Remittance Market Revenue Set to Grow at a CAGR of 17.8% from 2023 to 2033

Page Contents

Market Overview

Published Via 11Press: Remittance is the process of sending money from one place to another, usually within a country. It plays an integral role in global economy as it allows workers in one country to support their families and loved ones back home. There are two types of remittance: inward and outward; the former refers to money sent into a country while outward refers to funds sent out of that same jurisdiction. Remittance Market can be done through various channels like banks, money transfer operators, and online payment platforms.

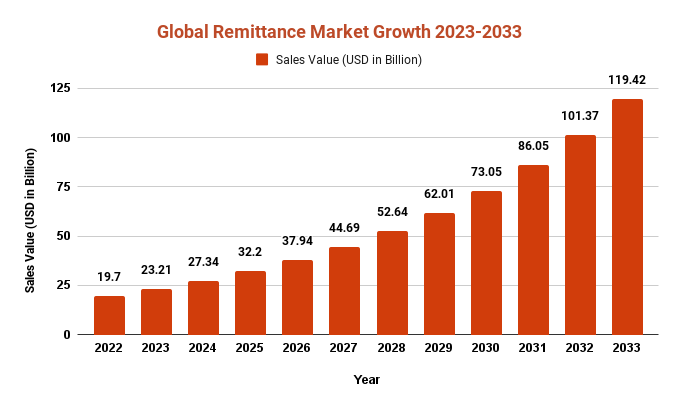

The Global Remittance market represented USD 19.7 Bn in 2022 and will anticipate around USD 119.42 Bn by 2033 projected around CAGR of 17.8% amid forecast frame of 2023 to 2033.

Remittances are an important source of income for many developing countries, with the World Bank projecting that they would reach $508 billion by 2019. Remittances also provide support to families, helping reduce poverty and raise living standards. Unfortunately, sending remittances can be expensive due to fees charged by money transfer operators and banks; furthermore, safety and security when handling remittance transactions may be problematic in areas with limited financial infrastructure or high levels of corruption.

Key Takeaways

- Remittance is the process of sending money from one location to another, typically across countries.

- Remittances between countries can be classified into two categories: inward remittances, which refers to money sent into a country; and outward remittances, which refer to cash sent out of that same jurisdiction.

- Remittance can be done through various channels such as banks, money transfer operators and online payment platforms.

- Remittances are an essential source of income for many developing countries, helping to alleviate poverty and raise living standards.

- Sending remittances can be expensive, with fees charged by money transfer operators and banks.

- Securing remittance transactions can be a challenge, particularly in places with weak financial infrastructure or high levels of corruption.

- Remittances play an integral role in the global economy, providing support to families and communities around the world.

Get Sample Report: https://marketresearch.biz/report/remittance-market/request-sample/

Regional Snapshot

- Asia-Pacific: The Asia-Pacific region is one of the top recipients of remittances worldwide, led by India, China and the Philippines. In 2020 alone, estimated remittance flows into this region totaled $302 billion with India alone receiving $83 billion.

- Europe and Central Asia: Remittances to Europe and Central Asia have seen a steady increase in recent years, reaching $68 billion by 2020. The top recipients in this region include Ukraine, Russia, and Uzbekistan.

- Latin America and the Caribbean: Remittance flows to Latin America and the Caribbean have been severely disrupted by the COVID-19 pandemic, with an expected decrease of 14% for 2020. Top recipients in this region include Mexico, Guatemala, and Colombia.

- Middle East and North Africa: The Middle East and North Africa region is a major sender and receiver of remittances, with Saudi Arabia, the United Arab Emirates, and Egypt as the top sending countries. Estimates place remittance flows into this region at $56 billion in 2020.

- Sub-Saharan Africa: Remittances to Sub-Saharan Africa have seen a steady increase in recent years, reaching $48 billion by 2020. The top recipients in this region include Nigeria, Ghana and Kenya.

Inquire with our industry specialist: https://marketresearch.biz/report/remittance-market/#inquiry

Drivers

- Economic Opportunities: The availability of economic opportunities in a country can influence remittance flows. For instance, individuals may migrate to countries with higher-paying jobs and send money back home to their families.

- Migration Policies: Government policies regarding immigration and work permits can have a significant effect on remittance flows. When policies make it simpler for individuals to immigrate and work in another country, this often results in higher remittance amounts sent back home.

- Exchange Rates: Changes in exchange rates can have a significant impact on remittance flows. When the exchange rate is favorable, senders of money abroad can send more funds back home.

- Financial Infrastructure: The availability and accessibility of financial infrastructure, such as banks and money transfer operators, can influence remittance flows. Countries with well-developed financial systems often have lower remittance costs which make sending money home more appealing for individuals.

- Political Instability: Political instability and conflict can result in a decrease in remittance flows. When individuals are forced to flee their homes, they may not be able to send money back home to their families.

- Natural Disasters: Natural events such as hurricanes, earthquakes and floods can disrupt remittance flows. When these tragedies strike, individuals may not be able to work or send money back home.

Restraints

Remittances can be costly, with fees charged by money transfer operators and banks. High costs may deter people from sending money back home, especially in low-income countries where remittances are essential for supporting households. Furthermore, limited financial infrastructure in some places may obstruct these flows; lack of banks or money transfer operators might make sending funds home difficult. Furthermore, regulatory restrictions like know-your-customer (KYC) requirements and anti-money laundering regulations may restrict movement as well. In certain countries there may be strict restrictions on cross-border payments which further hinder this practice.

Exchange rate volatility can have an impact on remittance flows, particularly in countries with unstable currencies. Fluctuations in exchange rates make it difficult for individuals to send or receive money in their home currency. Political unrest and conflict can disrupt these processes as well, particularly where individuals may have been forced to flee their homes. Furthermore, limited access to technology may obstruct electronic money sending or receiving; for example, some countries lack mobile phones or internet access which makes electronic transfers of funds impossible.

Opportunities

The digitalization of remittances presents an enormous opportunity for the industry. Not only does technology lower costs and boost efficiency, it makes sending money home simpler and more affordable, too. Mobile payments and other electronic payment methods could revolutionize this sector significantly. Furthermore, those receiving remittances often lack access to traditional banking services; by providing alternatives like mobile wallets and other digital payment methods, the remittance industry helps bring more people into formal financial systems.

The growth of cross-border e-commerce presents a unique opportunity for the remittance industry. As more individuals purchase and sell goods across borders, demand for cross-border payments will increase, giving remittance companies an opportunity to expand their services. Partnerships between remittance providers and fintech companies can facilitate greater access to remittance services. Fintech firms may provide innovative payment solutions and enhance customer experiences, thus drawing in new customers to the remittance industry. Impact investing offers the remittance industry an opportunity to support social and environmental causes. By investing in initiatives such as renewable energy, healthcare, and education, they can promote sustainable development while producing positive social effects.

Challenges

The remittance industry is subject to stringent regulatory requirements, particularly with regard to anti-money laundering (AML) and counter-terrorist financing (CTF) requirements. Complying with these regulations can be a complex and time-consuming task, while failure to do so could result in costly fines and damage to one's reputation. Furthermore, sending remittances abroad can be expensive due to fees charged by money transfer operators and banks alike. High fees can deter individuals from sending money home to their families, especially in low-income countries where remittances are essential for supporting households. Exchange rate volatility also plays a role, especially when currencies have unstable value. Fluctuations in exchange rates make it difficult for individuals to send or receive funds in their home currency.

Limited financial infrastructure can obstruct remittance flows. In certain countries, there may not be enough banks or money transfer operators available, making it difficult for individuals to send funds home. Furthermore, the remittance industry faces technological obstacles related to cybersecurity and fraud prevention as it becomes increasingly digitalized. To guarantee customer data is secure and fraud detection and prevention are top priorities; political instability or conflict also have the potential to disrupt these flows, particularly in places where individuals have been forced to flee their homes.

Market Segmentation

Type

- Inward Remittance

- Outward Remittance

End-User

- Migrant Labor Workforce

- Businesses

- Individual/Personal

Channel

- Banks

- Money Transfer Operators

- Mobile Banking

- Others

Platform

- Digital

- Non ? Digital

Key Players

- Societe Generale

- Absa Group Limited

- MoneyGram International Inc.

- Western Union

- Euronet Worldwide

- The Kroger Co.

- Banco Bradesco

- U.S. Bancorp

- Scotiabank

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 19.7 Bn |

| Revenue forecast by 2033 | USD 119.42 Bn |

| Growth Rate | CAGR Of 17.8% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

Growing Demand => Request for Customization

Recent Developments

The COVID-19 pandemic has hastened the transition towards digitalization in the remittance industry. Many providers have expanded their digital offerings to cater to customers who are unable or unwilling to visit physical locations. Furthermore, several regulatory changes have recently affected this space; for instance, in 2020 FinCEN introduced new regulations in the United States requiring greater transparency around cross-border payments.

Fintech companies are increasingly entering the remittance market, offering innovative payment solutions and improved customer experiences. This has the potential to increase competition and lower costs for customers. Some remittance providers are exploring using blockchain technology to enhance efficiency and security of cross-border payments. Blockchain has the potential to reduce costs while increasing transparency within this industry. The COVID-19 pandemic has had a profound effect on this sector with many individuals experiencing job losses or reduced income; remittance flows declined in 2020 but have since recovered in many countries as economic conditions improve.

Key Questions

1. What is remittance?

Remittance refers to the transfer of money between countries, typically by an individual to family or friends.

2. Why send remittances?

People send remittances for many reasons, such as to support family members, cover education or healthcare costs, or invest in businesses or property.

3. What is the cost of sending remittances?

Remittance costs vary by provider, typically ranging between 1% and 10% of the amount sent.

4. What are some of the challenges facing the remittance industry?

These include regulatory compliance, high fees and costs, exchange rate volatility, limited financial infrastructure, technological issues, as well as political instability or conflict.

5. How has digitalization affected the remittance industry?

Digitalization has had a tremendous impact on this sector, with many providers expanding their digital offerings to better cater to customer demands. This technology promises to reduce costs and boost efficiency within this space.

6. What are some potential opportunities for the remittance industry?

Some potential growth drivers include digitalization, financial inclusion, cross-border e-commerce, partnerships with fintech companies and impact investing.

Contact us

Contact Person: Mr. Lawrence John

Marketresearch.Biz (Powered By Prudour Pvt. Ltd.)

Tel: +1 (347) 796-4335

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.