WeWork Statistics 2024 By Revenue, Location, Employees and Expenses

Page Contents

- Introduction

- Editor's Choice

- WeWork Revenue Statistics

- Top Coworking Statistics

- WeWork Usage and User Statistics

- WeWork Employee Statistics

- WeWork Location Statistics

- WeWork Expenses Statistics

- Coworking Demographics

- Information About Coworking Sites

- Coworking Benefits Statistics

- Coworking Challenges

- Coworking and COVID-19 Statistics

- The Facts About WeWork

- Conclusion

Introduction

WeWork Statistics: WeWork is a company whose headquarters are in New York City. WeWork focuses on providing a pliable workspace solution in the real estate industry. This company offers ready-to-move-in private offices, coworking spaces, and managed office space and also added solutions like event spaces, business services, and virtual offices.

WeWork provides office services in 119 cities across 37 countries globally. Adam Neumann, the founder and the ex-CEO of WeWork, took it to great heights. Later, the company's value started decreasing, and its current valuation is $1.51 billion. Tech startups, entrepreneurs, and large- and small-scale businesses benefit from WeWork. In this WeWork Statistics, we will be studying the details of WeWork Statistics.

Editor's Choice

- 40% of the Global 500 trust WeWork for their workspace needs.

- Operating in 120 countries as of 2023, WeWork has a vast global presence.

- Softbank's investment in WeWork exceeds USD 18.5 billion.

- In 2020, WeWork reduced its workforce by 200 employees.

- WeWork's global revenue reached USD 3.1 billion in September 2022.

- A 12-minute meeting with Masayoshi Son led to a USD 4.4 billion investment in WeWork.

- From 23 locations in 2014, WeWork expanded to 777 sites by 2023.

- Despite earning USD 2.5 billion in 2021, WeWork faced a net loss of USD 4.6 billion.

- Valued at USD 47 billion by private investors in January 2019, its market cap was only USD 6.7 billion by January 2022.

- The We Company, WeWork's parent, was valued at USD 47 billion.

- A net loss of USD 1.9 billion was reported by WeWork in 2018.

- By the end of 2019, WeWork's arrears totaled USD 18.7 billion.

- Following a failed IPO, Softbank injected an additional USD 1.5 billion into WeWork in late 2019.

- WeWork boasts over 800 office locations across 32 countries.

- Membership exceeded 662,000 by late 2019, with 813,000+ desks available globally.

- The occupancy rate of WeWork's spaces dropped to 47% in January 2021.

- Revenue fell to USD 811 million in Q2 2020.

- The average lease length for a WeWork location stood at 15 years in 2019.

- Annual revenue per member was USD 6,928 in 2019.

- Revenue doubled to USD 1.8 billion in 2018 from 2017.

- With 12,500 employees in 2019, WeWork is a significant employer.

- USD 1.4 billion was dedicated to capital expenses in 2018.

- 30% of its revenue was generated from international markets in 2018.

- London saw the opening of WeWork's first location outside the US in 2014.

- The member count reached approximately 466,000 worldwide in 2018.

- WeWork became the largest office tenant in London in 2019, with 3.4 million square feet of office space.

- 40% of memberships in 2019 were from enterprise customers.

- Revenue increased by roughly USD 2.6 billion between 2016 and 2022.

- As of 2022, WeWork had 1.08 million members in the United States.

- Global membership stood at 738,000 as of September 2022.

- A 23.68% revenue increase was seen in 2023.

- USD 14.2 billion in funding was received by Adam Neumann from 2009 to 2019.

- Coworking spaces are projected to occupy 30% of corporate office space by 2030.

- 37.92% of SMEs globally use co-shared workplaces.

- 89% of members reported increased happiness from joining a coworking space.

- The flexible workspace industry is valued at USD 26 billion globally.

WeWork Revenue Statistics

- WeWork operates in 119 cities across 37 countries, catering to a diverse client base from tech startups to traditional businesses.

- In 2022, it was the second-largest shared office space provider in the US, with almost 250 locations.

- From 2016 to 2022, WeWork's revenue surged by approximately USD 2.6 billion, marking significant growth.

- Revenue for 2022 stood at around USD 3.1 billion, reflecting the company's recovery post-COVID-19.

- WeWork All Access was introduced in 2020, offering a monthly subscription to access all locations globally.

- WeWork Workplace, a workspace management application, was launched to support flexible and hybrid work environments.

- Revenue growth in Q1 2023 was 23.68% year-over-year, outpacing the US Real Estate Services industry's growth.

- WeWork's return on assets (ROA) is reported at -11.4%, lower than the industry average.

- Stock price projections for WeWork suggest an increase from USD 2.08 to between USD 6.50 and USD 11 by 2024.

- In September 2022, WeWork announced a revenue of USD 3.1 billion with a loss of USD -2.3 billion, indicating a profit margin of -73.7%.

- Revenue in 2021 was USD 2.5 billion, with a substantial loss of USD 4.9 billion and a profit margin of -192.10%.

- Revenue for Q3 2021 was USD 661 million, and for Q3 2022, it increased to USD 871 million.

Table: WeWork Revenue and Growth Indicators

| Year | Total Revenue (USD) | Key Developments |

|---|---|---|

| 2017 | 886 million | |

| 2018 | 1.82 billion | |

| 2019 | 3.459 billion | |

| 2020 | 3.416 billion | Launch of WeWork All Access |

| 2021 | 2.57 billion | Introduction of WeWork Workplace |

| 2022 | 3.1 billion | Continued recovery and growth |

WeWork's innovative offerings like WeWork All Access and WeWork Workplace are pivotal in its strategy to adapt to changing workspace demands, providing flexibility and technology-driven solutions. Despite facing financial challenges, the company's revenue growth and strategic initiatives signal a strong potential for recovery and expansion in the evolving office space market.

Top Coworking Statistics

- In the world, the number of coworking spaces in the world is expected to grow to 20,000 by the end of this year.

- In 2024, the coworking space will triple and even surpass the threshold of 40,000.

- As per Allwork. Space 13% of companies operating outside the US will utilize shared workspaces.

- In the year 2019, there were over 3 million coworking spaces. This number is which is expected to grow by 2024.

- Before the COVID-19 pandemic coworking spaces were among the fastest-growing types of office space available in commercial real estate. In 2030 coworking spaces are expected to increase around 30 percent.

- According to JLL, the flexible space market is growing at a rate of average annual growth of 23%.

- According to Forbes, the ten biggest companies offering flexible and coworking office spaces account for 36 percent of the overall market.

- In terms of new areas opening up, New York and London are the most renowned cities in the world.

- In 2022 China could be the largest market for coworking space.

- Flexible work spaces comprise only 5% of office inventory, but more than 15% of the space requirement.

- According to Knight Frank, about 69 percent of businesses plan to cut back on traditional office spaces while they move to more flexible alternatives.

- About 50% of sectors expect to screen 25 percent or more of the traditional offices within the next few years.

- IWG and WeWork are responsible for more than 50 percent of world sharing of coworking in the market.

- IWG Global Workplace survey polls 3000 businesses in many countries.

- Benchmark has clenched around 33 million class A shares from WeWork. JP Morgon has 18.5 million Class A shares. Softbank holds more than 114 million class A shares.

- The initial Softbank investment was $2 billion WeWork's valuation increased by $47 billion.

WeWork Usage and User Statistics

WeWork has shown remarkable growth and adaptability in the face of challenges posed by the COVID-19 pandemic, managing to sustain and grow its membership base globally. The statistics below encapsulate the company's trajectory and current standing in terms of membership:

- Pre-Pandemic Growth: Before the pandemic, WeWork was on a rapid growth path, significantly expanding both its memberships and office locations.

- Adaptation and Recovery: Although there was a slight contraction in 2020 and 2021 due to decreased office space demand, WeWork has effectively bounced back.

- Current Membership Count: As of the first quarter of 2023, WeWork boasts approximately 664,000 physical memberships across 781 locations in 39 countries, marking a 6% increase year over year.

- All Access Subscription Growth: The All Access subscription has seen a significant uptick, reaching about 75,000 members, which is a 36% increase from the previous year.

- Expansion in the United States: In 2022, the U.S. membership count reached 1.08 million, showcasing the company's strong foothold in the market.

- Corporate Clients: Nearly half of the Fortune 500 companies have leveraged WeWork's flexible workspace solutions, reflecting the company's appeal to large organizations aiming to streamline office setup costs and time.

- Membership Relocation: A significant portion of members, 84%, have chosen to relocate closer to their WeWork location, indicating the value they place on the convenience and community WeWork offers.

- Diverse Membership Base: The membership is diversified between approximately 67,000 having All Access memberships and the rest holding memberships at specific WeWork locations.

Membership Growth Table

| Year | Number of Members |

|---|---|

| 2017 | 175,000 |

| 2018 | 400,000 |

| 2019 | 600,000 |

| 2020 | 600,000 |

| 2021 | 590,000 |

| Q1 2023 | 664,000 (Physical Memberships) |

| 2022 | 1.08 million (U.S. Members) |

These figures underscore WeWork's strategic agility and its continued appeal to a wide range of customers, from individual freelancers and small startups to large enterprises, in navigating the shifting dynamics of workspaces in the post-pandemic era. The company's ability to maintain and grow its membership base amidst challenges is a testament to its strong value proposition and the effectiveness of its recovery strategies.

WeWork Employee Statistics

- Current Workforce: As of the latest update, WeWork employs 4,400 individuals globally.

- Workforce Reduction: From a high point in June 2019, when WeWork reported having more than 12,500 employees, the company has undergone a workforce reduction of at least 65%. This adjustment aligns with WeWork's efforts to streamline operations amidst changing market demands and operational challenges.

- Pandemic Impact: The global COVID-19 pandemic significantly influenced WeWork's decision to scale back its workforce. This strategic move was part of a broader initiative to adapt to the increased demand for remote work and to position the company for sustainable growth and profitability.

- Future Growth Outlook: WeWork indicates a more cautious growth approach post-pandemic, focusing on operational efficiency and profitability.

WeWork Location Statistics

- WeWork's global locations grew from 275 in 2017 to 777 in 2023, despite a slight decrease during 2020 and 2021 due to the pandemic.

- The number of locations peaked at 850 in 2019 before adjusting in response to global events.

- Location operating expenses significantly rose by 3.8 times from 2017 to 2021, highlighting the substantial cost of expanding and maintaining its vast network.

- By 2021, these expenses constituted 49% of WeWork's total expenses, underlining the financial challenges of its expansive operational footprint.

- As of mid-2023, WeWork supports a diverse membership base across 39 countries with approximately 906,000 workstations and 653,000 members, demonstrating its extensive global presence and commitment to flexible workspace solutions.

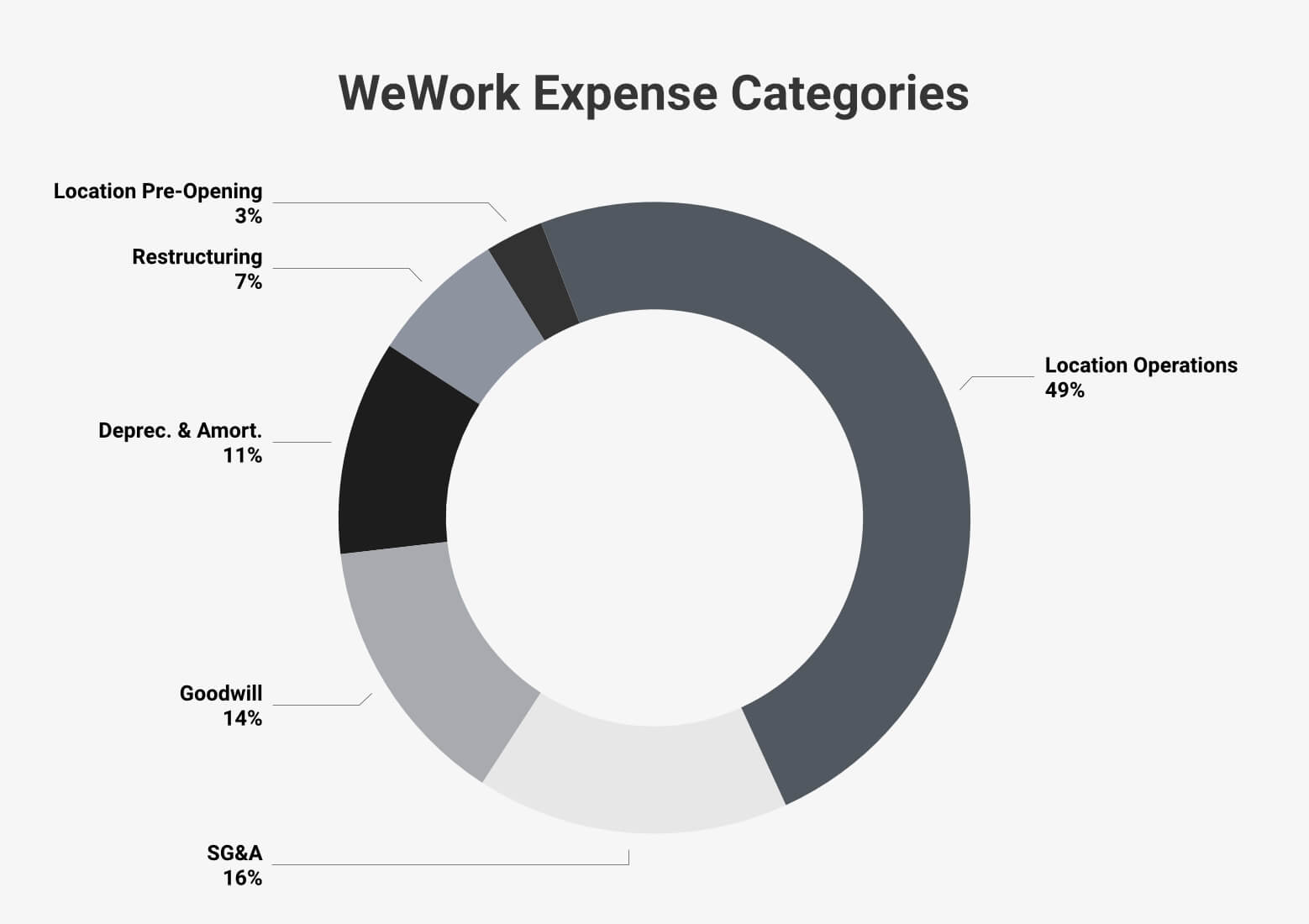

WeWork Expenses Statistics

- WeWork's locations grew from 275 in 2017 to 777 in 2023, despite a dip during the pandemic years (850 in 2019, decreasing to 756 by 2021).

- The company's location operating expenses significantly increased, nearly quadrupling from 2017 to 2021, reflecting the cost intensity of its expansion.

- By mid-2023, WeWork's global presence extended to 39 countries with 906,000 workstations and 653,000 memberships, underscoring its role in reshaping workspace solutions across various sectors.

WeWork's Growth and Operating Expenses:

| Year | Locations | Location Operating Expenses (USD) |

|---|---|---|

| 2017 | 275 | 815 million |

| 2018 | 518 | 1.492 billion |

| 2019 | 850 | 2.758 billion |

| 2020 | 792 | 3.543 billion |

| 2021 | 756 | 3.085 billion |

| 2023 | 777 | – |

This summary reflects WeWork's strategic efforts to adapt and grow, even as it navigates the financial challenges associated with rapid expansion and the evolving demand for flexible workspaces.

Coworking Demographics

- SMEs are stated to be the primary users of coworking spaces at 37.93%, followed by startup teams at 27.12% and freelancers at 16.61%.

- Digital remote employees are a minority in coworking spaces with 2.82%.

- Half of the coworkers are independent.

- Most coworkers have an academic education; 41% have a Bachelor's degree, and 41% have a Master's degree. And 4% have completed their Ph.D.

- The average age of coworking space members is 36.

- About 40% of the members are female and continue raising coworking spaces.

- As per the survey, taking care of children becomes a primary reason females cancel memberships. 50% of the female coworkers are aged 35 to 49, and 70% of those aged 50 and above have one or more kids.

- The global coworking survey states that 30% of respondents declared they were extroverts and 22% were introverts.

Information About Coworking Sites

- The most well-known coworking spaces at a global scale are Ucommune, Talent Garden, Mindspace, Google for startups, Spaces, WeWork, Impact Hub, and Regus.

- Europe boasts over 6131 square meters of workspace for collaboration, and the coworking community has 61 members.

- Based on the survey for 2023 over 2,800 companies located in the United Kingdom have flexible office space.

- London is a leader and the only country in the world with more than 1,400 coworking facilities, accounting for 15% of total office space taken up.

- In London, the city, big businesses, and companies make up 25-30 percent of flexible rooms.

- Central America has about 6,719 square feet of coworking space, with 59 coworking participants.

- In 2022, it was estimated that there are 6,200 coworking facilities in the United States. This indicates the Americans who work in these spaces make up 45 percent of the world sector.

- Asia includes 8101 sq ft of space for coworking. There are the coworking community has 113 members.

- Remote working statistics suggest that about 93,000 people within the United States use nearly 6200 coworking spaces.

- The typical size of a coworking space is around 9,799 square feet. it can accommodate a capacity of 105 people.

- Africa has 6131 square feet of space for coworking. coworking workers number 86.

- The IT industry now accounts for 20 percent of coworking space users in 2023.

- Oceania is home to three thousand square feet of office space. It also has the coworkers who are 83.

- WeWork offers more than 800 locations across the globe with more than 600,000 members. It also provides desks, private offices, as well as hot desks.

- Impact Hub has almost 100 locations across all 50 countries. It is home to nearly 16,000 members. Spaces has over 400 locations around the world.

- South America has around 3,955 square feet of coworking space and 53 members of the coworking community.

Coworking Benefits Statistics

- A company can save as much as 30% on the operational cost only by working from a coworking space.

- As per Colliers, 72% of the landlords believe that coworking spaces pass on a positive result for both the communities and the building

- Almost 83% of the individuals working from the coworking spaces face less isolation and feel less lonely.

- As per Small Business Labs, 82% of the respondents have expanded their network after joining the coworking space.

- Riveting enough for 37.93% of small to medium-sized businesses, 27.12% of startup teams, and 16.61% of freelancers to use them.

- As per GCUC, 84% of the coworkers say workers in the coworking space are motivated and feel energetic.

- As per the survey, 71% of people say coworking space enhances their work-life balance.

- Nearly 61% join the coworking community to balance their work-life balance.

- About 82% have expanded their professional network.

Coworking Challenges

- In 2019, the process of attracting more members became the most important challenge for coworking spaces.

- Statistics from global coworking spaces reveal that only 42% of the coworking spaces have a profit, while 33% of them manage to stay in the black, however, 25% are operating in losing money.

- In the United States, 52% of the spaces are operating with a profit, while only 17% of them suffer losses.

- Costs for renting are the primary expense to start an office space.

- The total expenditure budget is 40%. the rent cost is higher than the wage of a worker by 16%, as well as maintenance expenses.

Coworking and COVID-19 Statistics

- Since the outbreak began, 71.67% of places showed a significant drop in workers working in their coworking spaces.

- According to Coworking Information, 40.8% of the locations negatively impact the renewal of memberships and contacts.

- Nearly 67% of websites have seen an increase in membership applications.

- The coworking spaces reported membership cancellations of 36.47 percent.

- In 2020 in the pandemic year the daily number of users fell from 60% to 40 40%.

- Unhappy about the lack of supply coworking spaces lost around 20% of rent desks.

The Facts About WeWork

- Due to the rising cost of living and the upcoming recession, WeWork is predicted to cut around 300 employees from its locations that are not performing.

- Different from other coworking spaces The reason for WeWork's success is because it sold the company as a tech startup, rather than a real estate business.

- Adam Neumann received $14.2 billion in grants.

- Masayoshi Son decided to make an investment of 4.4 billion dollars in WeWork after a meeting lasting 12 minutes.

- It began in 2009. WeWork is currently valued at $450 through 2023.

- A staff member informed the employee employee that Adam Neumann offered tequila during the interview.

- WeWork has lost $5200 per new customer.

- In the year 2019, a newspaper in Australia named Adam Neumann the “Most hated man in America.”

Conclusion

WeWork is now the second-largest supplier of leaseable office space. WeWork is a massive business that saw rapid growth before the COVID-19 epidemic and fought to speed up the process that forced the company to cut costs. The future of WeWork is determined by the passage of time. Let's see if they can make progress soon and take a larger part of the revamped offices around the world following the pandemic.

Despite its impressive valuation, the company has reported a net revenue loss of $1.9 billion during 2018.WeWork remains a possibility despite the recent setback because of COVID-19's restrictions on pandemics that have proved to be a bit preposterous for many businesses in recent years.

Sources

FAQ.

The number of guests, including the host, is limited to the meeting rooms. The invitees must bring valid government-issued photo ID and check in through the community team. The invitros have to be present before the arrival of the invitees.

WeWork's all-access members are only allowed guests in the community in the meeting room after the booking.

WeWork, at present, charges a late fee that is equal to or less than 10% of the outstanding balance every month or the maximum rate/ fee permitted by law in the jurisdiction.

WeWork India's CEO, Karan Virwani, is confidently pulling the business off the cluster.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.