Buy Now Pay Later Statistics 2024 – By Purchase Category, Demographics, Brands, Reasons and Usage

Page Contents

Introduction

Buy Now Pay Later Statistics: The reports say that the market value of Buy Now Pay Later is expected to reach a value of $565.8 billion by the end of 2026. The online payment platform has grown enormously in recent years and many people around the people are taking advantage of the buy now pay later (BNPL) option, mostly preferred by Gen Z and Millennials with a share of 75%. Even having a risk factor for lenders and borrowers, the BNPL market is gaining huge popularity as it maintains effective regulations such as if customers make delays in payment after the due date then they need to pay more debt due to paying late fees.

These Buy Now Pay Later Statistics include insights from various aspects that provide light on why today BNPL is one of the best online paying platforms in the world.

Editor’s Choice

- According to the reports of Global Data, the global market share of buy now pay later is expected to be $309.2 billion by the end of 2023.

- By the end of 2026, the market of BNPL is predicted to gain a market share of $565.8 billion.

- The compound annual growth rate of the market is going to grow by 25.5% from 2023 to 2026.

- The global BNPL transaction value remains highest in the region of North America, which is going to account for around 40% from 2023 to 2026.

- As of 2023, the highest number of BNPL users observed is between the age group of 25 years to 34 years resulting in 40%.

- As of reports, the BNPL spending is segmented into 5 primary categories health and beauty, food and drink, electrical goods and home appliances, media, and entertainment, clothing and footwear.

- The clothing and footwear segment is going to capture around 60% of transaction value by 2023.

- The transaction value captured by the region of Europe is almost 30% in buy now pay later in the year 2023.

- The best players in this industry are Klarna, Afterpay, Sezzle, Affirm, Zip, PayPal, Paytm, Laybuy, and others.

- According to the analysis of the Federal Reserve the uses of buy now pay later stats by household income is followed by less than $75,000 (72.6%), and $75,00 and over (17.6%).

General Statistics of Buy Now Pay Later Statistics

- According to research by Exploding Topic, over 360 million global users are using BNPL services in January 2023 and it is expected that by the end of 2027, it is going to be 900 million BNPL users with an increment of 157%.

- By the end of 2030, the worth of the global BNPL market is expected to be $3.27 trillion.

- In the United States, around 79 million people are using BNPL services which 22% of users as of 2023 with an increment of 56.1% from last year. (Insider Intelligence).

- According to C+R Research, 60% of global people have already tried the service of buy now pay later, 46% of people are currently using the services, and 66% people think BNPL service is financially risky.

- According to the reports of MAG analysis, in the United States, the BNPL market is predicted to be the leading market with $90 billion and by the end of 2024, the market forecast is going to be around $100 billion.

- The expected market size of buy now pay later by the end of 2032 is expected to be $9,226.65 billion with a CAGR of 29% from 2023 to 2032.

(Source: buttercms.com)

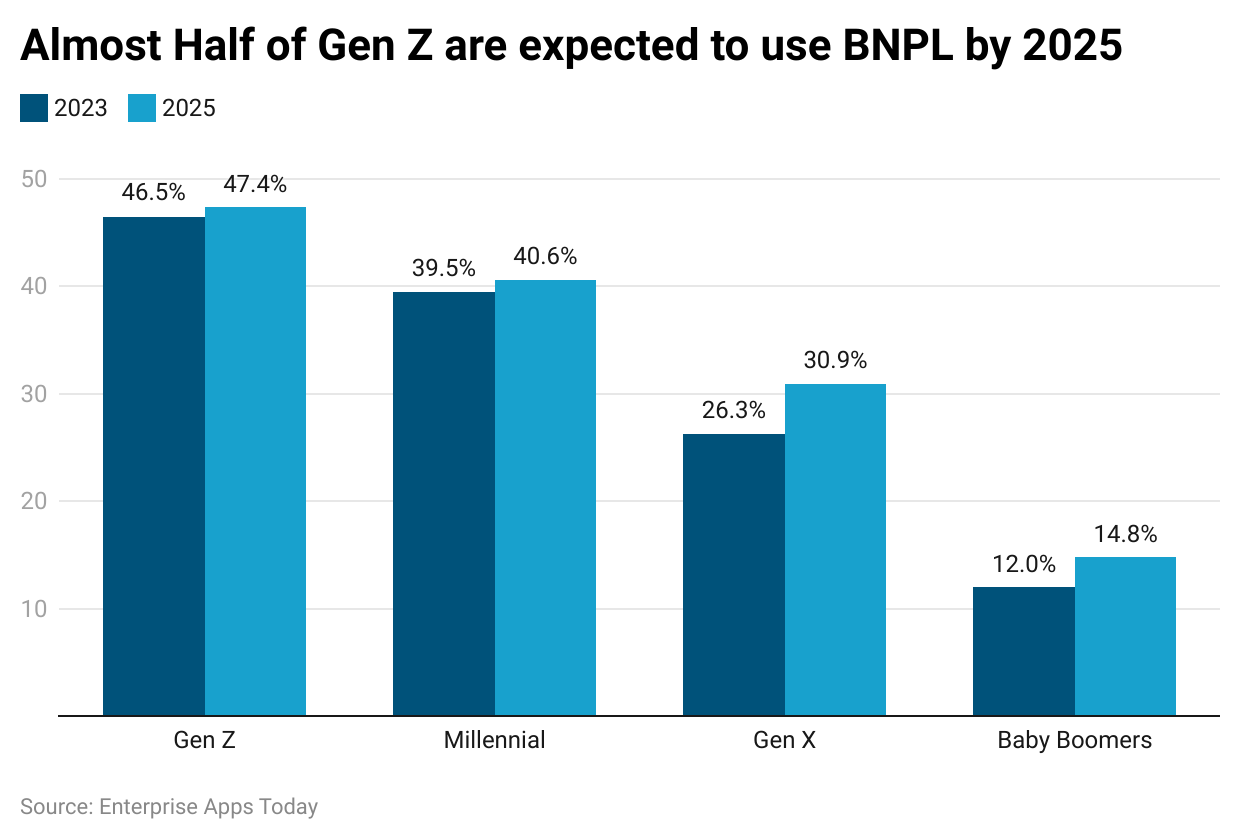

- The above graph represents the BNPL user's breakdown statistics by generation in 2023 and 2025 are described below. (eMarketer)

- As of 2023, the highest user generation is Gen Z with 46.5% others are followed by Millenial (39.5%), Gen X (26.3%), and Baby Boomers (12%).

- It is expected that by the end of 2025, the share of BNPL is expected to increase in every generation Gen Z (47.4%), Millennial (40.6%), Gen X (30.9%), and Baby Boomers (14.8%).

Buy Now and Pay Later Market Size Forecast

According to Market.us:

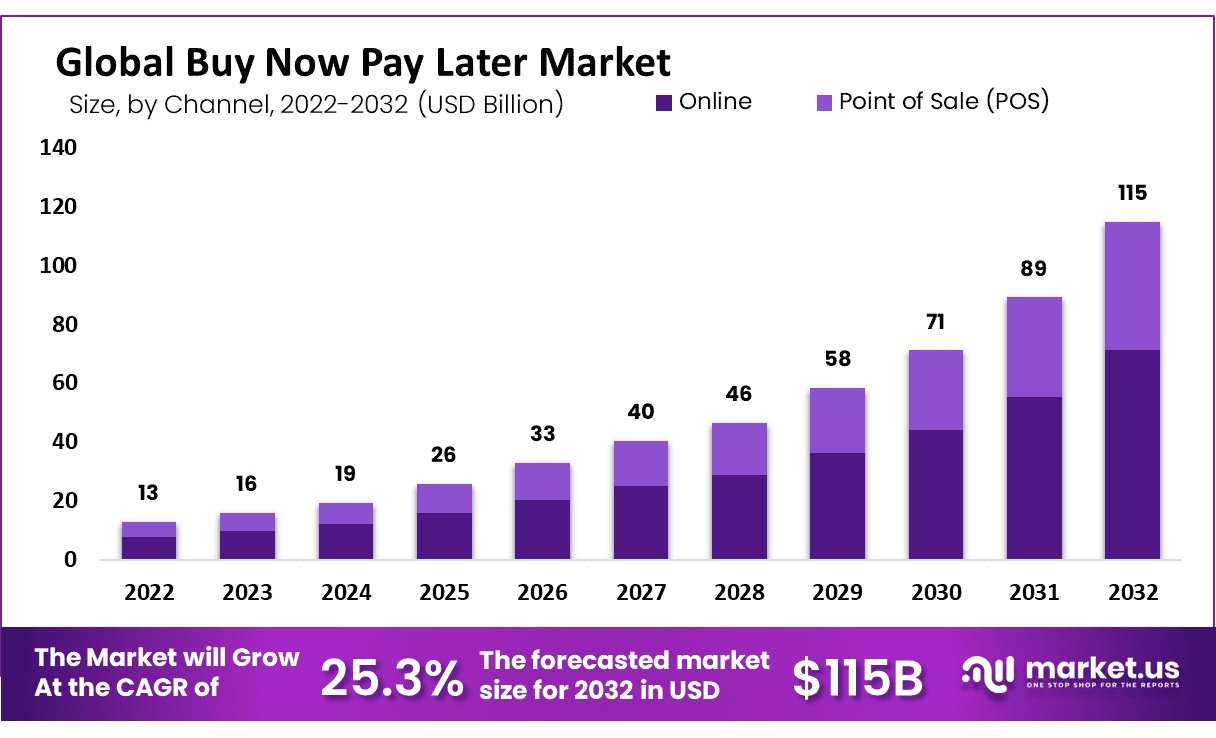

- Market Size and Forecast: The global Buy Now Pay Later (BNPL) market is currently valued at USD 16 Billion in 2023. It is expected to grow significantly, reaching an estimated USD 115.0 Billion by 2032.

- Growth Rate: The BNPL market is projected to expand at a Compound Annual Growth Rate (CAGR) of 25.3% during the period from 2023 to 2032.

- Dominant Channel: The online segment is the most profitable in the BNPL market. It accounts for 62% of the total global revenues.

- Leading End-User Sector: The retail sector is the top end-user in the BNPL market. It's expected to generate over 71.3% of the market's revenue throughout the forecast period.

- Regional Market Leader: As of 2022, North America holds the largest share in the BNPL market. It contributes about 32% to the global revenue.

By Purchase Category

(Source: buttercms.com)

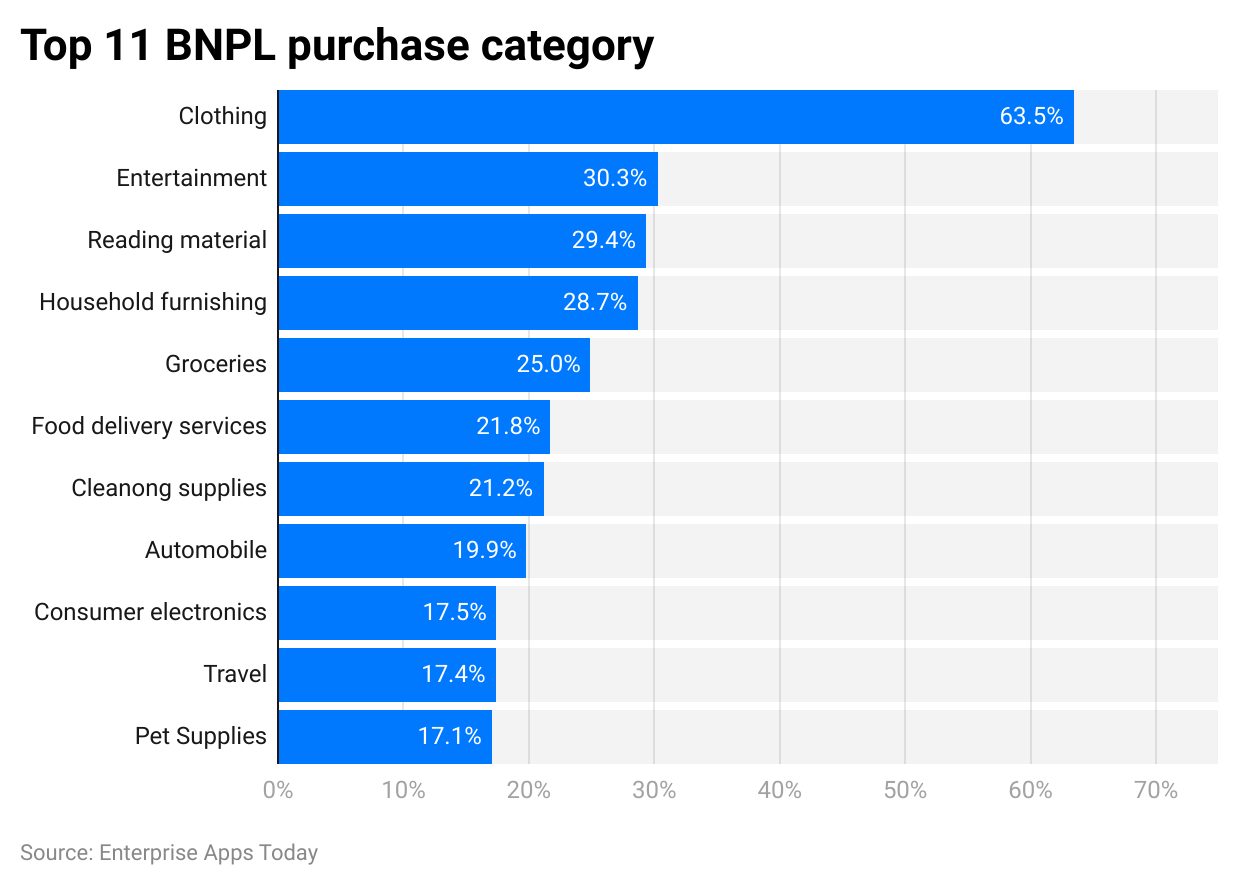

- Footwear and Clothing: Dominates the transaction value in the BNPL services, accounting for approximately 63.5% in 2023.

- Entertainment: Represents a significant portion, covering 30.3% of BNPL transactions.

- Reading Materials: Contributes to 29.4% of the BNPL service transactions.

- Household Furnishings: Accounts for 28.7% of the transaction value in BNPL services.

- Groceries: Captures 25% of BNPL transactions, indicating its growing popularity in daily essentials.

- Food Delivery Services: Comprises 21.8% of the transaction value in BNPL services.

- Cleaning Products: Holds a share of 21.2% in BNPL transactions.

- Automobile: Represents 19.9% of the transaction value in BNPL services.

- Consumer Electronics: Accounts for 17.5% of BNPL service transactions.

- Travel: Takes up 17.4% of the transaction value in BNPL services.

- Pet Products: Contributes 17.1% to the BNPL transactions, reflecting its relevance in the segment.

By Demographics

- In Statista reports for 2023, the highest number of groups of people who use buy-now-pay-later is the highest ever recorded across the United States.

- According to reports from surveys according to survey reports, the use of Buy Now Pay Later declined by 15% in the months between June 2022 and July 2023.

- In 2022 the service of BNPL was utilized by people aged 18 to 24 years old, with a share of 61 percent.

- The rate of penetration for buy-now-pay-later (BPNL) has been reached at 42 percent within the USA.

(Source: similarweb.com)

(Source: similarweb.com)

- At the time of June 2023, there was a report in June 2023 that stated the Buy Now Pay Later Statistics

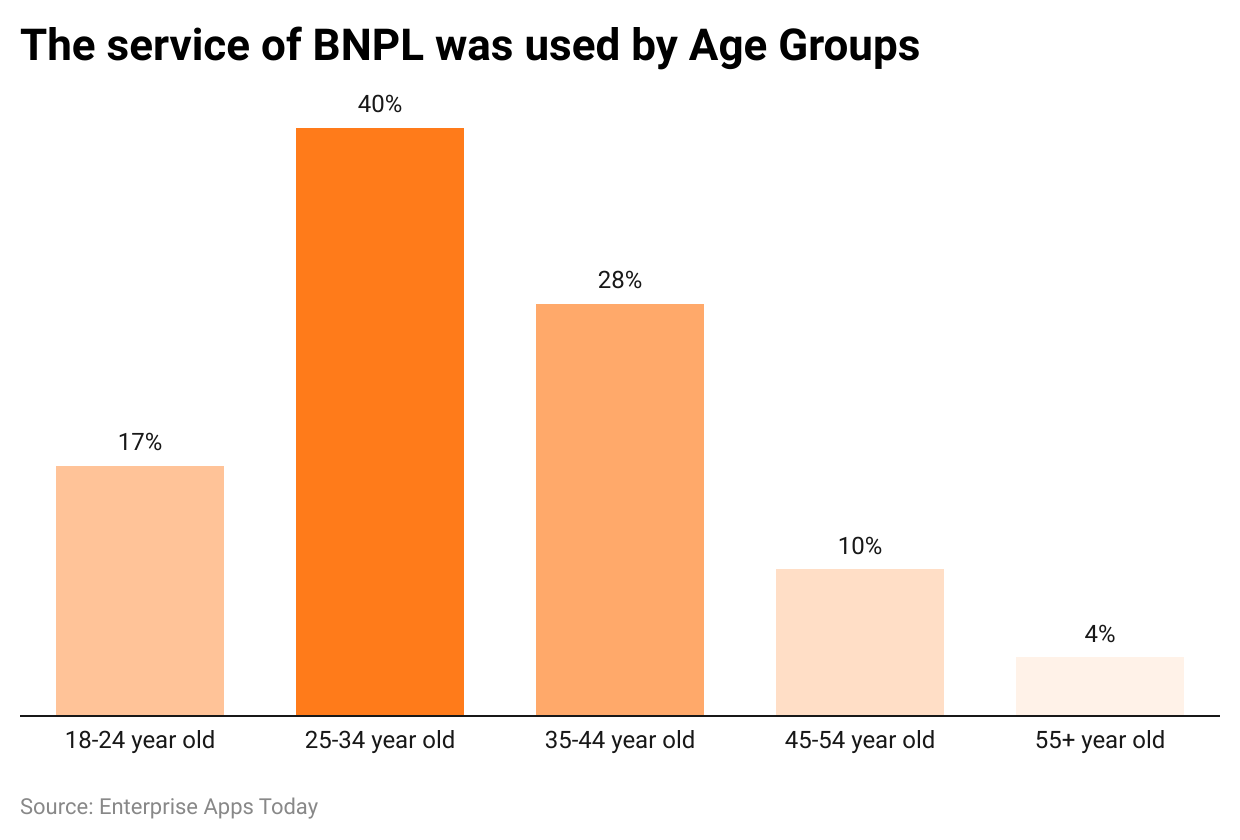

- according to the state of demographics, most people who use the service are in the age range between the ages of 25 to 34 years, which is about 40 percent.

- The figure is 17% for BNPL users between the ages of 18 to 24 years old.

- 28 percent and 10% belong to the age ranges of 35 to 44 years, and 45 years to 54 years.

- 4 percent of BNPL customers are older than 55.

- The use of BNPL is higher among males at 53% and females, at 47% during the year 2023.

- According to reports from CFPB Buy now pay later statistics by race are followed by white (26 percent), Hispanic (24%), and white (16 percent).

By Brands

| Platform | Percentage of consumers who use it |

| PayPal Credit | 57% |

| Afterpay | 29% |

| Affirm | 28% |

| Klarna | 23% |

| Zip (Zip Pay) | 19% |

(Source: bankrate.com)

Klarna

- According to Statista, by 2023 the United States is going to receive the highest number of merchants who offered Klarna and the use of Klarna remains highest in Europe.

- By August 2023, the estimated number of merchants available on the website is around 25,900.

- Almost 98% of Swedish domains preferred the buy now pay later option and 11% of the websites in Sweden had already offered payment technology.

- Other countries that offer Klarna are the United Kingdom and the United States.

Afterpay

- In 2023, the highest number of merchants offering Afterpay was observed in the United States by August 2023.

- On the other hand, the highest market share was recorded by New Zealand and Australia.

- As per the reports of Statista, till August 2023 Afterpay websites have estimated almost 5,000 merchants in New Zealand which is around 50% of all domains in the nation with an option of BNPL.

Sezzle

- In 2023, the market share of Sezzel around the world has resulted in a 27% share and the highest number of merchants offering Sezzel is in the United States.

- By August 2023, above 2,500 Canadian merchants were observed having Sezzel on their websites.

- The report states that 40% of the overall domain in the country uses the BNPL option.

Affirm

- According to Statista, around the world, Affirm as a BNPL option is only offered by the United States.

- It is estimated that in August 2023, there were above 560 Canadian merchants using Affirm which is more than 8% of all domains in the country are buying with an option of buy now pay later.

Zip

- In 2023, the highest number of Zip offering merchants is observed in Australia and the market share remains highest in the Philippines.

- As of August 2023, around 390 Canadian merchants were observed having Zipl on their websites representing 4% of the overall domain using the BNPL option within the country.

By Reasons

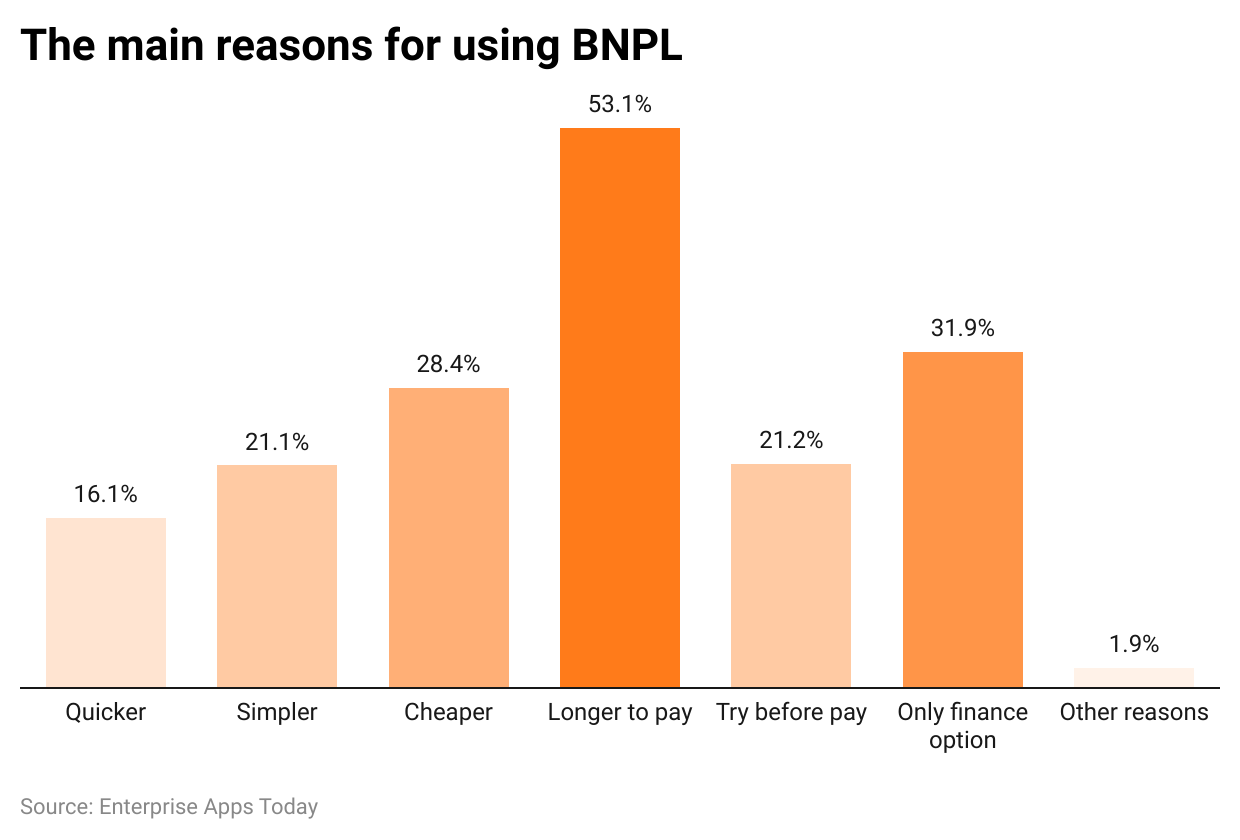

(Source: similarweb.com)

- The main reasons for using BNPL are segmented into 3 categories such as convenience, only option, and try before committing.

- Convenience is the biggest factor in 2023 as it enables longer to pay (53.1%), cheaper (28.4%), simpler (21.1%), and quicker process (16.1%) claimed by respondents.

- On the other hand, 31.9% of respondents said BNPL is the only option that is suitable for purchasing products which has been claimed by 35% of female users and 28% of male users.

- Whereas, Try before committing is another reason that was preferred by 21.1% of respondents, and other reasons share holds 1.9% of preference.

Advantages and Disadvantages

Advantages

- The effective benefit is that BNPL service or option helps in paying split up or breaks up a payment option that means paying fees into smaller parts scheduled within 2 or 4 weeks apart or months, thus termed as most manageable amounts.

- 0% financing is another positive side because if people pay their payments on exact time or before the due date they don’t need to pay any interest.

- This allows financial approval without having a credit check and also offers an attainable option of financing.

Disadvantages

- There are several disadvantages and isn’t always necessarily safer for regular financing as it includes various financial risks.

- Fees and Interest is one of them, if someone miss a BNPL payment then they are charged with late fees or interest rate over the unpaid balance and the interest depends upon the lender of the BNPL.

- Furthermore, other disadvantages are followed by possible overdrafts, easily overextended finances, missing out on rewards, and returns can be difficult.

By Usage

- According to recent survey reports from 2023, on a monthly basis, there are around 29% of BNPL regular users.

- Every 6 months, there are more than 80% of BNPL users around the world. (C+R Research)

- Use of BNPL services statistics by consumer frequency is followed by more than once in a week (2%), once a week (8%), once a month (19%), once every three months (22%), once every six months (29%), and once a year or less (20%).

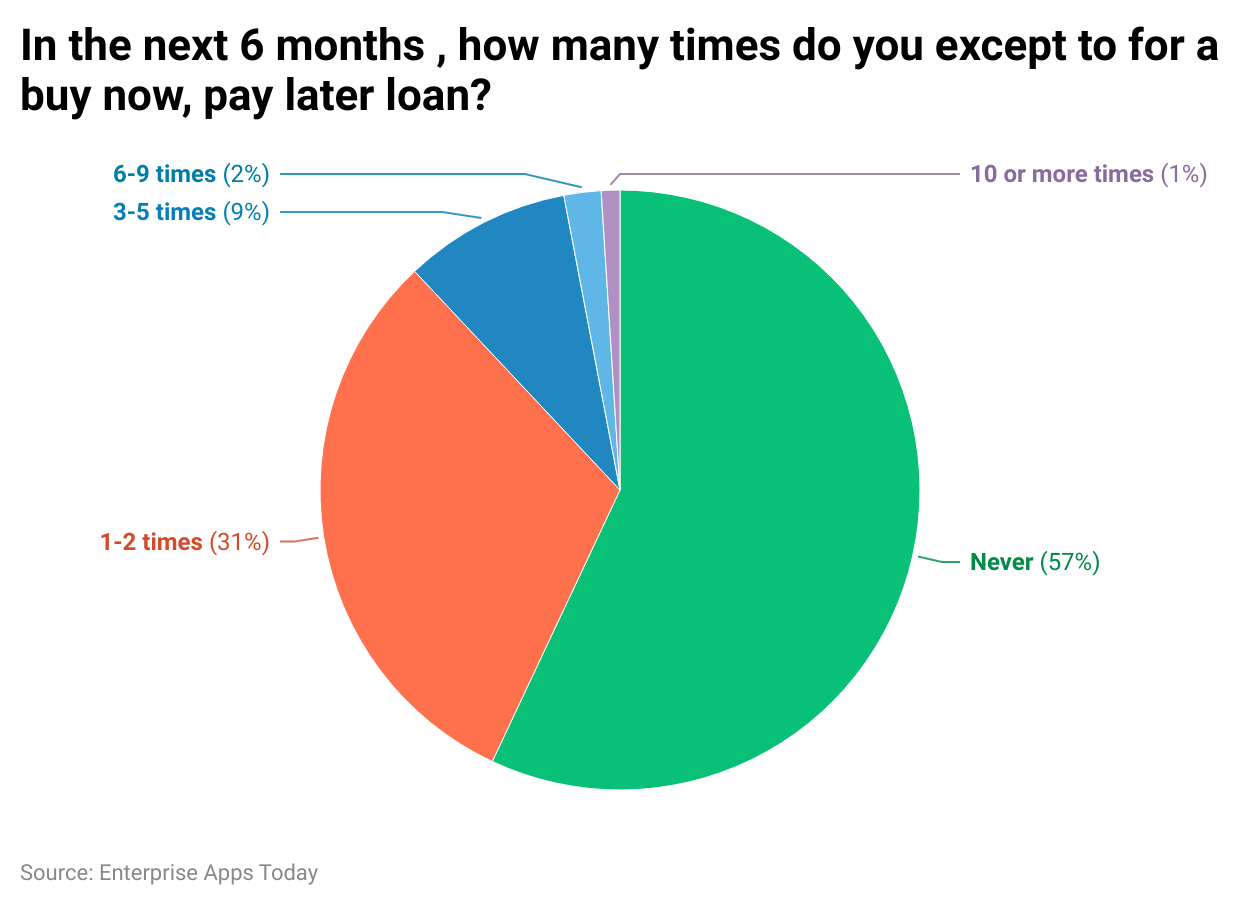

(Source: lendingtree.com)

- According to survey reports of 5th October 2023, around 43% of the United States people have accepted that they have used the BNPL services once in 6 months.

- On the other hand, in America, 57% of people never used BNPL within the last 6 months, 31% of people used (1-2 times), 9% of people (3-5 times), 2% of people (6-9 times), and 1% people (10 or more).

(Source: lendingtree.com)

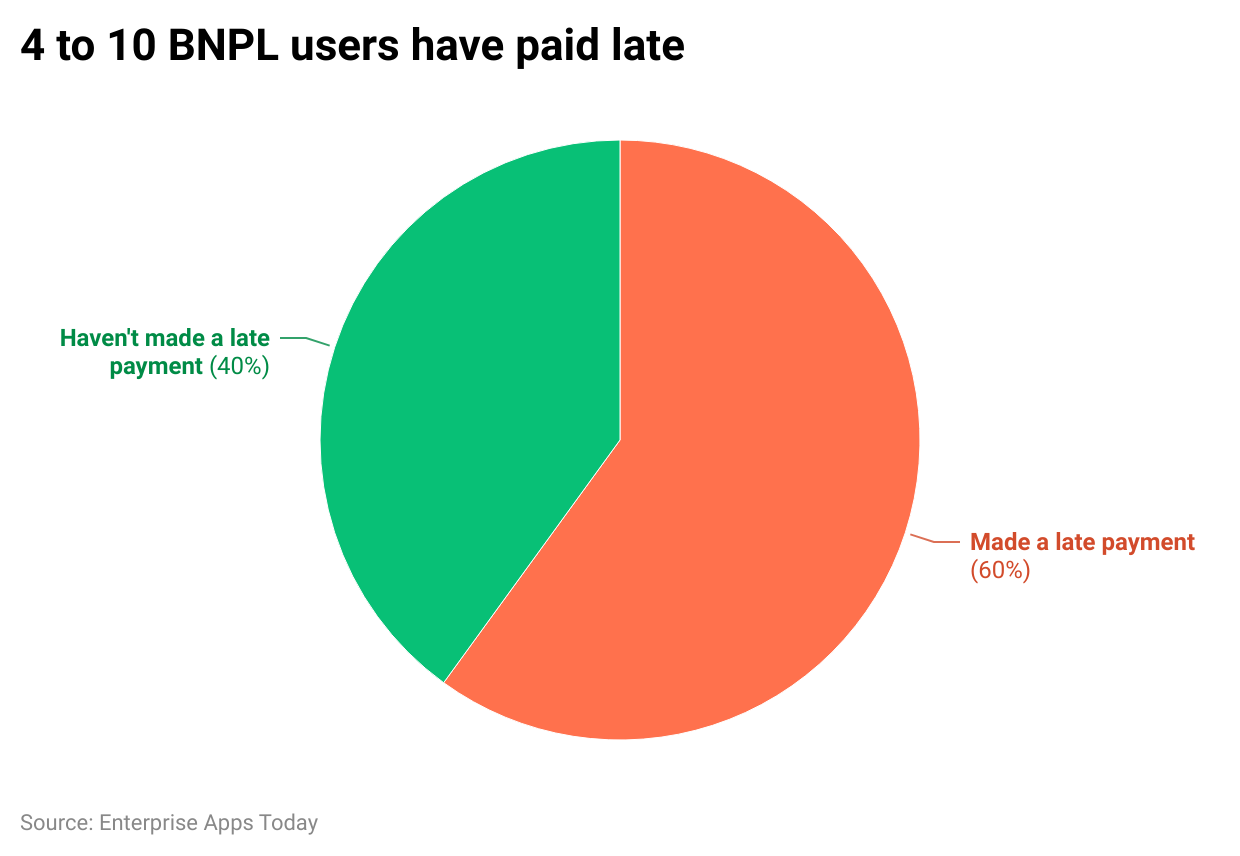

- As of March 2023, according to the research conducted by Lending Tree Survey among 940 BNPL users, it has been observed that 10 out of 4 BNPL users have paid late fee repayment.

- 60% of people didn’t make late payments but 40% of people have made late payments.

Future Statistics

- According to Precedence Research, by the end of 2028 market size of the North American region will grow higher in the United States expected to be $8.86 billion, and Canada ($2.37 billion).

- Furthermore, the Asia Pacific region is predicted to be the fastest-growing region with a market share of China resulted in $5.35 billion, Japan ($3.42 billion), South Korea ($2.18 billion), and India ($2.54 billion) by the end of 2028.

Conclusion

As of today, after completing the article on Buy Now Pay Later Statistics it is estimated that the service of this platform will grow enormously over the world in 2023. After analysis of various reports, it is expected that the market size of BNPL is supposed to hit $9.22 trillion by the end of 2032.

This platform enables both businesses and consumers to benefit from the e-commerce industry from the option of buy now pay later which leading providers are Klarna, Afterpay, Sezzle, Affirm, Zip, etc. This article includes several effective statistics of this platform that will help in understanding the services of buy now pay later in recent days.

Sources

FAQ.

After buying online products through the buy now pay later, people need to set an interest-free period and repay fees on a fixed date. This is a type of installment loan in which purchases are divided into multiple equal payments.

If someone forgets to make the repayment on a fixed day then it will cost extra interest charges and if someone stops paying then it leads to lender freezing of the account and accounts stop from further purchases, or debts may be turned over to a debt collector.

Yes, if someone is purchasing for the first time by the option of BNPL its mandatory to complete the online KYC verification for validating the digital service provider’s platform.

No, it’s impossible to get back money if paid once, and won’t be able to use the account or card to access cash through ATMs or branches.

As of 2023 reports, In India, 22% of consumers are currently investing in this platform between the age groups of 26 years to 35 years.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.