Essential PayZapp Statistics to Understand Its Popularity In The Mobile Payment Market

PayZapp Statistics: PayZapp, an electronic wallet facility, was launched by HFC Bank in 2015 to keep pace with changing banking conditions and meet consumer needs. The app PayZapp is available through Visa and MasterCard. PayZapp users can sync their HDFC Bank debit and credit cards to their PayZapp mobile application to access unlimited benefits provided by the electronic-wallet service. This app provides many benefits, including cashback, movie and trip bookings, discounts and payments to other PayZapp wallets or bank accounts, dinner bookings and easy mobile recharges. This e-wallet service has been launched by HDFC bank to further the vision of India becoming a digital economy. It also allows for easy mobile recharges and DTH services to be accessed from remote areas. We will be discussing PayZapp statistics in order to better understand current financial trends and the app's usage.

Key PayZapp Statistics

- The e-wallet facility has been unveiled by HDFC bank in 2015.

- PayZapp mobile app from HDFC bank is accessible to the existing HDFC bank customers and customers of other banks as well.

- PayZapp mobile app has secured the 1052nd rank in the finance category in Canada.

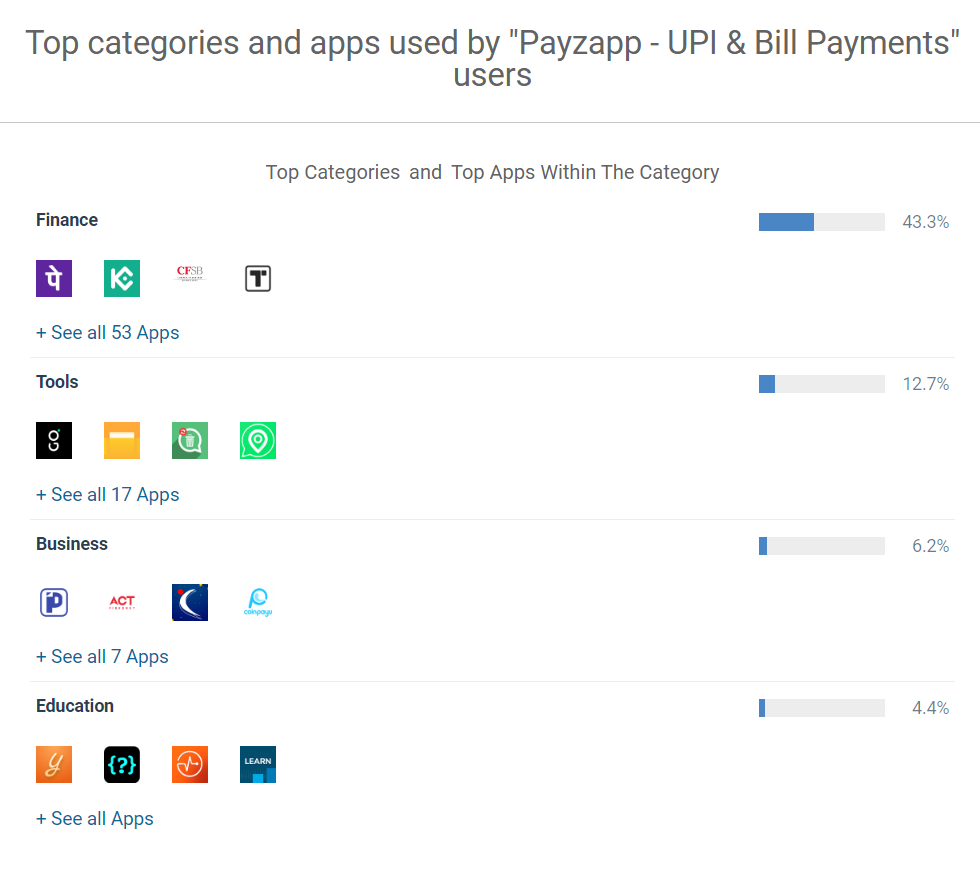

- Around 43.3 percent of PayZapp users use the e-wallet facility for finance-related tasks.

- The total traffic on the PayZapp mobile app is generated from referrals.

- As per PayZapp statistics, the e-wallet facility accounts for more than 14 million users. While more than half of these users are young adults and do not have a bank account.

- Users can use the e-wallet service offered by HDFC bank to pay utility bills, recharge mobile and DTH services, and book movie and travel tickets.

- A user can sync a maximum of 2 PayZapp mobile numbers or two PayZapp accounts registered to one PAN number. While a user cannot win cashback on more than 5 transactions per mobile device each day. A user is allowed to process a maximum of 10 commercial transactions per mobile device each day.

- HDFC has enabled UPI transactions as well on its e-wallet facility PayZapp.

- HDFC has recently revamped the mobile payment app PayZapp, however, the rollout of this new version of PayZapp is limited to a closed group of users only.

General PayZapp Statistics

#1. The total traffic on the PayZapp mobile app is generated from referrals

The referral is the largest source of traffic on HDFC bank’s e-wallet facility PayZapp. PayZapp offers many benefits and rewards to users who send out referrals of the mobile payment app to other customers.

From around the web to the store page

| Direct | 0% |

| Search | 0% |

| 0% | |

| Referrals | 100% |

| Social | 0% |

| Display Ads | 0% |

(Source: Similarweb.com)

#2. PayZapp mobile app from HDFC bank is accessible to the existing HDFC bank customers

As per PayZapp statistics, customers from other banks as well can have access to the PayZapp mobile payment app for digital transactions.

#3. As per PayZapp statistics, the e-wallet facility accounts for more than 14 million users

While more than half of these users are young adults and do not have an active bank account. It shows that this mobile payment app is quite popular among young people.

#4. The e-wallet facility has been unveiled by HDFC bank in 2015

Users can have an access to a wide range of benefits via this e-wallet and can execute a variety of tasks such as online and offline shopping, funds transfer, bill payments, and recharges.

#5. Nearly 43.3 percent of PayZapp users use the e-wallet facility for finance-related tasks

About 12.3 percent of PayZapp users utilize this mobile payment app technology and tools-related things. While 4.4 percent of PayZapp users use it for educational services and 6.2 percent of PayZapp users utilize the e-wallet app for business-related services

(Source: Similarweb.com)

(Source: Similarweb.com)

#6. HDFC has recently revamped the mobile payment app PayZapp

The revamp of the mobile payment app offered by HDFC bank has taken place at a time when third-party payment applications such as Google Pay, PhonePe, Paytm, and Amazon pay are leading the mobile payment scenario. However, the rollout of this new version of PayZapp is available to a closed group of users only. The complete payments app is now known as PayZapp 2.0.

#7. HDFC has enabled UPI transactions as well on its e-wallet facility PayZapp

The PayZapp mobile payment app will now consist of a wide variety of payment methods, such as pay-to-transact at all business firms with the requisite enablement and tap.

#8. A user can sync a maximum of 2 PayZapp mobile numbers or two PayZapp accounts registered to one PAN number

Whereas a user cannot win cashback on more than 5 transactions per mobile device each day. A user is allowed to process a maximum of 10 commercial transactions per mobile device each day.

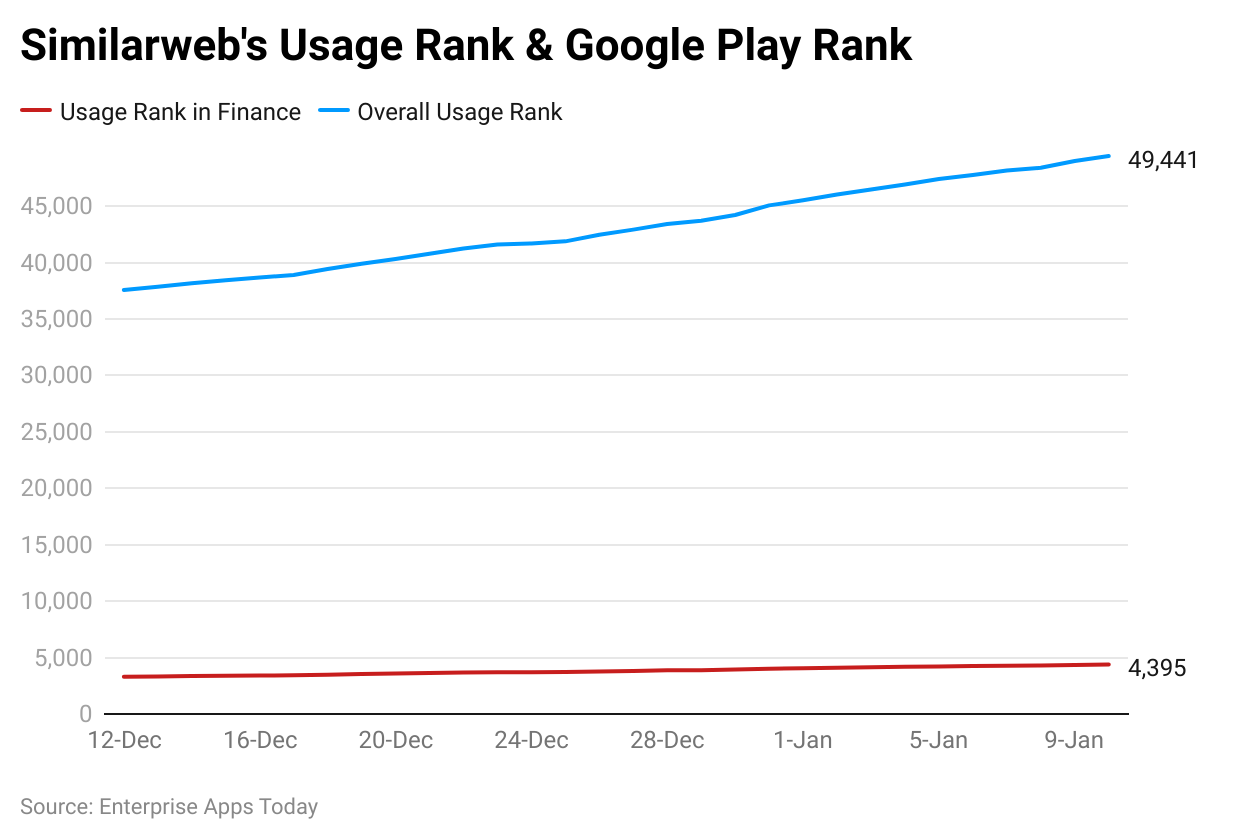

#9. PayZapp mobile app has secured the 1052nd rank in the finance category in Canada

It seems HDFC bank’s PayZapp is quite popular in Canada. The mobile payment app has secured 1454th rank in France in the finance category.

#10. With the launch of revamped mobile payment app PayZapp, HDFC plans to leverage the strength of the existing app

As per PayZapp statistics, HDFC officials claim that the revamped PayZapp app will have multiple offers across business categories via its SmartBuy platform.

#11. HDFC bank’s e-wallet facility PayZapp has secured 4217th rank in the United States

As per the PayZapp statistics, the mobile payment app is yet to get headway in the mobile payment market in the US.

(Source: Similarweb.com)

(Source: Similarweb.com)

#12. HDFC hopes that in the next three years, PayZapp will be among the top three mobile payment applications in the country in terms of the volume of transactions.

Conclusion

The officials from HDFC bank have been planning to make a significant ramp-up for PayZapp not in terms of engagement and accessibility to services of holistic payments to their existing wing of 60 million customers across the country. As per PayZapp statistics, the e-wallet service will be a major source for acquiring new customers with the help of a wide range of payment methods. As per the latest report, HDFC officials will be including multiple e-commerce platforms and partners in their mobile payment all PayZapp in the next few months. These services will be offered to other bank customers as well.

FAQ.

Users who have not completed their KYC can only transact INR 10000 each month and users who have upgraded accounts can transfer INR 50000. Users who have not completed their KYC can only transfer INR 5000 per day.

Customers of any other bank can sync their debit or credit cards to their PayZapp accounts and can avail of the benefits of the e-wallet.

HDFC bank unveiled its e-wallet PayZapp in 2015.

Users can earn many rewards such as discounts, sign-on bonuses, cashback, and loyalty points. Customers can save money, whenever they shop online, recharge their mobile phones or book a cab through a mobile app.

PayZapp offers a service for transferring wallet balances to bank accounts. However, the e-wallet charges a fee of 3.5 percent of the transacted money as a transfer fee.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.