Investment Banking Market CAGR ( 5.9%), Porters Five Forces| Forecast By 2032

Page Contents

Market Overview

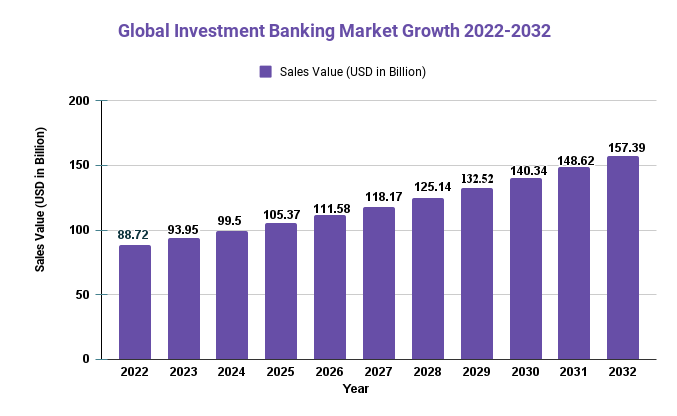

According to a report by Market.us, the global investment banking market size was valued at USD 88.72 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2032.

The investment banking industry plays a critical role in facilitating capital formation, mergers and acquisitions, and other strategic financial transactions for corporations, governments, and other entities. Here's an overview of the market size for the investment banking industry:

Geographically, North America is the largest market for investment banking, followed by Europe and Asia Pacific. The growth of the investment banking industry in these regions is driven by the increasing demand for financial advisory services, favorable government regulations, and growing capital markets.

Overall, the investment banking industry is expected to continue to grow as companies seek capital to fund their growth initiatives and strategic transactions. However, the industry is also subject to regulatory and economic risks, and competition among firms can be intense.

We Have Recent Updates on the Market in Sample Copy@ https://market.us/report/investment-banking-market/request-sample

Key Takeaway

- In 2020, the global investment banking market size was valued at USD 79.11 billion and is anticipated to expand at a compound annual growth rate (CAGR) of 5.9% from 2021-2028.

- The investment banking market can be broken down into service types such as mergers and acquisitions (M&A), debt capital markets, equity capital markets and others. M&A is expected to be the leading segment within this space.

- Geographically, North America is the leading market for investment banking, followed by Europe and Asia Pacific.

- Investment banking is subject to both regulatory and economic risks, while competition among firms may be fierce.

- The industry is expected to keep expanding as companies seek capital for their expansion plans and strategic transactions.

Regional Snapshot

- North America

- North America is the biggest market for investment banking. This is due to the strong presence in the region of large investment banks such JPMorgan Chase and Goldman Sachs as well as Morgan Stanley. Due to the presence and favorable policies of governments, this region is expected continue to dominate global investment banking markets.

- Europe:

- Europe is the second largest market for investment banking. It has major financial centers like London, Frankfurt, Paris. This region is home to the largest international investment banks, such as Credit Suisse, Deutsche Bank, Barclays and Deutsche Bank.

- Asia Pacific

- Because of the rapid economic growth occurring in India and China the Asia Pacific region is expected be the fastest growing market for investment banking. The growth of the region's investment banking sector is being driven by the increase in mergers and acquisitions as well as the rising demand for financial advice services.

- Latin America

- Latin American investors banking market is driven in part by the increasing demand for financial services and the number of M&As taking place in the region. Brazil is followed by Argentina and Mexico as the largest investment banking market in the region.

- Middle East and Africa

- Because of the increased number and demand for financial advisory service, the Middle East & Africa investments banking market is expected grow. The region is home for major financial centers like Abu Dhabi & Dubai and is attracted investment from international investment banking banks.

Market Dynamics

Drivers

- There is an increasing demand for capital. Companies from all industries need capital to finance their growth initiatives, make strategic investments and expand their businesses. Companies can access capital markets via debt or equity offerings by investing banks.

- There are more mergers and acquisitions. Companies are looking to increase their business, gain competitive advantage, and enter new markets. M&A advisory services are provided by investment banks to help companies find potential targets, negotiate deals and secure financing.

- Favorable government policies are: All over the globe, governments have policies that encourage investment and stimulate economic growth. These policies create an environment that is favorable for investment banking activities such as the underwriting of debt or equity offerings.

- Globalization is increasing: Companies are expanding across borders due to increased globalization. Investment banks assist companies in navigating the complex financial and regulatory environments of different countries. They facilitate cross-border mergers, acquisitions, and other strategic transactions.

- Technological advances: Investment banks are increasingly using technology to improve their operations and offer more efficient services to their clients. Investment banks use data analytics to identify potential M&A targets, and provide better financial valuations.

Restraints

- Regulatory risks: The regulatory environment for investment banking is strict. Financial regulators and governments have established stringent guidelines that can pose compliance and operational challenges. It is possible for investment banks to limit the types and amount of transactions they can do.

- Economic risks: The global economy's performance is critical for the success of the investment banking sector. An economic downturn can result in a reduction of strategic transactions and impact on the profitability of investment banking institutions.

- High level of competition: Large investment banks from around the world dominate the market. Smaller banks might find it difficult compete with larger banks which have more resources and are better equipped.

- Fluctuations on financial markets: Financial markets fluctuations can have a significant impact on the investment banking sector. This includes changes in interest rate or stock market volatility. These fluctuations could have an effect on the demand and profitability of investment banking services.

- Customers changing their preferences: Customers are looking for alternative financing options like crowdfunding or peer to peer lending. This may reduce the demand for traditional investment banking services.

Opportunities

- Emerging Markets: Emerging economies such as China, India and Brazil offer tremendous potential for investment banks due to their large populations, growing economies and increased demand for financial services.

- Digital Transformation: Investment banks can utilize digital technologies like artificial intelligence and blockchain to streamline operations, boost efficiency, and offer more tailored services to clients.

- Sustainable Finance: Companies are increasingly looking for sustainable finance solutions, such as green bonds and sustainable loans, in order to address environmental and social problems. Investment banks can play a vital role in providing these solutions and promoting sustainable finance.

- Private equity: The private equity industry is growing rapidly, with increasing amounts of capital raised by these firms. Investment banks can offer advisory services to these firms and help them identify potential investment opportunities.

- Infrastructure Financing: Infrastructure projects such as renewable energy plants and transportation networks require significant amounts of financing. Investment banks can offer solutions and advisory services to governments and private sector clients involved in these endeavors.

View Detailed TOC of the Report : https://market.us/report/investment-banking-market/table-of-content/

Challenges

- Economic Uncertainty: Economic uncertainties such as trade tensions and geopolitical risks can negatively influence demand for investment banking services and make it difficult for banks to plan and execute strategic transactions.

- Talent Retention: The investment banking industry is highly competitive, making it difficult to retain top talent. Investment banks must offer competitive compensation packages, career development opportunities and an encouraging work atmosphere in order to attract and keep talented staff.

- Disruptive Technologies: New technologies such as fintech and digital currencies are revolutionizing the financial services industry and creating new competition for investment banks. To stay ahead of this wave of technological innovation, investment banks must adjust their business models accordingly.

- Regulatory Compliance: Investment banks must abide by stringent regulatory compliance requirements, which may present difficulties and raise operational expenses. To manage their regulatory risks effectively, investment banks need effective compliance programs in place.

- Client Expectations: Client demands are becoming increasingly complex, necessitating investment banks to offer tailored solutions tailored to each individual's needs. In order to do this efficiently, investment banks must possess an intimate knowledge of their clients' businesses in order to provide tailored advice and solutions tailored specifically for them.

Key Market Segments

Type

- Mergers And Acquisitions Advisory

- Debt Capital Markets Underwriting

- Equity Capital Markets Underwriting

- Financial Sponsor/ Syndicated Loans

Application

- Bank

- Investment Banking Companies

- Securities Company

Key Market Players

- Barclays

- JP Morgan

- Goldman Sachs

- Bank Of America Merrill Lynch

- Morgan Stanley

- Deutsche Bank

- Credit Suisse

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 88.72 Bn |

| Revenue forecast by 2032 | USD 157.39 Bn |

| Growth Rate | CAGR Of 5.9% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Frequently Asked Questions

Q: What is the current market size for the Investment Banking Market?

A: According to a report by Market.us, the global investment banking market was valued at USD 88.72 billion in 2022 and is expected to reach USD 157.39 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

Q: What are the key segments of the Investment Banking Market?

A: The Investment Banking Market can be segmented based on type (Mergers And Acquisitions Advisory, Debt Capital Markets Underwriting, Equity Capital Markets Underwriting, Financial Sponsor/ Syndicated Loans), application (Bank, Investment Banking Companies, Securities Company), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa).

Q: Who are the key players in the Investment Banking Market?

A: Some of the key players in the Investment Banking Market include CBarclays, JP Morgan, Goldman Sachs, Bank Of America Merrill Lynch, Morgan Stanley, Deutsche Bank, Credit Suisse.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.