Some Essential PhonePe Statistics And Usage Data Analysis For 2023

PhonePe Statistics: PhonePe is an Indian payment application that is based on the Unified Payments Interface. The app is used by millions of people to pay utility bills, transfer money, invest and shop online. It offers numerous cashback deals to its users. Using PhonePe, people can send, receive and add money via a bank account. It is a safe application that meets users’ all banking needs. PhonePe has shown incredible growth in its all line of business since its inception in 2015. It has emerged as India’s one of largest payment applications lately. Here we will discuss some crucial PhonePe statistics to understand its growth and expansion in recent years.

PhonePe Statistics (Editor’s Choice)

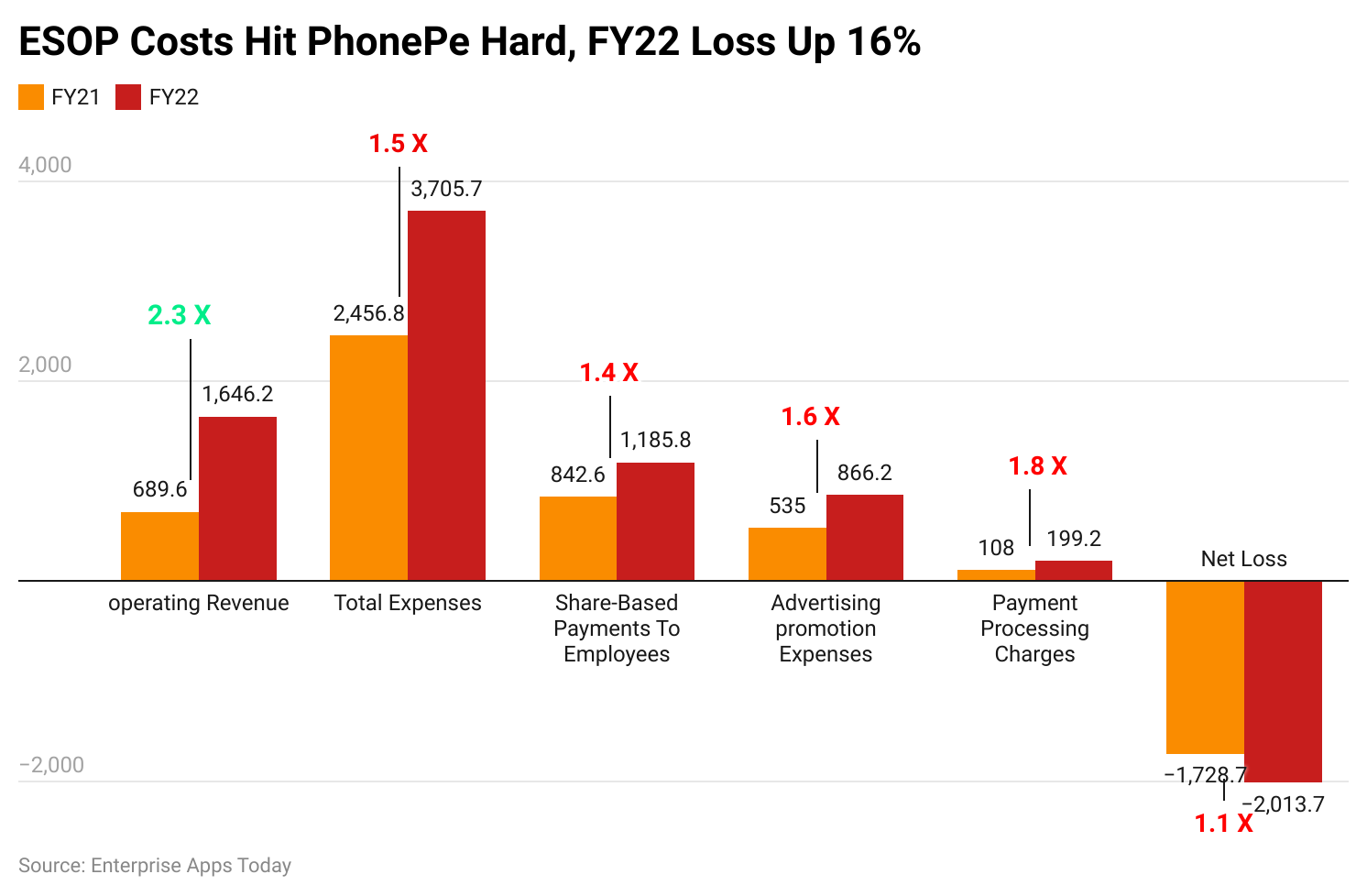

- The total revenue of the Walmart-funded startup PhonePe shot up by 133% to INR 1692.7 Cr in 2022.

- The total expense of PhonePe increased by one and a half fold amounting to INR 3705.6 Cr in 2022.

- PhonePe invested around INR 866.2 Cr on advertising and promotional activities in 2022 as compared to INR 534.9 Cr in the financial year of 2021.

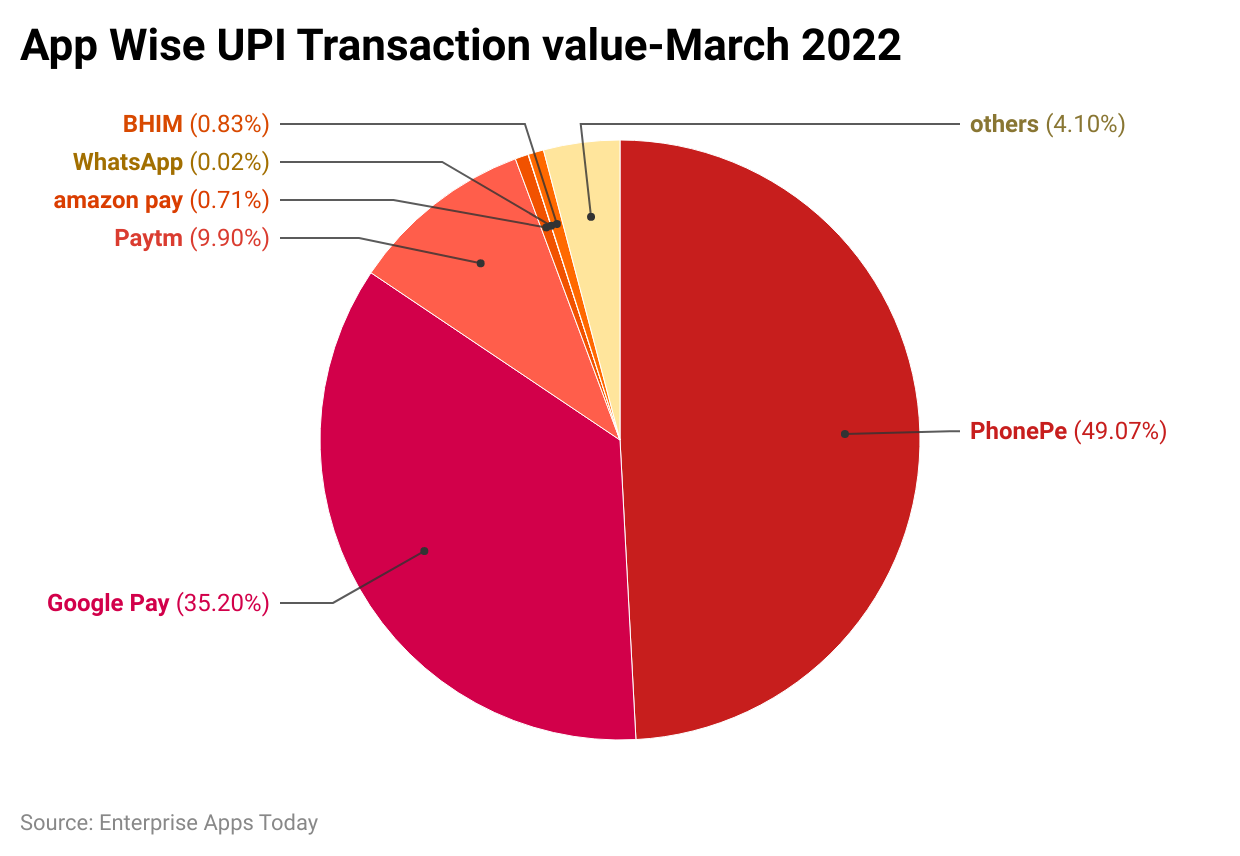

- As per the 2022 PhonePe statistics, the payment app has acquired around 49.07 percent of the market share.

- PhonePe carried out more than 2.7 billion transactions in 2022.

- PhonePe is the fastest payment application in India.

- PhonePe saw a 15.64 percent month-on-month growth in the financial year of 2022.

- The fintech startup invested around INR 139.8 Cr in information technology in 2022.

- People can also buy 24-karat gold using this payment app.

- UPI payment services offered by PhonePe have so far digitalized over 30 million offline trades.

- PhonePe accounts for more than 400 million listed users.

- PhonePe claims to have 165 million monthly active users.

- The payment has recorded around 100 million transactions within a day in the first quarter of 2022.

General PhonePe Statistics

#1. In 2022, PhonePe acquired nearly 49.07 percent of the share of customer transaction volume via UPI (Unified Payment Interface)

PhonePe has the largest share of customer transaction volume which makes it the most popular payment application across the country.

(Source: Inc42.com)

#2. The total revenue of the Walmart-funded startup PhonePe increased by 133% to INR 1692.7 Cr in 2022

PhonePe saw a 133% year-on-year (YoY) boost in its total revenue in the financial year of 2022. It reported a total consolidated revenue of INR 1,692.7 Cr in 2022 as compared to the total combined revenue of INR 725.3 Cr in the previous financial year.

#3. The total expenditure of PhonePe increased by one and a half fold amounting to INR 3705.6 Cr in the financial year of 2022

The total expenditure of PhonePe was around INR 2,456.8 Cr which shows a 1.5 times increase in the total expenditure of the fintech firm this year.

#4. The net loss of PhonePe shot up by 16.4 percent amounting to INR 2,013.7 Cr in the financial year 2022.

The net loss of the payment app was around INR 1,728.7 Cr in 2021. As per PhonePe statistics, a more than 40 percent increase in ESOP expenses led to such a huge net loss.

(Source: Inc42.com)

#5. The startup’s income generated from operations increased more than twofold amounting to INR 1,646.2 Cr in 2022 from

The revenue of PhonePe originating from operations was around INR 689.6 Cr in the financial year of 2021.

#6. PhonePe accounts for more than 400 million listed users

With more than 400 million certified users, PhonePe statistics show that more than one in four Indians are utilizing PhonePe services.

#7. The separation from the Flipkart group in 2016 made PhonePe a fully India-domiciled firm.

However, Walmart still remains the majority shareholder in the fintech company.

#8. PhonePe invested around INR 866.2 Cr on advertising and promotional activities in 2022

On the other hand, the company spent around INR 534.9 Cr in the financial year 2021.

#9. PhonePe invested nearly INR 199 Cr in payment processing charges

It shows a boost of 84.4 percent from INR 108 Cr in the financial year of 2021.

#10. PhonePe has carried out more than 2.7 billion transactions in 2022

This number of transactions led by PhonePe resulted in a transaction value of 47.14 Lakh Cr in 2022. Google Pay secured the second spot with a total transaction value of INR 3.39 Lakh Cr in the financial year of 2022.

#11. PhonePe saw a 15.64 percent month-on-month growth in the financial year of 2022

The startup has been leading the digital payment industry on all measures such as volume and the number of transactions and listed users across the country. It has been showing an enormous month-on-month growth.

#12. As per PhonePe statistics and trends, it is the fastest payment application available in India

Due to the COVID-19 pandemic, people have been opting for digital financial payments. As per a study, PhonePe has been instrumental in the digital India movement and it is considered the best and fastest UPI payment app in India.

#13. The fin-tech startup invested around INR 139.8 Cr in information technology in the financial year 2022

On the other hand, PhonePe spent nearly INR 89.9 Cr in making the app more user-friendly in the financial year 2021. It shows an enormous increase in the startup’s investment in the IT sector.

#14. UPI payment services provided by the payment app have so far digitalized over 30 million offline trades

PhonePe has digitalized around 35 million offline trades across many 2. 3, and 4-tier cities. The payment app is accessible in 99 percent of pin codes in India.

#15. People can also buy 24-karat gold using this payment app

PhonePe also began retailing silver on its platform. It has recently brought many mutual fund and insurance products such as liquid funds, tax-saving funds, life insurance, international travel insurance, and COVID-19 insurance on the payment service platform.

#16. PhonePe claims to have 165 million monthly active users

In the first quarter of 2022, PhonePe recorded around 165 million monthly active users on its platform.

#17. The payment has recorded around 100 million transactions within a day in the first quarter of 2022

In the same time frame, the startup claimed to surpass 100 million transactions in a day. It shows the popularity of the payment app in the country.

#18. PhonePe generates revenue from the commission it makes from an insurance firm for the placement of insurance policies.

#19. PhonePe got insurance broking approval from the Insurance Regulatory and Development Authority of India (IRDAI) in 2021.

#20. The fintech startup makes commissions from the circulation of mutual funds as well.

Conclusion

In the modern financial and tech landscape, PhonePe is contesting against the likes of payment apps such as Google Pay, PayTM, and Amazon Pay. India’s digital payments system has seen phenomenal growth in the past five years. As digital payments become universal, there is substantial room for growth to drive India to emerge as a cashless economy.

With a massive 49.07 percent of the market share, PhonePe plans to widen its reach to more than 500 million users soon, and with a quarter of the Indian population already using the payment app, it appears to be quite achievable. The officials from the company are planning to make the app India’s super app where every citizen of the country makes money, pays, and invests further.

These statistics mentioned above indicate that as the country’s digital payment system steps into a new era, PhonePe might be able to achieve its status as India’s fintech Super App.

Sources

FAQ.

A user can process a maximum of 10 or 20 money transactions in a day via the PhonePe app. The daily limit for UPI transactions is 20.

No, PhonePe does not offer any kind of advantage or interest on Wallet Deposit.

As per the company, PhonePe charges a nominal fee for recharges and bill payments which includes GST.

PhonePe offers a qualified UPI service to its users. They require to have their bank accounts linked to their active mobile number in order to have a PhonePe account on the app and use PhonePe UPI.

Users can choose from options such as the PhonePe wallet, UPI, debit card, or credit card in order to make payments via the PhonePe app.

New users do not need to complete their KYC for using PhonePe services. However, users require to complete a minimum KYC to have PhonePe wallet benefits. Users will keep receiving cashback in their PhonePe wallets irrespective of their KYC status. They can utilize cashback money to make payments on the app.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.