Income Tax Statistics 2023 – Tax Brackets (USA, UK, Germany, Canada and India)

Page Contents

- Introduction

- What Refers To Income Tax?

- Key Income Tax Statistics (Editor’s Choice)

- Who Pays Most Income Tax in The USA by Income Bracket

- Income Tax: The Good Side

- Income Tax: The Bad Side

- Types Of Taxes

- Tax Percentage Around The World According To The Type

- Taxable Income Tax Slabs/Brackets By Country

- Top 3 Highest Corporate Tax-Paying Companies

- Conclusion

Introduction

Income tax statistics: When we talk about income simultaneously, we consider income tax. Every country in this world apart from a few countries tax payable countries. There are many types of taxes that a person has to pay in his employment period. Be it a business or any individual doing a normal job, they are never exempted from paying income tax unless the income doesn’t fall under the predetermined slab. In these Income tax statistics, we will get an idea of what income tax is, how it is different in every country, and many other insights. It is not only the duty of the individual to pay taxes but also corporations that run their business within specified legal boundaries.

What Refers To Income Tax?

The word tax refers to the amount paid to the government on the income earned by any individual by means of business or employment within the local boundaries. It is not mandatory to pay taxes until the individual reaches the predetermined tax slab. Income tax is a part of the government’s revenue used to spend on public services or utilities. The income is used only for the good of the public within the specified boundaries

(Source: Investopedia.com)

Key Income Tax Statistics (Editor’s Choice)

- As of 2023, countries with zero Income tax are the United Arab Emirates, the Bahamas, Monaco, Kuwait, Nauru, the Cayman Islands, and Bermuda.

- Ivory Coast has(60%) personal income tax. The country ranks first in the list of highest-income tax countries.

- As of 2023, around the world, the highest income taxes rate is experienced by Europe.

- The highest Income tax rates of Denmark, France, and Belgium are 46.34%, 45.4%, and 42.92% respectively.

- The lowest rates of income tax in Iraq and Kuwait are 1% and 1.4% respectively.

- If income tax is not paid, then the entity or the individual has to pay a high amount of penalties.

- The United States of America has different slabs according to their status. Such as individual taxpayers, married taxpayers who pay jointly, the head of the house who pays tax solely, and married taxpayers paying separately.

- Apart from all other countries, India has a very considerate amount of tax rate where a person who has less income under 2,50,000 does not have to pay any taxes.

- In the year 2022-2023, individuals who paid taxes filed around 74 million tax returns.

- In the year 2019, individuals with the highest income paid the highest income tax.

- Taxpayers have paid 97% of individual income tax in the list of top 50.

- On the other hand, the remaining 50% paid 3%.

- In India, Akshay Kumar who is a Bollywood actor is announced as the highest tax-paying individual.

- In 2023, Wyoming ranked 1st in the list for The State Tax Business Climate Index for having the best business climate in the United States of America.

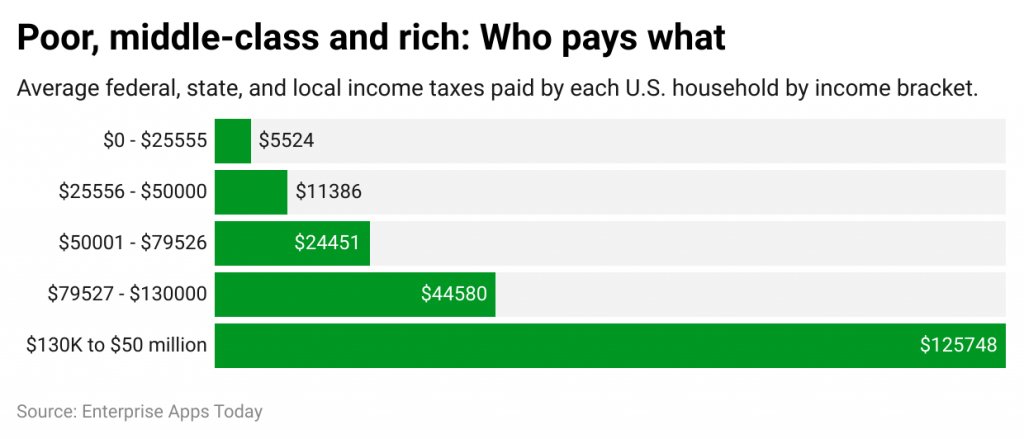

Who Pays Most Income Tax in The USA by Income Bracket

(Source: cbsnews.com)

In the United States of America, households with income between $130k to $50 million are the highest income taxpayers. On average, an individual pays $24,451 tax for having an income between $50,001 to $79,526.

Income Tax: The Good Side

As there are two sides to every coin, every factor in this world has a good and bad side. People in the world tend to avoid paying taxes by saying, why give hard-earned money to the government? But in reality, the government has a lot of things to offer by spending such an amount on the development of the country. Following are some good sides of income tax. (Source: OkCredit)

- When any individual or any business entity pays the tax, they are registered under the government with unique identification numbers. This increases the identity as an authorized person or authorized identity.

- While traveling abroad, visa application centers ask for such documents to verify identity as well as income proof. If no such documents are present then, the visa is denied

- If a person is in need of a loan and has a habit of regularly paying income tax, his loan is approved on a speedy basis

- The government can develop the country using this money

- Many schemes are launched under-saving income by means of income tax

- Acts as a source of income for the government

Income Tax: The Bad Side

- If income tax is not paid, then the entity or the individual has to pay a high amount of penalties

- It creates a bad image of government if the government doesn’t provide utilities with the same money

- Having a high level of tax rates may affect people’s minds to save money

Types Of Taxes

There are various types of taxes around the world. Everyone has to pay some amount of taxes in their life. Anyone does not have to all types of income taxes only a few individuals or business entities will be paying according to the activity they are doing. (Source: Tax Foundation)

- Corporate income tax paid to the government is a case of profits from business or revenues minus costs.

- Individual income tax is paid when the individual sits under the bracket for salaries, wages, and other types of incomes

- Capital gain tax is paid when owned assets are used for personal benefits for reasons such as bonds, homes, personal reasons, investments, and jewelry.

- Gross receipt tax is paid on the company’s total sales irrespective of profits without any deduction

- Sales tax is paid on the basis of the sale of goods and services.

- VAT (Value added Tax) is paid on the values added in the production of goods and services.

- Excise tax is paid when things such as alcohol, soda, gasoline, cigarettes, and betting are consumed on a broader aspect.

- Property tax is paid on owned assets that are not movable like buildings, land, and houses

- Inheritance tax is paid when a person receives property from their inherited family members at the time of death.

Tax Percentage Around The World According To The Type

There are barely a few countries that do not charge any tax on the hard-earned income of their residents. Few countries have high taxes and few with minor percentages. Following is the list of countries having different percentiles. (Source: World Population Review)

Top 10 Countries with High Corporate Taxes

- Comoros (50%)

- Argentina, Chad, Cuba, Equatorial Guinea, and Guinea (35%)

- Brazil (34%)

- Bangladesh (32.5%)

- Benin, Central African Republic, Costa Rica, Democratic Republic of the Congo, El Salvador, Ethiopia, and India (30%)

- Colombia (31%)

- France (28.41%)

- Canada (26.47%)

- Bhutan, Bolivia, Belgium, Austria, and Angola (25%)

On the other hand, Bahrain, Vanuatu, and Bermuda do not have any corporate taxes payable.

Top 10 Countries With High Personal Income Tax

- Ivory Coast (60%)

- Finland (56.95%)

- Japan (55.95%)

- Denmark (55.00%)

- Austria (55.00%)

- Sweden (52.90%)

- Aruba (52.00%)

- Belgium, Slovenia, and Israel (50.00%)

Top 10 Countries With High Sales Tax

- Bhutan (50%)

- Hungary (27%)

- Croatia, Norway, Denmark, and Sweden, (25%)

- Finland, Greece (24%)

- Iceland, Portugal, and Poland (23%)

Tax havens are a term called for allowing foreign inventors to invest in another country. Following are the top 10 tax havens; Luxembourg, Ireland, Jersey, Cayman, Island of Man, Bermuda, Monaco, Mauritius, Bahamas, and Switzerland.

Countries With Zero Income Tax

The United Arab Emirates, the Bahamas, Monaco, and Bermuda

Taxable Income Tax Slabs/Brackets By Country

Slabs or brackets are the differentiation of the payable tax based on the income which varies from country to country. (Source: Worldwide Tax Summaries Online – PwC)

#1. United States of America

The United States of America has different slabs according to their status. Such as individual taxpayers, married taxpayers who pay jointly, the head of the house who pays tax solely, and married taxpayers paying separately.

Single Taxpayers

| Taxable income | Taxes owed |

| $11,000 or less | 10% of the taxable income |

| $11,001 to $44,725 | $1,100 plus 12% of the amount over $11,000 |

| $44,726 to $95,375 | $5,147 plus 22% of the amount over $44,725 |

| $95,376 to $182,100 | $16,290 plus 24% of the amount over $95,375 |

| $182,101 to $231,250 | $37,104 plus 32% of the amount over $182,100 |

| $231,251 to $578,125 | $52,832 plus 35% of the amount over $231,250 |

| $578,126 or more | $174,238.25 plus 37% of the amount over $578,125 |

A person who is single is eligible to pay 10% of their income to the government when the individual earns $0 to $11,000. Furthermore, the range increases when the income ratio is $11,001 to $44,725. The above table explains until the maximum amount of income is reached under a single taxpayer.

Married Taxpayers Filing Jointly

| Taxable income ▲ | Taxes owed |

| $190,751 to $364,200 | $32,580 plus 24% of the amount over $190,750 |

| $22,000 or less | 10% of the taxable income |

| $22,001 to $89,450 | $2,200 plus 12% of the amount over $22,000 |

| $364,201 to $462,500 | $74,208 plus 32% of the amount over $364,200 |

| $462,501 to $693,750 | $105,664 plus 35% of the amount over $462,500 |

| $693,751 or more | $186,601.50 plus 37% of the amount over $693,750 |

| $89,451 to $190,750 | $10,294 plus 22% of the amount over $89,450 |

When the individual is married the taxable income is jointly counted when both the married persons are paying the tax. The above table has surfaced the income tax brackets information.

A married person, whose spouse is jointly filling the returns and has more than $693,751 and more income early is supposed to pay taxes around 37%.

Married Taxpayers Filing Separately

On the other hand, when the person is married but only one individual out of two is earning then he/she is liable to pay according to the above tax rates. These rates are quite similar to the slabs with single taxpayers. On the other hand, when married couples pay income tax separately, with an income level of $323,926 and more are also supposed to pay 37%.

#2. United Kingdom

The United Kingdom does not have any kinds of tax brackets such as the United States of America. The taxes are simply counted on the following income without any subcategories

| 2023/24 | Rate | Bracket | Rate |

| Personal

allowance |

0% | £0 to £12,570 | 0% |

| Basic | 20% | £12,571 to £50,270 | 20% |

| Higher | 40% | £50,271 to £125,140 | 40% |

| Additional | 45% | Over £125,140 | 45% |

#3. Canada

On the contrary, Canada has an income tax slab according to its province. The rate of tax differs by province. The following table explains the differences between the rates of taxable income.

Federal Taxes An Attribute.

| Federal taxable income (CAD*) | Tax on the first column (CAD) | Tax on excess(%) | |

|---|---|---|---|

| cover | Not cover | ||

| 0 | 50,197 | 0 | 15.0 |

| 50,197 | 100,392 | 7,530 | 20.5 |

| 100,392 | 155,625 | 17,820 | 26.0 |

| 155,625 | 221,708 | 32,180 | 29.0 |

| 221,708 | 51,344 | 33.0 | |

Taxable Brackets According To The Province

| Recipient | Provincial/territorial tax | Provincial/territorial surtax | |||

|---|---|---|---|---|---|

| Top rate(%) | Taxable income (CAD) | Rate(%) | Threshold (CAD) | ||

| Alberta | 15.0 | 314,928 | N/A | N/A | |

| British Columbia | 20.5 | 227,091 | N/A | N/A | |

| Manitoba | 17.4 | 74,416 | N/A | N/A | |

| New Brunswick | 20.3 | 166,280 | N/A | N/A | |

| Newfoundland and Labrador | 21.8 | 1,000,000 | N/A | N/A | |

| Northwest Territories | 14.05 | 147,826 | N/A | N/A | |

| Nova Scotia | 21.0 | 150,000 | N/A | N/A | |

| Nunavut | 11.5 | 155,625 | N/A | N/A | |

| ontario | 13.16 | 220,000 | 20 and 56 | 4,991 and 6,387 | |

| Prince Edward Island | 16.7 | 63,969 | 10 | 12,500 | |

| Quebec(1) | 25.75 | 112,655 | N/A | N/A | |

| Saskatchewan | 14.5 | 136,638 | N/A | N/A | |

| Yukon | 15.0 | 500,000 | N/A | N/A | |

| Non-resident | 15.84(2) | 221,708 | N/A | N/A | |

#4. India

Apart from all other countries, India has a very considerate amount of tax rate where a person who has less income under 2,50,000 does not have to pay any taxes. The following table shows the structures of slabs of income tax in India. People in India are extremely happy with this kind of slab because they have eventually a low level of income and sometimes can’t afford to pay any kind of tax to the government.

The majority of the people are earning up to 2,50,000 or below.

| Income Tax Slab | Income Tax Rate |

| Up to Rs.3 lakh | Nil |

| Rs.3 lakh – Rs.6 lakh | 5% |

| Rs.6 lakh – Rs.9 lakh | 10% |

| Rs.9 lakh – Rs.12 lakh | 15% |

| Rs.12 lakh – Rs.15 lakh | 20% |

| Above Rs.15 lakh | 30% |

#5. Germany

Germany has one of the strongest employment hubs the following slabs differ by various factors such as employment, business, agriculture, and many more things

| Income | Tax Rate |

| Less than 10.908 euros | 0% |

| 10.909 – 62.809 euros | 14% to 42% |

| 62.810 – 277.825 euros | 42% |

| More than 277.826 euros | 45% |

Top 3 Highest Corporate Tax-Paying Companies

Not to mention the big corporations performing very well on an international level. There is vast competition in the market, and various types of companies are battling with each other to create a healthy competitive environment. This is causing them to increase production, demand, and therefore sales. This is helping such companies to gain more profits and revenues and they become the top 3 highest tax-paying companies. The list is not tax-wise.

1. Apple

Apple being one of the strongest players in the world manufacturing modern and advanced electronic devices has paid around $16.635 billion dollars in 2023. It is no wonder that, day by day because of the technological advancements in the products and effective marketing strategies apple’s sales are increasing.

2. Reliance Industries Ltd

Reliance being into various types of businesses has paid around Rs. 20,713 Cr in the year 2023. The reliance industry is booming in India due to its network services in all parts of India. Jio is a widely used network service by the majority of people because of its range and cheaper rates.

3. Walmart

Walmart is one of the largest store chains in the United States of America. In the last financial year, it paid around of $6.895 billion in tax by 31st July 2023.

This list of the highest corporate taxpayers changes every now and then and also according to the category of the business. This list is random and can’t be taken for granted. As businesses grow on a daily basis, their number changes often.

Conclusion

As seen in these income tax statistics, every country has its own rules and regulations about all kinds of taxes. It is obvious that the individual who earns more pays the maximum tax compared to a person with a low level of income. It is the duty of the residents in every country and businesses according to the legal boundaries to pay taxes to the governments.

The majority of the people who do fail to pay income tax should be compensated for paying the taxes so that the habit will be improved. Income taxes are a great revenue for the government to increase the infrastructure and bring changes to the country. Today, the world is about technological developments where a huge number of investments are necessary. Moreover, maintaining such technology is also at a costly level. Therefore, it is our duty to support our country’s government to develop the country.

Sources

Michael Singer is a career coach, podcast host, and author to help you step into a career you're excited about. Currently, He is a coach and trainer helping entrepreneurs and executives achieve business and leadership success. He is also an award-winning business journalist focused on the intersection of technology, Big Data, Cloud, SaaS, SAP, and other trending technology.