical store locations, Morris said there is a question of scale. “The volume data is far more extensive in stores; it’s Amazon cubed. E-commerce providers do not necessarily understand this.”

As current infrastructures depreciate, Morris believes retailers will increasingly look to the cloud to help them centralize their operations and create seamless customer experiences. But first they will have to be convinced of the ROI. “Our contention is a cloud-based infrastructure costs way less,” he said, in large part because it makes security and maintenance tasks so much easier.

Not Just Retail Technology

Retailers also will need to ensure they put the proper people and processes in place to support technology, Morris said, noting he sees “a lack of organizational alignment” around unified commerce strategies. For example, he said, some retailers will struggle with questions like, “Who gets credit for the sale if a customer buys a size 11 shoe that was not in store one but ended up being shipped to the customer by store two?”

“Most of our clients give both stores the credit. Otherwise, store two will simply say they do not have an item in stock,” he said. “This kind of example shows the need for synergy between people, processes and technology.”

Ann All is the editor of Enterprise Apps Today and eSecurity Planet. She has covered business and technology for more than a decade, writing about everything from business intelligence to virtualization.

Public relations, digital marketing, journalism, copywriting. I have done it all so I am able to communicate any information in a professional manner. Recent work includes creating compelling digital content, and applying SEO strategies to increase website performance. I am a skilled copy editor who can manage budgets and people.