Average Labour Cost Statistics – By Country, Demographics, Hours, Sectors

Page Contents

- Introduction

- Editor’s Choice

- What is Labour Cost?

- General Labour Cost Statistics

- Average Labour Cost

- Average Labour Cost Statistics by Country

- Average Labour Cost Statistics by Hours

- Average Labour Cost Statistics by Demographic

- Average Labour Cost Statistics by Sectors

- Impact of Labour Cost on Economy Statistics

- Future of Labour Cost Statistics

- Bottom line

Introduction

Labour Cost Statistics: Labour cost statistics provide companies and organizations with information regarding costs incurred as a result of employing personnel, including employee pay and salaries as well as expenses such as social security contributions, benefits, taxes etc. Labour cost figures serve many functions; they may help organizations make budgetary, personnel and compensation choices while giving policymakers insights into labour market trends.

Statistics on labour costs; are typically collected by; national statistical organizations and can be broken down by industry; profession and other variables. They're often combined with other indicators to gain a fuller picture of economic health such as productivity and inflation rates.

Editor’s Choice

- Argentina, Egypt, Philippines, Lithuania, Russia India Brazil Uruguay Ukraine South Africa are among those nations with significant increases in labour cost index in 2021 as compared with 2020.

- India experienced an increase of 6.6% compared to last year and witnessed 55% annualized growth between 2010-2021.

- Ireland was home to some of the lowest labour cost indices in 2021, followed by Greece, Cyprus, Japan, Switzerland, Spain, Croatia, Italy Denmark France as some of the others with low labour cost indices.

- Wages and salaries saw increases of 5 per cent year-on-year between March 2023 and 2022, as measured by wage gains.

- Quarter II 2022 saw an 8.055% increase in adjusted hourly labour cost (working days adjusted) when compared with quarter I 2022.

- Quarter II 2022 experienced an 11.67% increase in hourly labour cost (working days adjusted).

(Referenxe: statista.com)

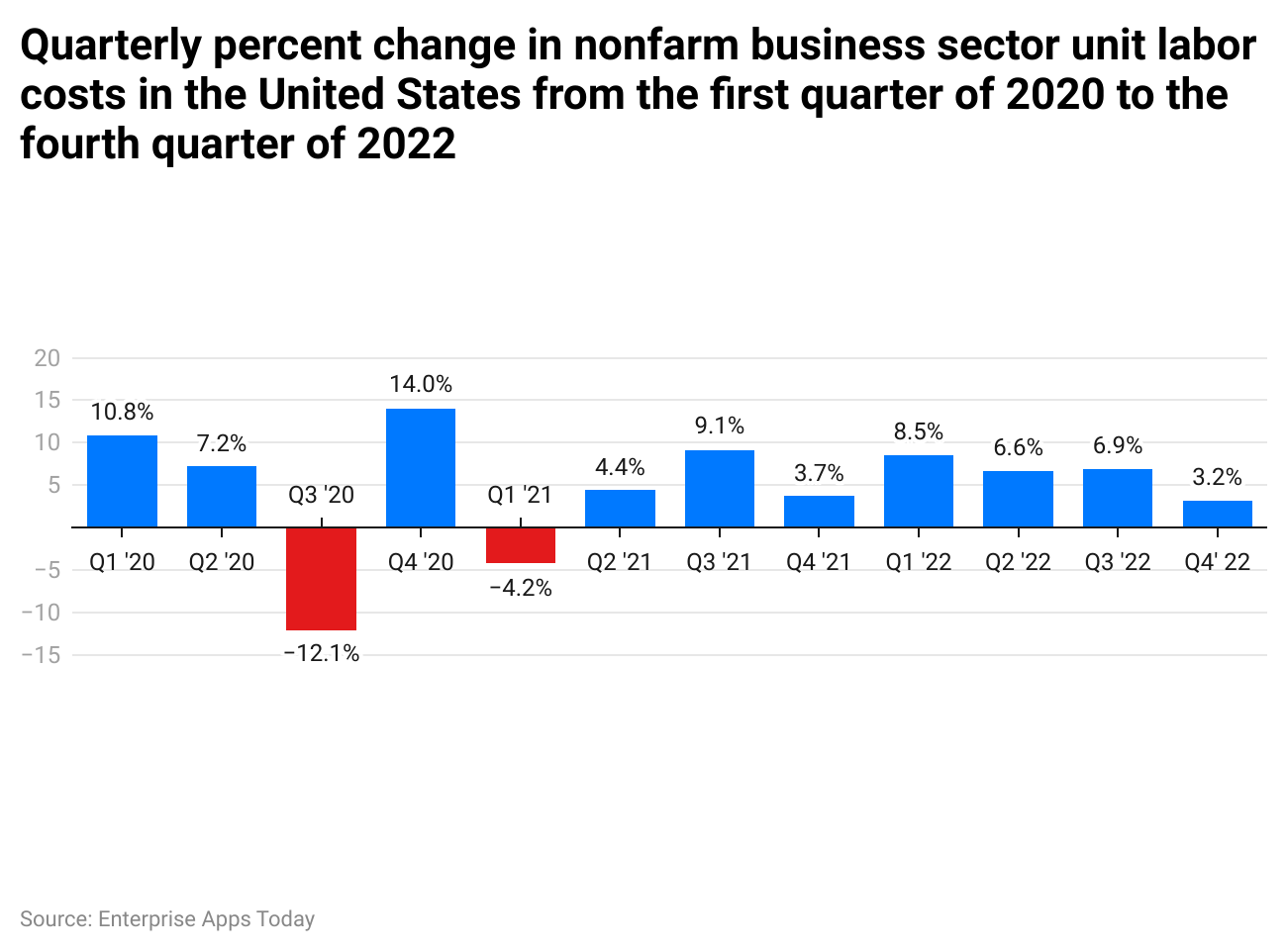

Unit labour expenses in the nonfarm business sector of the US rose 3.2% year-on-year during the fourth quarter, seasonally adjusted, as compared with the third quarter. Unit labour costs provide an indication of producer inflationary pressure as hourly pay raises lead to increased unit labour costs; while increasing productivity balance compensation increases and thus decreases unit labour costs.

What is Labour Cost?

Costs for labour refer to expenses paid by companies and other organizations for employee expenses, such as salary and wages along with tax benefits, benefits and social security benefits for every employee. Costs for labour could be among the most significant expenses for companies operating in certain industries, such as construction, manufacturing, and healthcare. Controlling the costs is often one of their primary goals in the quest to remain successful and compete.

The cost of labour includes indirect costs such as healthcare benefits retirement contributions, and taxes, in addition to direct compensation such as salaries and wages

Costs can differ considerably depending on variables like the workforce size, type of business activity conducted in an organization and current regulatory environments – for instance, the overall labour cost per hour worked, total labour costs per employee as well as total labour as a proportion of sales or profits are ways of measuring these expenditures; using such indicators helps companies understand how spending impacts their bottom line as well as potential cost-cutting measures

The cost of labour is not only significant to companies; economists and politicians also find it paramount. Labour costs have an outsized influence on employment levels, inflation levels, and total economic growth; high labour costs may lead to decreased corporate competitiveness while low labour costs may result in reduced pay or decreased consumer demand – making labour costs an essential element of modern economies that must not be overlooked.

General Labour Cost Statistics

Statistics on labour costs provide a complete picture of the expenses that firms and organizations incur due to staff. They often include pay, benefits and employment-related taxes as components.

- Hourly labour costs: These expenses refer to how much is paid out per hour to workers in various European Union member states, with Denmark, Luxembourg and Belgium having among the highest hourly labour costs and Bulgaria, Romania and Latvia having among the lowest costs per hour of labour.

- Labour cost per employee refers to the total expense associated with employing one individual, typically estimated in the United States as approximately $35 an hour – comprising wages and compensation expenses comprising approximately 70% of this expense.

- Labour cost as a percentage of revenue measures the proportion of revenue that goes toward labour expenses, with service industries like healthcare and education having higher labour expenses compared with manufacturing sectors.

- Labour productivity measures the output produced for every hour of labour spent by companies, with increased labour productivity enabling companies to produce more output with equal labour input, thus offsetting rising expenses associated with this expense.

- Minimum wages refers to the lowest wage that companies are legally obliged to pay their employees; there may be significant regional variations and some nations have no minimum wage at all. Although several US states and localities offer greater minimum wages, the federal minimum wage now stands at $7.25 an hour.

- Gender Salary Gap: The gender wage gap refers to the pay disparity between males and females for equal labour performed, with many nations paying female workers less. The extent of the gender wage gap depends on factors like nationality and sector.

- Index of Labour Expenses: This metric tracks variation in labour costs over time, providing organizations and decision-makers with valuable insight into labour cost patterns for wise decision-making on employment levels, pay, and other workforce issues.

Average Labour Cost

Statistics on average labour costs can differ significantly based on variables like region, industry and occupation; yet patterns may still be visible across various settings and sectors.

- Average hourly pay refers to the total compensation given per hour of labour performed. According to the Bureau of Labor Statistics, this figure averages approximately $28 in all industries of the United States; however, hourly wages can differ significantly depending on your industry or profession.

- Average Annual Salary: The annual salary refers to all wages received in one year by workers in any given job or career field, estimated by the Bureau of Labor Statistics as being approximately $56,000; however, incomes can differ significantly depending on business and career choices, just like hourly pay does.

- Total labour costs per hour represent the full expense associated with hiring workers per hour of work, including wages, benefits and taxes. According to Eurostat's estimates, the hourly total labour cost in Europe averages out at around EUR28; this figure may differ between nations as some have higher or lower expenses associated with labour than others.

- Labour costs associated with hiring one individual for one year include salaries, benefits and taxes; according to the Bureau of Labor Statistics estimates, hourly labour costs average approximately $35 in the U.S.

- Average labour cost as a per cent of revenue: This statistic depicts what share of total revenue is spent on labour expenditures, such as payroll. Labour expenses as a per cent of revenue range widely by industry in the US from approximately 10% in manufacturing to more than 60% for healthcare and social assistance services.

- Average productivity: The amount of work performed by each employee is known as average productivity. An increase in productivity allows organizations to produce more output with equal labour input, which can offset increased expenses. Average labour productivity across different industries differs significantly; some industries, like manufacturing, can be far more productive.

Average Labour Cost Statistics by Country

(Reference: statista.com)

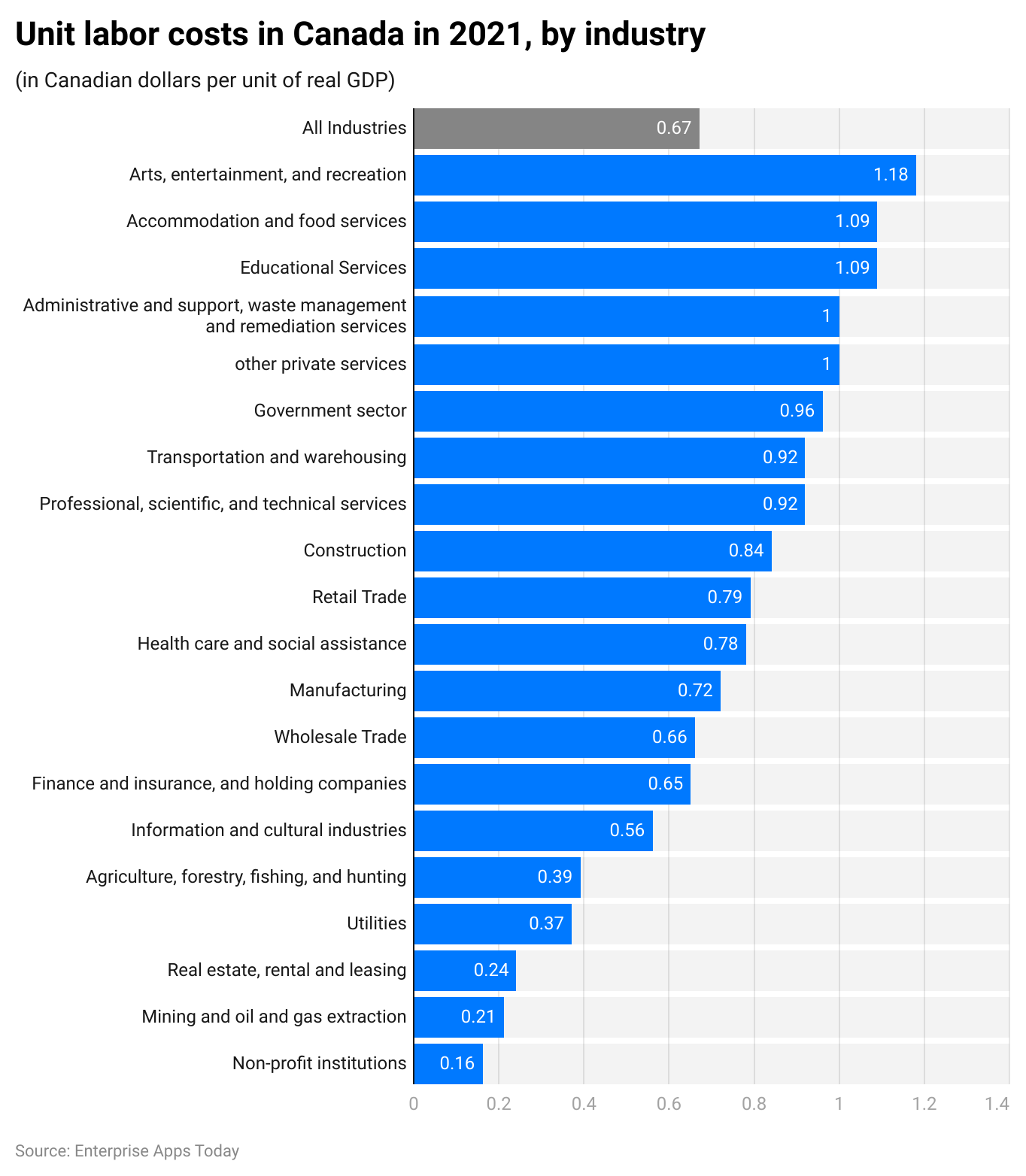

This statistic; showcases Canadian unit labour expenses in 2021 by industry. Construction sector; unit labour expenses totalled 0.84 Canadian dollars per real GDP unit in 2021.

Due to variations in wages, benefits, taxes and other considerations, labour cost numbers vary considerably between nations and regions.

- United States: According to the Bureau of Labor Statistics, hourly pay across industries in the US averages about $28 across industries and the annual wage is roughly $56,000 with benefits and taxes contributing an hourly labour cost per employee of around $35 an hour.

- European Union: Within the European Union, hourly labour prices vary considerably across national boundaries. According to Eurostat's estimates for 2020, Denmark, Luxembourg and Belgium had among the highest hourly labour expenses (averaging EUR46.8) per hour while Bulgaria Romania and Latvia experienced some of the lowest costs at only EUR6.0 on average per hour total labour cost for labour costs across Europe as an entire entity. On average total labour cost averaged out to around EUR28 an hour across all national boundaries combined.

- Statistics Canada reports the average hourly pay in Canada as being approximately CAD 27 across industries and the typical annual wage is roughly 55,000; on average an employee costs about CAD 39 per hour in terms of pay, benefits, and taxes.

- Japan: According to the Ministry of Health, Labour, and Welfare, Japan's average hourly pay across industries is about JPY 2,200; annual wages average approximately JPY 4.5 million with the hourly labour cost per employee amounting to approximately JPY 3,200 per hour of labour cost per employee including pay, benefits, taxes etc.

- Australia: According to the Australian Bureau of Statistics, Australia offers an hourly wage average of approximately AUD 29 across industries and an annual compensation package that amounts to roughly AUD 60,000; when salaries, benefits, and taxes are taken into consideration, hourly labour cost per employee amounts to roughly AUD 41 per hour worked.

- China: According to China's National Bureau of Statistics, hourly pay in China averages CNY 32 across all industries and an annual salary of approximately 70,000 CNY is typical. When combined with benefits and taxes, labour costs per employee average CNY 44 an hour on average.

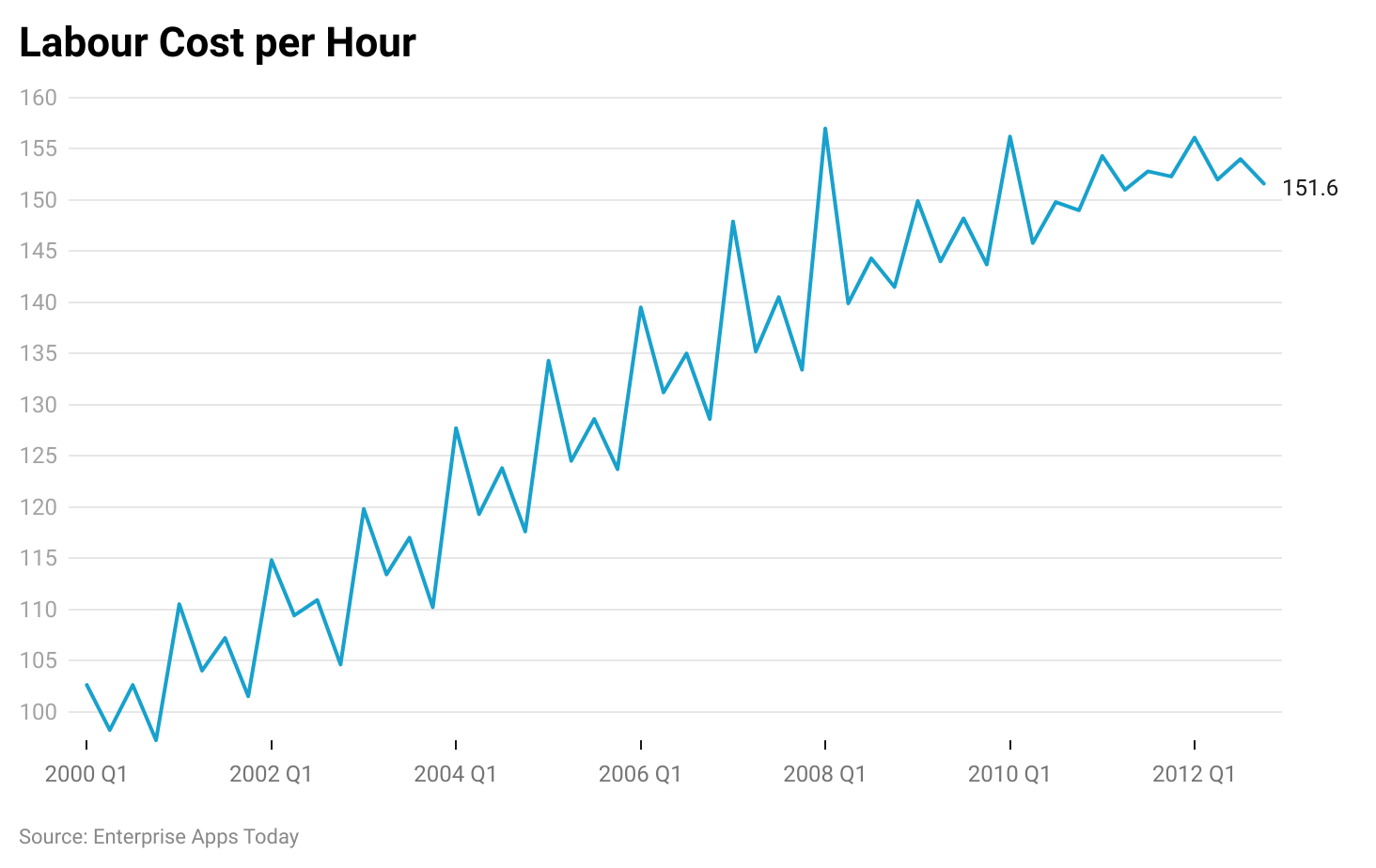

Average Labour Cost Statistics by Hours

(Reference: economicshelp.org)

Due to variations in labour costs depending on whether an employee works full or part-time, average labour cost data can also be examined by hours worked.

- Average Costs of Part-time Employment: Part-time workers often put in less than 35 hours each week and typically have lower labour expenses than full-time workers, according to the Bureau of Labor Statistics. Their hourly pay averages about $15 across industries while, when taken together with benefits and taxes, the total part-time labour cost per worker averages about $26 an hour.

- Average Full-time Labor Cost: Due to perks and taxes associated with full-time employment, full-time employees tend to work 35+ hours each week, often exceeding part-time employees in terms of labour costs. According to the Bureau of Labor Statistics, full-time workers in the United States tend to make roughly $30 an hour across industries; pay, benefits and taxes bring the hourly total up to around $39 an employee hour for full-time workers in this category.

- Average overtime labour cost: Overtime refers to hours worked beyond an employee's regular workweek of forty hours, in addition to any overtime pay rates or other considerations, which may increase its price relative to regular hours. According to the Bureau of Labor Statistics, overtime pay rates average around $42 per hour across industries in the US while total employee costs, including pay, benefits and taxes total $53 per hour on average for overtime labor costs.

- Double-time labour refers to hours worked at two times the regular hourly rate, typically on holidays or other exceptional cases, at twice their hourly rate. Double time can be much more costly than standard hours or overtime work; according to the Bureau of Labor Statistics, average double-time pay in the United States across industries averages $56 per hour while employee costs associated with working double time total roughly $67 an hour.

- Flexible work arrangements usually consist of job sharing, telecommuting and reduced workweeks – with any of these potentially impacting work-life balance, productivity and labour costs in significant ways. Research by the International Labour Organization has revealed how flexible working arrangements have enhanced productivity by up to 30% while decreasing labour expenses by as much as 20%.

Average Labour Cost Statistics by Demographic

Statistics on labour costs can differ significantly based on the demographics of your workforce; such as their age; gender, education level and race/ethnicity.

- Age: The hourly pay of workers aged 16-19 averages approximately $11; while that of individuals 25 to 54 is around $26 and that for 55+ is $23. These figures suggest that younger workers typically make less money due to less training and expertise.

- Gender: According to the Bureau of Labor Statistics; women typically earn an hourly wage of about $22 while their male counterparts receive approximately $27 an hour on average. This longstanding gender wage gap may be caused by discrimination; discrepancies in education and experience levels between genders; or occupational segregation – though women tend to work part-time and in lower-paying occupations than males despite wage discrepancies.

- Education: Workers with no higher than a high school diploma earn approximately an hourly income of roughly $18, while those holding bachelor's degrees or above earn over $36 an hour, suggesting greater levels of education lead to increased wages; however, employees should take note that education costs continue to escalate at an exponential pace and are carrying significant student debt burdens as a result.

- Race/Ethnicity: According to the Bureau of Labor Statistics, white employees average an hourly wage of approximately $28, while black and Hispanic/Latino employees earn an hourly pay of roughly $21 and $20 respectively. Accordingly, these numbers illustrate large racial and ethnic salary disparities likely caused by prejudice, disparate training experiences or occupational segregation; workers of colour may also be more likely to work low-paying unstable occupations that contribute further to an existing wage gap.

- Disability: According to the Bureau of Labor Statistics, people with disabilities receive an hourly wage that averages approximately $18 in comparison with $27 for people without impairments, suggesting there may be discriminatory practices and barriers preventing workers from getting education and training opportunities.

- Immigration Status: According to the National Immigration Forum, undocumented employees generally make an hourly wage of approximately $10 while legal immigrants typically receive an hourly wage of around $18 per hour – this disparity is likely due to precarious employment situations without access to legal safeguards for protection.

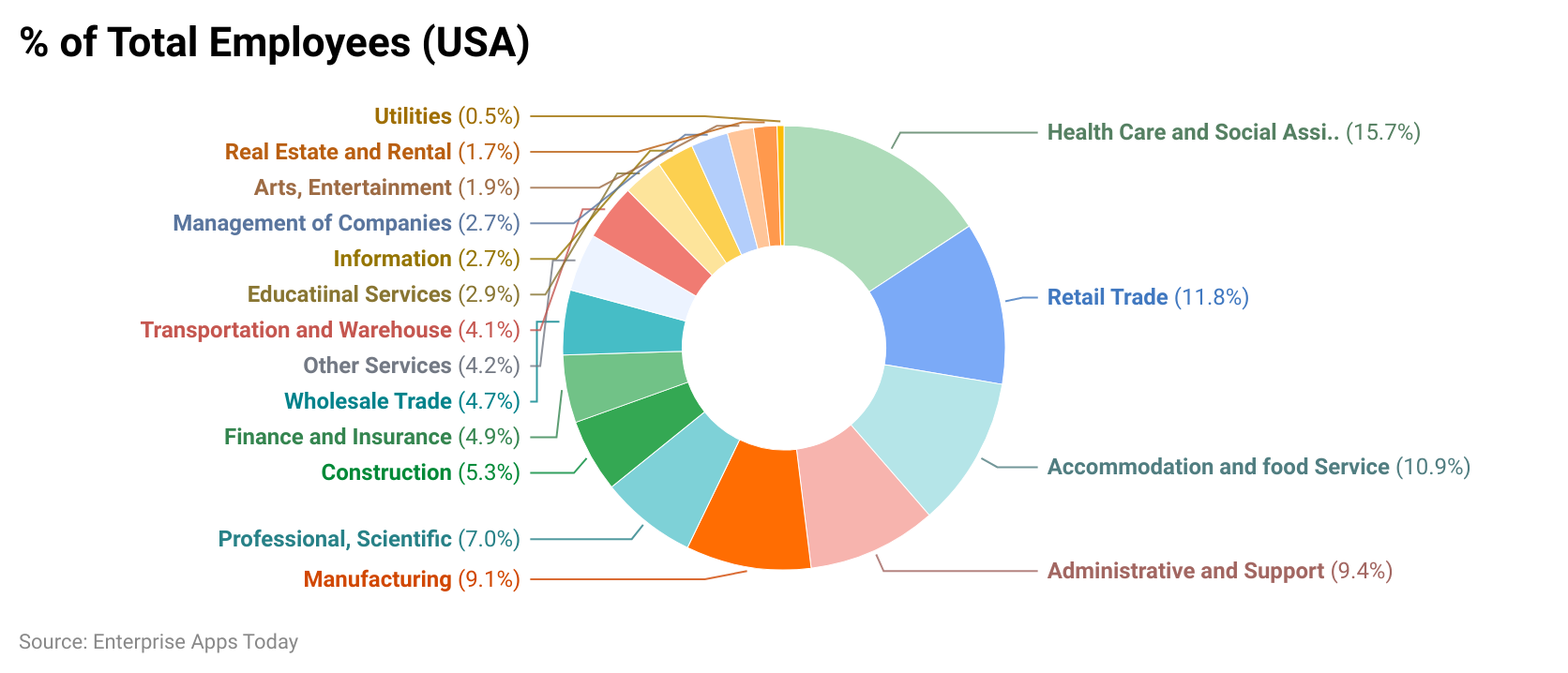

Average Labour Cost Statistics by Sectors

Labour cost figures can differ considerably between industries, with certain offering higher wages and benefits than others.

(Reference: statista.com)

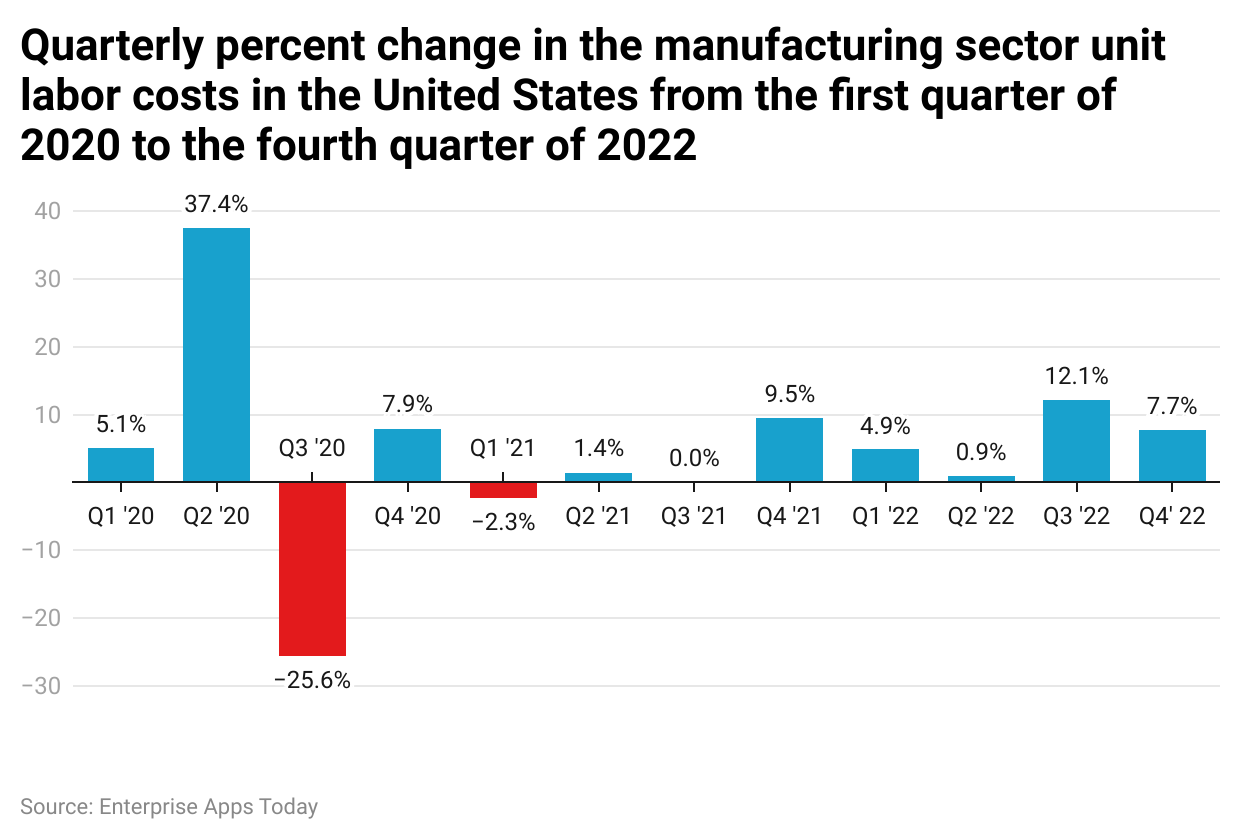

In the fourth quarter of 2022, unit labour expenses in the US manufacturing sector increased by 7.7 per cent year-on-year at seasonally adjusted annual rates. Unit labour costs serve as an indicator of producer inflationary pressure; when hourly pay rises significantly so do unit labour costs; however advances in productivity balance compensation increases and bring down unit labour costs accordingly.

- Manufacturing: According to the Bureau of Labor Statistics, hourly wages across all manufacturing industries average approximately $22. When combined with pay, benefits, and taxes for employees in this industry, typical labour costs per hour range between $29-30; manufacturing tends to incur greater labour expenses due to its technical requirements and training requirements for some professions within this field.

- Retail: According to the Bureau of Labor Statistics, retail sector average hourly pay averages $15 across industries, when considering pay, benefits and taxes included; with such costs totalling approximately $22 an hour; however due to a greater presence of part-time and lower-paying jobs this sector typically sees lower labour costs than others.

- Healthcare: According to the Bureau of Labor Statistics, average hourly salaries across all industries in healthcare range between $31 and $41. Average labour costs per employee total around $41, including salaries, benefits and taxes. Due to extensive education requirements for many positions as well as increased demand for healthcare services this industry often experiences higher labour costs than other industries.

- Construction: According to the Bureau of Labor Statistics, average hourly pay in construction industries averages $25 and hourly labour cost per employee includes pay, benefits, and taxes equaling around $32. Given its highly physical nature and potential hazards associated with many operations within construction operations, this industry often incurs greater labour expenses.

- Information Technology: According to the Bureau of Labor Statistics, hourly pay in all information technology occupations averages $42, with benefits and taxes comprising an employee's labour cost per hour averaging around $57 an hour – as these occupations usually demand high degrees of technical competence and knowledge this industry often has greater labour expenses.

- Education: According to the Bureau of Labor Statistics, hourly salaries across industries in the education sector average $24 hourly salaries across all industries in this industry and the hourly labour cost per employee is around $31. Given the extensive training necessary for many education occupations as well as the high demand for educational services this industry often has higher labour costs.

Impact of Labour Cost on Economy Statistics

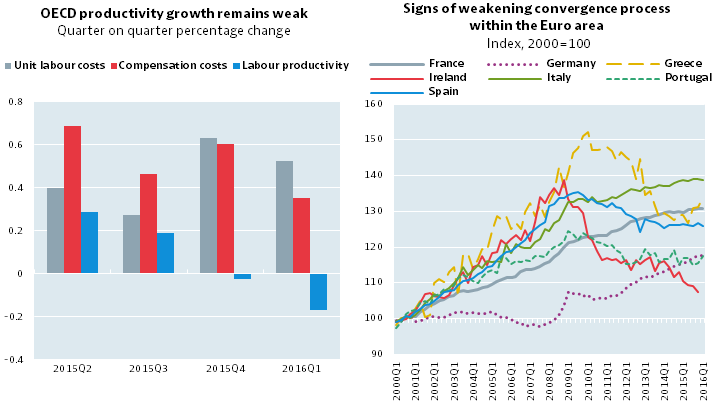

(Reference: wikipedia.org)

Labour costs have an immense influence on our economy

- Inflation: Labour expenditures play an essential role in shaping product and service costs, leading to inflation through rising product pricing due to higher labour expenses. In the US alone, labour expenses make up around two-thirds of total costs and any increase has an immediate effect on the consumer price index (CPI), an indicator of inflation.

- Unemployment: Increased labour expenses have been shown to correlate with greater unemployment rates, as companies attempt to cut costs by hiring less staff or firing existing ones; in some instances, they may outsource work to nations with lower labour costs as a means of mitigating high costs.

- Productivity: Labor costs can have an effect as well, often encouraging businesses to invest in automation and labour-saving technology in order to gradually decrease their labour expenses, leading to both increased productivity and reduced labour expenses over time. This could result in both higher productivity and decreased labour expenses in the long term.

- Income Inequality: Low labour costs could also play a part in driving income inequality. When labour costs drop significantly; employees may find it more challenging to make ends meet and this may exacerbate disparities in income and wealth between groups of workers – for instance; in recent decades, top earners in the U.S. have seen their incomes increase more rapidly than the rest of society.

- Economic Growth: Labour costs also play a pivotal role. Businesses benefiting from lower labour costs may invest more and experience economic expansion; however, too low costs may prevent employees from earning enough to support themselves and expand the economy. Conversely, higher labour costs may encourage businesses to invest in innovative ideas or technology which boost productivity, leading to stronger growth overall.

These figures illustrate the intricate relationship between labour costs and the economy. Higher labour costs may lead to inflation and unemployment, but can also facilitate innovation and productivity growth. Policymakers must strike a delicate balance between protecting employee rights to fair compensation while supporting stability and development in the economy.

Future of Labour Cost Statistics

Future labour cost figures will depend upon numerous variables, such as technological innovation, demographic changes, economic policy decisions and globalization.

- Automaton and Artificial Intelligence: Labour cost statistics could be affected by automation and AI usage in the workplace. Costs could reduce as more tasks are automated; however, there may also be increased demand for experts with technical skills and data analysis abilities.

- Gig Economy: As more individuals engage with the gig economy – which refers to short-term contracts and freelance employment arrangements – its growth may impact labour cost statistics. Calculating expenses accurately could become more challenging as more individuals enter it than traditional employment models.

- Aged Workforce: With populations becoming older in many nations, labour costs could change as elderly individuals remain active for extended periods, impacting productivity levels, earnings and benefits.

- Globalization: Globalization has already had an immense impact on labour cost statistics, and this trend will only intensify over time. Comparing labour costs across nations may become increasingly challenging as businesses outsource employment to those offering cheaper labour costs.

- Economic Policies: Labour cost figures will continue to be affected by changes to economic policies, such as raising the minimum wage or altering labour regulations. A raise in minimum wages could cause firms to incur increased labour expenses which in turn could impact employment levels.

- As future changes; bring with them many factors affecting labour cost statistics; it will be essential to closely observe; and assess their development; so as to ascertain their effects on both the economy and employees. Furthermore; new techniques must be created so as to accurately represent how work changes as workforce sizes expand or contract over time.

Bottom line

Labour costs are an integral component of our economy that have an effect on individuals, businesses and governments alike. They influence productivity levels, inflation rates, income inequality, employment levels and national demographics – often fluctuating greatly from nation to nation or industry to industry and demographic. Future labour cost statistics will depend on factors like technological advancements, economic policies implemented locally or globalization among others. Politicians must factor the impact of labour costs into decisions concerning minimum wages, labour regulations and economic policies. Policymakers must strike a balance between providing fair salaries to employees while still maintaining company profitability so as to promote economic development and stability.

As employment dynamics change due to the gig economy and automation, new methods must be created for accurately tracking and assessing labour expenses. This will make it easier for decision-makers, employers, and employees alike to adapt to the evolving workplace environment. Labour costs are multidimensional issues that warrant careful study – they have an immense effect on people, communities, and economies around the world.

Sources

FAQ.

Employee remuneration (such as wages, salary in cash and kind, employers' social security contributions and additional expenses such as vocational training costs and extra costs such as hiring fees or charges for work attire can all be considered labour costs; any subsidies received would reduce this total amount.

A semi-variable cost refers to costs which have both fixed costs and variable costs that fluctuate with output changes; variable expenses change with output increases/decreases while fixed expenses stay the same regardless of output growth/decline.

Period expenses, which encompass indirect worker costs such as rent, interest payments on loans taken out by companies and advertising expenses are considered period costs.

Labour cost refers to any expenses related to labour. As labour is an integral component of manufacturing processes, therefore its expense becomes an essential element in producing goods or services. Therefore, labour costs represent money spent hiring staff members for manufacturing operations.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.