Car Rental Statistics 2024 – By Region, Revenue, Demographics and Brands

Page Contents

- Introduction

- Editor’s Choice

- Facts About Car Rental

- What Includes The Car Rental Industry?

- Advantages Of Car Rental

- General Car Rental Statistics

- By Best Time To Book

- By Worldwide

- By Revenue

- By Sales Channel

- By Users

- By Region

- By Country

- By Cheapest Price

- By The Brands

- By Location

- By Demographics

- Trends About Car Rental

- Recent Development in the Car Rental Industry

- Conclusion

Introduction

Car rental statistics: car rental statistics offer valuable insights into the dynamics of this industry. In recent years, the car rental market has experienced significant growth and transformation, driven by various factors. With a global market size projected to reach USD 124.56 billion by 2026, according to recent forecasts, it's evident that the demand for rental vehicles continues to rise steadily.

This growth is fueled by increasing travel and tourism activities worldwide, as well as the growing popularity of ride-sharing services and the need for flexible transportation options. Additionally, the rise of digital platforms and mobile applications has revolutionized the way consumers access and book rental cars, making the process more convenient and efficient.

However, the industry also faces challenges such as fluctuating fuel prices, regulatory changes, and the emergence of alternative transportation solutions. By exploring key statistics and trends in the car rental sector, we can gain valuable insights into consumer preferences, market dynamics, and opportunities for growth and innovation

Editor’s Choice

- Volkswagen holds the top spot for car rentals in Lithuania, Norway, and Latvia, with 68%, 57%, and 51% of bookings respectively.

- Corporate clients contribute 25% of the car rental industry's revenue.

- The projected revenue for the car rental industry by 2023 is USD 99.54 billion.

- Asia's car rental market is anticipated to gain 348.9 million users by 2027.

- The United States boasts over 2 million economy-class rental vehicles.

- Expected car rental users could reach 602.2 million by 2026.

- The U.S. accounts for nearly 50% of the global car rental industry annually.

- American car rental users are forecasted to rise to 108.50 million by 2027.

- Popular rental choices in New Zealand and Australia include Toyota and Hyundai.

- In 2022, the car rental industry generated USD 81.32 billion in revenue.

- The leisure division holds approximately 55% of the market share, while the commercial division holds around 45%.

- The industry's revenue dropped by 27.4% in 2020 compared to 2019.

- Hertz, one of the largest car rental companies, experienced a 56% revenue loss in 2020 and filed for bankruptcy, exiting in 2021.

- The American car rental industry employed 132,908 individuals in 2021.

- 50.5% of car rental agents are female.

- Renting a vehicle is possible in New York and Michigan for individuals as young as 18.

- Drivers under 25 years old are subject to a Young Renter surcharge.

You May Also Like To Read

- Trucking Industry Statistics

- Food Truck Statistics

- Airlines Statistics

- Ridesharing Industry Statistics

- Electric Vehicle Statistics

- LYFT Statistics

- Aviation Statistics

Facts About Car Rental

- The global car rental industry is projected to generate revenue of approximately USD 99.54 billion by 2023.

- Asia's car rental market is expected to reach 348.9 million users by 2027.

- The United States holds a dominant position in the car rental industry, accounting for nearly 50% of the global market annually.

- In 2022, the car rental industry recorded revenue of USD 81.32 billion.

- Hertz, one of the largest car rental companies, experienced a 56% revenue loss in 2020 and filed for bankruptcy, exiting in 2021.

- Car rental agents in the U.S. are projected to reach 108.50 million by 2027.

- Popular rental choices in New Zealand and Australia include Toyota and Hyundai.

- Corporate clients contribute 25-30% of the car rental industry's revenue.

- Over 2 million economy-class rental vehicles are operating in the U.S. market.

- The leisure division holds approximately 55% of the car rental market share, while the commercial division holds around 45%.

What Includes The Car Rental Industry?

The car rental industry includes various companies or agencies that let an individual hire or rent a car for a specific period. Bookings for rental services can be done through phone, website, or application. Renting a car allows individuals to drive worry-free of any worries about insurance or maintenance charges.

Advantages Of Car Rental

- Provide easy booking and payment.

- Various types of rental vehicles and brands are available.

- Pocket-friendly travel.

- Convenience in international boundaries.

- 24/7 breakdown assistance

General Car Rental Statistics

- By the year 2026, the expected number of car rental users is 602.2 million.

- The most demanded type of car for rent is economy cars followed by executive and luxury cars.

- In the year 2021, the share of demand for economy cars was 36.07%.

- As of 2021, the total number of rented cars around the globe was 29.2 million.

- There are more than 2 million economy-class vehicles in the car rental industry of the United States of America.

- United States of America accounts for nearly 50% of the car rental industry every year.

- 25% of the revenue is generated from corporate clients.

- The daily car rental prices increased by 76% which increased by 278% for tourist places.

- Volkswagen is the most popular car to rent in Lithuania, Norway, and Latvia as 68%, 57%, and 51% book this brand respectively.

- Whereas, in North America such as Canada and the United States of America the famous brand for renting a car is Toyota.

- The majority of the population in New Zealand and Australia choose Toyota and Hyundai.

- On a similar note, 3 countries prefer Renault such as Belarus (59%) Guadeloupe, and Egypt with 49% respectively.

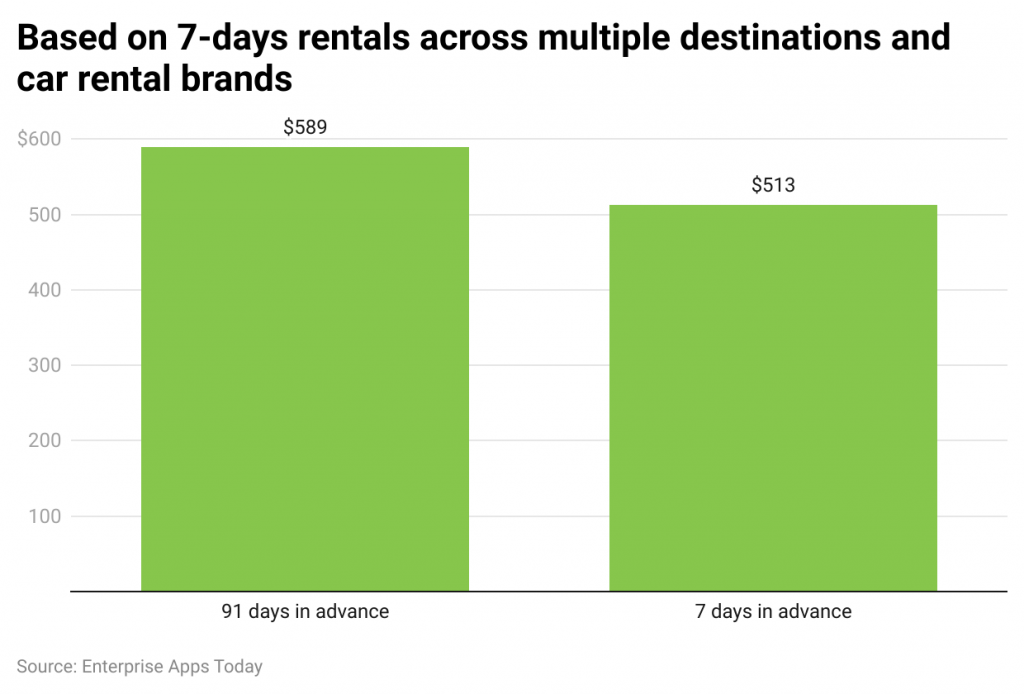

By Best Time To Book

- On average for 7-day rental and various brands, if booked 91 days in advance a rental car can cost around USD 589 while 7 days in advance can cost around USD 513 on a similar basis.

By Worldwide

- The global car rental statistics say that the market is expected to reach USD 99.54 billion in the year 2023.

- The highest revenue is generated from the United States of America resulting in USD 29,200 million as of 2023.

- The average revenue per user is projected at USD 194.30.

- Car rental statistics say that the projected number of users by the year 2027 is 616.5 million.

- The user penetration by 2023 is 6.7% whereas it is expected to rise to 7.8% by 2027.

- The global annual growth rate is expected at 4.65% resulting in USD 119.40 billion by the year 2027.

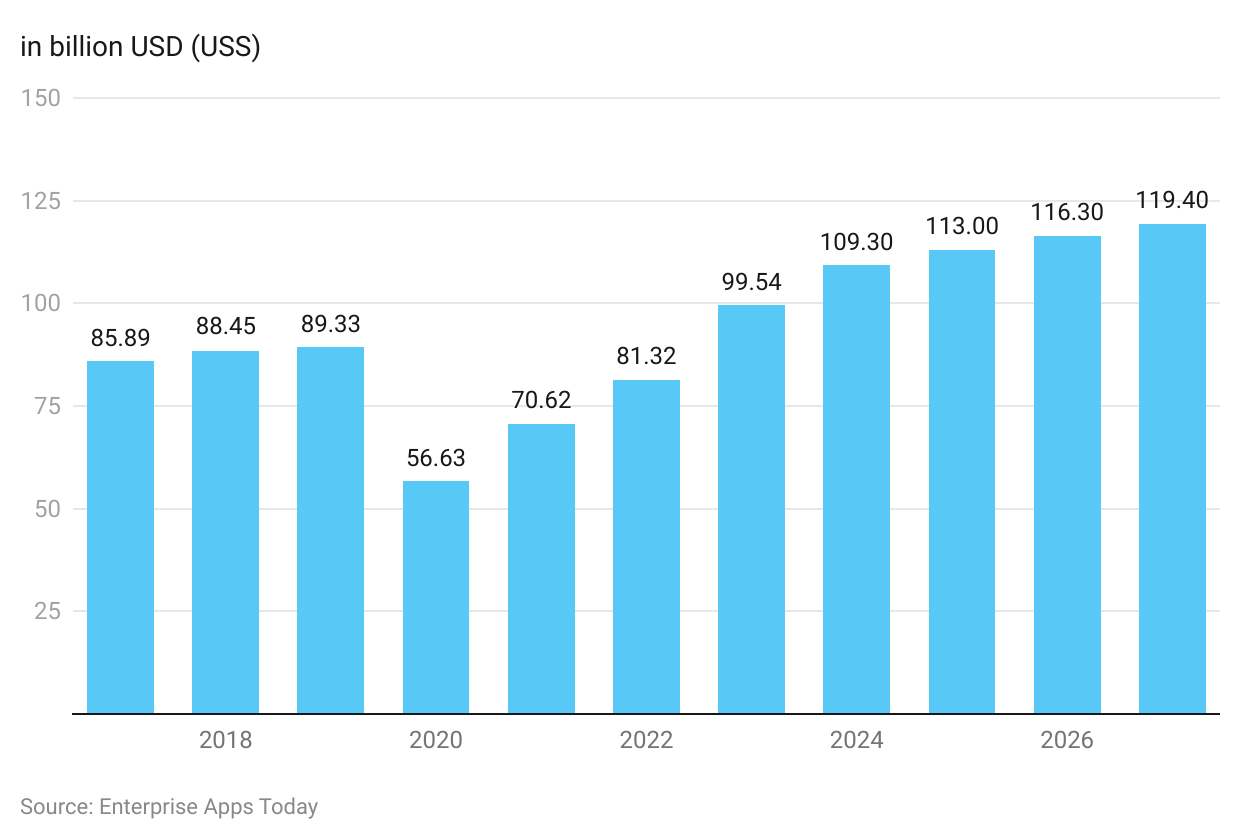

By Revenue

(Reference: Statista)

(Reference: Statista)

- Considering the last 5 years from 2017 to 2021 the revenue earned in each year respectively is USD 85.89 billion, USD 88.45 billion, USD 89.33 billion, USD 56.63 billion, and USD 70.62 billion.

- As of 2022, the revenue generated as per car rental statistics is USD 81.32 billion.

- By the year 2023, the expected revenue is USD 99.54 billion.

- By the year 2024 and beyond the industry will experience a continuous rise in revenue in respective years by the year 2027 as USD 109.30 billion, USD 113 billion, USD 116.30 billion, and USD 119.40 billion.

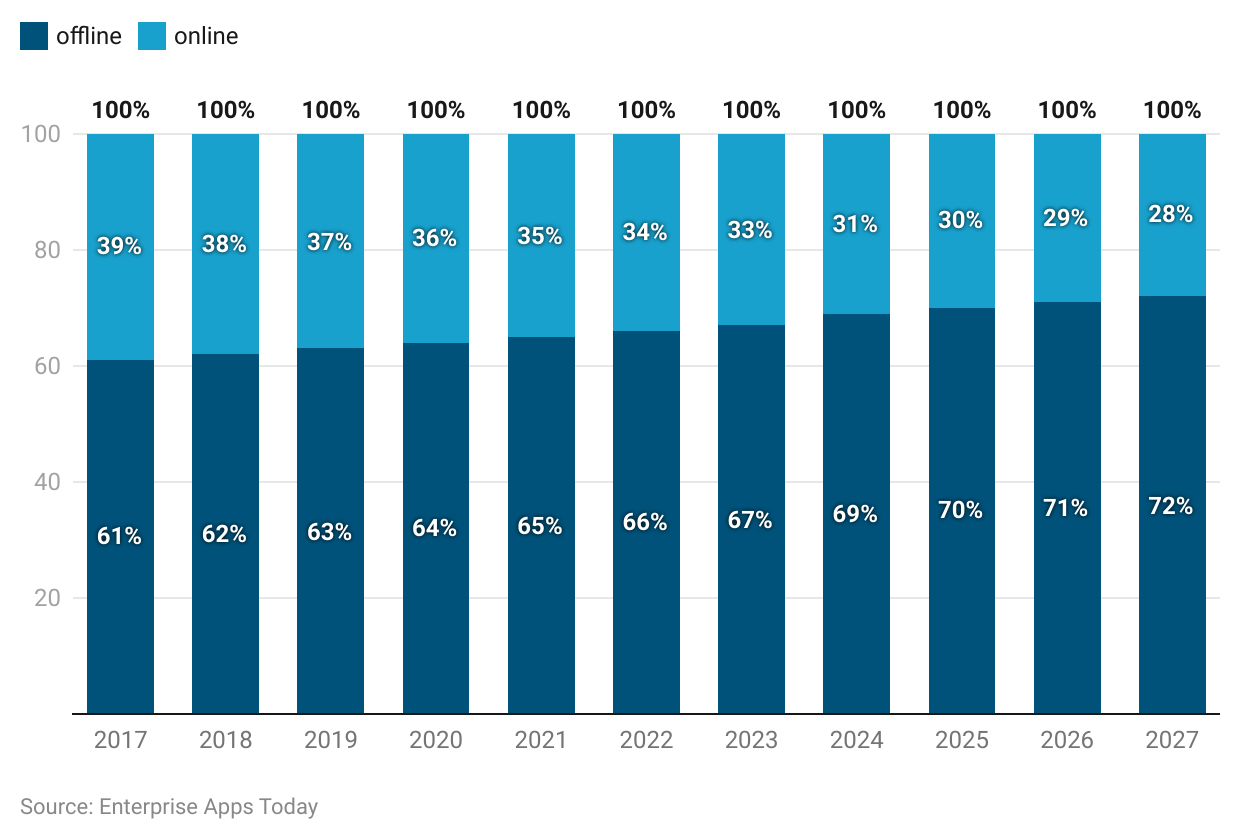

By Sales Channel

- The last five-year analysis of car rental statistics says that the overall car renting activity was conducted online while the average reaching 40% was offline renting activity.

- 2017 experienced 39% offline sales while 61% were online. In the year 2018, the ratio of offline to online was 38:62.

- In the following years, this online-to-offline ratio was maintained as of 2019, 2020, and 2021 at 37:63, 36:64, and 35:65 respectively.

- In the year 2022, the recorded offline sales were 34% while 66% were online.

- As of 2023, the expected offline-to-online ratio is 33:67.

- In the coming respective years of 2024, 2025, 2026, and 2027 the projected sales ratio is 31:69, 30:70, 29:71, and 28:72.

(Reference: Statista)

(Reference: Statista)

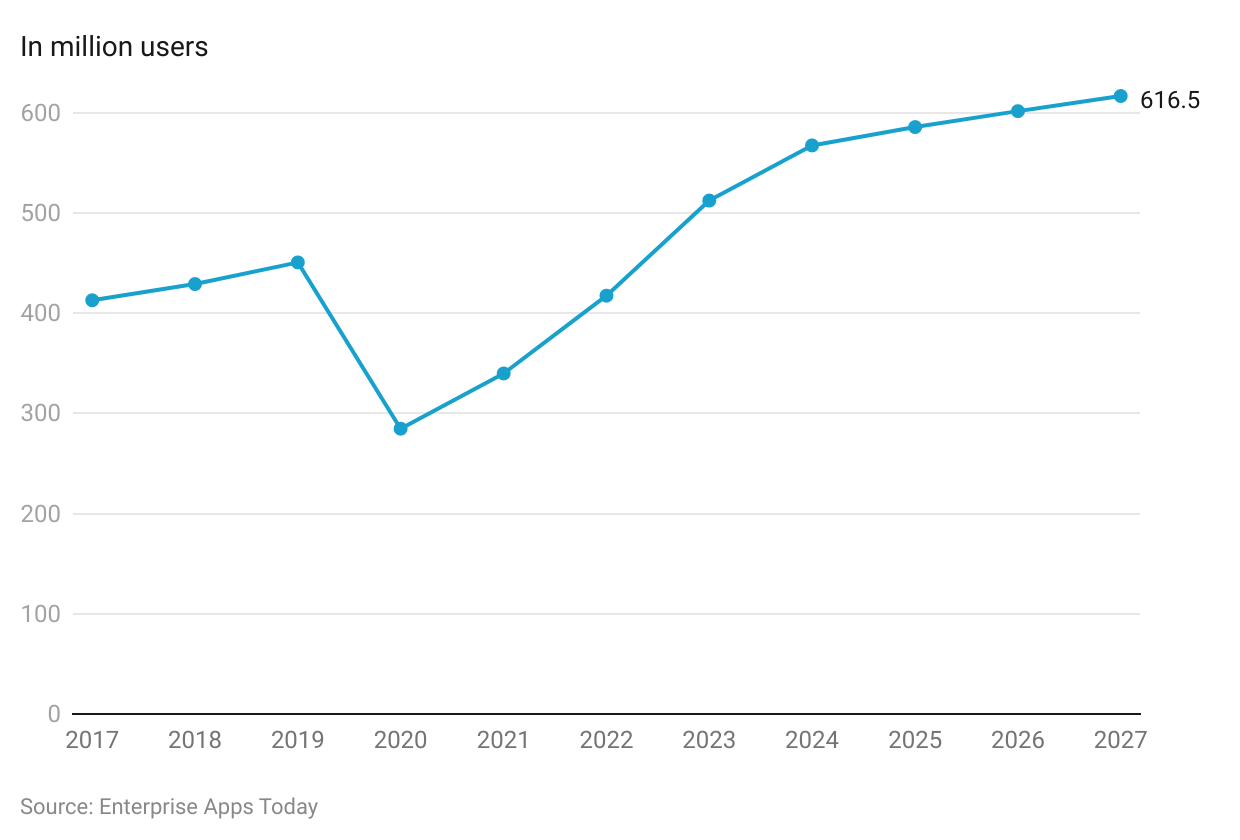

By Users

(Reference: Statista)

(Reference: Statista)

- Similarly, the last 5 years’ analysis of the car rental industry says there were 412.7 million users in car renting activity which fell to 284.6 million in the year 2020.

- As of 2021 and 2022, there were 339.7 million and 417.3 million users around the world.

- The expected number of users in the year 2023 is 512.2 million.

- By the year 2024, the projected number of users is 567.2 million whereas it will rise to 585.5 million in the year 2025.

- Furthermore, by the year 2026, the number of users will reach 601.4 million, and 616.5 million by the year 2027.

By Region

Asia

- The car rental statistics say that the market in Asia is expected to gain an overall 348.9 million users by the year 2027.

- By the year 2027, the Asian car rental industry will generate 68% of its revenue from online sales.

- According to car rental statistics, the annual growth rate in the Asian market will be at a CAGR of 6.08% resulting in USD 51.71 billion by the year 2027.

- The average revenue per user is USD 141.40.

- The revenue of car rentals in the Asian market is expected to generate USD 40.84 billion in the year 2023.

- As of 2023, the user penetration is 6.4% whereas it will rise to 7.5 USD by the year 2027.

Europe

- The expected user penetration in 2023 is 6.4% whereas it will rise to 7.5% by 2027.

- By the year 2027, the total expected number of users in the car rental industry will be 63.4 million.

- By the year 2027, the European region will experience 72% of the car industry rental segment from online sales.

- The average revenue per user is USD 279.60.

- In the year 2023, the European car industry market is expected to reach USD 15.11 billion.

- Furthermore, car rental statistics say that the expected annual growth rate will be CAGR 5.46% resulting in $18.69 billion by the year 2027.

Africa

- The expected revenue earned from renting cars in the African region will be USD 3.57 billion as of 2023.

- The average revenue per user is projected at USD 53.90.

- The overall car rental activity will generate 56% of the revenue from online sales by the year 2027.

- The African car rental statistics further say that there will be a total of 91 million users by the year 2027.

- In the year 2023, the user penetration is projected at 5.3% whereas it will be 6.6% by the year 2027.

- The revenue is projected to grow at an annual growth rate of 8.47% reaching $4.94 billion by the year 2027.

Americas

- In the year 2023, in the American car rental industry, the expected revenue is USD 38.50 billion.

- The overall number of users in the American market will rise to 108.50 million by the year 2027.

- As of 2023, the user penetration is 9.8% and it will reach 10.4% by the year 2027.

- The average revenue per user is expected to be USD 0.39K.

- By the year 2027, 77% of the revenue in the car rental segment will be generated from online sales.

- The American car rental market is expected to grow at CAGR 2.44% reaching USD 42.40 billion by the year 2027.

By Country

(Reference: Statista)

(Reference: Statista)

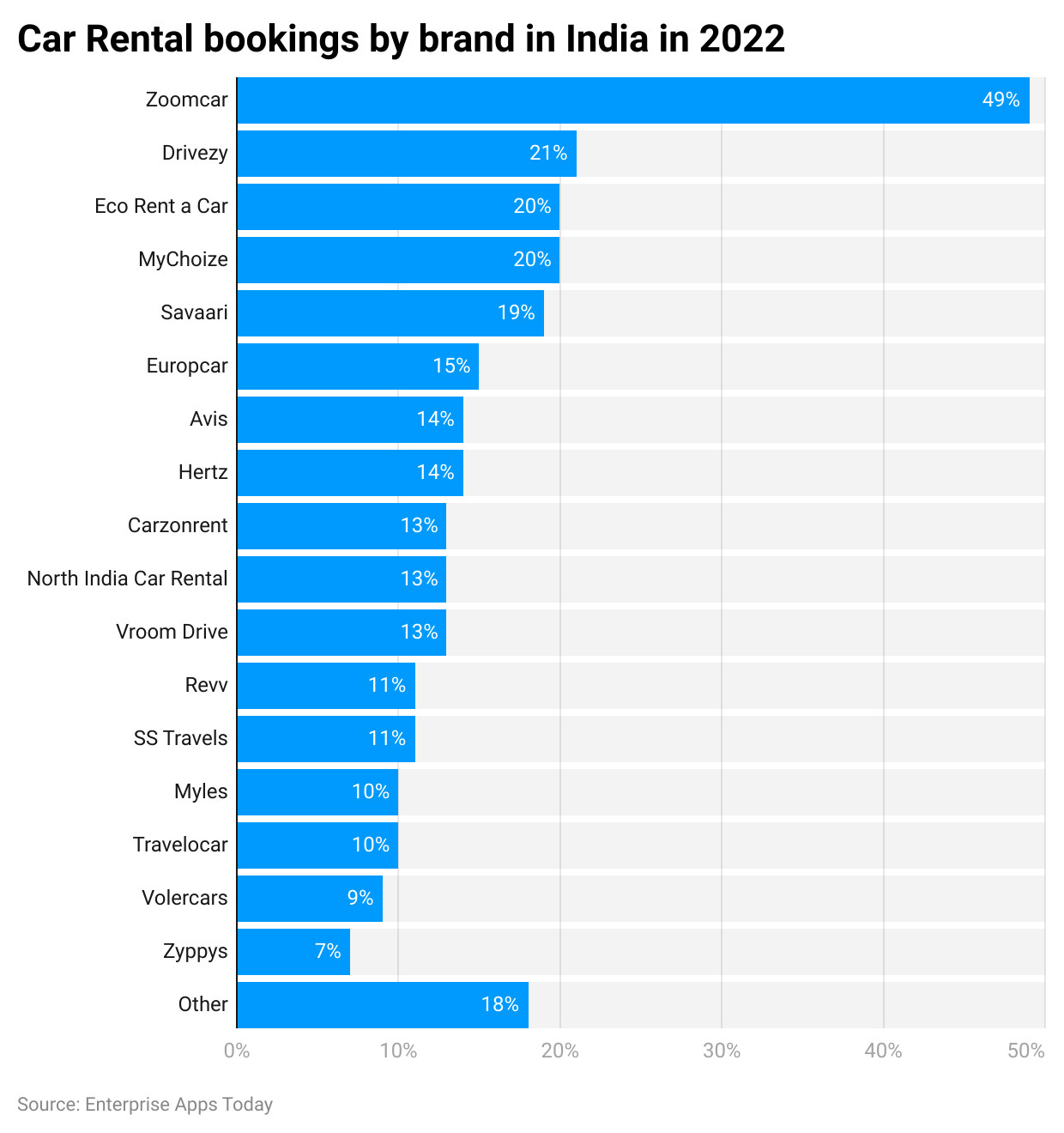

- Over the last 12 months as of 2022, Car rental statistics in India said that 49% of the people ordered a car on Zoomcar.

- 21% of the people booked a rental car on Drivezy while 20% people preferred Eco rent a car.

- The population who booked rental cars contributing to other companies are MyChoize (20%), Savaari (19%), Europcar (15%), Avis and Hertz (14%), Carzonrent, North India car rental, and Vroom Drive (13%), Revv and SS travels (11%), Myles and Travelocar (10%), Volercars (9%), Zyppys (7%) and Other rental companies (18%).

By Cheapest Price

(Reference: nerdwallet)

(Reference: nerdwallet)

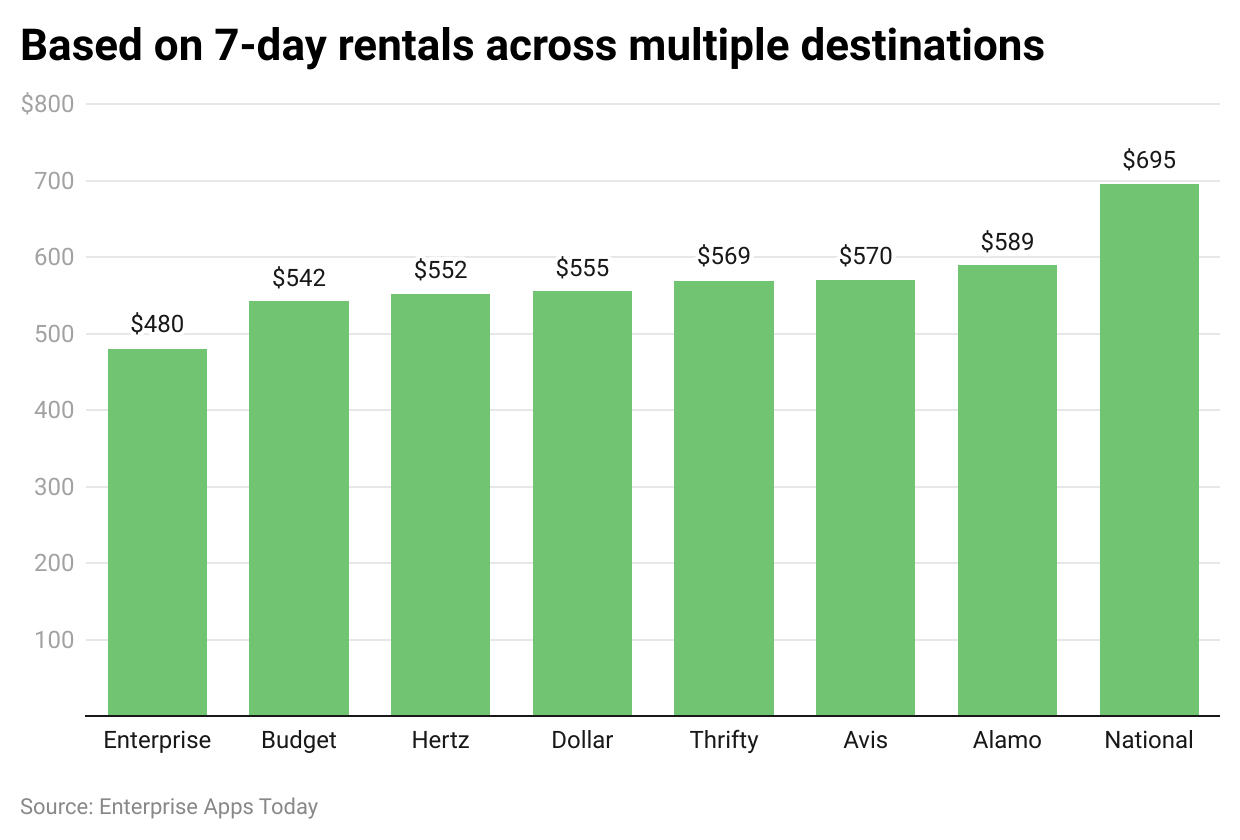

- On average of 7 days, a rental car from Enterprise in a city commute on multiple locations costs around USD 480 being the lowest of all.

- In the similar category, Budget company costs around USD 542 whereas Hertz and Dollar with a minor difference cost $552 and $555 respectively.

- Thrifty costs around USD 569 while Avis charges in a similar segment around USD 570.

- Alamo company costs around USD 589 while National company is chargeable at USD 695 being the highest.

By The Brands

(Reference: ZIPPIA)

(Reference: ZIPPIA)

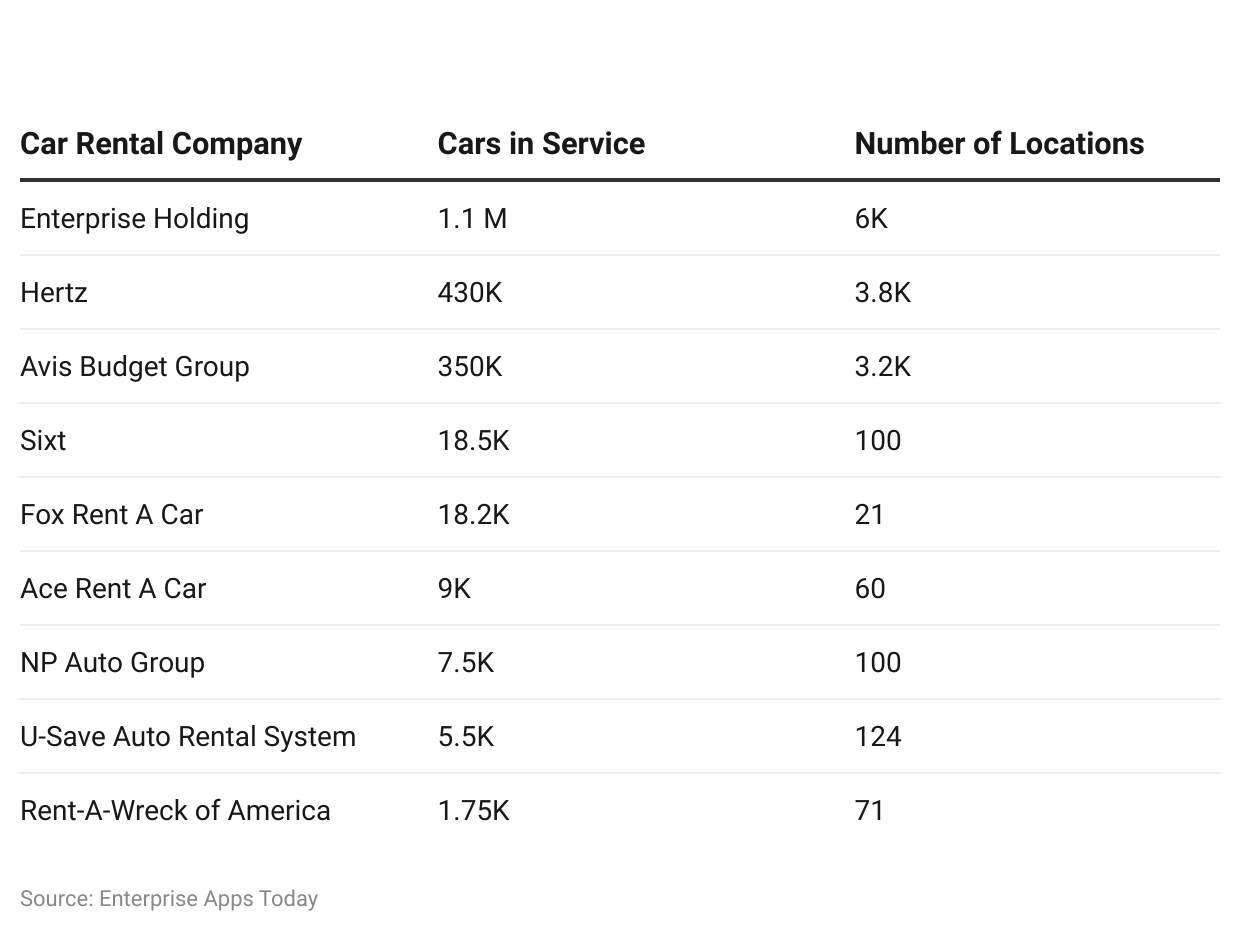

- As of 2022, Enterprise Holding has the highest number of cars in service as per Car rental statistics, resulting in 1.1 million. This company operates in around 6K locations.

- Hertz has 430K cars in service, while operations are spread at 3.8K locations.

- There are 350K rental cars that belong to the Avis budget group. This company is operating at 3.2K different locations.

- Other companies with the highest number of rental cars in service are Sixt 18.5K cars and 100 locations, Fox Rent a Car – 18.2K cars and 21 locations, Ace Rent a Car- 9K cars and 60 locations, NP Auto Group -7.5K cars and 100 locations, U-Save Auto Rental System -5.5K cars and 124 locations and rent A wreck of America – 1.75K cars and 71 locations.

(Reference: brandirectory)

(Reference: brandirectory)

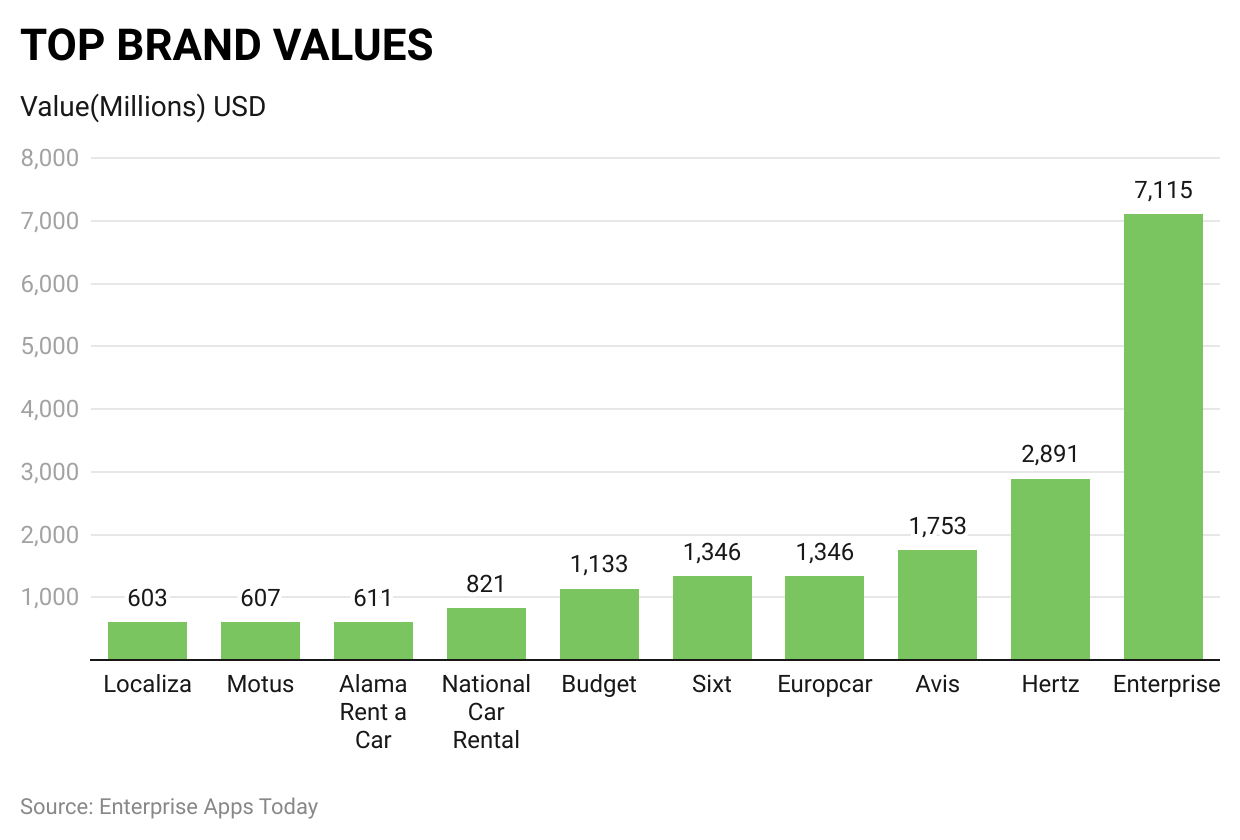

- Bola car rental services have a brand value of USD 603 million, while Motus has USD 607 million.

- There are two more companies whose brand value is less than USD 1,000 which are Alamo rents a car at USD 611 million while National Car Rental has USD 821 million.

- Other companies with a brand value of more than USD 1,000 but less than USD 2,000 million are Budget (USD 1,133 million), Sixt (USD 1,346 million), Europcar (USD1,346 million), and Avis (USD 1,753).

- The highest brand value is for Enterprise (USD 7,115 million) and Hertz (USD 2,891 million).

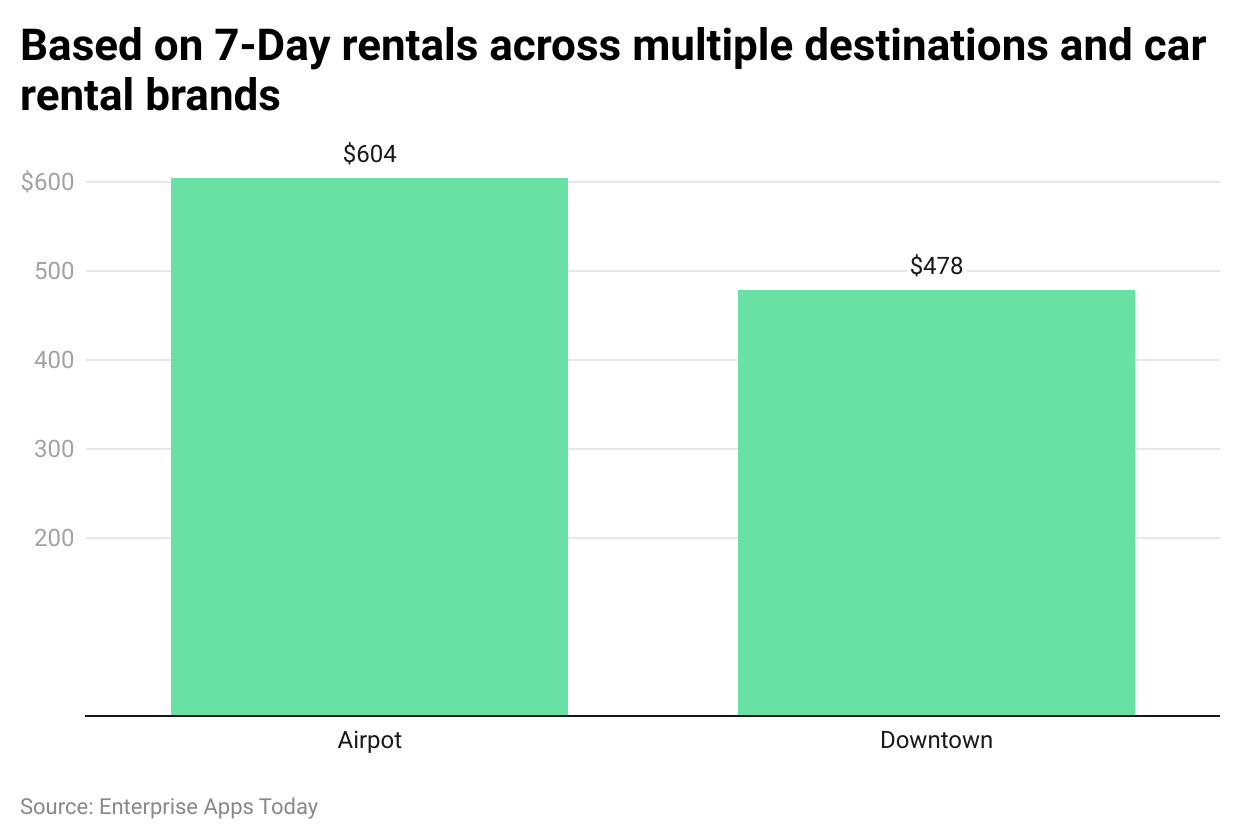

By Location

(Reference: nerdwallet)

(Reference: nerdwallet)

- On average for 7 days, renting a car for a downtown commute can cost up to Usd 478.

- On the other hand, renting a car in the airport area or going to the airport on a 7-day basis can cost up to USD 604.

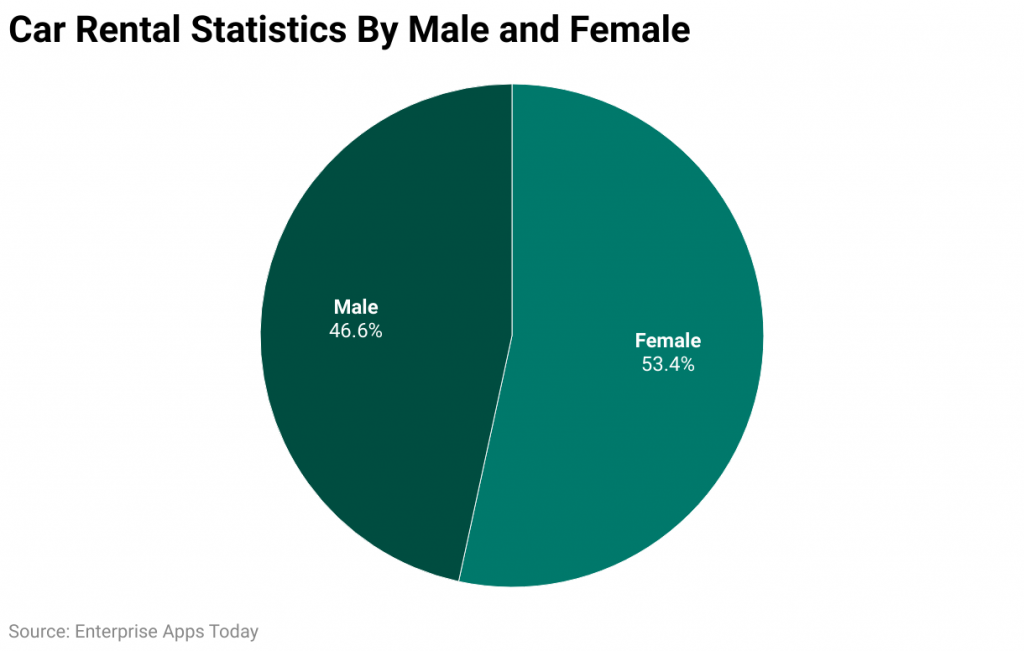

By Demographics

(Reference: ZIPPIA)

- According to car rental statistics, there are 53.4% of car rental agents while 46.6% are male agents around the globe.

- The above number shows that car renting agencies are female-dominated.

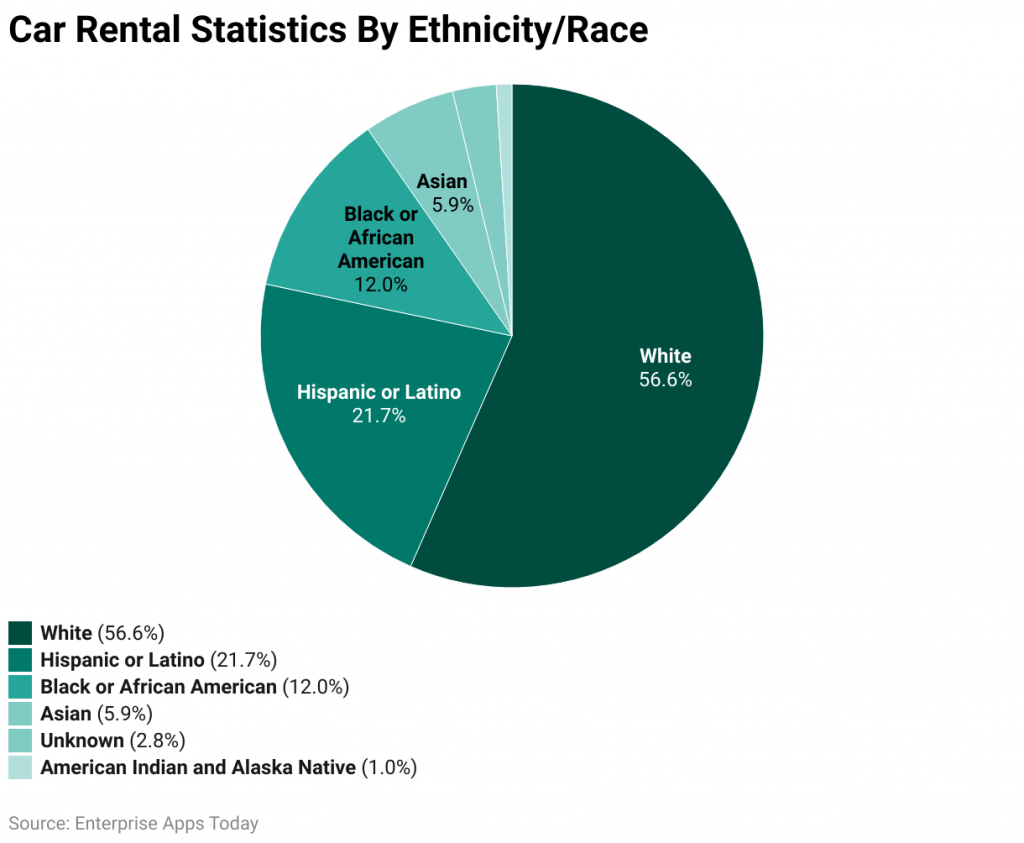

(Reference: ZIPPIA)

(Reference: ZIPPIA)

- Considering the ethnic background of car rental agents, 56.5% are white population while 21.7% are Hispanic or Latino.

- 12% belong to black or African American and 5.9% are Asian car rental agents.

- 1% of the population belongs to American Indians or Alaska natives while 2.8% haven’t revealed their ethnic background.

Trends About Car Rental

- The car rental industry is experiencing a trend towards increased digitization and online bookings.

- There is a growing preference for environmentally friendly rental options, such as electric and hybrid vehicles.

- Subscription-based car rental services are gaining popularity, offering customers flexibility and cost-effectiveness.

- Peer-to-peer car-sharing platforms are emerging as an alternative to traditional rental companies, allowing individuals to rent out their vehicles.

- Contactless pickup and drop-off options are becoming more common, providing convenience and safety for customers.

- Car rental companies are expanding their fleets to include more diverse vehicle options, catering to varying customer preferences.

- Demand for long-term rentals is increasing, driven by remote work and flexible travel arrangements.

- Rental companies are implementing stricter cleaning and sanitation protocols to ensure customer safety in response to the COVID-19 pandemic.

- Personalization and customization options are being offered to enhance the customer experience and loyalty.

- Collaborations between car rental companies and other travel-related businesses, such as airlines and hotels, are on the rise to provide integrated services and discounts.

Recent Development in the Car Rental Industry

- Car rental companies are investing in expanding their electric vehicle (EV) fleets to meet the growing demand for eco-friendly transportation options.

- The integration of artificial intelligence (AI) and data analytics is improving operational efficiency and customer service in the car rental industry.

- Subscription-based models and flexible rental options, such as hourly and weekly rentals, are being introduced to cater to changing consumer preferences.

- Contactless rental processes, including digital check-in and keyless entry, have been implemented to enhance safety and convenience for customers.

- Partnerships with ride-hailing companies and travel agencies are being forged to offer bundled services and seamless travel experiences.

- Car rental companies are adopting dynamic pricing strategies and loyalty programs to attract and retain customers in a competitive market.

- Investments in fleet management technologies, including telematics and predictive maintenance, are optimizing vehicle utilization and reducing operational costs.

- Expansion into new markets and geographical regions, particularly in emerging economies, is driving growth opportunities for car rental companies.

- Innovations in mobile apps and digital platforms are streamlining the rental process and improving accessibility for customers on the go.

Conclusion

In conclusion, the car rental industry continues to be a vital sector in the global transportation market, with significant growth and evolving trends shaping its trajectory. By 2023, the projected revenue for the car rental industry is estimated to reach USD 99.54 billion, reflecting a promising outlook for market expansion. With an expected user base of 602.2 million by 2026, the industry is poised for substantial growth opportunities, particularly in the Asian market, which is forecasted to gain 348.9 million users by 2027.

Despite challenges such as the 27.4% revenue drop in 2020 due to the pandemic, the industry is rebounding, with players adapting to new demands and adopting innovative strategies. Car rental companies are investing in electric vehicle fleets, AI-driven technologies, and contactless rental processes to meet evolving customer preferences and enhance operational efficiency.

With dynamic pricing strategies and partnerships with ride-hailing companies, the industry aims to remain competitive while catering to diverse consumer needs. As the industry navigates through challenges and embraces opportunities, it continues to play a pivotal role in providing convenient and accessible transportation solutions worldwide.

FAQ.

It depends on the country but on average a person can rent a car once he turns 21 and has a valid driving license.

New York, London, Los Angeles, and Florida have the highest number of car rentals

Enterprise Holdings, Hertz Global, and Avis budget group are the largest companies in the car rental industry market.

Economy cars are the cheapest to rent.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.