Most Insightful Digital Banking Statistics To Know in 2022

Page Contents

Digital Banking Statistics: With the inception of online or digital banking, customers have been introduced to a much more convenient way of paying bills, transferring funds, making deposits, and shopping online from the comforts of their homes. Digital banking has helped customers manage their funds whenever and wherever they want while offering the utmost safety. However, online banking, or digital banking has brought some challenges for financial institutions and customers along with its benefits. Here we will delve deeper into the most essential digital banking statistics to give a well-versed insight into this popular mode of banking.

Key Digital Banking Statistics (Editor’s Choice)

- India accounts for the most number of digital transactions across the world.

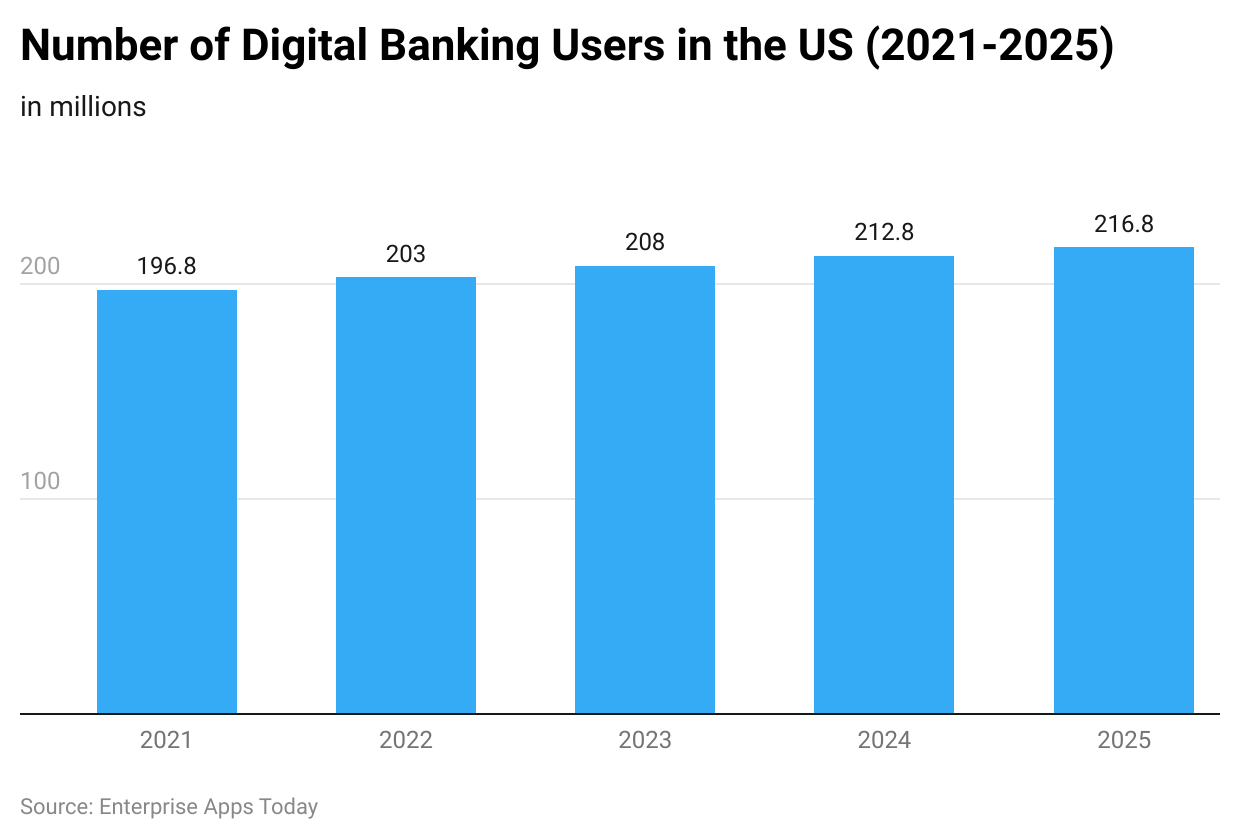

- By 2025, the United States will witness around 216.8 million digital banking users.

- The number of digital banking users is expected to reach 3.6 billion worldwide by 2024.

- Around 94% of mobile banking users access digital banking services at least once a month.

- Experts predict that the usage of chatbots will help the banking industry save nearly $7.3 billion in customer support costs by 2023.

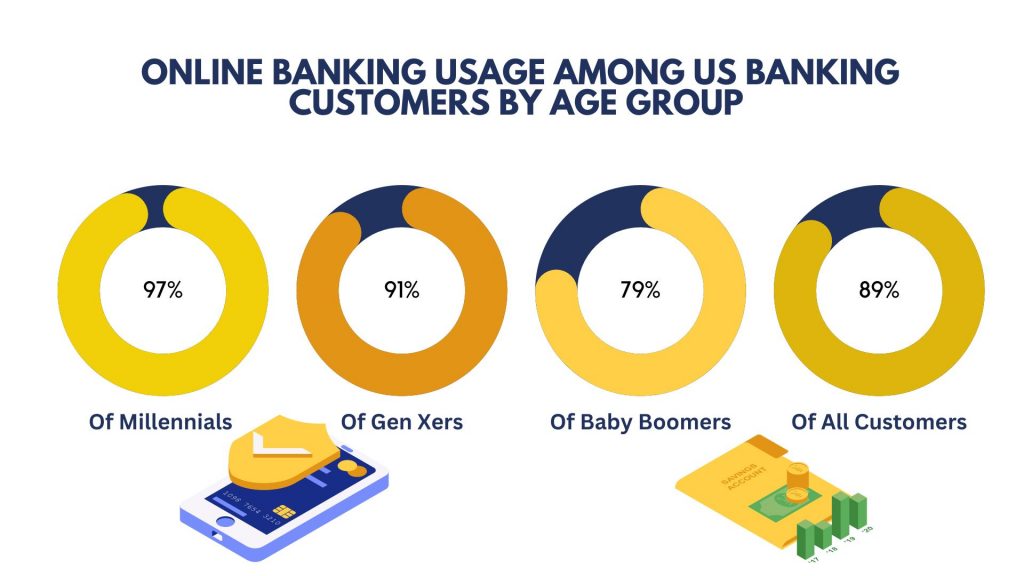

- Nearly 89% of bank account holders in the US use mobile online banking for managing their accounts.

- 25% of customers prefer using bank branches instead of digital banking.

- Around 39% of consumers use banking apps as the primary banking method.

- Nearly 82% of customers are not willing to switch their banks due to the digital banking platform.

- Banks across the world face a loss of more than $1 trillion due to the rising rate of cybercrimes each year.

- About 80% of banks in the US started offering digital banking services by 2006.

- The first online-only bank was launched in 1995.

General Digital Banking Statistics

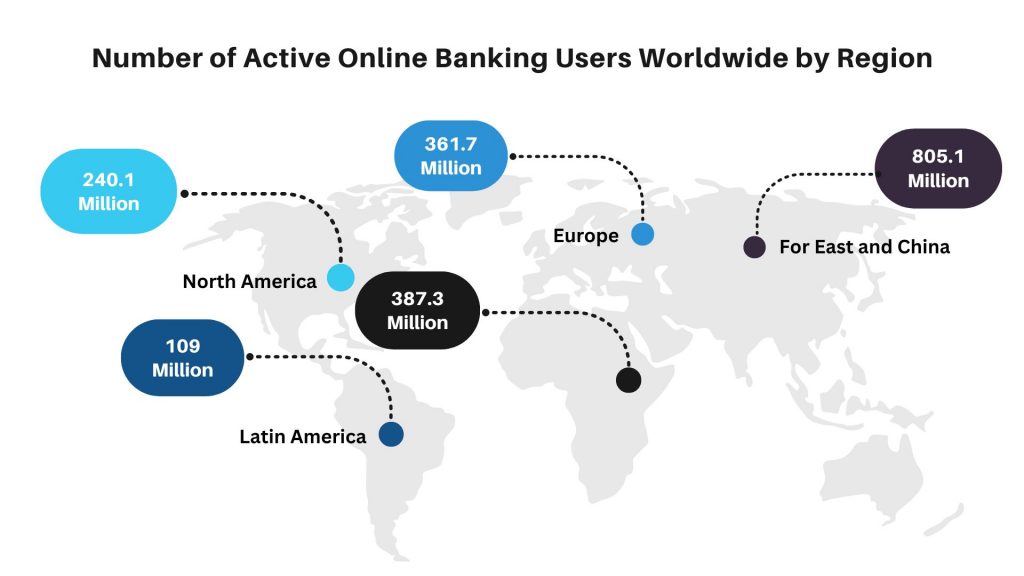

#1. The Far East and China contributed to nearly 800 million digital banking users in 2020

It is estimated that there will be around 1 billion digital banking users in these regions by 2024.

(Source: Statista)

#2. As per the 2021 digital banking statistics, India leads the world in the number of real-time online transactions

India accounted for around 48 billion real-time online transactions in 2021 followed by China, the US, Canada, the UK, France, and Germany.

#3. The usage of chatbots can save around $7.3 billion for financial institutions in customer support costs

Although customer satisfaction with artificial intelligence-based customer service might need some improvements, the use of chatbots can save a massive amount for the global digital banking industry.

#4. Nearly 82% of customers say that they have not changed their banks due to the digital banking platforms

As per the latest digital banking statistics, digital banking platforms can increase banks' customer retention. Financial institutions can boost their customer base by upgrading their online banking platforms. Experts say that banks that provide top-class digital banking services have an edge in bringing in new customers.

#5. Digital banks can provide 1 to 2% more APY as compared to traditional banks

Digital banks offer higher annual percentage yields as they have reduced costs.

#6. There will be nearly 216.8 million digital banking users in the United States by 2025

The number of digital banking consumers is steadily rising in the United States, which reflects that the adoption rate is growing each passing year.

(Source: Statista)

#7. In 2001, Bank of America became the first bank in the US that acquired more than 3 million digital banking users

At that time, digital banking consumers accounted for only 20% of its total customer base.

#8. Security First Network Bank was launched as the first fully digitalized bank in 1995

It was the first fully online bank in the US without any branch offices. Fully digitalized banks can offer higher interest rates to their customers and reduced service costs.

#9. As per digital banking statistics, financial institutions began their experiments with digital banking in the 1980s.

#10. Stanford Federal Credit Union began offering online banking services to its consumers in 1994.

Traditional And Digital Banking Statistics

#11. The number of digital banking users is expected to reach 3.6 billion by 2024

It shows that a huge portion of the world's population will be using digital banking services. This growth indicates better infrastructure of digital banking and easy access to online services in high-income nations.

#12. A survey done in the US shows that only 20% of customers visit the branch office of their banks

This recent survey shows that only 20% of account holders visit branch offices of their banks rather than handling their accounts via digital banking.

#13. Younger customers are more likely to use digital banking or mobile banking services as compared to older customers

Around 30% of customers who are below 54 years of age access mobile payment services such as Apple pay and Venmo at least once a week. While only 12% of consumers who are older than 54 years use such services.

#14. The 2020 digital banking statistics showed that the total branch count of the US financial industry reduced by more than 1500 within 12 months

It hints at a bright future for digital banking.

#15. The COVID19 pandemic played a huge role in the adoption of digital banking

A survey revealed that around 63% of people in the US said that they were keener on trying a new digital banking app during the pandemic. While 80% of surveyed people said that they were scared of catching the virus while paying a visit to branch offices of their banks.

#16. By 2025, the United States will witness around 216.8 million digital banking users

As per the latest digital banking statistics, the number of digital banking users will keep growing in the upcoming years. Experts predict that the number of functions performed on the digital banking app as well is likely to increase as banks plan to add more features for customers.

European Digital Banking Statistics

#17. 68% of European customers in the age range of 25 to 34 years have access to digital banking services

Digital banking stats indicate that the usage of online banking services is relatively high among young generation customers. It is obvious because older customers are accustomed to traditional banking and they find it hard to make a switch.

#18. Denmark, the Netherlands, and Finland are the EU member states with the highest fraction of digital banking users

Promoting the benefits of digital banking and persuading people to opt for online banking services have boosted the adoption rate of digital banking in these EU member states.

#19. Bulgaria, Romania, Greece, and Cyprus are the EU member states with the lowest number of digital banking consumers

People living in these regions vastly like using traditional banking methods. Experts say that National banks might not be able to improve digital banking services or have not been able to educate customers well about the benefits of online banking.

#20. The number of digital banking users in European regions increased twofold from 2007 to 2018.

Mobile Banking Usage Statistics

#21. Nearly 95% of customers have faith in their banks that the online banking platform and their data will be protected

The majority of consumers are happy with the security measures offered by their banks to protect their money and data. Customers have full trust in their banks as the money saved in their bank accounts is insured for up to $250000, which shows that customers will be paid this money if there is a security breach in the bank.

#22. 89% of bank account holders in the US use mobile online banking for managing their accounts

The usage of mobile banking is quite prevalent in the United States. In fact, nearly 97% of millennials use mobile banking in the US.

(Source: Insider Intelligence)

#23. Nearly 47% of mobile banking users believe that turning off card payments through the digital banking app is more convenient

Cybercriminals have started using more advanced techniques nowadays, which is why security is always a concern in online banking.

#24. Around 39% of consumers have access to their banking apps as their primary online banking platform

Mobile banking apps offer a convenient user experience that has led to a boost in the mobile banking trend.

#27. 24% of mobile banking users do international fund transfers.

#28. Nearly 26% of mobile banking users use their smartphones to update account details.

#29. Mobile banking trends in the US show that there has been a constant rise in this type of service since 2011.

Online Banking Statistics

#30. About 66% of the credit union and online bank services users appear to be happy with the service

The digital banking industry is moving in the right direction as most customers are showing a positive outlook toward online banking services.

#31. The global online banking statistics show that around 73% of customers utilize online banking platforms at least once a month

While around 59% of mobile banking users use the platform at least once a month.

#32. Financial industry statistics show that 70% of consumers are interested in a consistent online and mobile banking service while opting for a bank.

#33. Around 44% of online banking users use the service for paying their bills.

#34. Online banking statistics show that the number of neobank users is going to reach 85 million in Europe by the end of 2023.

#35. The latest US online banking trends show that only 7 million deposit accounts exist in digital banks in the US.

Online Banking Scam Statistics

#36. The Central Bank of Bangladesh suffered a cyber heist attack in February 2016

Cybercriminals fixed malware in the system of the bank and whipped out around $101 million. However, nearly $81 million has still not been traced out of the total stolen amount.

#37. The median yearly cost of cybercrime is nearly $18.37 million per financial institution worldwide.

Conclusion

These digital banking statistics show that the adoption rate of digital banking is growing in the finance industry. A blend of technology progression and the COVID19 pandemic has attracted more customers to transit from traditional banking to digital banking facilities. Experts have revealed that digital-only banks as well are incentivizing interest in the online banking sector as they can provide the best deals to consumers. As technology evolves, digital banking stats as well will grow. These stats indicate that digital banking services are here to stay.

Sources

FAQ.

Digital banking is done via digital platforms online. Such a digital platform can offer services like pay-in-slips, demand drafts, fund transfers, balance inquiries, and issuing cheques. It can be defined as accessibility to all banking services online.

Paperless banking, the facility of online bill payments and shopping, reduced service costs, convenient banking services, and extended banking services in remote areas are some of the benefits of digital banking.

India contributes to the highest number of digital transactions with 48 billion real-time online transactions.

Internet banking, mobile banking, banking cards, United Payment Interface (UPI), Mobile Wallets, and Point of Sales Machines are some forms of digital banking.

There are around 216.8 million digital banking users.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.