Money Laundering Statistics By Country, Demographic, Issues and Causes

Page Contents

- Introduction

- Editor’s Choice

- What is Money Laundering?

- General Money Laundering Statistics

- Money Laundering By Country

- Money Laundering Statistics By Demographic

- US Money Laundering Statistics

- Crypto vs Fait Money Laundering Statistics

- Issues and Causes of Money Laundering

- Money Laundering- Trends and Predictions

- Final Words

Introduction

Money Laundering Statistics: Global financial systems are under attack from money laundering, with its consequences reaching as far as banks, shell businesses, and virtual currencies. Money laundering statistics highlight its scope and effects – alarming figures show trillions are laundered annually, constituting a sizeable portion of global GDP! As its source remains hidden behind multiple channels like banks, shell businesses, or virtual currencies it remains hard to trace its source; furthermore, its serious repercussions include undermining economic stability while aiding organized crime groups or funding terrorism financing networks.

Financial institutions and regulatory agencies worldwide are tirelessly fighting against money laundering through heightened due diligence, international collaboration, and the implementation of effective anti-money laundering measures. However, combating this global menace requires persistent surveillance and coordination due to the ever-changing tactics used in money laundering.

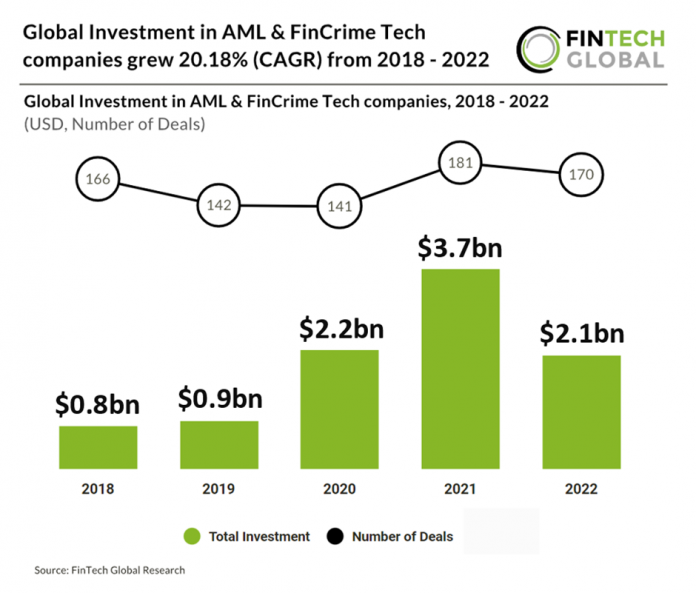

(Source: fintech.global)

Editor’s Choice

- The United States is home to an annual fraud volume exceeding $300 billion.

- Every year; thieves across the globe launder an estimated annual total of between $800 million and $2 trillion through fraudulent practices.

- Global banks were penalized $10.4 billion for money-laundering offenses in 2022 alone.

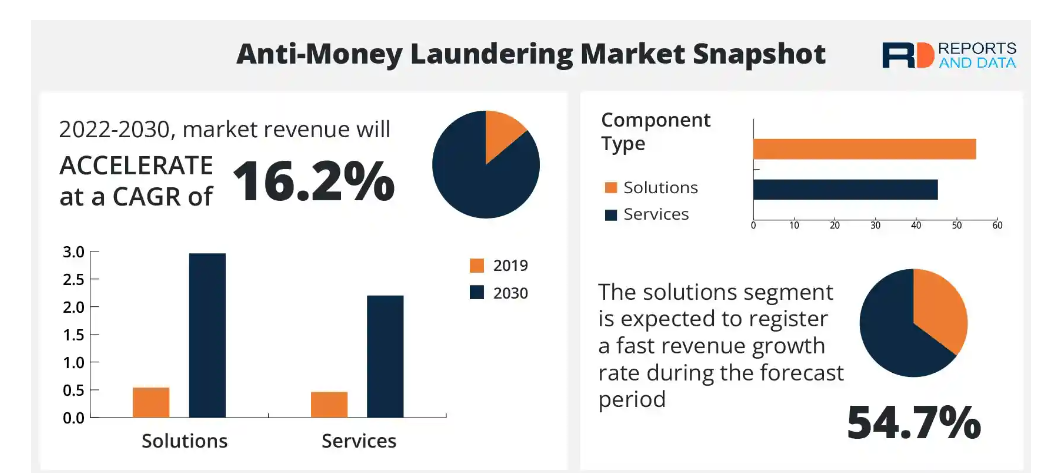

- By 2023; it is projected that sales of anti-money laundering software would reach $1.77 billion.

- Identity theft has become a prominent trend in money laundering.

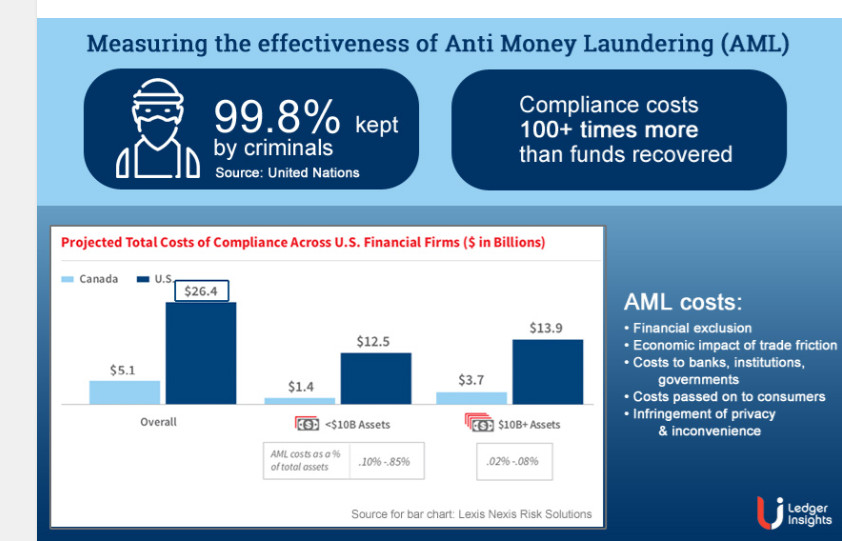

- Anti-money laundering efforts recover only 0.1% of illicit funds.

- Money laundering costs range between 2% and 5% of global GDP.

- Three steps are involved in money laundering. With repeated anti-money laundering violations at Standard Chartered Bank, their practices continue to garner widespread scrutiny.

(Source: reportsanddata.com)

What is Money Laundering?

Money washing, the act of making illegally obtained funds look legal or lawful, is known as money laundering. This involves concealing their source, which often comes from illegal operations like drug trafficking, corruption, and selling of weapons illegally obtained. By concealing illicit funds inside legal financial systems it becomes harder for law enforcement officials to trace these illicit sources and identify criminals involved in these illicit operations.

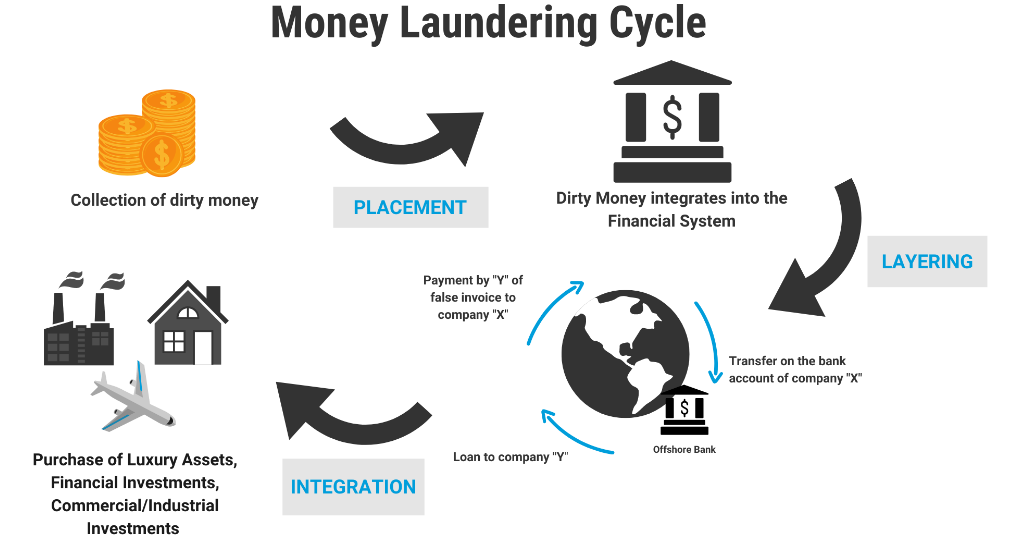

Money laundering typically entails three phases: placement, layering, and integration.

- Position: Next comes insertion into the financial system of illegal funds. Criminals often attempt to dilute large sums of cash into smaller sums that will later be put in bank accounts, used for purchasing assets, or invested legally – with this aim in mind: the covert transference of criminal cash into legal economic activity.

- Layering: Launderers employ various financial transactions in this step to obscure any trace of illegally obtained funds, including transferring them worldwide or offshore, shifting accounts around, or performing operations that make determining where it came from difficult. Layering can make law enforcement efforts harder by isolating illegal monies from their illicit source.

- Integration: After cleaning, money that has been laundered must be integrated back into real economy assets that appear legitimate – such as real estate purchases or designer items bought with stolen money; companies investing in legitimate products may also buy these assets as legitimately-appearing ones – the goal being for money launderers to legalize their wealth without raising suspicion, as this enables them to enjoy the fruits of illegal operations without raising suspicion through merging illicit funds into legitimate assets.

Money laundering has significant repercussions for society and the economy as a whole. It gives criminals an avenue for illegal income, jeopardizes financial institution stability, and restricts fair competition; furthermore, it facilitates financing terrorism or other illegal operations. Governments and financial institutions have implemented various preventative measures against money laundering such as anti-money laundering laws, customer due diligence standards, and international collaboration to share information and monitor suspicious financial activity.

(Source: unodc.org)

General Money Laundering Statistics

Money laundering refers to making illegally obtained funds look legitimate and legal – an issue affecting all countries around the globe. Money laundering can compromise financial systems while aiding illicit activity.

- Due to its covert nature, money laundering can be difficult to quantify internationally. According to estimates by the UN Office on Drugs and Crime (UNODC), global money laundering accounts for between 2-5% of world GDP annually; that translates into billions or even trillions each year.

- Money laundering is closely connected with illegal activities like drug trafficking, organized crime, fraud, corruption, and human trafficking as well as financing for terrorism. Criminals generate large sums from these illicit enterprises which they attempt to blend into the existing financial system by laundering it through money laundering schemes.

- Money laundering occurs globally, but its frequency and methods used may differ based on location. Money laundering rates tend to be highest in nations with inadequate regulatory systems, poor governance practices, or high levels of corruption; high-risk areas have been identified across Asia, Latin America, and Africa.

- Costs associated with financial crime prevention have skyrocketed since 2022.

- From 2021-2025; it is anticipated that the anti-money laundering software market will experience compound annual compound growth of 14%.

- Richmond; Virginia tops the list for the highest white-collar crime rates (7,504 offenses per 10,000 residents).

- Over 90% of money laundering offenses go unreported while 91.1% of perpetrators end up behind bars.

- 15% to 38% of worldwide money laundering occurs in the US.

- As an intermediary of financial transactions, the banking industry is particularly susceptible to money laundering. Banks, investment companies, money service providers, and virtual currencies may all be used for money laundering activities. Recently there has been an increased focus in digital and cryptocurrency industries on combatting money laundering activities.

- Governments and international organizations have taken steps to combat money launderings, such as creating financial intelligence units (FIUs), international cooperation frameworks, and anti-money laundering legislation and regulations; also, there is the Financial Action Task Force (FATF), an international, intergovernmental organization which establishes guidelines and supports AML policies globally.

- Money laundering detection can be challenging, yet authorities have made great strides toward efficiency in their detection methods. Financial intelligence, AML compliance processes, and suspicious transaction reporting have all contributed to an increase in detection rates; prosecution rates remain relatively low when it comes to crimes involving money laundering, however.

- Money laundering has far-reaching social and economic repercussions, from undermining market integrity to encouraging corruption and diminishing confidence in financial institutions. Crime money is often recycled back into crime funds – creating unstable cycles.

- Money laundering techniques are always evolving to take advantage of flaws in the financial system. Authorities now face new problems due to technological breakthroughs like cryptocurrency, internet platforms, and anonymization methods – thus regulatory bodies and law enforcement must adapt and develop cutting-edge techniques in order to keep up.

Money Laundering By Country

Money laundering is a global problem that affects every nation differently. Due to its covert nature, however, accurate statistics on money laundering by nation are difficult to collect; nonetheless, several nations have been identified as being at high risk or engaging in significant money laundering activities.

- United States: As one of the world's largest economies and an established financial center, the United States presents significant obstacles when it comes to combatting money laundering. According to estimates, financial institutions in this nation use their accounts to launder billions annually. FinCEN serves as the main body responsible for combatting this activity while setting stringent anti-money laundering (AML) rules across its jurisdictions.

- Comparative to cryptocurrencies, fiat currencies can be used to launder 400 times more money.

- Financial Crimes Enforcement Network of the US Treasury upholds a barrier of $300,000.

- 95% of the money laundering notifications generated by this system were false positives.

- According to money laundering statistics by nation, Afghanistan stands out as the country most at risk from schemes.

- 30% of money mules under 21 in the UK.

- London in particular has long been seen as a key centre for money laundering within the UK; according to estimates by the National Crime Agency (NCA). Each year; this nation launders hundreds of billions in cash via measures such as the Fifth Money Laundering Directive implementation and Office for Professional Body Anti-Money Laundering Supervision (OPBAS). Both initiatives aim at strengthening Britain's anti-money laundering systems.

- Russia: Money laundering accusations have been leveled against Russia, often in relation to corruption, organized crime, and unauthorized financial flows. This problem has been compounded by its extensive shadow economy and lax regulatory environment; Global Money Integrity's (GFI) research estimates that illegal outflows totaled an estimated total of $97.4 billion over recent years from Russia.

- China: With its rapid economic development and high level of corruption, China is a prime target for money laundering operations. China has taken steps to combat money laundering operations such as creating the China Anti-Money Laundering Monitoring and Analysis Center (CAMLMAC) and tightening AML legislation; however, due to hundreds of billions of dollars estimated as illicit cash leaving the nation, there still remain challenges associated with money laundering operations in China.

- Mexico: Mexico's status as both a transit and final destination for drug trafficking proceeds has long linked it with money laundering activities. Criminal organizations use various techniques, including trade-based money laundering and transaction structuring, to conceal their unlawful assets. Nonetheless, Mexico has strengthened cooperation with foreign partners as well as its anti-money laundering framework to combat money laundering activities.

- Switzerland: For some time now, Switzerland was perceived as an attractive option for illicit money-seekers seeking financial anonymity. Though Switzerland has made great strides toward increasing openness and preventing money laundering, issues remain. According to the Financial Action Task Force (FATF), Swiss legal systems and enforcement of money laundering charges need improvement.

- Offshore Financial Centers: Attracted by attractive tax structures and secrecy regulations, offshore financial centers like the Cayman Islands, British Virgin Islands, and Panama have long been used to launder money. Such jurisdictions often act as cover to hide the true source of funding.

Money Laundering Statistics By Demographic

Money laundering statistics by demographic groupings can be difficult to access due to their inherent secrecy and limited information on those involved. It involves people from diverse backgrounds and communities, and its motivation often lies beyond demographic considerations.

- Money laundering refers to any attempt by people who seek to conceal funds derived illegally and keep them out of sight from authorities, usually by hiding it through financial means such as offshore accounts, shell businesses, or professional help. Money laundering operations can be conducted by people from diverse socioeconomic backgrounds – both those with high incomes as well as those engaging in illegal activity at lower income levels can engage in it; those with access to offshore accounts, shell businesses, or professional assistance may have more chances for sophisticated money laundering schemes.

- Money laundering occurs across nations and regions for various reasons. Lax regulatory frameworks, corruption, or involvement with illegal activities like drug trafficking or organized crime may make certain geographical regions more susceptible than others to money laundering operations. It's essential to remember that money laundering is an international problem that affects individuals from various national backgrounds.

- Due to their nature, certain occupations and sectors pose an increased risk of money laundering. Financial professionals such as those employed at banks or money service organizations may be at greater risk, while professionals in other sectors such as real estate, gaming, or dealing with high-value assets could become involved with money laundering operations as well.

- Money laundering often has links with large-scale criminal organizations that engage in various unlawful activities, as well as networks consisting of members from diverse racial and ethnic backgrounds who collaborate to launder money — often across international boundaries, making money laundering a global concern.

Although money laundering data by demographic groupings may be scarcer than usual, understanding all contributing variables and vulnerabilities is invaluable when developing effective prevention and detection strategies. To effectively counteract illegal behavior such as money laundering, regulatory organizations, law enforcement agencies, and financial institutions frequently prioritize creating comprehensive anti-money laundering procedures that apply equally across demographic backgrounds.

US Money Laundering Statistics

The United States due to its expansive economy, a large impact on the global financial system, and abundance of financial institutions has an ongoing problem with money laundering. Due to its secrecy, it can be challenging to obtain accurate and up-to-date data regarding this crime; however, certain indicators can give insight into its severity in America.

- According to estimates from FinCEN, a division of the United States Department of Treasury, billions are laundered annually via American financial institutions – yet due to their illegal nature it's impossible to ascertain an exact figure.

- S. lawmakers and regulators have taken proactive measures against money laundering by passing stringent anti-money laundering (AML) legislation and regulations, with the Bank Secrecy Act (BSA) serving as its focal point and surrounding rules providing guidance. Financial institutions must create comprehensive anti-money laundering processes including client due diligence checks, reporting requirements of suspicious behavior, and record-keeping obligations.

- Now, the United States' statistics on money laundering encompass North Korea.

- Wachovia Bank was recently implicated in one of the highest-profile money laundering incidents ever to occur in America.

- S. Treasury data shows that airport money laundering seizures cost passengers millions annually.

- Law enforcement officials successfully prosecuted 2,300 money mules in 2022.

- Laundered money remains undetected: according to statistics from 2022, 90% remains hidden from view.

- Through enforcement actions and convictions, the U.S. government has demonstrated its dedication to fighting money laundering. FinCEN works closely with federal and state agencies to investigate instances of money laundering while the Department of Justice (DOJ) often helps bring such activities to light when combined with other criminal accusations.

- Asset forfeiture is an effective weapon in the fight against money laundering, disrupting illicit financial flows while simultaneously deterring perpetrators. Through the DOJ's Asset Forfeiture Program, billions in proceeds from money laundering and other unlawful activity have been discovered and forfeited to the United States government.

- The United States contains several areas with an increased risk of money laundering, such as border states with major drug trafficking operations or near Mexico where illicit drug money launderers operate. For instance, the Financial Action Task Force (FATF) highlighted the Southwest Border region due to its closeness with Mexico and associated money laundering schemes relating to illicit drugs.

- Money launderers in the US employ various techniques to hide their illicit activity, including structuring transactions to bypass reporting requirements, using shell corporations and offshore accounts, trade-based laundering schemes, and exploiting virtual currencies like Bitcoin for illicit gains. With virtual currencies like this one coming online, it has created even greater challenges when it comes to detecting and preventing money laundering activities.

- To combat money laundering, the United States works closely with other nations. To facilitate information sharing and cross-border investigations, they take part in programs like FATF as well as negotiate Mutual Legal Assistance Treaties (MLATs).

Crypto vs Fait Money Laundering Statistics

Money laundering is an international problem affecting both conventional fiat currencies and cryptocurrencies, yet patterns and findings should still be taken into consideration when discussing money laundering related to either type. Although full and accurate information related to cryptocurrency vs fiat is often difficult to come by, several key points should still be kept in mind when discussing money laundering directly related to either.

Fiat Money Money Laundering

With fiat currencies so widely accepted and utilized today, money laundering has long been an accepted practice. Here are several significant statistics and findings:

- Magnitude: According to the United Nations Office on Drugs and Crime (UNODC), money laundering involving fiat currencies accounts for between two to five percent of global GDP.

- Methods: Traditional money-laundering approaches involve structuring transactions, the use of offshore accounts and shell companies, trade-based laundering, and moving illegal currency through banks or financial organizations.

- Detection: Authorities have made great strides toward increasing the detection of fiat currency money laundering through anti-money laundering (AML) compliance processes, suspicious transaction reporting systems, and financial intelligence units. Prosecutions may still vary between jurisdictions for any such charges brought forth against individuals involved.

- Only 0.3% of global money laundered is through illicit channels and 0.9% in the US uses bitcoin.

- As of 2022, the IRS had amassed over $1.2 billion worth of cryptocurrency.

Money Laundering With Cryptocurrencies

With the rise of cryptocurrency comes new risks and opportunities for money laundering. Although cryptocurrencies offer certain advantages for illegal activity, it may be difficult to establish exactly how much laundering occurs directly involving cryptocurrency – but patterns and findings suggest otherwise:

- Anonymity and Pseudonymity: Cryptocurrencies offer different levels of privacy and anonymity that can help facilitate money laundering activities. By employing cryptocurrency tumblers, mixers, and privacy-focused currencies users may be able to hide both the source and destination of their funds.

- Darknet Markets: With cryptocurrency-powered Darknet markets, illegal goods like drugs, guns, and stolen data have never been easier to sell. Money laundering often occurs when illegal funds are converted into cryptocurrency before being mixed with or converted to fiat currencies like the USD.

- Even as cybercrimes surged during 2022, cryptocurrency-related criminal activity decreased by over 50% between 2021 and 2022.

- Over 99.9999% of Bitcoin transactions occur on exchanges subject to AML regulations.

- Governments and regulatory entities have recognized the necessity of taking steps against cryptocurrency-related money laundering risks. AML/KYC requirements have been implemented by several countries for Bitcoin exchanges and service providers in order to strengthen accountability, uphold due diligence standards, and reduce potential money laundering and terrorist financing activities.

- Improved Detection: The rise in popularity of cryptocurrencies has created new efforts to detect and counter cryptocurrency-related money launderings, such as tracking transactions on open blockchains or identifying suspicious activity through analysis and forensic tools. Law enforcement agencies, financial institutions, and cryptocurrency firms have collaborated in tracking down illegal transactions more effectively through collaboration efforts.

Issues and Causes of Money Laundering

Money laundering presents governments, law enforcement agencies, and financial institutions alike with a complex and multifaceted challenge.

- According to estimates by the United Nations Office on Drugs and Crime (UNODC), between 2-5% of global GDP or $800 billion to $2 trillion per year may be engaged in illegal money transactions worldwide – having an enormous effect on world economies while feeding into organized crime, tax fraud, and corruption.

- Money laundering's primary motivation lies in concealing or converting illegal funds to legal assets, but its causes may include:

- Corruption: According to the World Bank, corruption costs the global economy an estimated annual loss of $1.5 trillion and allows money-laundering activities.

- Organized crime: Organized criminal operations such as smuggling; human trafficking and drug trafficking may use elaborate financial networks to hide their profits from public view.

- Money laundering is a widespread practice used by both individuals and businesses alike to bypass paying their tax liabilities on earnings.

- Political Instability: Lack of political stability or ineffective governance frameworks in certain locations makes money laundering easier, which in turn encourages corruption and illegal financial activity.

- Emerging technologies such as cryptocurrencies, virtual assets, and peer-to-peer (P2P) platforms have opened up new avenues for money laundering operations. P2P networks may facilitate such operations due to their informal nature; while cryptocurrencies could serve the same function thanks to their anonymity and decentralized nature.

- Success rates of money laundering charges may differ among countries, even as great strides have been made toward better identifying and prosecuting such activities. According to the Financial Action Task Force (FATF), several nations, particularly emerging economies, still possess gaps in their anti-money laundering regimes that need improvement.

- Money laundering's effects reach far beyond economic concerns; from encouraging criminal activity, increasing economic inequality, and diminishing public confidence in financial institutions and processes to further social damage.

Combatting money laundering effectively requires an integrated strategy that addresses its root causes, makes use of technical advancements, strengthens regulatory frameworks and international collaboration, as well as properly resources and implemented Anti Money Laundering (AML) regimes, and ensures those engaging in money laundering activities are held responsible through prosecution or asset recovery measures.

(Source: ledgerinsights.com)

Money Laundering- Trends and Predictions

Given the fluid nature of crime and covert tactics employed by criminals, it can be challenging to predict future trends in money laundering. We may gain some insight into probable changes by studying current patterns and emerging hazards; here are some notable money laundering trends and projections:

- As cryptocurrency adoption increases, criminals may use them as a form of money laundering. Though cryptocurrencies do offer certain advantages for illegal activity, regulatory initiatives and improvements in blockchain analytics should help increase capacities for detection and oversight, potentially prompting thieves to use more private cryptocurrencies or find other means of hiding transactions such as decentralized exchanges or privacy-enhancing protocols to maintain anonymity during transactions.

- Locating and stopping money laundering has become more complex due to the development of financial technology (FinTech) and internet platforms, with criminals using these websites for illegal transfers between individuals or cross-border remittances. Regulators will likely focus on tightening AML controls for FinTech platforms like those found online platforms; including setting higher customer due diligence standards as well as real-time transaction monitoring capabilities.

- Governments around the globe are taking steps to combat money laundering. More stringent anti-money laundering requirements have been placed upon financial institutions and virtual asset service providers through new rules such as Financial Action Task Force's Travel Rule or EU's Fifth Money Laundering Directive, among others. More jurisdictions should implement comprehensive anti-money laundering frameworks as this trend develops further strengthening global cooperation.

- Beneficial ownership transparency is an integral part of combatting money laundering and one of its primary focuses. Accurate identification of those who own and control legal companies is essential if illicit cash flows are to be stopped. Authorities will endeavor to increase this transparency by developing central registers or beneficial ownership databases that track beneficial ownership.

- Collaboration among governments and regulatory agencies is essential in combatting transnational money laundering. Governments and regulatory bodies have increased their cooperation by sharing intelligence, coordinating investigations across jurisdictions, and exchanging information. Establishing financial intelligence units or global alliances such as the Egmont Group encourages closer coordination to identify and dismantle money laundering networks.

- Integrating machine learning (ML) and artificial intelligence (AI) technologies could enhance money laundering detection and prevention. AI-powered systems are capable of quickly processing large volumes of financial data to identify trends or irregularities. Financial institutions and regulatory organizations will likely utilize these technologies as part of AML compliance initiatives and transaction monitoring systems.

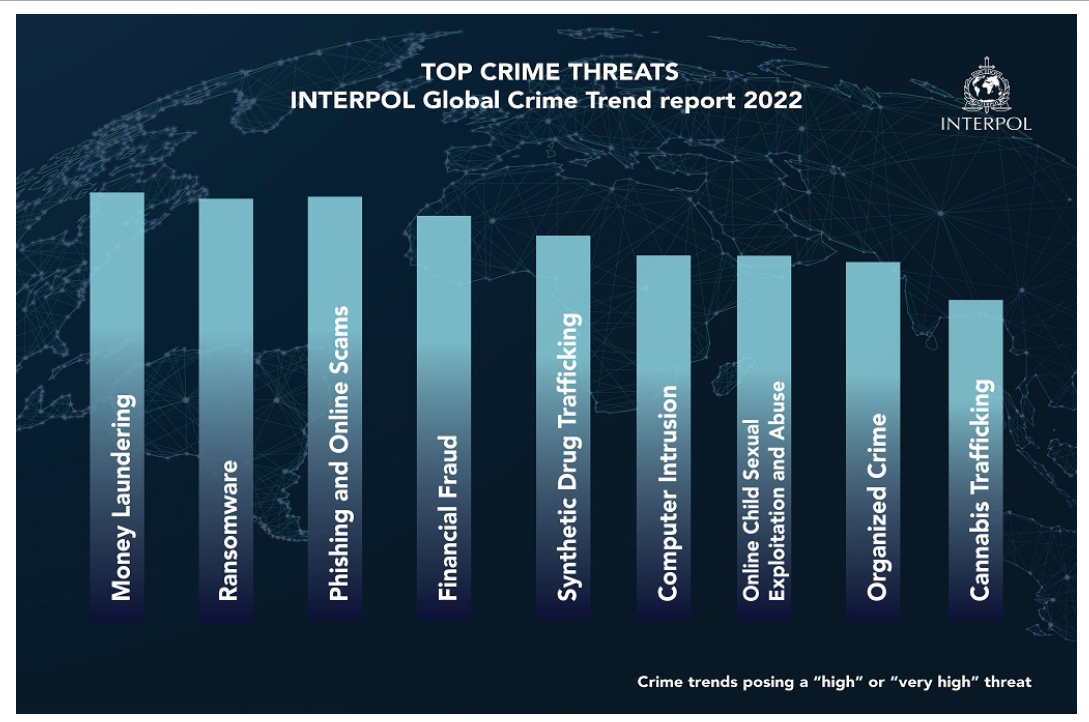

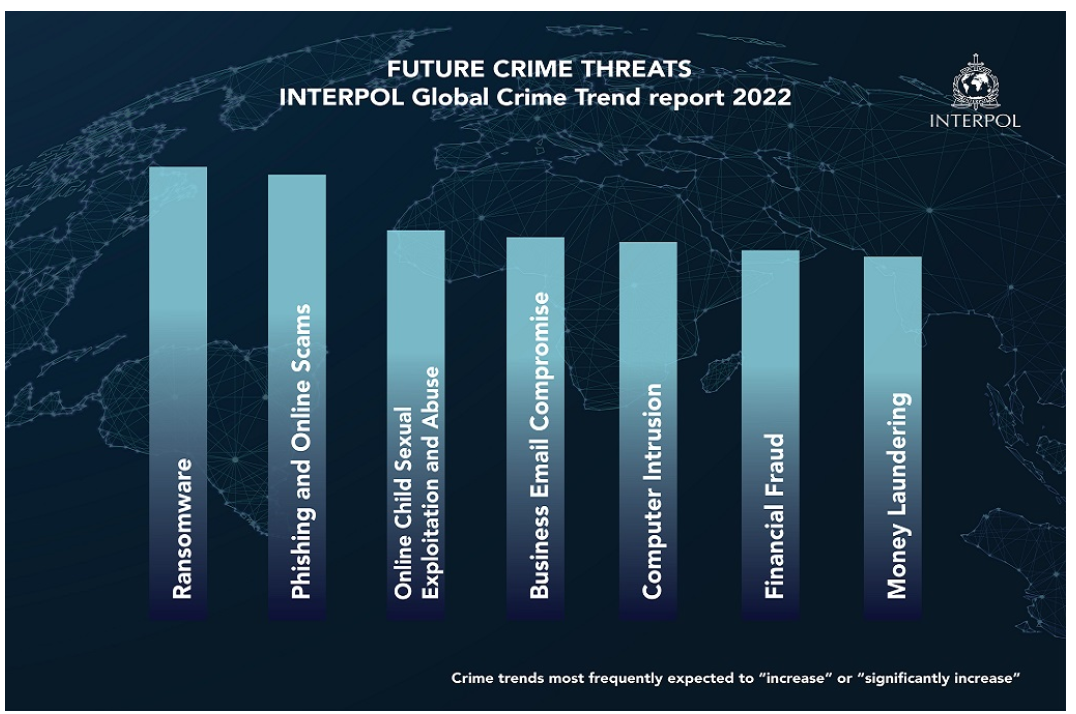

(Source: interpol.int)

Final Words

Money laundering remains a global challenge with billions of dollars being laundered illegally each year, creating an ongoing global issue. Due to its secrecy, accurate and complete statistics regarding money laundering remain difficult to gather; nonetheless, trends and observations provide important insight. Numerous demographic groups regardless of socioeconomic status are affected by money laundering activities, with organized criminal networks playing a large part in providing the channels through which illegal funds flow; this issue is further compounded by lax legal frameworks, corruption, globalization, and technological innovations which contribute significantly towards its incidence.

Governments, regulatory agencies, and financial institutions have adopted stringent anti-money laundering measures in an attempt to put an end to this practice. Major tactics used to detect and stop money laundering operations include strengthening anti-money laundering (AML) legislation, encouraging global collaboration, and using cutting-edge technologies like blockchain analytics and artificial intelligence.

Future trends in money laundering can be hard to anticipate, yet key areas of focus include digital currencies, an increasing emphasis on beneficial ownership transparency, an expanding regulatory environment, cross-border cooperation, and AI/ML technologies. To stay abreast of the ever-evolving methods employed by money launderers, continuous monitoring, creativity, and international cooperation are necessary. Society should seek to lessen its impacts and protect its people by addressing its causes while taking effective preventive steps against money laundering.

FAQ.

Organizations involved in busting share the proceeds from illegal narcotics seizures with law enforcement for use in equipment purchases, training programs and educational initiatives that help fight crime.

Money laundering serves the purpose of disguising illicitly obtained funds as having come from legitimate sources, so they don't get linked back to illicit activity by law enforcement authorities. People engaging in illicit activity often employ money-laundering techniques as part of the criminal justice process to try and cover up evidence linking it back to criminality.

Money laundering is considered illegal under US Code Section 1957 when any financial transactions involving property acquired illegally through US banks, other financial institutions, or foreign banks total more than $10,000.

As of 2020, British Columbia has overtaken London as the epicentre of money laundering globally; London had previously been one of them. An estimated $5 billion was laundered through illicit means here alone in 2020 alone!

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.