Some Vital UPI Statistics And Trends To Understand Its Growth in Recent Years

UPI Statistics: UPI or Unified Payments Interface is an instant real-time payment method that allows users to transfer funds instantly between two bank accounts via a mobile app. Therefore, UPI is an idea that helps many bank accounts to exist in a sole mobile app platform. UPI has been established by the National Payments Corporation of India (NPCI) and is controlled by the Reserve Bank of India (RBI) and the Indian Bank Association (IBA). UPI has shown tremendous year-on-year growth as digital payment has become more prominent in today’s times. Here we will discuss some crucial UPI statistics that will help us understand the prevalence and growth of this payment method since its inception.

UPI Statistics (Editor’s Choice)

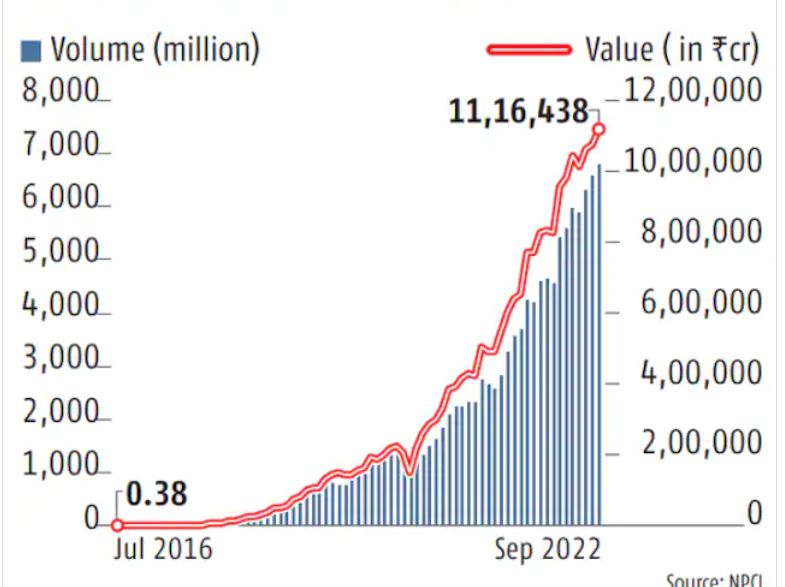

- Unified Payments Interface or UPI has led to nearly 7.3 billion transactions in October 2022.

- UPI was introduced by the National Payments Corporation of India (NPCI) in 2016.

- The total volume of transactions via UPI amounts to INR 12.11 trillion.

- There has been a 73 percent increase in the volume of UPI transactions.

- As per the latest UPI statistics, there has been around 57 percent growth in the UPI transaction Value.

- In 2019, UPI crossed the mark of 1 billion transactions.

- Due to the COVID-19 crisis, UPI has become the most popular payment method in India.

- In the fiscal year of 2022, UPI handled transactions worth INR 75 trillion.

- Peer-to-Merchants (P2M) and Peer-to-Peer (P2P) transactions contribute majorly to the overall growth of UPI.

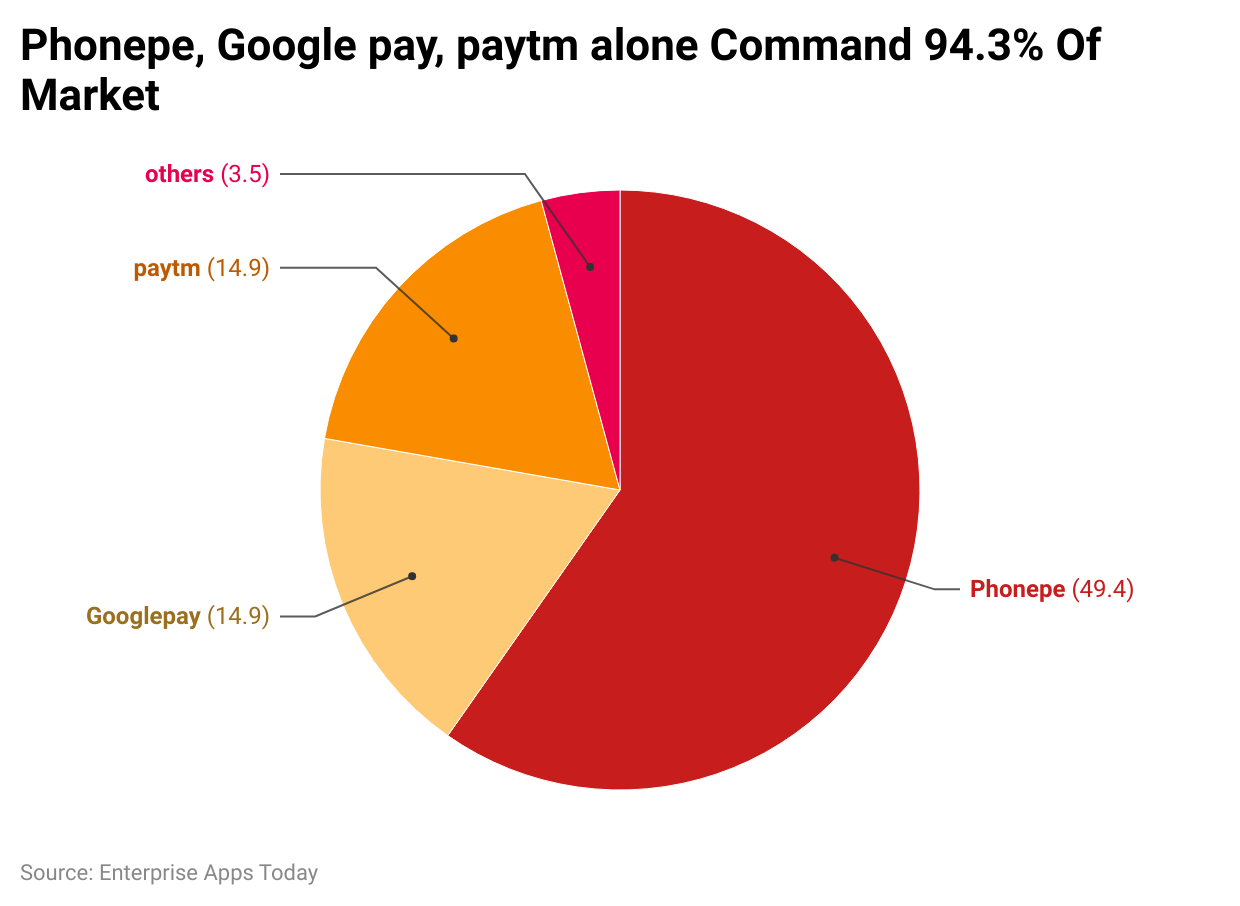

- Around 94.3 percent of the UPI transactions have been done via PhonePe, Google Pay, and Paytm.

- The trio of PhonePe, Google Pay, and Paytm has the largest UPI market share with 94.3 percent.

- The number of UPI transactions is expected to grow up to 1 billion per day in the near future.

UPI Statistics And Trends

#1. Unified Payments Interface or UPI has led to nearly 7.3 billion transactions in October 2022

Nearly 7.3 billion UPI transactions have been processed in October 2022. The huge number of UPI transactions contributed to INR 12.11 trillion.

#2. There has been a 73 percent increase in the volume of UPI transactions

As per the latest UPI statistics from the National Payments Corporation of India, there has been a 57 percent increase in the UPI transaction value.

#3. In 2022, PhonePe has accounted for nearly 49.4 percent of the share of customer transaction volumes on the UPI (Unified Payment Interface)

Around 94.3 percent of customer transactions have been led by PhonePe, Google Pay, and Paytm.

#4. CRED handled nearly 14.8 million transactions

Cred secured the fourth spot in transaction volume amounting to INR 19,716.43 Cr.

#5. The National Payments Corporation of India (NPCI) launched the Unified Payment Interface in 2016

After its inauguration in 2016, UPI paced up its growth and touched the milestone of 1 billion transactions within three years.

#6. The total transaction volume of UPI in 2022 has reached around $850 billion so far

It is around INR 67.21 Lakh Cr.

#7. WhatsApp’s payment feature has contributed to the growth of the Unified Payment Interface (UPI)

The UPI governing body, NPCI has allowed the messaging platform WhatsApp to make the UPI feature accessible to 100 million users in 2022.

#8. The payment feature of WhatsApp has reported around 230 million or 2.3 Cr UPI transactions

The volume of its UPI transactions amounts to INR 429.06 Cr.

#9. The average size of the WhatsApp payment feature has been nearly INR 186.55

It shows that only incentive-driven users have been transacting the fund via the payments feature of the messaging app.

#10. In September 2022, the volume of UPI transactions stood at 678 Cr that has made up of INR 11.16 trillion

UPI accounted for 6.8 billion transactions in September which amounted to INR 11.17 trillion. It shows 3.05 and 4.06 percent growth in transaction volume and value on a month-on-month (MoM) basis.

(Source: NPCI)

#11. In the fiscal year of 2022, UPI handled transactions worth INR 75 trillion

UPI has recorded transactions worth INR 75 trillion, which is much greater than the 22.28 billion transactions that were recorded via UPI in the previous year.

#12. Peer-to-Merchants (P2M) and Peer-to-Peer (P2P) transactions contribute majorly to the overall growth of UPI

Peer-to-Merchants (P2M) transactions have taken over Peer-to-peer (P2P) transactions in terms of volume. It is estimated to increase further as linking of RuPay credit cards to UPI will let customers make a payment to merchants via UPI while using their credit cards.

#13. Post pandemic Festive season has led to a surge in UPI transactions

As Indian households prepare to celebrate a restriction-free festive season, spending is expected to grow further while many people will be visiting offline stores and will be engaged in online shopping.

#14. The COVID-19 pandemic accelerated the implementation of UPI

As the trend of UPI accelerated during the pandemic, the digital payment index of the Reserve Bank of India (RBI) went up from 207.94 in March 2020 to 349.30 in March 2022.

#15. The number of UPI transactions is expected to grow up to 1 billion per day in the near future

The next goal for the Unified Payment Interface (UPI) is to handle a billion transactions per day in the next 3 to 5 years.

Conclusion

In India, the instant payment system generated an added cost savings of $12.6 billion last year. The same has helped unleash $16.4 billion of the country’s economic output or 0.56% of GDP. It is expected that an additional $45.6 billion in economic output will be enhanced by the Unified Payments Interface by 2026.

It is a fact that with an initiative to tie credit cards with UPI, the future of money appears to be digital. India’s massive success of UPI has become a Universal case study. With the extensive adoption of UPI, India has become a global leader in Digital payment systems and its GDP as well is booming proactively. UPI has received endorsement in countries such as Bhutan Singapore, and Nepal. These statistics show that UPI payment has made money transactions easier for many businesses and individuals as well.

Sources

FAQ.

The transaction limit on UPI varies from one bank to the other. However, ideally, a person can process a maximum of 10 to 20 UPI transactions per day via PhonePe UPI.

An individual should have a banking account with a member bank that allows the user to utilize the UPI facility.

UPI allows 3 attempts to enter the correct pin if a user enters an incorrect pin to gain access to the UPI facility. After excessing 3 attempts, the user needs to wait for 24 hours to make a payment via UPI or need to reset the UPI pin.

The Unified Payment Interface has been developed by the National Payments Corporation of India (NPCI) in 2016.

PhonePe is certainly one of the fastest payment apps in India and is considered much better than the majority of the other UPI payment applications or internet banking services

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.