Some Vital MasterCard Statistics To Scale Its Growth In The Payment Industry Worldwide

MasterCard Statistics: MasterCard is second in the payments industry, just behind Visa. American Express and Discover are also very popular payment grids. MasterCard has teamed up with many members of the financial industry to provide MasterCard-branded network card payment cards to customers. MasterCard makes payment transactions possible by using its patented global network of payments, which is its main network. It generally includes the MasterCard account holder, merchant, and individual financial institutions. MasterCard makes it possible for customers to pay with credit, debit, or pre-paid cards. To understand MasterCard's global importance and future growth in the online payments industry, we will present some important MasterCard statistics.

Key Statistics and Trends

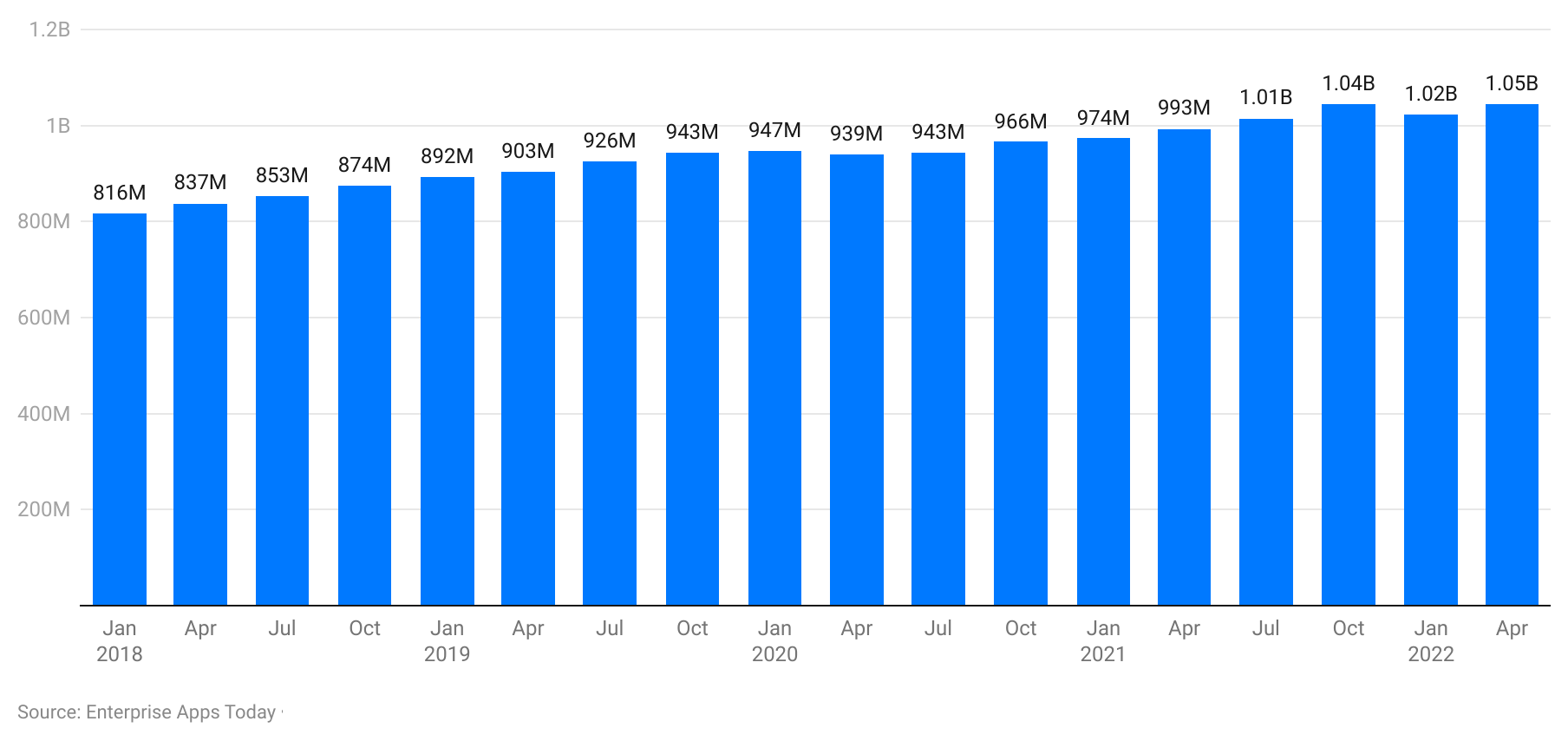

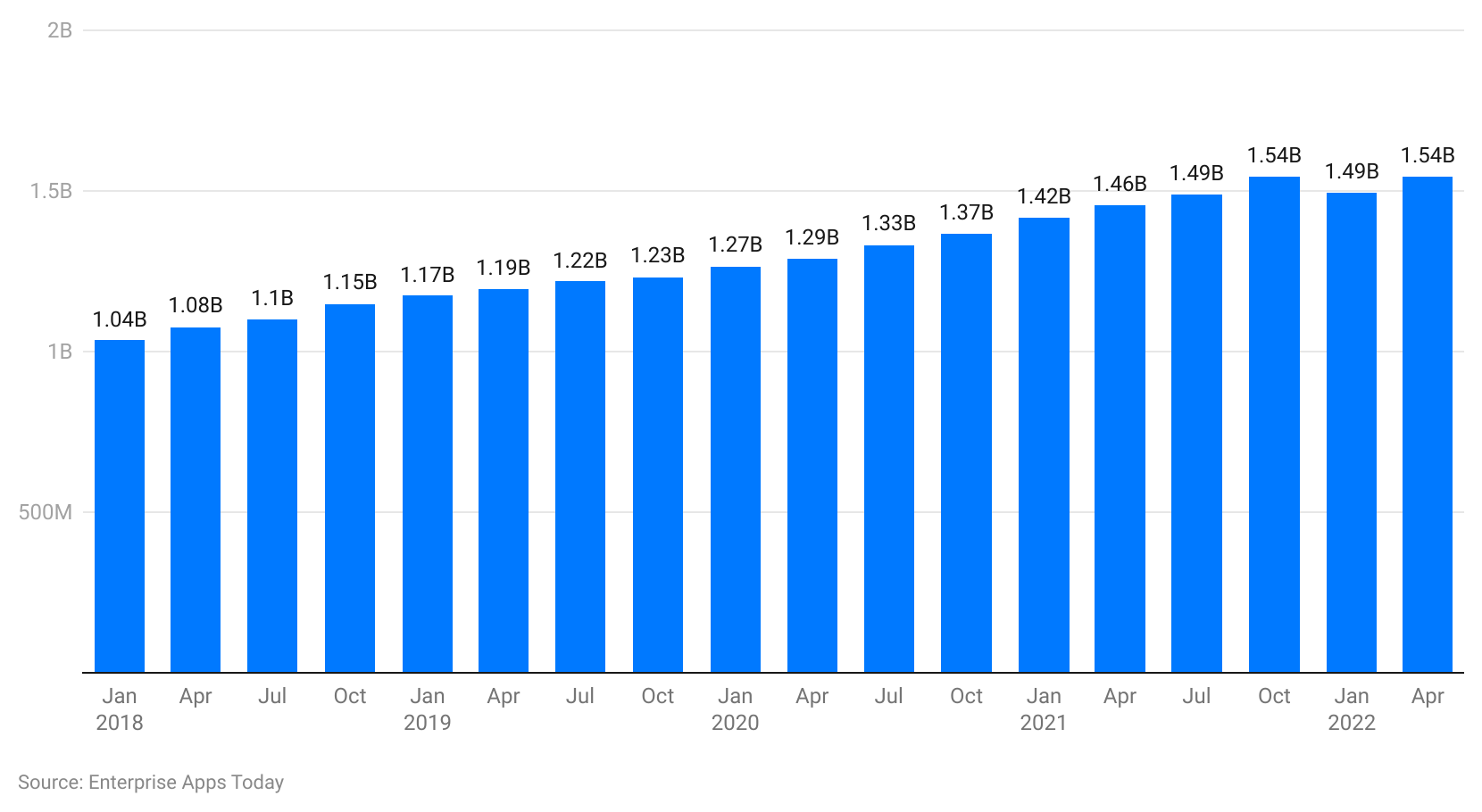

- According to MasterCard statistics, almost 1.544 billion MasterCard debit cards are in circulation worldwide.

- MasterCard statistics show that approximately 1.05 billion MasterCard credit and debit cards are currently in circulation.

- Nearly 293 million MasterCard credit cards are currently in circulation in America.

- According to the report in America, 311 million MasterCard debit cards exist.

- MasterCard processed $2.054 Trillion in money in 2021.

- MasterCard was used to buy goods or services for more than 113 billion transactions in 2020

- MasterCard processed about 3585 transactions per Second in 2020.

- MasterCard statistics show that nearly $679 Billion of the total $2.054 Trillion MasterCard money processed in 2021 came primarily from the United States.

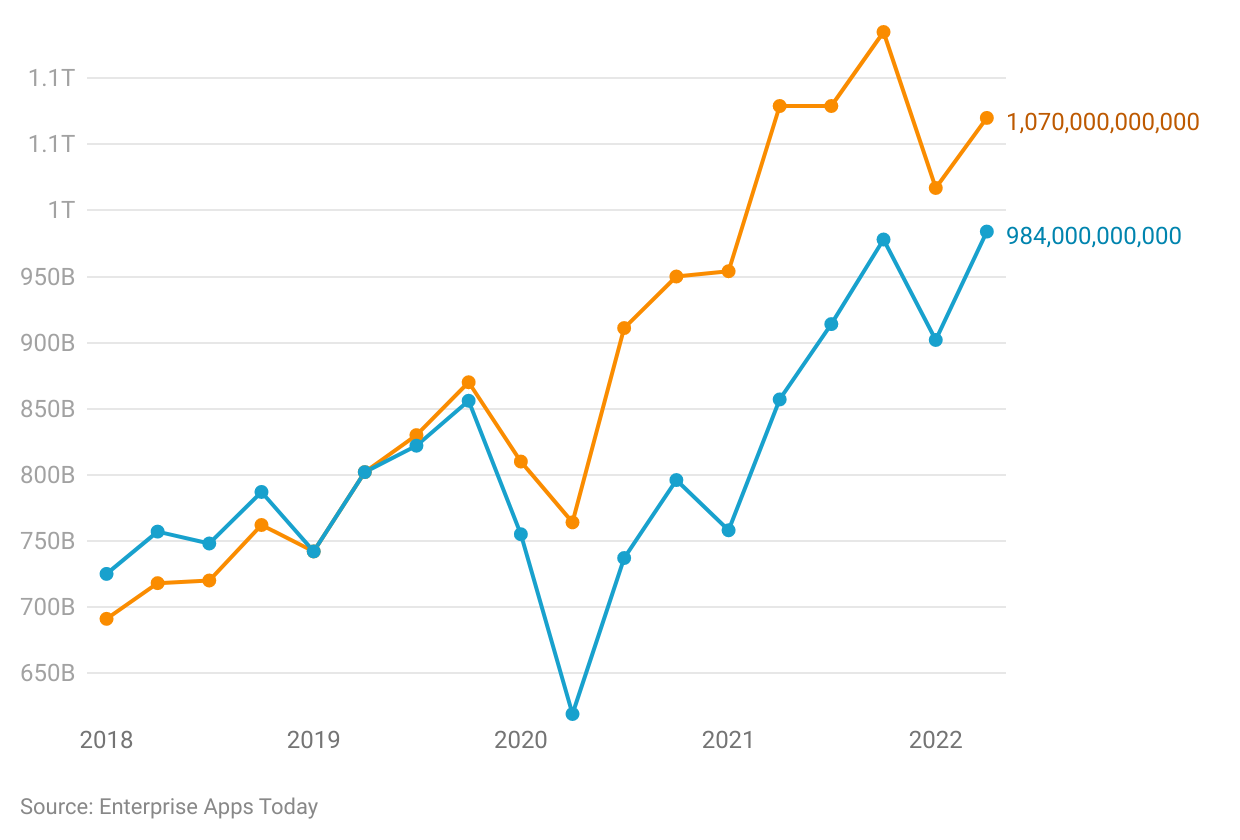

- MasterCard credit cards were responsible for approximately $984 billion of $2.054 Trillion in transactions processed by MasterCard in 2021, according to MasterCard statistics.

- MasterCard had revenue of $ 5.216 billion in the fourth quarter, of 2021. But it was significantly lower than Visa's $7.059 Billion revenue.

- MasterCard received nearly $4.74 Trillion in payments in 2020, according to new data.

- Around 2.33 billion MasterCard payment cards were in circulation by 2020. Visa had 3.59 Billion cards in circulation that year.

- From North America, approximately $6.594 trillion of MasterCard's total revenue of $ 18.884 billion in 2021 will be generated.

- MasterCard earned nearly $10.8 billion through transaction processing fees in 2021. It was a significant increase over the $8.731 billion it earned in 2020.

- According to MasterCard statistics, in 2021 the total costs and expenses for MasterCard reached $ 8.8 billion. This was a significant increase from the previous year. The data shows that MasterCard's 2020 costs and expenses stood at $7.22 Billion.

- Data shows that MasterCard spent almost $895 million in advertising between 2021 and 2021. There was a slight increase in advertising dollars by MasterCard in 2021. It was approximately $657 million in 2020.

- MasterCard statistics reveal that MasterCard employed approximately 2000 people at the close of 2021. Nearly 8400 of MasterCard’s 24,000 employees were based in the United States in 2021.

- MasterCard bought Vocalink, a fintech firm, for $920 million in 2017.

- Until the late 1970s, MasterCard was first known as Interbank Card Association (ICA).

- For $3.19 billion, MasterCard purchased Nets, the payments platform that was previously owned by Nets.

- MasterCard, the payment system, launched Maestro in 1991. It was the first online point-of-sale debit service.

- MasterCard bought Finicity, an real-time financial data aggregates and insights firm for $825 million, in 2020

General MasterCard Statistics

#1. The most recent MasterCard statistics reveal that around 1.05 billion MasterCard credit cards are in circulation around the world

In the United States, nearly 293 million MasterCard credit cards are in circulation currently.

(Source: Wallstreetzen.com)

#2. MasterCard has partnered with a wide range of institutions to provide multiple kinds of cards

Broadly, MasterCard’s card offerings consist of credit, debit, and prepaid cards. Most of MasterCard’s business takes place via partnerships with financial establishments and their administrative co-brand partners to provide open-loop credit card choices.

#3. MasterCard cards are supplied by member banks with the MasterCard logo and are branded as open-loop.

This means that the MasterCard card issued by member banks can be utilized at places where the MasterCard payment processor is accepted.

#4. In the payments industry, there are four key payment card processors

MasterCard, Visa, American Express, and Discover. Each firm works as a payments network and allies with a wide variety of financial bodies for card offerings.

#5. MasterCard joins hands with member financial bodies that, in turn, issue MasterCard-branded payment cards to customers, students, and small trades

Member financial bodes often affiliate with companies in co-branded associations to issue MasterCard-branded rewards cards to their user bases. These firms can be from different industries such as airlines, hotels, and retailers.

#6. As per the latest MasterCard statistics, there are nearly 1.544 billion MasterCard debit cards in circulation across the globe

As per the report, in the United States, around 311 million MasterCard debit cards are in circulation.

(Source: Wallstreetzen.com)

(Source: Wallstreetzen.com)

#7. When partners issue credit, debit, and prepaid MasterCard cards the financial body is mainly responsible for all of the guaranteeing and issuance of the card

Financial bodies provide many features on MasterCard-branded cards to entice different types of customers. There are some common credit card features such as no annual fee, cash back, issuer-branded or custom company-branded rewards points, and zero percent introductory rates.

#8. In 2021, MasterCard processed a total of $2.054 trillion in money

It highlights the amount of money systematically transacted on all types of MasterCard card offerings.

#9. Around $984 billion out of a total of $2.054 trillion money processed by MasterCard in 2021 came from MasterCard credit cards

As per the MasterCard stats, MasterCard credit cards account for the largest sum of the company’s total processed money.

(Source: Wallstreetzen.com)

(Source: Wallstreetzen.com)

#10. In 2020, more than 113 billion transactions were done using MasterCard to buy goods and services

As per MasterCard statistics and trends, in the same year, MasterCard processed around 3585 transactions per second.

#11. In 1991, MasterCard, the payment unveiled Maestro, the first online point-of-sale debit service

MasterCard is the second-biggest payment-processing company across the globe. It provides a wide range of financial facilities and tools. The company’s main aim is to handle payments between the merchants’ banks and the credit unions of the buyers who use the MasterCard-brand debit, credit, and prepaid cards to purchase any service or product. MasterCard was initially known as the Interbank Card Association (ICA) until the late 1970s.

#12. In 2020, MasterCard took over a real-time financial data aggregate and insights firm, which is known as Finicity for $825 million.

MasterCard acquired many companies over the years to increase its customer base across the world. In 2019, MasterCard took over the payments platform known as Nets for $3.19 billion. In 2017, MasterCard took over the fintech firm, which is known as Vocalink for $920 million.

#13. MasterCard statistics reveal that at the end of 2021, MasterCard employed around 2000 people

Roughly 8400 of MasterCard’s 24,000 staff in 2021 were based in the United States.

#14. As per the data, MasterCard invested nearly $895 million in advertising in 2021.

The investment in advertising by MasterCard saw a slight increase in 2021. In 2020, it was around $657 million.

#15. As per the latest MasterCard statistics, the costs and expenses of MasterCard reached $8.8 billion in 2021

While it was much lower in the previous year. As per the data, the costs and expenses of MasterCard were around $7.22 billion in 2020.

#16. In 2021, MasterCard generated nearly $10.8 billion via transaction processing fees

MasterCard itself is a financial services firm. As per the data, it mainly generates its revenue via transaction fees taken from issuers and acquirers, that pay MasterCard established on gross dollar volume (GDV). There was a considerable increase from $8.731 billion in 2020.

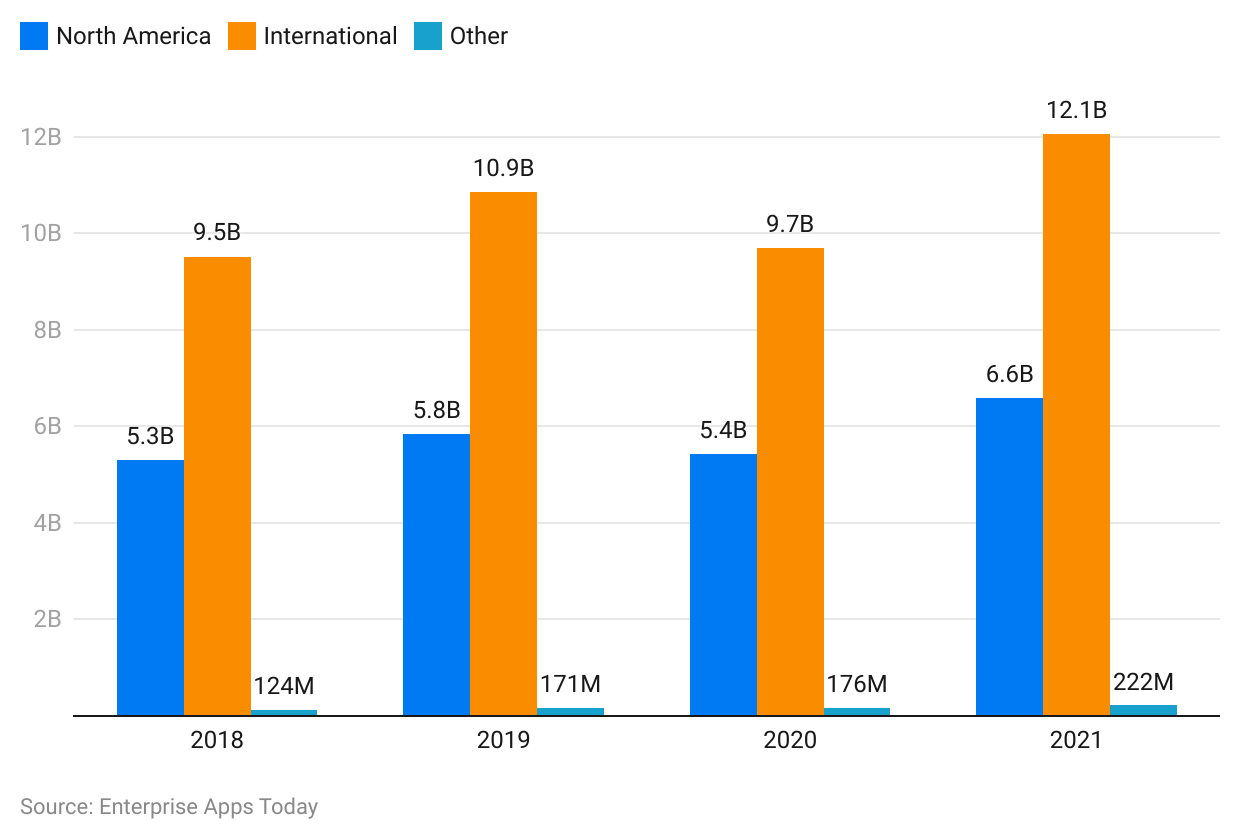

#17. In 2021, around $6.594 billion out of MasterCard’s total $18.884 billion revenue was generated from North America

North America has a major part to play in generating MasterCard’s revenue. Nearly $12.07 billion is generated from the rest of the countries around the world where MasterCard is accepted.

#18. In 2020, there were around 2.33 billion MasterCard payment cards in circulation across the world

While Visa had around 3.59 billion cards in circulation in the same year.

#19. In the fourth quarter of 2021, MasterCard generated around $5.216 billion in revenue

However, as per Visa statistics, MasterCard’s revenue was quite less than the revenue of Visa Inc. which was around $7.059 billion in the fourth quarter of 2021.

#20. Nearly $679 billion out of a total of $2.054 trillion money processed by MasterCard in 2021 came from the United States

As per MasterCard statistics, a large sum of total money processed via MasterCard came from the United States in 2021.

(Source: Wallstreetzen.com)

(Source: Wallstreetzen.com)

#21. MasterCard spent around $7.09 billion on the general and administrative sectors in 2021

Around $726 million was spent on Depreciation and Amortization by MasterCard. While nearly $94 million was spent on provisions for litigation in the same year by MasterCard.

Conclusion

Experts say that modernization is at the epicenter of MasterCard’s DNA. The company has implemented the latest tools to aid and support safe, fast, and secure payment transactions. MasterCard has been able to achieve this forward-thinking approach in part via partnerships that have been built in the growing fintech sector over the years. As a global tech firm in the payments industry, MasterCard is on a mission to associate with and implement a comprehensive digital economy that will benefit everyone and everywhere by enabling safe, accessible, and easy payments.

As the digital revolution continues to change people’s every aspect of lives across the world, soon MasterCard will be the top financial firm leading at the forefront with its payment tools and invention. These MasterCard statistics indicate that MasterCard might emerge as a game changer in the payment industry in the future.

FAQ.

MasterCard works to unite and influence a comprehensive digital economy that offers benefits to everyone and everywhere by enabling safe, easy, and accessible transactions.

As per the report, users can withdraw around $1,000 in ATMs via MasterCard debit cards per day. While they can transact around $1,500 online via MasterCard debit cards per day if the amount is available in the account.

There are three kinds of MasterCard payment cards such as Standard, World, and World Elite.

The company offers its customers convenient and safer payment methods via credit, debit, prepaid, contactless, online, and mobile payments. MasterCard brings merchants to consumers at the local level and across the world. Through MasterCard customers, trades and authorities can monitor and reorganize their spending.

Visa, Discover, Capital One, American Express, and PayPal are rivals of MasterCard in the payment industry.

There are more than 2.5 billion MasterCard payment cards in circulation across the world.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.