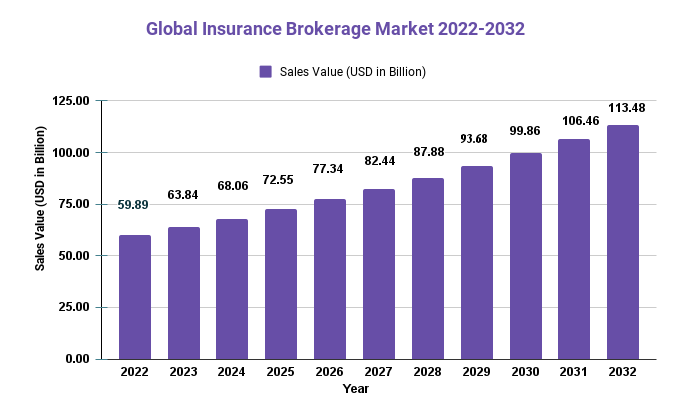

Insurance Brokerage Market Study Reveals Size USD 113.48 Bn For Emerging Segments by 2032

Page Contents

Published Via 11Press: The Insurance Brokerage market is a vast and rapidly developing industry that provides insurance products and services to both individuals and businesses alike. It consists of various players such as insurance brokers, agents, and other intermediaries who collaborate with insurance companies in order to offer coverage to customers.

Market.us Research recently estimated the global Insurance Brokerage market size at USD 59.89 billion in 2022 and projects it to grow at a compound annual growth rate (CAGR) of 6.6% between 2022 and 2032.

Take Advantage of a Free Sample PDF Report at | https://market.us/report/insurance-brokerage-market/request-sample

Regional Snapshot

- North America. North America is America's largest market in Insurance Brokerage. Its market was worth USD 21.5 Billion by 2020. This region has some of the world's largest insurance companies and a well-established insurance industry.

- Europe: Europe has the 2nd largest market in Insurance Brokerage. Its market is valued at USD 16.4 million for 2020. This region boasts a well-regulated and predictable insurance market.

- Asia Pacific: Asia Pacific has the highest growth rate for Insurance Brokerage. Its CAGR is 8.6% between 2021-2028. It is also home to many of the most dynamic economies around the globe. The growing middle class is driving insurance product and service demand.

- Latin America. The Latin America Market for Insurance Brokerage has a 7.5% annual growth rate from 2021-2028. It has both a large and growing population, creating new opportunities for brokers and intermediaries in insurance.

- Middle East & Africa: From 2021-2028, Middle East & Africa's market for Insurance Brokerage will grow at a 6.7% CAGR. There is a rising population in the region and an expanding economy which drives demand for insurance products.

Drivers

- Increased Demand for Insurance Products: The demand for insurance products and services continues to increase due to factors such as population growth, urbanization, and rising incomes. This presents an exciting opportunity for insurance brokers and intermediaries to link customers with insurers.

- Rising Awareness of Insurance Products: As people become more informed about the significance of having insurance, they are increasingly turning to brokers and intermediaries for assistance in navigating the complex insurance market and finding the appropriate coverage tailored to their individual needs.

- Technological Advancements: The adoption of cutting-edge technologies such as artificial intelligence, machine learning, and blockchain is revolutionizing the Insurance Brokerage market by making it more efficient and productive.

- Increased regulatory adherence: Governments around the world are enforcing regulations to guarantee insurance brokers and intermediaries operate fairly and transparently. This presents companies with an opportunity to demonstrate they are adhering to these regulations.

- Expansion into Emerging Markets: Insurance brokerage companies are expanding into emerging regions such as Asia Pacific and Latin America, where there is significant growth potential due to rising demand for insurance products and services.

Restraints

- Competition from Direct Sales Channels: Insurance companies are increasingly providing their products directly to consumers via online platforms and other outlets, potentially decreasing the need for insurance brokers and intermediaries.

- Economic Uncertainty: Economic uncertainty can cause a reduction in demand for insurance products and services, as individuals and businesses may decide to cut back on expenses.

- Increasing Regulatory Burden: While regulations offer advantages to companies that comply, they also place a burden on those who struggle to meet compliance standards. This could increase costs and decrease profitability for these organizations.

- Cybersecurity Risks: Insurance Brokerage companies handle sensitive customer data, making them prime targets for cyberattacks. Security breaches can cause reputational harm as well as financial losses.

- Consolidation in the Insurance Industry: The insurance sector is consolidating, with larger companies buying out smaller ones. This could result in a concentration of power within the sector, decreasing competition and providing limited opportunities for smaller insurance brokers and intermediaries.

- Lack of Trust: Some consumers may be wary of insurance brokers and intermediaries due to concerns about transparency or conflicts of interest. This could limit the growth potential of the Insurance Broker market.

Opportunities

- Expansion into New Markets: Insurance brokerage companies can expand into emerging markets to take advantage of the growing demand for insurance products and services. Asian Pacific, Latin America, and Africa are particularly appealing due to rising incomes and an expanding middle-class population.

- Innovation in Technology: Utilizing advanced technologies like artificial intelligence, machine learning, and blockchain can enhance efficiency and provide insurance brokers and intermediaries with new opportunities to provide value-added services to their clients.

- Specialization in Niche Markets: Insurance brokerage companies can leverage niche markets like cyber insurance, environmental insurance, or health insurance to differentiate themselves and create new revenue streams.

- Collaboration with Insurtech companies: Insurtech companies are revolutionizing the traditional insurance industry with innovative products and services. Insurance brokerage companies can work hand-in-hand with Insurtech firms to offer new solutions to clients and enhance their value proposition.

- Increased Focus on Customer Experience: Improving customer experience can help insurance brokers and intermediaries stand out from their competitors, and attract and retain clients. This can be accomplished through technology-driven services, personalized recommendations, and open communication.

- Mergers & Acquisitions: Insurance Brokerage firms can diversify and expand their client base as well as their product offering and market share by merging and buying other companies.

Interested to Procure the Data? Inquire here at | https://market.us/report/insurance-brokerage-market/#inquiry

Challenges

- Competition: The Insurance Brokerage market is becoming more and more crowded, with both new entrants and established companies competing for market share. This puts pressure on prices and margins, making it difficult for firms to differentiate themselves.

- Changed customer expectations: Customers are increasingly demanding personalized and customized insurance products and services tailored to their individual needs. Insurance brokerage businesses must adapt to these evolving customer expectations or risk losing business to competitors.

- Regulatory Adherence: Complying with regulations can be a complex and expensive undertaking, particularly as they change over time. Insurance Brokerage companies must guarantee they adhere to regulatory requirements in order to avoid penalties or reputational damage.

- Talent Retention: Insurance Brokerage companies need to attract and retain skilled, experienced personnel in order to offer clients superior services. However, this can be challenging in a tight labor market where the demand for talent is high.

- Cybersecurity Risks: Insurance Brokerage companies handle sensitive customer data, making them prime targets for cyber attacks. Companies must invest in robust cybersecurity measures to safeguard themselves and their clients.

Key Market Segments

Type

- Commercial P&C insurance

- Personal P&C insurance

- Health and medical insurance

- Life and accident insurance

- Insurance administration and risk consulting

- Annuities

Application

- Property

- Institution

- Individual

Key Market Players

- Wells Fargo Insurance Services

- National Financial Partners

- Meadowbrook Insurance Group

- Jardine Lloyd Thompson Group

- BB&T Insurance Services

- Willis Group

- Marsh & McLennan

- Arthur J. Gallagher

- Hub International

- Brown & Brown

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 59.89 Bn |

| Revenue Forecast by 2032 | USD 113.48 Bn |

| Growth Rate | CAGR Of 6.6% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Frequently Asked Question

Q: What is the current market size for the Insurance Brokerage Market?

A: According to a report by Market.us, the Insurance Brokerage Market was valued at USD 59.89 billion in 2022 and is expected to reach USD 113.48 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

Q: What are the key segments of the Insurance Brokerage Market?

A: The Insurance Brokerage Market can be segmented based on Type (Commercial P&C insurance, Personal P&C insurance, Health, and medical insurance, Life and accident insurance, Insurance administration and risk consulting, Annuities), By Application (Property, Institution, Individual)and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa).

Q: Who are the key players in the Insurance Brokerage Market?

A: Some of the key players in the Insurance Brokerage Market include Wells Fargo Insurance Services, National Financial Partners, Meadowbrook Insurance Group, Jardine Lloyd Thompson Group, BB&T Insurance Services, Willis Group, Marsh & McLennan, Arthur J. Gallagher, Hub International, Brown & Brown.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.