Pet Insurance Market to Offer Numerous Opportunities, Growing at a CAGR of 11.90% through 2032

Page Contents

Pet Insurance Market Overview

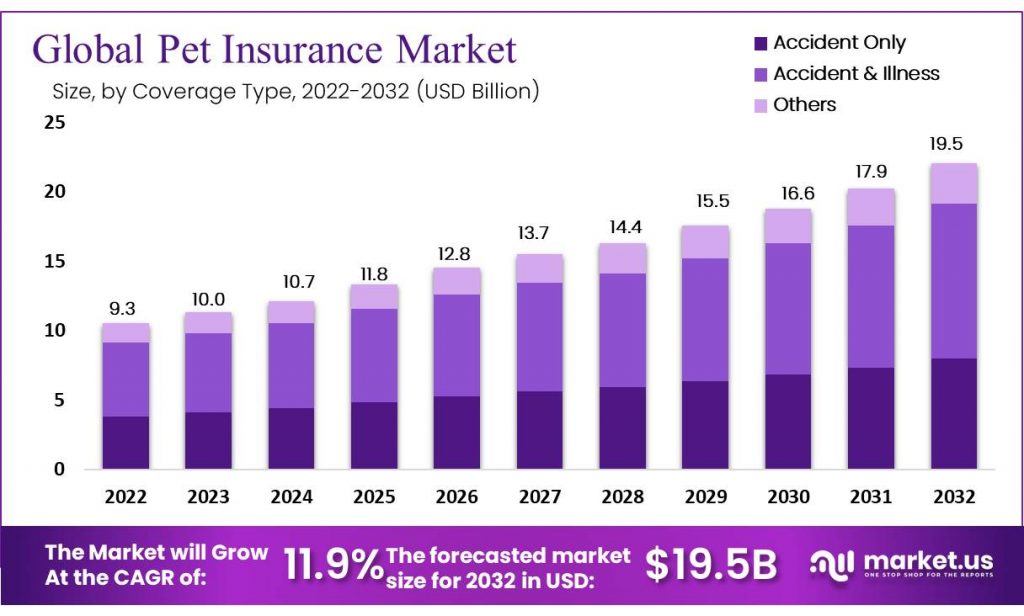

Published Via 11Press: The global pet insurance market size is expected to be worth around USD 19.15 Bn by 2032 from USD 9.3 Bn in 2022, growing at a CAGR of 11.90% during the forecast period from 2022 to 2032.

Pet insurance policies typically cover a range of conditions, including accidents, illnesses, and routine care. Some policies also offer coverage for hereditary and congenital conditions, alternative therapies, and prescription medications.

The market is primarily driven by increasing pet ownership, rising disposable income, growing awareness of pet insurance, and advancements in veterinary medicine. However, high premiums, limited coverage, complex policies, limited provider options, and lack of awareness are some of the restraints that can impact market growth.

The pet insurance market is a growing industry that offers peace of mind to pet owners by helping them manage the cost of unexpected veterinary expenses. As pet ownership continues to rise, and pet owners become more aware of the benefits of having pet insurance, the market is expected to continue growing in the coming years.

Request For Sample Report Before Buying@ https://market.us/report/pet-insurance-market/request-sample/

Key Takeaways

- The pet insurance market is a growing industry that offers insurance coverage for veterinary expenses associated with pet healthcare.

- The global pet insurance market size was valued at USD 9.3 billion in 2022 and is projected to reach USD 19.15 billion by 2032, growing at a CAGR of 11.90% during the forecast period (2022-2032).

- The key drivers of the pet insurance market include the increasing prevalence of chronic diseases in pets, rising pet adoption rates, growing awareness of the benefits of pet insurance among pet owners, and the availability of various coverage options.

- Some potential challenges in the pet insurance market include limited penetration, premium costs, coverage limitations, increasing competition, and navigating regulatory environments.

- Some recent developments in the pet insurance market include increased mergers and acquisitions, the introduction of new coverage options, and partnerships with veterinary clinics.

- Opportunities in the pet insurance market include increasing pet ownership, growing awareness of pet health, technological advancements, customized coverage options, online platforms, and partnerships with veterinary clinics.

- Increasing pet food cost is also important factor.

Purchase This Report Via Secured Link and Avail Discount: https://market.us/purchase-report/?report_id=32245

Regional Analysis

- North America dominates the pet insurance market with over ~50% share. This dominance is fueled by high pet ownership rates, growing awareness about pet health issues, and rising veterinary expenses.

- Europe: The European pet insurance market is the second-largest globally. Factors such as rising pet ownership and awareness about pet health, as well as a high level of disposable income, are driving its growth within the region.

- Asia Pacific: The pet insurance market in Asia Pacific is growing rapidly, due to rising pet ownership rates, growing awareness about pet health issues and expanding pet healthcare infrastructure.

- Rest of the World: Other regions such as Latin America, the Middle East and Africa are also witnessing growth in the pet insurance market, though at a slower rate than other regions. Factors such as increasing pet ownership rates, changing attitudes toward pet health issues and rising urbanization are driving this growth in these regions.

Drivers

- Global pet ownership is on the rise, with dogs and cats dominating pet ownership worldwide. According to the American Pet Products Association, 67% of US households own a furry companion. As such, pet insurance policies have become increasingly popular as pet parents seek ways to protect their beloved companions. Advancements in veterinary medicine have enabled improved treatments for pets which have driven up healthcare costs; making pet insurance an attractive option for pet owners as it helps manage expenses related to veterinary care.

- Rising Disposable Income As disposable income rises, pet parents are more willing to invest in their pet's health and well-being. This includes purchasing pet insurance policies to cover unexpected veterinary expenses. Growing Awareness of Pet Insurance

Recently, the pet insurance market has become more competitive with more companies offering policies tailored for different pets and owners. This has increased awareness about the advantages of having pet insurance – driving demand upwards. - Customized Insurance Policies Many pet insurance providers now provide customized policies, enabling pet owners to select the coverage that best meets their pets needs. This flexibility is appealing for pet parents who want to customize their policies according to specific health concerns for their furry friend.

Restraints

- Pet insurance premiums can be costly, particularly for comprehensive policies that cover a wide range of conditions. This may deter some pet owners from purchasing a policy – particularly those with multiple pets. Limited Coverage Some pet insurance policies have limitations such as age limits and preexisting conditions which could prove deterrents for older pets or those with chronic health conditions. Complex Policies unele pet insurance policies may be complex to understand for non-experts, making it difficult to pick the right plan that meets their needs.

- Limited Provider Options The pet insurance market is relatively small, with only a handful of major providers. This limits the choices available to owners, making it difficult to find a policy that fits both their budget and pet's requirements. Lack of Awareness

Despite rising awareness around pet insurance, many still do not understand its advantages due to inadequate education on the topic or lack of marketing by providers.

Opportunities

- Growing Pet Ownership will increase the demand for pet insurance. This presents an opportunity for pet insurance companies to expand their customer base and boost revenues. Growing Awareness of Pet Health As more pet parents become educated on the significance of pet health, demand for pet insurance is likely to rise. This presents an opportunity for pet insurance companies to inform pet parents about its advantages and expand their market share. Technological Advancements Veterinarian technology is continuously progressing, leading to more and better treatments for pets. This presents pet insurance companies with an opportunity to offer more comprehensive coverage options and attract customers seeking more comprehensive protection.

- Customized Coverage Options Pet insurance companies can differentiate themselves by offering customized coverage options tailored to the needs of various pets. This presents them with the chance to provide value-added services and attract customers seeking tailored coverage options. Online Platforms Many pet insurers now provide online platforms that enable customers to quickly compare coverage options and purchase policies. Doing so presents them with the chance to expand their customer base while cutting acquisition costs through digital channels.

- Partnerships with Veterinary Clinics Pet insurance companies can partner with veterinary clinics to provide pet owners access to coverage at the point of care. This presents an opportunity for pet insurers to expand their customer base and enhance customer acquisition by providing a convenient and seamless purchasing process.

Challenges

- Limited Penetration Despite growing awareness about pet insurance, a significant portion of pet owners do not have coverage for their animals. This presents an obstacle for companies offering pet insurance services to reach out to a broader customer base and increase penetration rates. Premium Costs Pet insurance premiums, particularly comprehensive plans, can be expensive. This presents pet insurance companies with the challenge of striking a balance between affordability and profitability while still offering comprehensive coverage options. Coverage LimitationsCertains pet insurance policies have coverage limitations, such as preexisting conditions, breed-specific issues or age restrictions. This presents pet insurers with the challenge of finding the balance between providing adequate coverage and the risk and cost associated with insuring different pets.

- Increasing Competition As the pet insurance market expands, more companies are entering it, creating increased competition. This presents a challenge for pet insurance companies to differentiate their offerings and offer unique value propositions to customers. Regulatory Environment The pet insurance market is subject to regulations that differ by country and state; this presents another obstacle for companies trying to navigate this environment while providing consistent coverage options to clients.

Recent Development

July 2022: JAB Holdings agreed to acquire the German pet insurance provider Agila from Wertgarantie Group, continuing its breakneck expansion into the global pet insurance market.

December 2021: Chewy Inc. is a leading online resource for pet parents and their partners. Trupanion Inc. Japan is an industry leader in medical insurance for pets. They announced a partnership to provide a special suite of pet health and wellness plans to over 20 million Chewy customers.

Key Market Segments

Based on Coverage Type

- Accident Only

- Accident & Illness

- Others

Based on Animal Type

- Dogs

- Cats

- Others

Based on Sales Channel

- Broker

- Direct

- Agency

- Bancassurance

Based on Provider

- Public

- Private

Market Key Players

- Trupanion

- Nationwide Mutual Insurance Company

- Healthy Paws Pet Insurance, LLC

- Embrace Pet Insurance Agency, LLC

- Anicom Holdings

- Figo Pet Insurance LLC.

- Agria Pet Insurance Ltd.

- 24 Pet Watch

- Pets Best Insurance Services, LLC

- ASPCA

- Pet Plan Insurance

- MetLife Services and Solutions LLC

- Petfirst Healthcare LLC

- Ipet Insurance Co, Ltd.

- Hartville Group

- ASPCA Pet Insurance

- Animals Friends Insurance Services Limited

- Progressive Casualty Insurance Company

- Other Key Players

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 9.3 Bn |

| Revenue forecast by 2032 | USD 19.15 Bn |

| Growth Rate | CAGR Of 11.90% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

FAQ.

The Pet Insurance Market is studied from 2017 - 2032.

The Pet Insurance Market is growing at a CAGR of 11.90%

Asia Pacific is growing at the highest CAGR over 2022- 2032.

North America holds the highest share in 2022.

Trupanion, Nationwide Mutual Insurance Company, Healthy Paws Pet Insurance, LLC, Embrace Pet Insurance Agency LLC, Anicom Holdings, Figo Pet Insurance LLC, Agria Pet Insurance Ltd, 24 Pet Watch, Pets Best Insurance Services LLC, ASPCA, Pet Plan Insurance, MetLife Services and Solutions LLC, Petfirst Healthcare LLC, Ipet Insurance Co, Ltd, Hartville Group, ASPCA Pet Insurance, Animals Friends Insurance Services Limited, Progressive Casualty Insurance Company

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.