Cards And Payments Market to Reach USD 1,829.5 Billion by 2032, Says Market.us Research Study

Page Contents

Market Overview

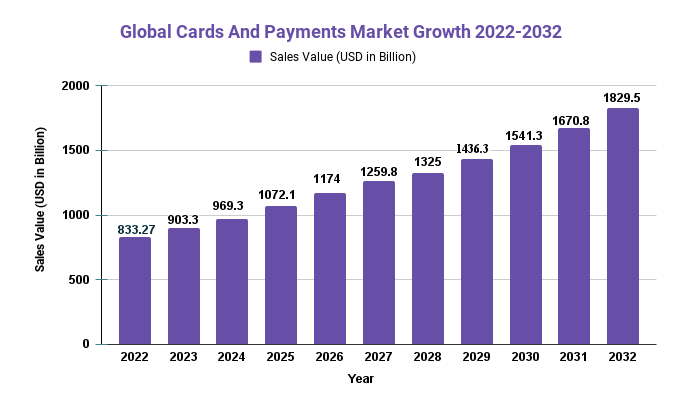

Published Via 11Press: The Cards And Payments Market size is expected to be worth around USD 1,829.5 Bn by 2032 from USD 833.27 Bn in 2022, growing at a CAGR of 8.4% during the forecast period from 2022 to 2032.

The Cards and Payments market has experienced significant growth in recent years. The market is driven by the increasing adoption of electronic payment systems, which include debit cards, credit cards, and mobile payments. These payment methods have become popular due to their convenience and ease of use. Furthermore, governments across countries have also been promoting cashless transactions to reduce the circulation of counterfeit currency.

The demand for contactless payment options has also fueled the growth in the Cards and Payments market. Contactless payments allow customers to make transactions without physically swiping or inserting their card into a machine. Instead, they can simply tap their card or mobile device on a point-of-sale (POS) terminal to complete the payment process. This feature is especially useful during a global pandemic where people are wary about touching surfaces that could potentially carry germs.

Request For Sample Report Here: https://market.us/report/cards-and-payments-market/request-sample/

Key Takeaways

- The global cards and payments market is experiencing rapid expansion due to the increasing adoption of digital payments and e-commerce.

- Mobile payments, contactless payments, and other innovative payment methods are revolutionizing the industry by making payments faster, safer, and more convenient for consumers.

- The cards and payments industry comprises a diverse group of players, such as banks, payment processors, card networks, fintech startups, and others.

- Some of the major players in the cards and payments market include American Express, Visa, Bank Of America, PayPal, And MasterCard.

- The expansion of the cards and payments market presents new risks for fraudulence and cybersecurity, which companies must actively address to safeguard both their consumers and businesses alike.

- Regulating and adhering to compliance are major priorities for companies operating in the cards and payments market, as they must navigate a complex web of rules at both national and international levels.

- Looking ahead, the cards and payments market is expected to keep growing and evolving due to emerging technologies and shifting consumer behaviors. Companies that can quickly adapt and innovate will be the most successful in this highly competitive industry.

Regional Analysis

- The North American cards and payments market is the largest in the world, thanks to a highly developed financial infrastructure as well as high levels of consumer adoption of digital payments. The United States leads this region with major players like Visa, Mastercard, and American Express headquartered there.

- The European cards and payments market is highly developed, with a focus on digital payments and tight regulation. Major players such as Visa, Mastercard, and PayPal are present in the region along with numerous fintech startups that are rapidly growing in number.

- The Asia-Pacific region is one of the fastest-growing markets for cards and payments, driven by rising incomes, urbanization, and an increasing reliance on smartphones and mobile payments. China leads this space with major players like Alipay and WeChat Pay dominating its mobile payments landscape.

- The Latin American cards and payments market is relatively underdeveloped compared to other regions, but it is growing rapidly. Brazil leads the region with an increasing number of digital payment startups and a focus on financial inclusion.

- Middle East and Africa, The cards and payments market in the Middle East and Africa is growing rapidly, driven by the increasing adoption of mobile payments and digital financial services. Major players like Mastercard and Visa are present, as well as a burgeoning number of fintech startups and mobile money providers.

- Overall, the cards and payments market is a fast-paced, rapidly transforming industry with various regional challenges and opportunities. Companies that can successfully navigate this landscape and adjust to local conditions will be best equipped to succeed.

Drivers

- Increased Adoption of Digital Payments: As more consumers transition away from cash and checks, digital payments are becoming increasingly popular, fuelling growth in the cards and payments industry.

- Rise of E-Commerce: The growth in e-commerce and online shopping is driving demand for secure and convenient payment solutions, creating new business opportunities in the cards and payments market.

- The emergence of mobile payments: The growth in mobile payments and digital wallets has revolutionized how consumers make purchases, making payments faster and more convenient than ever before.

- Innovation and New Technology: The cards and payments industry is rapidly modernizing, driven by advances in technologies like blockchain, artificial intelligence, and biometrics that offer companies new opportunities to innovate and differentiate their products.

- Globalization and Cross-Border Transactions: With global trade and cross-border transactions continuing to expand, companies in the cards and payments market are striving to extend their reach and provide more streamlined payment solutions for customers around the world.

- Financial Inclusion and Access to Banking Services: The cards and payments industry plays a pivotal role in fostering financial inclusion and expanding access to banking services, particularly in emerging markets where traditional banking infrastructure may not exist.

- Overall, the cards and payments market is being shaped by various factors such as changing consumer behaviors, technological innovation, and global economic trends. This presents both opportunities and challenges for companies in this industry.

Restraints

- Security Concerns: As digital payments and e-commerce grow more commonplace, security is becoming a paramount concern. Companies must invest heavily in cybersecurity measures to safeguard their customers' personal and financial data an endeavor that can be expensive and time-consuming.

- Competition and Consolidation: The cards and payments market is highly competitive, with many players competing for market share. This can lead to consolidation or mergers within the industry, making it harder for new entrants to break into the space.

- Regulatory Environment: The cards and payments market is highly regulated, with different rules in different countries and regions. Companies must navigate this complex regulatory framework to abide by a variety of legal obligations which can prove both challenging and expensive for them to fulfill.

- Payment Fraud: Fraudulent activity remains a serious problem in the cards and payments sector, with criminals constantly searching for new ways to steal personal and financial data. This can lead to significant losses for both companies and customers alike.

- Consumer Adoption: Although digital payments are becoming more widely used, a significant portion of the population still prefers traditional methods like cash and checks. This may hinder growth in certain regions or industries for cards and payment services.

- Overall, the cards and payments market is facing a variety of obstacles, from security worries and competition to regulatory hurdles and consumer adoption issues. Companies that are able to address these difficulties while innovating will be the ones best placed to prosper in this rapidly transforming industry.

Opportunities

- Emerging markets offer significant potential for growth in the cards and payments market: as more consumers gain access to banking services and digital payment technologies.

- Cross-border Transactions: As international trade and cross-border transactions continue to expand, companies in the cards and payments market can benefit from an increasing need for more seamless and efficient payment solutions.

- Financial Inclusion: The cards and payments industry can play a pivotal role in fostering financial inclusion, particularly in emerging markets where traditional banking infrastructure may not exist.

- Innovation and New Technology: The cards and payments market is primed for innovation, with cutting-edge technologies like blockchain, artificial intelligence, and biometrics providing companies with new chances to differentiate their products and services.

- E-commerce and Mobile Payments: The growth of e-commerce and mobile payments presents significant opportunities for companies in the cards and payments market, as more consumers seek secure and convenient payment solutions.

- Collaboration and Partnerships: Companies in the cards and payments market can benefit from partnerships and collaborations with other players in the industry, leveraging each other's strengths and capabilities to develop more creative, comprehensive payment solutions.

- Overall, the cards and payments market is packed with opportunities for companies that can innovate and adapt to shifting consumer habits, technological advances, and market dynamics. Companies that identify and seize these chances will be best equipped to thrive in this rapidly developing industry.

Browse the summary of the report and Complete Table of Contents (TOC): https://market.us/report/cards-and-payments-market/table-of-content/

Challenges

- Security Risks: The rising frequency of cyberattacks and data breaches poses a significant challenge for the cards and payments industry.

- Companies must invest heavily in cybersecurity measures to safeguard customer data, which can be expensive and time-consuming to implement.

- Adapting Consumer Behaviour: Companies in the cards and payments market must be able to adjust to these changes in order to remain competitive. This may prove particularly challenging as new technologies and payment methods emerge.

- Regulatory Compliance: The cards and payments industry is heavily regulated, necessitating companies to adhere to a variety of legal requirements. Adhering to all these regulations can be daunting for smaller firms that may not have enough resources available for dedicated compliance efforts.

- Competition and Consolidation: The cards and payments market is highly competitive, with many players striving for market share. This can lead to consolidation or mergers within the sector, making it harder for new entrants to break into the space.

- Payment fraud is a major concern in the cards and payments market, so companies must invest in fraud prevention measures to safeguard themselves and their customers. Unfortunately, these solutions can be expensive and negatively affect user experience.

- Cost Pressures: The cards and payments industry is facing increasing cost pressures, particularly as new entrants disrupt traditional business models. Companies must find ways to cut expenses while still providing superior service quality and security.

- Overall, the cards and payments market faces a variety of obstacles to success – from security risks and changing consumer behavior to regulatory compliance and cost pressures. Companies that are able to successfully navigate these difficulties while innovating will be best equipped for success in this rapidly developing industry.

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 833.27 Bn |

| Revenue forecast by 2032 | USD 1,829.5 Bn |

| Growth Rate | CAGR Of 8.4% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Key Market Segments

Type

- Cards

- Payment Services

Application

- Banks

- Non-Banking Financial Institutions

- Others

Key Market Players included in the report:

- American Express

- Visa

- Bank Of America

- PayPal And MasterCard

Frequently Asked Questions

What is the market study period?

The Cards And Payments Market is studied from 2017 – 2032.

What is the growth rate for the Cards And Payments Market?

The Cards And Payments Market is growing at a CAGR of 8.4%

Who are the major players in the Cards And Payments Market?

American Express, Visa, Bank Of America, PayPal And MasterCard

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.