Blockchain in Fintech Market Is Expected To Rise At A CAGR Of 75.30% | Market.us

Page Contents

Market Overview

Published Via 11Press: Blockchain technology has had a dramatic impact on the financial sector in recent years. Blockchain, which functions like a decentralized digital ledger, allows secure, transparent, and tamper-proof transactions without the need for intermediaries such as banks or financial institutions. This has allowed for faster, cheaper transactions with greater assurance – an innovation that has had a major impact on fintech firms across the board.

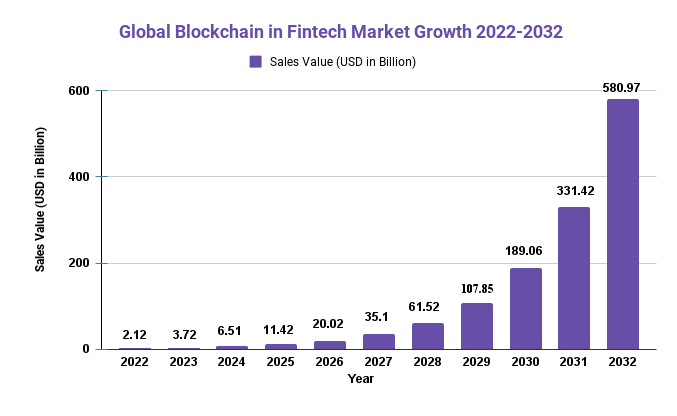

The global blockchain in fintech market size is forecast to reach USD 580.97 billion by 2032 from USD 2.12 billion in 2022, rising at a compound annual growth rate (CAGR) of 75.30% during the forecast period. This can be attributed to several factors including the increasing adoption of blockchain technology by financial institutions; increasing demands for more secure and transparent transactions; as well as the growing popularity of cryptocurrencies.

Blockchain has many applications in fintech, particularly payments, and remittances. Blockchain makes cross-border transactions faster and cheaper, leading to an increase in the adoption of blockchain-based payment solutions by both individuals and businesses alike. Furthermore, Decentralized finance (DeFi) platforms are being created which offer users access to financial services without the need for intermediaries.

Blockchain is being utilized in fintech to revolutionize identity verification and authentication. Blockchain-based identity verification solutions give users the security to store and share their identity data digitally, potentially replacing traditional methods like physical documents or passwords with electronic verification.

Key Takeaways

- Blockchain technology has revolutionized the financial sector by providing secure, transparent, and immutable transactions without the need for intermediaries.

- The global blockchain in the fintech market is projected to reach USD 580.97 billion by 2032, growing at an annual compound growth rate (CAGR) of 75.30% from 2022-2032.

- Blockchain technology is being adopted in the fintech space for payments and remittances, identity verification and authentication, as well as developing decentralized finance (DeFi) platforms.

- Blockchain-based payment solutions enable faster and cheaper cross-border transactions.

- Blockchain-based identity verification solutions allow users to securely store and distribute their identity data, eliminating the need for traditional identity verification methods.

- Blockchain adoption in the fintech market is expected to accelerate, driving further disruption and innovation within this sector.

Request For Sample Report: https://market.us/report/blockchain-in-fintech-market/request-sample/

Regional Snapshot

- North America: The North American region was an early adopter of blockchain technology in the fintech market, with the US leading the charge. This growth can be attributed to major financial institutions and technology firms present here as well as increasing demand for secure and transparent transactions.

- Europe: The European region has been quick to embrace blockchain technology in the fintech sector, with countries like Switzerland and Estonia leading the charge. This growth can be attributed to an accommodating regulatory environment and growing demand for efficient payment systems.

- Asia-Pacific: The Asia-Pacific region is expected to experience tremendous growth in the blockchain fintech market, with countries like China and Singapore leading the charge. This expansion can be attributed to the increasing adoption of blockchain technology by financial institutions as well as the rising popularity of cryptocurrencies.

- Middle East and Africa: The Middle East and Africa region has seen a meteoric rise in the blockchain fintech sector, with countries like UAE and South Africa investing heavily. This growth can be attributed to governments and financial institutions adopting blockchain technology for improved efficiency and transparency.

Drivers

- Blockchain Technology Fuels Demand for Secure and Transparent Transactions: Blockchain technology offers a secure, transparent, and tamper-proof method of conducting transactions without the need for intermediaries. This has spurred an increased interest in blockchain-based solutions within the fintech space.

- Growing Adoption of Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, have seen a meteoric rise in recent years due to blockchain technology's power behind them. With the increased adoption of cryptocurrencies comes an increasing need for blockchain-based solutions within the fintech space.

- Blockchain Technology Facilitates Faster and Cheaper Cross-Border Transactions: Blockchain technology facilitates quicker and cheaper cross-border transactions, which has been a major driving factor in its adoption within the fintech space. Blockchain-based payment solutions offer individuals and businesses an efficient means of sending and receiving funds across borders quickly at lower costs.

- Favorable Regulatory Environment: Certain regions, such as Europe and parts of Asia, have established favorable regulatory frameworks for blockchain technology adoption and investment in the fintech market.

- Financial Institutions Adopting Blockchain Technology: Financial institutions such as banks and insurance companies have begun adopting blockchain technology to enhance their operations and offer new services. This has resulted in increased investment and expansion within the blockchain-in-fintech market.

Restraints

- Lack of Standardization: Lacking standardization in the blockchain industry can be a major hindrance to its adoption in fintech markets. Without common guidelines, interoperability issues arise and hinder the adoption of blockchain-based solutions.

- Security Concerns: While blockchain technology is often touted as secure, there remain security vulnerabilities that need to be addressed. Hackers have successfully exploited vulnerabilities in some blockchain systems, and as the use of this emerging technology expands, the potential for breaches in security will only grow.

- Scalability Issues: Blockchain technology is currently limited in terms of its scalability. Blockchain-based solutions may struggle to handle large volumes of transactions, which could hamper their adoption within the fintech space.

- Lack of Regulatory Clarity: Although some regions have supportive regulatory frameworks for blockchain technology, there remains a lack of clarity in certain areas. This uncertainty creates uncertainty and can impede the adoption of blockchain-based solutions.

- Cost: Implementing blockchain-based solutions can be expensive, particularly for smaller businesses. The expense of building and maintaining a blockchain infrastructure may pose an impediment to entry for some firms.

Opportunities

- Blockchain Business Models: Blockchain technology has opened the door to new business models that were previously unattainable. For instance, blockchain-based peer-to-peer lending platforms that connect borrowers and lenders directly without intermediaries are revolutionizing the traditional lending industry.

- Blockchain Technology Improved Efficiency: Blockchain technology offers the potential to automate and streamline many financial processes, such as payments, trade finance, and settlement. This can result in significant cost savings for businesses while increasing efficiency levels.

- Greater Financial Inclusion: Blockchain technology can promote financial inclusion by providing access to financial services to those individuals and businesses who are underserved by traditional financial institutions.

- Blockchain Technology Provides Increased Transparency: Blockchain technology's inherent transparency and immutable nature can add an extra layer of protection for financial transactions, helping prevent fraudulence and building trust between parties.

- Reduce Costs: Blockchain technology can help cut expenses associated with financial transactions by eliminating intermediaries and cutting down on transaction fees.

Challenges

- Regulatory Challenges: The regulatory environment for blockchain technology is still developing, and there are numerous legal and regulatory obstacles that need to be addressed. The lack of clarity and consistency across jurisdictions can create uncertainty for businesses operating within the blockchain-in-fintech space.

- Interoperability: Lack of interoperability between different blockchain platforms and systems can pose obstacles for businesses looking to implement blockchain-based solutions, potentially restricting its potential benefits and hindering adoption in the fintech space.

- Integration with Existing Systems: Many businesses already have legacy systems that are incompatible with blockchain technology, making it challenging to incorporate blockchain-based solutions into their operations and necessitating significant investment in new infrastructure.

- Talent Shortage: Unfortunately, there is a critical shortage of qualified personnel with the necessary skillset and expertise to develop and implement blockchain-based solutions. This makes it difficult for businesses to locate qualified individuals to build and maintain their blockchain systems.

- Scalability: Scaling blockchain platforms remains a challenge, especially as their transaction volume grows. This may restrict its potential uses and hinder adoption in the fintech space.

Grow your profit margin with Market.us Get this Report

Recent Developments

- Central bank digital currencies (CBDCs): Central banks around the world are exploring developing CBDCs, digital versions of traditional fiat currencies. Blockchain technology is being considered as a potential solution for creating and implementing CBDCs.

- Decentralized Finance (DeFi): DeFi is becoming a major application of blockchain technology in the fintech space. DeFi applications leverage this revolutionary new paradigm to create decentralized financial systems that are accessible to anyone with an internet connection.

- Non-fungible Tokens (NFTs): NFTs are digital assets stored on a blockchain, which have seen immense popularity in the art and collectible markets. Now they may provide an ideal solution for tokenizing other assets, such as real estate.

- Integration with Traditional Financial Systems: Many traditional financial institutions are exploring how to incorporate blockchain technology into their current systems. For instance, some banks are looking into using this new technology for cross-border payments and trade finance.

- Sustainability and Energy Consumption: As blockchain technology continues to develop and grow, concerns have been expressed about its energy requirements for running networks. Some blockchain platforms are exploring more sustainable solutions such as proof-of-stake consensus mechanisms to reduce their environmental impact.

Key Market Segments

Type

- Application & Solutions

- Middleware & Services

- Infrastructure & Base Protocols

Application

- SMEs

- Large Enterprises

Key Market Players

- Amazon Web Services

- IBM

- Microsoft

- Oracle

- Ripple

- Earthport

- Chain Inc

- Bitfury Group

- BTL Group

- Digital Asset Holdings

- Circle

- Factom

- AlphaPoint

- Coinbase

- Plutus Financial

- Auxesis Group

- BlockCypher

Nature Insights

Nature Insights are the conclusions drawn from analyzing large datasets using advanced data analytics techniques. In the context of blockchain in fintech, nature insights can be useful to gain a deeper comprehension of market trends, customer behavior patterns, and other elements influencing the adoption of blockchain technology within this sector.

Nature insights can be particularly valuable in the blockchain-fintech market due to the vast amounts of data generated by blockchain networks. Analyzing this information allows one to identify patterns and trends, providing valuable insight into participants in this ecosystem.

Nature insights can be utilized to assess the volume and frequency of transactions on blockchain networks, the types of transactions being conducted, as well as the geographic distribution of participants. This data helps businesses operating in the blockchain-driven fintech space identify areas for growth and potential opportunities.

Nature insights can also be utilized to anticipate potential risks and obstacles related to the adoption of blockchain technology in fintech. For instance, they could assist in recognizing patterns of fraudulent activity on blockchain networks or assessing how regulatory changes may influence how quickly blockchain-based solutions take hold.

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 2.12 Bn |

| Revenue forecast by 2032 | USD 580.97 Bn |

| Growth Rate | CAGR Of 75.30% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Frequently Asked Questions

Q: What is blockchain technology?

Blockchain technology is a distributed ledger technology that enables secure and transparent peer-to-peer transactions without the need for intermediaries.

Q: What is the fintech industry?

Fintech refers to the application of technology to enhance and automate financial services such as banking, payments, investments, insurance policies, and more.

Q: How is blockchain being utilized in fintech?

Examples of its application in fintech include cryptocurrency, smart contracts, decentralized finance (DeFi), and digital identity management.

Q: What are the potential advantages of blockchain technology in fintech?

Blockchain offers several potential benefits for fintech firms, such as increased security and transparency, reduced transaction costs, and expanded access to financial services for underserved populations.

Q: What are the challenges associated with adopting blockchain technology in fintech?

The adoption of blockchain technology within fintech faces numerous hurdles, such as regulatory uncertainty, interoperability issues, integration with existing systems, talent shortage, and scalability concerns.

Q: What are some recent advancements in the blockchain in the fintech market?

Some notable innovations include central bank digital currencies (CBDCs), decentralized finance (DeFi), non-fungible tokens (NFTs), and the integration of blockchain technology into traditional financial systems.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.