Financial Services Cybersecurity Systems And Services Market Size Worth USD 103.13 Bn by 2033 | CAGR: 14.09%

Page Contents

Market Overview

Published Via 11Press: Financial Services Cybersecurity Systems And Services firms are becoming more vulnerable to cyber attacks, making cybersecurity systems and services an essential element of their operations. Financial Services Cybersecurity Systems And Services are designed to shield financial institutions from cyber threats such as data breaches, malware, and phishing attempts. They encompass technologies such as firewalls, intrusion detection and prevention systems, encryption tools, threat intelligence services, incident response teams and security consulting firms.

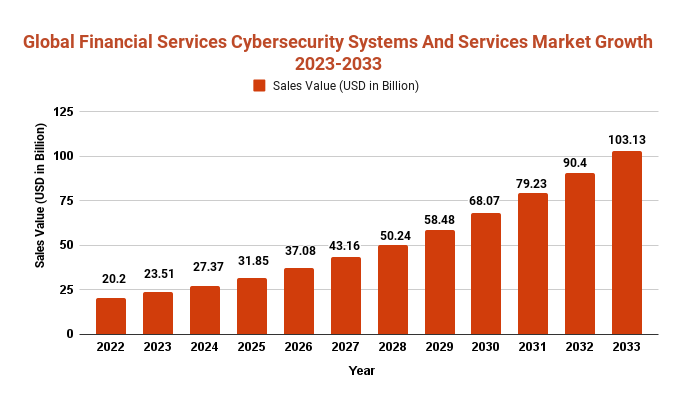

Global Financial Services Cybersecurity Systems and Services market size is expected to be worth around USD 103.13 Bn by 2033 from USD 20.2 Bn in 2022, growing at a CAGR of 14.09% during the forecast period 2023 to 2033.

Financial institutions must adhere to various regulations and standards regarding cybersecurity, such as the Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation (GDPR). With evolving cyber threats, financial institutions must remain vigilant and invest in advanced systems and services to safeguard their customers and business operations.

Key Takeaways

- Firewall, Intrusion Detection and Prevention, Endpoint Security, Identity and Access Management, Data Loss Prevention, Security Information and Event Management are some of the essential systems financial institutions use to safeguard their systems, data, and customers against cyber attacks.

- Penetration testing services identify vulnerabilities in systems by simulating real-world attacks; while security consulting offers expert guidance and advice on cybersecurity best practices, risk management strategies, compliance issues, as well as incident response practices.

- Financial services organizations must adopt a multi-layered approach to cybersecurity in order to safeguard against various cyber threats. To stay secure, financial institutions must stay abreast of the latest threats and best practices related to this field, keeping their systems and data encrypted at all times.

Sample Pages of This Report @ https://marketresearch.biz/report/financial-services-cybersecurity-systems-and-services-market/request-sample/

Regional Snapshot

Cybersecurity systems and services used by financial services organizations may differ across regions due to factors such as local regulations, threat landscape, and technology infrastructure.

- North America: North American financial institutions boast some of the most sophisticated cybersecurity systems and services, due to stringent regulations such as Gramm-Leach-Bliley Act (GLBA) and Sarbanes-Oxley Act (SOX). Common solutions used here include advanced firewalls, SIEM systems, DLP solutions, and Identity Access Management (IAM) solutions.

- Europe: The General Data Protection Regulation (GDPR) has obliged financial institutions in Europe to prioritize data privacy and security. Key cybersecurity systems used include multi-factor authentication, encryption, data masking technologies. Moreover, European financial institutions rely heavily on third-party vendors for security services like threat intelligence or incident response.

- Asia-Pacific: Financial institutions across Asia-Pacific have witnessed an alarming spike in cyber attacks over the last few years, prompting them to invest in advanced cybersecurity systems and services. Popular solutions used include cloud-based security solutions, behavioral analytics, and machine learning-based threat detection. Furthermore, Asian-Pacific financial institutions rely on regulatory frameworks such as the Personal Data Protection Act (PDPA) for guidance when it comes to their cybersecurity efforts.

- Middle East and Africa: Financial institutions in the Middle East and Africa face unique cybersecurity challenges due to geopolitical instability and a lack of regulatory frameworks. Key systems used in the region include advanced encryption technologies, identity verification systems, mobile security solutions. Furthermore, financial institutions rely on third-party security service providers for incident response services as well as threat intelligence.

Drivers

Financial institutions across regions are investing in advanced cybersecurity systems and services to protect themselves against cyber threats. While regulatory frameworks and threat landscapes may differ, financial institutions must stay abreast of the most up-to-date cybersecurity best practices and technologies to safeguard their systems, data, and customers from malicious cyberattacks.

- Regulatory Compliant: Financial institutions must abide by stringent regulations that require them to implement adequate cybersecurity measures in order to protect customer data and transactions. Non-compliance can lead to substantial fines as well as reputational damage.

- Cybersecurity Threats: Financial institutions are prime targets for cybercriminals who aim to steal sensitive financial data and assets. Cybersecurity systems and services help financial institutions detect and prevent attacks, minimizing the risk of financial loss as well as reputational damage.

- Digital Transformation: Financial institutions are rapidly adopting digital technologies to boost efficiency and customer experience. Unfortunately, these advancements also present new cybersecurity risks which must be managed with advanced security systems and services.

- Reputation management: Cybersecurity incidents can have a devastating impact on a financial institution's reputation, leading to customer loss and decreased market share. Implementing advanced cybersecurity systems and services helps financial institutions maintain customer trust and confidence.

- Competitive Advantage: Financial institutions that invest in advanced cybersecurity systems and services can differentiate themselves from their competitors, attracting new customers and business opportunities.

The adoption of cybersecurity systems and services in financial services organizations is driven by a variety of factors. Compliance, cyber threats, digital transformation, reputation management, and competitive advantage all play an integral role in motivating companies to invest in advanced security measures and services.

PLACE AN INQUIRY BEFORE PURCHASE: https://marketresearch.biz/report/financial-services-cybersecurity-systems-and-services-market/#inquiry

Restraints

- Implementing and maintaining advanced cybersecurity systems and services can be costly, necessitating significant investments in hardware, software, and personnel. Financial institutions may hesitate to invest in such solutions if they appear too costly. Advanced cybersecurity systems and services can be complex to deploy and administer, especially for financial institutions that lack the specialized skills or experience to do so. This could cause delays or major interruptions in operations. Financial institutions often have multiple legacy systems and applications in place, making integration of new cybersecurity equipment and services difficult. Integration issues may lead to data siloes, diminishing the efficacy of security measures.

- Financial institutions may face regulatory uncertainty regarding cybersecurity requirements, making it challenging to implement systems and services that abide by evolving rules. Although these systems and services are designed to protect against external threats, insider threats remain a significant risk. Financial institutions must balance the need for cybersecurity with maintaining trust among employees. When considering whether to adopt advanced cybersecurity systems and services, financial institutions must carefully weigh costs, complexity, integration challenges, regulatory uncertainty, as well as insider threat risks into account.

Opportunities

- AI and machine learning technologies hold the potential to greatly enhance cybersecurity systems and services. Financial institutions can utilize these advancements for improved threat detection, incident response, and risk management. Cloud-based cybersecurity solutions offer several advantages, such as scalability, flexibility and cost effectiveness. Financial institutions can take advantage of cloud-based solutions to strengthen their cybersecurity posture while cutting infrastructure and maintenance expenses. Cyber threats are rapidly evolving, making it difficult for financial institutions to stay abreast. Collaboration among institutions, regulatory bodies and cybersecurity vendors can improve threat intelligence sharing and enable financial institutions to stay ahead of emerging risks.

- Traditional perimeter-based cybersecurity approaches are no longer sufficient to protect against modern cyber threats. Risk-based approaches can help financial institutions identify and prioritize their most critical assets, then implement appropriate cybersecurity measures. It's everyone's responsibility for cybersecurity – financial institutions must ensure all employees receive training on best practices for protecting against attacks from insiders. Regular training and awareness programs help reduce the potential risk of insider threats while strengthening overall cybersecurity posture.

Challenges

- Globally, there is a shortage of cybersecurity talent, making it difficult for financial institutions to locate and retain qualified cybersecurity professionals. This shortage can cause delays and increased costs in implementing and maintaining cybersecurity systems and services. Cyber threats are constantly changing; financial institutions must stay ahead of emerging threats to maintain an effective cybersecurity posture. Keeping up with the most recent threats and implementing appropriate measures can be tedious work that requires plenty of time.

- Financial institutions typically have multiple legacy systems in place, making it challenging to integrate new cybersecurity systems and services seamlessly. Integration issues may lead to data silos and reduce the effectiveness of cybersecurity measures. Financial institutions are subject to complex cybersecurity regulations which vary by region and jurisdiction, making compliance time-consuming and expensive. Financial institutions may lack the required skillset or expertise necessary for deploying and maintaining advanced cybersecurity systems and services – leading to delays or increased costs when implementing or updating measures.

Acquire Report Here at Discounted Price: Purchase Market Report

Recent Developments

- Increased Adoption of Cloud-Based Cybersecurity Solutions: Financial services organizations are increasingly turning towards cloud-based cybersecurity solutions, which offer several advantages such as scalability, flexibility and cost efficiency. Furthermore, cloud-based solutions offer advanced threat intelligence capabilities which allow organizations to detect and respond more effectively to cyber threats.

- Integration of AI and ML Technologies: Financial services organizations are integrating AI and ML capabilities into their cybersecurity systems and services to enhance threat detection, incident response, and risk management. AI/ML can offer advanced analytics capabilities which allow organizations to detect and respond to threats faster.

- Increased Focus on Third-Party Risk Management: Financial services organizations are placing greater emphasis on third-party risk management, as these vendors can pose cybersecurity threats. To mitigate these hazards, organizations are conducting regular assessments of their third-party vendors and implementing appropriate cybersecurity measures.

- Adoption of Zero Trust Architecture: Financial services organizations are moving toward zero trust architecture, which assumes all network traffic is potentially malicious and requires authentication and authorization before granting access. This approach can help organizations detect and prevent cyber attacks more efficiently.

- Collaboration among industry stakeholders: Financial services organizations are working more closely with regulatory authorities, cybersecurity vendors and other industry representatives to share threat intelligence and best practices. This collaboration helps organizations stay ahead of emerging threats and boost their overall security postures.

Market Segmentation

Global Financial Services Cybersecurity Systems and Services Market: By Solution and Services

- Endpoint Security

- Identity and Access Management

- Mobile Enterprise Management

- Mobile Security, Security Information and Event Management

- Content Security

- Data Loss Prevention (DLP)

- Datacenter Security

- Firew

Global Financial Services Cybersecurity Systems and Services Market: By End User

- Banking

- Insurance

- Credit Unions

- Stock Brokerages

- Stock Exchange

- Investment Funds

- Consumer Financing Services

- Payment Card and Mobile Payment Services

- Government-related Financial Services

Key Players

Experian Information Solutions, Inc., Accenture PLC., Agiliance, Inc., IBM Corporation, Airbus SE, AhnLab, Inc., VMware, Inc., Akamai Technologies, Inc., Alert Logic, Inc., AlienVault, Inc., and Avast Software S.R.O.

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 20.2 Bn |

| Revenue forecast by 2032 | USD 103.13 Bn |

| Growth Rate | CAGR Of 14.09% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

Key questions

1. What are the most significant cyber threats facing?

Cybercriminals may use phishing emails or social engineering techniques to dupe employees into divulging sensitive information like passwords or other credentials. Malware and ransomware attacks can infiltrate financial institutions' networks, steal data, or hold systems hostage for ransom payments.

2. How can financial services organizations integrate AI and ML technologies?

Financial services organizations can embed AI (Artificial Intelligence) and ML (Machine Learning) technologies into their cybersecurity systems and services to bolster their capabilities while staying ahead of cyber threats.

3. How can financial services organizations effectively manage third-party cybersecurity risks?

Financial services organizations should conduct a thorough assessment of potential third-party vendors before working with them. This assessment should include an examination of the vendor's security policies, procedures, and controls to guarantee they meet the financial institution's cybersecurity requirements.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.