Opayo Statistics (Formerly Sage Pay) Usage, Features and Market Share

Page Contents

Introduction

Opayo (Sage Pay) Statistics: On a positive note, life has become easier in terms of the digital world after the pandemic period. Most importantly, businesses reached a worldwide level and revenues increased because of the online payment system. There are n number of online payment services and Opayo (Sage Pay) is one of them. This platform was initially launched as Sage Pay, after which the name changed to Opal. In this, Opal (Sage Pay) Statistics we will have a look at its meaning, features, general statistics, and the difference between Opayo (Sage Pay) and Stripe.

Opayo Statistics (Editor’s Choice)

- As of 2023, Opayo (Sage Pay) is being used by more than 6,526 companies with a market share of 0.17%.

- In 2023, the global rank of sagepay.com turned out

- The United Kingdom has the highest amount of traffic towards the website having around 89%.

- Opayo (Sage Pay) Statistics state that more than 85,000 businesses have created their digital business in just 4 months.

- Contactless payments in the offline store are being attracted around 49% of the population.

- 68% of people started using contactless payments after the pandemic years.

- Russia has 2.04% of the traffic with a surprisingly increased rate of visitors by 562.8%.

- According to Opayo (Sage Pay), Statistics of online transactions with 200% of the increase in home and leisure products were recorded.

- There are 47%of female users and 53% of male users for Opayo.

- Opayo (Sage Pay) offers an option for multiple payments at the same time.

- The United Kingdom has around 86% of the Opayo (Sage Pay) users.

What is Opayo?

Opayo is an online payment processing platform that has the ability to pay money on international as well as local levels. The special feature of this company is, they provide telephonic money transfers. The initial name of the company when was incorporated was Sage Pay.

Opayo Features

- Worldwide accepted online and offline payment.

- Online invoicing.

- Opayo also accepts payments made through telephone.

- 24/7 UK-based support.

- Single click checkout.

- Customizable payment gateways.

- Offers payments such as Portable card machines, mobile card machines, and countertop card machines.

- Strong fraud detection services.

- Accepts payments more than in 25 currencies.

- Opayo (Sage Pay) offers an option for multiple payments at the same time.

- Advanced fraud protection tools.

- Real-time reports regarding each transaction.

- Accepts payments from multiple payment methods.

Opayo Statistics

- According to the Opayo (Sage Pay) Statistics, the revenue of the company will be $25 million to $50 million by September 2023.

- Opayo (Sage Pay) website has around 17.14% of the bounce rate

- In the month of September 2023, the official website of Opayo (Sage Pay) received around 3.2 million visits. The percentage has shown a reduction in visitors by 1.15% change in the last month.

(Source: Similarweb)

(Source: Similarweb)

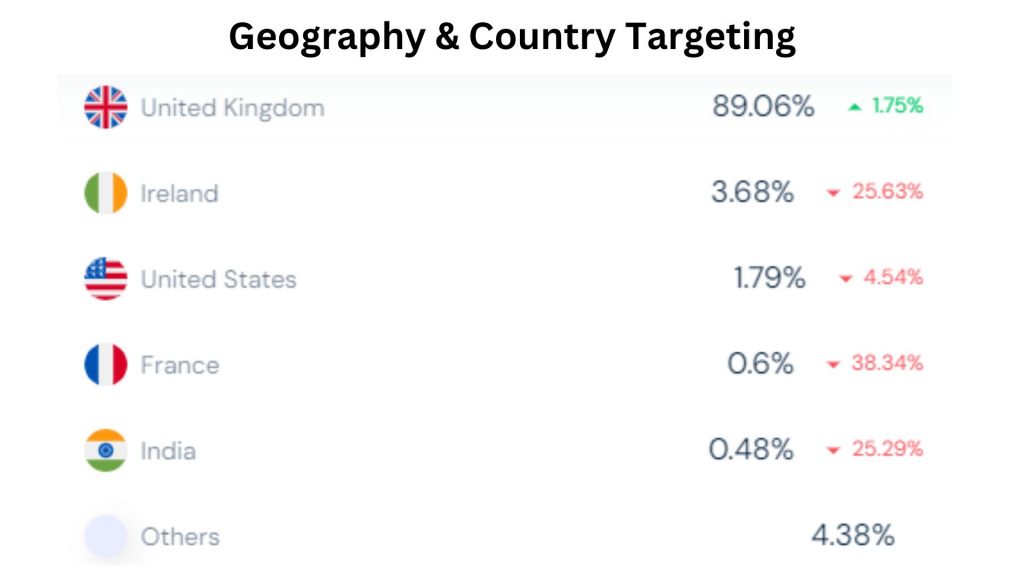

- According to the Opayo (Sage Pay) Statistics, the United Kingdom has the highest amount of traffic to the website around 89.06%. The last year’s comparison, it has shown an increase in the number of visitors by 1.75%.

- In Ireland, traffic towards Opayo (Sage Pay) is around 3.68% with a decreased rate of visitors by 25.63%.

- United States of America has 1.79% of the traffic with a decreased rate of 4.54%.

- France has around 0.6% of the traffic attracted to the Opayo (Sage Pay) Website.

- On the other hand, India has 0.48% of the traffic with a surprisingly decreased rate of visitors by 25.29%.

- Other countries with a negligible percentage of visitors are around 4.38%.

- As per the Opayo (Sage Pay) Statistics, there are 47% female users and 53% of male users.

- According to Opayo (Sage Pay) Statistics, online grocery shopping in the month of June increased by 91%.

- Moreover, online transactions with 200% of the increase in home and leisure products were recorded.

- Opayo (Sage Pay) Statistics state that more than 85,000 businesses have created their digital business in just 4 months

- 68% of people started using contactless payments after the pandemic years.

- Contactless payments in the offline store are being attracted around 49% of the population.

(Source: Similarweb)

(Source: Similarweb)

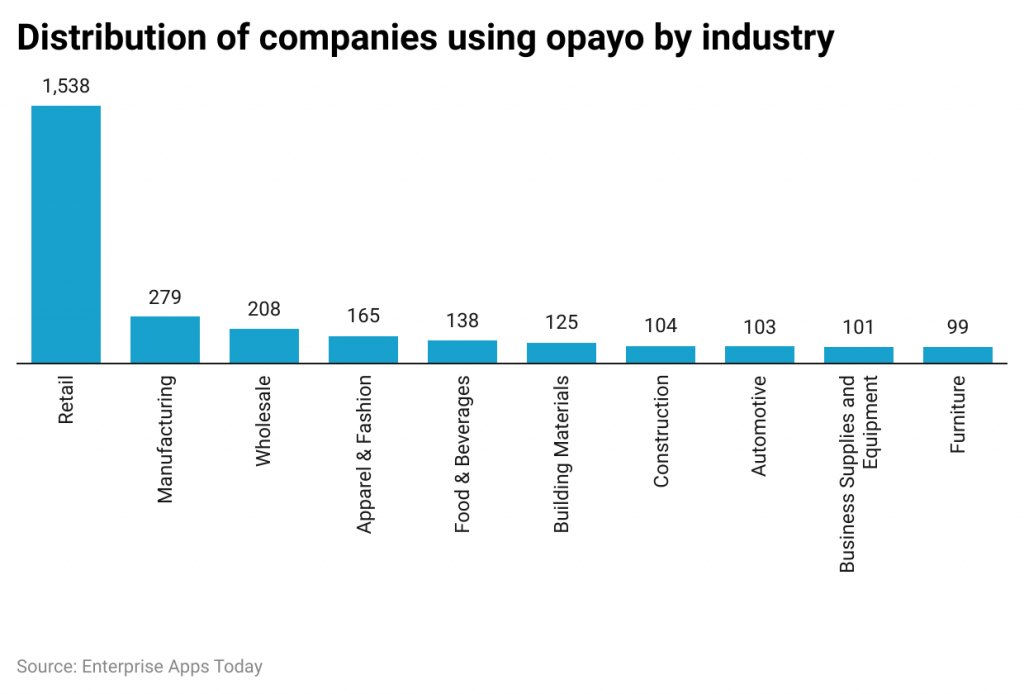

- Opayo (Sage Pay) is being used by around 1,538 companies in the retail sector having at least a share of 24% in the market being the maximum in 2023.

- Whereas, manufacturing and wholesale industries are around 279 and 208 respectively.

- There are a total of 165 apparel and fashion industries that use the Opayo (Sage Pay) payment platform.

- The food and beverage industries also have around 138 stores.

- The building materials and construction industries have a contribution of around 125 and 104 companies respectively.

- Furthermore, other industries are followed by automotive, business supplies equipment, and furniture have around 103, 101, and 99 contributions.

(Source: similarweb)

(Source: similarweb)

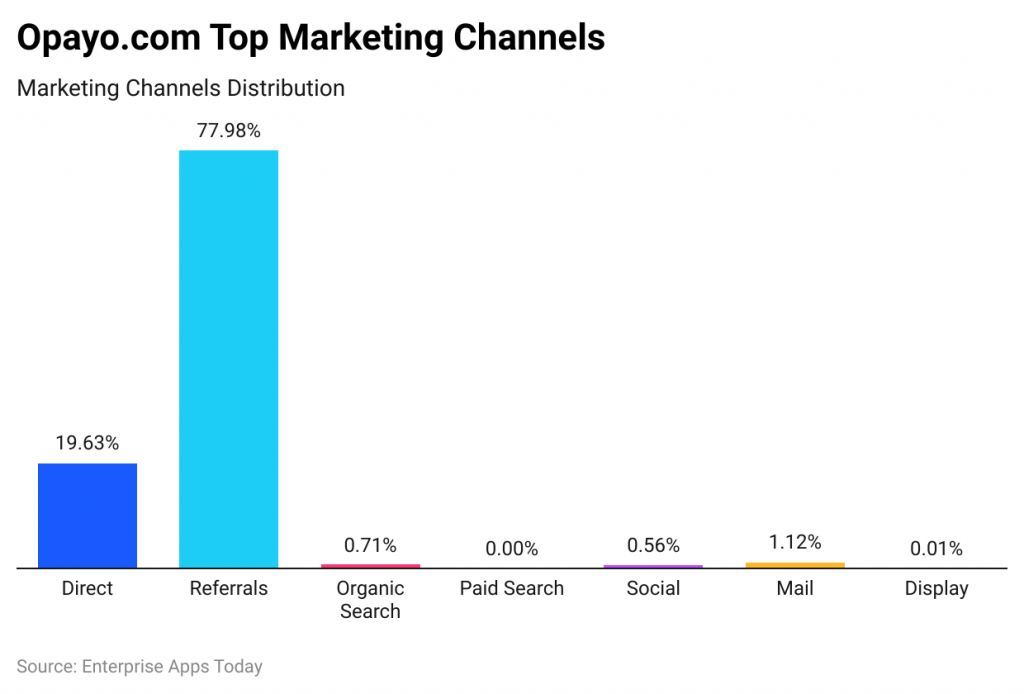

- Users who come to the Opayo (Sage Pay) website are mostly from referrals resulting in 77.98%.

- Other users resulting in 19.63% visiting the website from direct sources.

- Social media and mail referrals contributed around 0.56% and 1.12% respectively.

- People who come from organic search have the maximum percentage of around 0.71%.

- Display referrals have a negligible percentage of 0.01% in overall referrals towards the website.

(Source: similarweb)

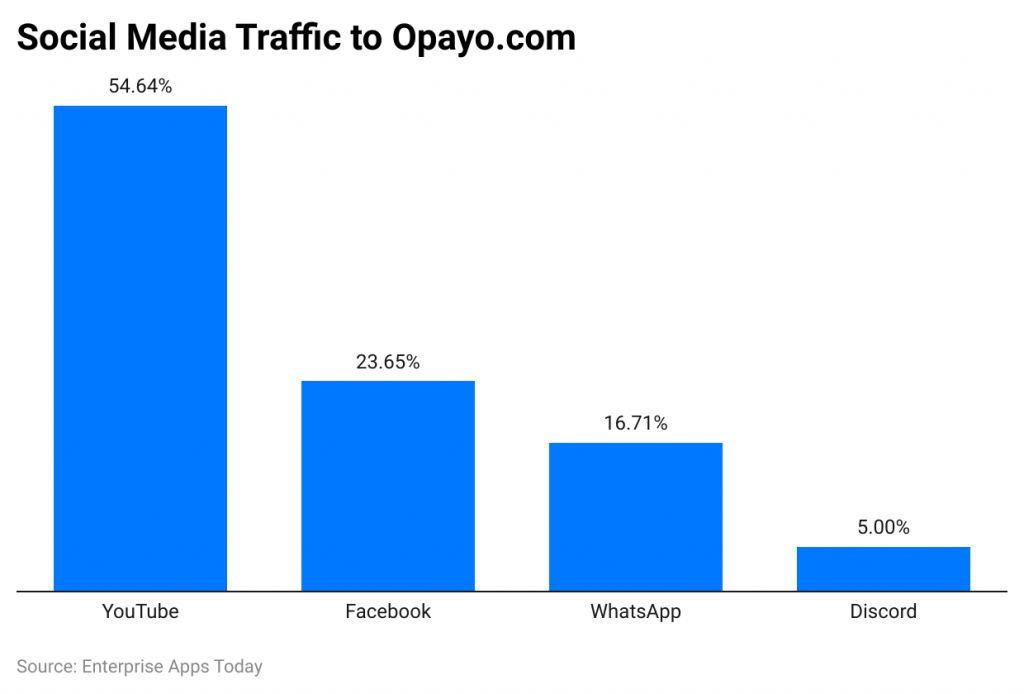

- Opayo (Sage Pay) receives traffic from only 2 social media – YouTube resulting in 54.64%, Facebook with 23.65%, and WhatsApp (16.71%), and Discord (5%).

- Referrals received to the Opayo (Sage Pay) website from other financial websites are around 69.99% being the maximum.

- Whereas graphics multimedia and web design websites referred to around 4.28%.

- Some of the digital marketing websites contributed up to 4.25% whereas, other home and garden websites referred to around 2.55%.

- Websites related to jewelry and luxury-related products referred around 2.55%similst to home and garden websites.

- Opayo (Sage Pay) has 1,249 unique domains.

(Source: similarweb)

(Source: similarweb)

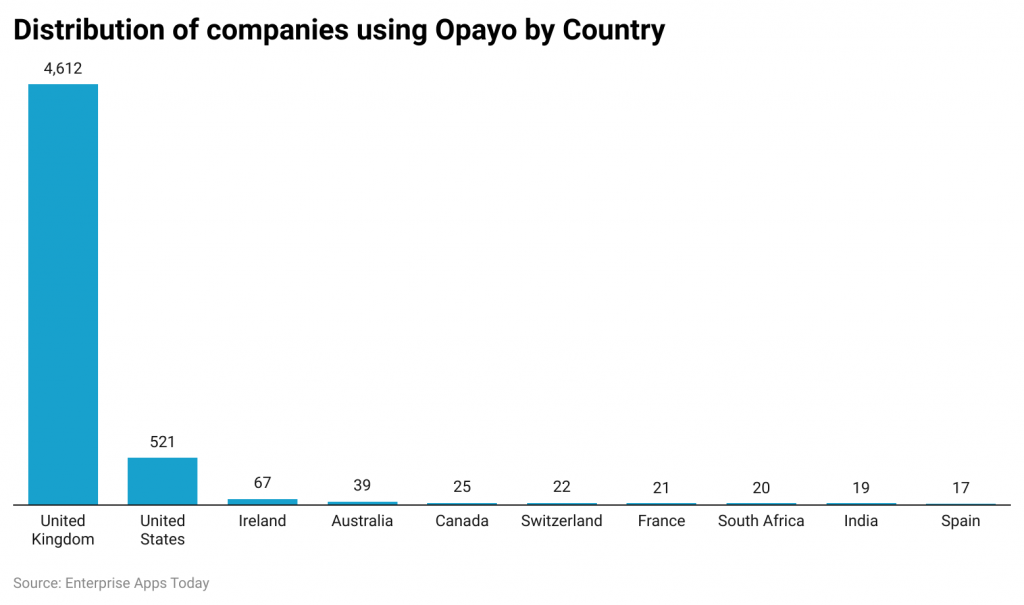

- Other than the comparison of maximum site traffic, the United Kingdom has around 71% of the users for Opayo (Sage Pay) which has resulted in 4,612.

- In the United States of America, there are 8% of the users resulting in 521.

- Whereas Ireland has 67, Australia, and Canada users resulting in 39 and 25 users respectively.

- Switzerland and France have around 22 and 21 total users whereas; South Africa has 20 which is similar to India’s users 19.

- However, among all Spain has the lowest number of users resulting in 17.

- Opayo's (Sage Pay) market share is only 0.17%.

- Opayo (Sage Pay) users are spread around the world, out of which 13.88% of the users are from the age group of 18 years to 24 years.

- 6% of users are from the age group of 25 years to 34 years which is the highest.

- There are around 17.71% of the users from the age group of 35 years to 44 years.

- On the other hand, people from the age group of 45 years to 54 years resulted in 18.77%.

- Baby boomers group from 55 years to 64 years and 65 years plus are around 14.44% and 10.59% respectively.

- The websites that support the Opayo (Sage Pay) platform are as per the above chart. The United Kingdom has around 6,445 websites and the United States of America has 1,002 websites supporting the Opayo (Sage Pay) platform.

- According to Opayo (Sage Pay) Statistics, India and Ireland have around 22 and 258 websites whereas; Australia, France, and Germany have 58, 32, and 34 websites respectively.

- Spain, South Africa, Switzerland, and Canada have around 36, 35, 31, and 30 websites supporting the Opayo (Sage Pay) platform for online payments and Italy has 15 websites.

- Among the lowest in the list is Pakistan with only 5 websites.

- Other countries with a negligible number of websites result in a total number of 170 websites.

Opayo (Sage Pay) Vs Stripe

Opayo and Stripe are both strong online payment competitors. Each of the services has its own special features. Stripe allows individual-level and business payments from around the world. Stripe has easy to use a platform by which customer satisfaction has increased more than any other competitor around the world. Stripe’s payment system has built-in analytics such as Sigma and Radar which helps as a reporting tool and provides high-end protection against fraud. Another feature of Stripe which is special is that it provides a free card swiper that can be connected to any device easily.

On the other hand, Opayo (Sage Pay) offers streamlined payment with a 99.99% reliability rate. This platform has industry industry-leading gateway enabled to receive amounts at your own convenience. Moreover, protection against fraud is also at a better level with multi-layered fraud detection techniques. Following are some features of both online payment services.

Opayo (Sage Pay)

- Opayo has 95% of customer satisfaction as well as an 8.5 smart score.

- The pricing package for merchants starts from pound 20.90.

- This platform offers monthly payments.

- Other features available with the Opayo platform are mobile card machines, point-of-sale integrations, options for customization, face-to-face payments, phone as well as invoice payments, fraud prevention, business insights, and the ability to accept payments in above 25 currencies.

- The platform can be integrated with PayPal, Drupal Commerce, BigCommerce, Kartis, Cube Cart, and Egg basket

- It supports only the English language.

- The most prominent clients of Opayo are Art Class London, Lorna Syson, and SSP Hats and Accessories.

- The Opayo (Sage Pay) platform is suitable for all kinds of businesses such as small-scale industries as well as medium and large-scale industries.

- Customer support is available 24/7.

- Customers can contact the company through email, phone, and tickets.

Stripe

- Stripe has 97% of user satisfaction and a 9.6 smart score.

- Pricing is percentage-based.

- Stripe offers a pricing model as monthly payment and quote-based.

- Some of Stripe’s wonderful features are authorization, consolidated reports, accounting integrations, unified payout, dispute handling, mobile customer interface, various payment options, invoicing, multiple currency payouts, and much more…

- Stripe has no monthly setup fees.

- This platform is integrated with Amex Express Checkout, Visa Checkout, Masterpass b MasterCard, Ronin, inviteRobot, Taxamo, SumAll, Shipping Easy, Plum voice, Zoho reports, compass, Chatfuel, and many others…

- Stripe’s platform is available in Chinese, English, Spanish, French, Italian, and Dutch

- Stripe’s prominent clients are Shopify, Pinterest, Slack, and Kickstarter.

- Moreover, Stripe is compatible with Windows, Android, desktop, and iOS.

- In terms of receiving payments, freelancers as well as other sizes of businesses can use the Stripe platform, such as small-scale industries, medium-scale industries, and large-scale industries.

- In the case of Stripe, customer support is available 24/7 with options such as phone, email, live support, and tickets.

Which is Better?

Considering the comparison, both of the online payment services are better in their own place. But looking at the features, if you are a freelancer then Stripe is a better option, otherwise, Opayo (Sage Pay) fits well. On the other hand, Stripe is a competitive online payment service, and it has more features than Opayo (Sage Pay) therefore if you are running a small business you can use Opayo.

Conclusion

Digitalization is bringing a lot of positive changes in terms of online businesses, Opayo (Sage Pay) like payment services applications is helping such businesses to gain more revenue. Considering the market share of other online payment applications, Opayo is at the lowest level. But looking at the features it still can be called one of the best. The size of the business never matters when you have an online business. But to receive payment you need to have at least one payment method that will enable the online transactions. Before going with ultra-premium online payment options, Opayo (Sage Pay) is also a better option to start with.

FAQ.

Yes. Sage Pay changed its name to Opayo in the month of July 2020.

Yes. Opayo (Sage Pay) accepts payments from anywhere around the world

Yes. In order to authorize the payments, it is required to connect to bank account.

Yes. According to the Opayo company, they have separate auditor to check whether they comply with the latest security standards or not.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.