Social Security Fraud Statistics 2024 By Facts, Trend and Insights

Page Contents

- Introduction

- Editor’s Choice

- Social Security Fraud Overview

- Advantages of Social Security Program

- Disadvantages of Social Security Program

- Facts About Social Security Fraud

- Social Security Fraud Trends

- Tips To Stay Protected

- Legal Penalties for Committing Disability Fraud

- Common Social Security Scams

- Recent Development

- Conclusion

Introduction

Social Security Fraud Statistics: Social Security Fraud is faced when an uncertified third party gains access to your Social Security number and capitalizes it for their financial benefits. Suppose Social Security fraud is a recipient that receives benefits connected to false or omitted information on government paperwork. Your Social Security number is often legally needed when applying for jobs or financial accounts, paying taxes, or getting medical care.

However, fraudsters often search them out to commit identity fraud or financial theft. Criminals also use illegally received Social Security numbers to file false income tax returns and collect fraudulent refunds. We will be studying more about Social Security Fraud Statistics in this report.

Editor’s Choice

- One among four working-age people in the rural area uses indistinct ailments to claim benefits.

- In 2022, about 422 million people were affected by data breaches.

- People aged 30 to 39 have reported the highest number of identity theft cases.

- The number of adults insured under SSDI were doubled from 1970.

- In 2022, there were 1802 data breaches, a 3% reduction from 2021 statistics.

- From 2021, Government documents or benefits fraud declined by 85% in 2022.

- Synthetic fraud is the fastest-growing method found in the market. The auto lending industry has faced a loss of $1.8 billion at the start of 2023.

- In 2021, 57,912 reports were filed compared to 396,025 in 2021.

- People lost about $153 million to scammers pretending to be government officials.

- The American Association of Retired Persons reported that at least 94% of all calls received are fraud.

- Credit card fraud was a prevalent type of theft in 2022, with around 440,666 reports. In the first three quarters of 2023, about 318,087 cases were found.

- The COVID-19 pandemic has stoked a rise in social security abuse.

- Nearly 35% of Social Security disability benefits claims are consented.

- In 2022, Georgia, Louisiana, and Florida were the top three states to experience maximum thefts.

- Synthetic fraud is the fastest-growing type of auto lending in the industry.

Social Security Fraud Overview

- Nearly 10% of the Social Security disability cases are found to be fraud.

- In 2020, the United States Social Security Administration showed over $174 million in potential disability fraud.

- The SSA predicted that 1% of all disability payments are made with fraud.

- Roughly 30% of the committed fraud in Social Security Disability is because of wrong statements or misrepresentation of income or employment status.

- As a penalty for SSD fraud, a person has to pay a fine of $250,000 and a maximum of 5 years of imprisonment.

- In past years, about 39,000 allegations of disability fraud were found.

- The SSA's Inspector General's office has inquired about 1,153 fraud schemes that involved around 5000 people.

- Approximately, the SSA OIG arrests almost 1,100 people yearly for disability fraud.

- A total of 359 people were arrested by SSA for disability fraud in 2022.

- In the fiscal year 2020, SSA's Cooperative Disability Investigations program contributed approximately $267.8 million in estimated savings to SSA's disability program.

- Total Social Security advantages will exceed $900 billion, eliminating $3 billion yearly of Improper payments.

- The SSA OIG field division took over 580,000 investigative activities against fraud in 2020.

- The Social Security Trustees projected that reducing benefits to return solvency will require a 16.4% benefit cut equal to reduced benefits every year by $150 billion.

- As per the Social Security Administration, all the improper payments made, including payments to the deceased and old, are predicted to be about $3 billion yearly.

(Source: iii.org)

- The potential total loss gained to $10.2 billion in 2022, up from $6.9 billion in 2021. California, Texas, and Florida had the highest number of cybercriminals victims.

- Credit card frauds account for 43.7% of identity thefts, followed by various identity thefts at 28.1%.

Advantages of Social Security Program

- Even though one is experiencing social security benefits, they can qualify for SSI.

- About 1.2 million beneficiaries on disability under 65 years received both Social Security and SSI in January 2022.

- SSDI or SSI applicants must make less than $1310 monthly to be eligible for the benefits.

- Scalable Benefits: Individuals can choose when to retire and start receiving benefits, from as early as age 62 to as late as age 70, allowing for flexibility in planning retirement income.

- Minimum Benefits for Low-Income Workers: The program ensures that qualified low-income workers receive a minimum benefit, providing a safety net for those with limited earnings history.

- Spousal Benefits: Non-working spouses are eligible to collect benefits, which equals up to 50% of the working spouse's benefit, ensuring support for the entire household.

- Tax-Free Benefit for Many: A significant portion of beneficiaries do not pay federal income tax on their Social Security benefits, making it a more valuable source of income.

- Work During Retirement: Beneficiaries can continue to work during retirement, potentially increasing their benefits over time.

- Guaranteed Lifetime Income: Approved applicants receive a guaranteed monthly benefit for life, providing a consistent source of income.

- Healthcare Access: Social Security enables many individuals, especially the elderly, to afford healthcare services.

- Government-Insured Benefits: The benefits are insured by the government, offering peace of mind and financial security, even during economic downturns.

Disadvantages of Social Security Program

- SSDI applications are challenging to get passed. About 63% of applications get rejected.

- Social Security Disability insurance benefits take about five months to start coming.

- In January 2022, monthly disability insurance benefits were $1222.75.

- Disabled workers get almost $1358.50, while their wives and children get $376.51 and $428.84 respectively.

- The benefits earned can be taxed. The income exceeding the limit of $25,000 will be charged tax.

- Unsustainability: The Social Security system faces funding issues, with projections suggesting that the number of beneficiaries could exceed contributors as soon as 2022. This imbalance may necessitate higher taxes, increased federal deficits, or other financial adjustments.

- Limited Eligibility: Not everyone qualifies for Social Security benefits. Individuals must accumulate 40 credits, equating to 10 years of work, to be eligible. This system excludes those with insufficient work history, including late-life immigrants and individuals with sporadic employment.

- Disproportionate Benefit to High-Income Earners: The benefit calculation formula favors high-income earners, potentially marginalizing lower-income individuals. This discrepancy raises concerns about the program's equity and its role in widening income gaps.

- Reduced Early Benefits: Claiming benefits before reaching full retirement age results in permanently reduced payments. This aspect can particularly affect individuals who, due to health or employment issues, opt for early retirement.

- Inflation Issues: The program's failure to fully incorporate inflation into benefit adjustments means that payments may not keep pace with the cost of living, eroding the purchasing power of beneficiaries over time.

- Dependency on Workforce Size: The sustainability of Social Security depends on a large, contributing workforce. However, demographic shifts, such as increased life expectancy and lower birth rates, challenge this model by expanding the retiree population without a corresponding increase in workers.

- Non-Working Spouses' Benefits: While non-working spouses are eligible for benefits based on their partners' work history, this provision does not address the broader issues of program sustainability and fairness.

Facts About Social Security Fraud

- Over nine million US citizens receive Social Security disability benefits, with 85% of these beneficiaries being workers. This underscores the reliance on these benefits by a significant portion of the population.

- The incidence rate of disability fraud in the US is lower than 1%, indicating the effectiveness of the Social Security Administration's (SSA) zero-tolerance policy against fraudsters. However, California saw 345,000 suspicious disability claims at the beginning of 2022, highlighting potential regional disparities in fraud rates.

- Social Security fraud is not limited to external scams; it also involves misuse or misrepresentation of one's personal information to receive benefits illegitimately. Common types of fraud include representative payee fraud, impersonation, misuse of Social Security numbers, and benefits fraud among others.

- The Cooperative Disability Investigations Program plays a crucial role in preventing fraud, saving an estimated USD 188.5 million in fiscal year 2018 by investigating questionable applications early.

- Despite the low overall fraud rate, the SSA and other bodies remain vigilant against various fraudulent activities. This includes everything from phishing and impersonation scams to the illegal purchase or sale of Social Security data.

- Legal penalties for committing disability fraud are severe, emphasizing the legal system's commitment to protecting the integrity of Social Security benefits. These penalties serve as a deterrent against fraud and help to ensure that benefits are distributed to those who genuinely need them.

Social Security Fraud Trends

- Increased Impersonation Scams: Criminals continue to impersonate the Social Security Administration (SSA) and its Office of the Inspector General through phone calls, emails, texts, social media messages, and letters, aiming to steal personal information or money.

- Use of Sophisticated Tactics: Scammers are employing more sophisticated tactics, including the use of legitimate names of SSA employees, spoofing official government phone numbers, and sending official-looking documents to gain victims' trust.

- Payment Method Preferences: Fraudsters often request payment through gift cards, prepaid debit cards, wire transfers, cryptocurrency, or by mailing cash, taking advantage of these methods' difficulty to trace.

- AI as a New Scamming Tool: There's a growing concern over scammers using Artificial Intelligence (AI) to create more convincing scams, indicating the need for increased awareness and preventative measures against this evolving threat.

- Targeting of Vulnerable Populations: Veterans, active-duty service members, and their families, as well as older adults and people living with dementia, are being targeted at higher rates due to perceived financial stability or vulnerabilities.

- Public Sector Fraud Concerns: Besides Social Security fraud, SNAP fraud, Medicare/Medicaid fraud, tax refund fraud, unemployment insurance fraud, and student loan fraud are also top concerns for government agencies in 2023.

Tips To Stay Protected

- Never give personal data to outsiders. The SSA never asks for sensitive and private information.

- Scammers can find personal data online, but it doesn’t mean they are from the SSA.

- Keep checking your credit reports from the credit bureaus for the signs to identify fraud.

- Recognize the signs of a scam: Fraudsters often impersonate credible agencies, create a sense of urgency, pressure for immediate action, and request payment in untraceable ways.

- Verify the source: Always confirm the identity of the caller or sender by using contact information you have independently verified, rather than information they provide.

- Be cautious with personal information: Do not share personal details like your Social Security number, birth date, or financial information without verifying the legitimacy of the request.

- Trust your instincts: If something seems too good to be true or you're pressured to act quickly, it's likely a scam.

- Limit information shared online: Adjust your social media settings to private and be mindful of the personal information you post.

- Use strong, unique passwords: Avoid using easily guessable passwords and enable two-factor authentication where available.

- Secure your devices: Ensure your devices are locked with a passcode or biometrics, and only download apps from trusted sources.

- Be wary of phishing: Don't click on links or attachments from unknown senders, and be cautious of emails asking for personal information.

- Educate yourself and others: Stay informed about the latest scams and share this knowledge with friends and family.

Legal Penalties for Committing Disability Fraud

- General Penalties: Committing Social Security disability fraud can result in imprisonment for up to five years, a fine of up to $250,000, or both. These penalties apply to individuals who knowingly make false statements or misrepresentations to receive disability benefits.

- Enhanced Penalties for Professionals: For those in positions of trust or authority, such as doctors, Social Security Administration (SSA) representatives, or others who are involved in the facilitation of the fraud, the penalties are even more stringent. They could face up to ten years in prison and may also be required to pay civil fines up to $7,500 for each false statement or omission made in connection with the determination of benefits.

- Restitution and Additional Consequences: Beyond the primary penalties, individuals found guilty of disability fraud may also be ordered to repay the fraudulently received benefits. Federal courts have the authority to order restitution to the Commissioner of Social Security in cases where the fraud resulted in improper benefit payments or financial loss to an individual due to the fraud. This restitution is in addition to, or in lieu of, other legal penalties.

- Specific Case Outcomes: An illustrative case involved an individual who, after being found guilty of disability fraud, was required to repay all received benefits, sentenced to two years of jail time, and subjected to three additional years of supervision. This case underscores the legal system's commitment to addressing and rectifying instances of fraud.

Common Social Security Scams

Here's a summary of prevalent Social Security scams:

- Impersonation of SSA Officials: Scammers often pose as Social Security Administration (SSA) or Office of the Inspector General (OIG) officials to deceive individuals into divulging personal information or sending money.

- Threats and Pressure Tactics: Fraudsters may threaten victims with arrest, legal action, or suspension of their Social Security number to coerce them into immediate payment or information sharing.

- Demands for Payment: Unusual payment demands, such as requests for gift cards, prepaid debit cards, wire transfers, cryptocurrency, or mailing cash, are a hallmark of these scams.

- Social Media and Digital Communication: Scammers leverage emails, texts, direct messaging on social media, and spoofed phone calls, often using information or images that mimic official SSA communication to appear legitimate.

Efforts to Combat Social Security Fraud:

- OIG's Efforts: The Office of the Inspector General has been instrumental in combating Social Security fraud, leading to significant financial recoveries and numerous convictions related to fraudulent activities.

- Cooperative Disability Investigations (CDI) Program: The CDI program has saved billions by investigating and preventing fraud in the Social Security disability benefits program.

Financial Implications:

- Financial Losses: Social Security scams have led to substantial financial losses for victims. For instance, scams originating on social media accounted for $2.7 billion in reported losses since 2021.

- Investment in Fraud Prevention: The Social Security OIG spends significant resources annually to investigate fraud, demonstrating the financial commitment to protecting the system and its beneficiaries.

Prevention and Reporting:

- Recognizing Scams: Knowledge of scam tactics and the official procedures of the SSA can help individuals avoid becoming victims.

- Reporting: Victims and those who encounter Social Security scams are encouraged to report these incidents to the OIG to help in the fight against fraud.

Recent Development

- A Social Security Administration (SSA) employee was caught using his position to fraudulently obtain over USD 324,000 by creating Social Security Numbers for fictitious children and establishing entitlements for surviving child benefits connected to a deceased individual. This case, which spanned from August 2019 to September 2021, underscores the internal risks and the measures taken by the SSA and IRS-CI to address such fraud.

- The SSA's Office of the Inspector General (OIG) has issued warnings about scammers using fraudulent SSA letterhead in mailed letters, falsely advising recipients to call a toll-free number to activate an increase in SSA benefits, such as cost-of-living adjustments (COLA). This scam tactic exploits the COLA's automatic nature, attempting to deceive beneficiaries into providing personal information or money.

- The SSA and OIG continue to update the public on the prevalence of phone scams. These scams often involve callers pretending to be SSA officials, requesting personal information, money, or retail gift cards under false pretenses. Beneficiaries are reminded to hang up immediately on such calls and report suspicious activities to the OIG.

- In response to these increasing threats, the SSA and OIG have announced the opening of additional anti-fraud units across the country. These Cooperative Disability Investigations (CDI) Units play a crucial role in identifying, investigating, and preventing Social Security disability fraud, thereby ensuring the integrity of the agency’s anti-fraud initiative.

Conclusion

In analyzing Social Security fraud statistics, the data underscores a critical challenge facing the Social Security Administration and its beneficiaries. With over USD 2.7 billion lost to social media scams since 2021, the scale of fraud is both significant and concerning. The Cooperative Disability Investigations (CDI) program's efforts have been instrumental, saving over USD 4.4 billion between 2005 and 2020 by curbing fraudulent claims and ensuring the integrity of disability benefits. The Office of the Inspector General (OIG) further highlighted the extent of these issues, identifying nearly USD 37 million in potential overpayments due to wage reporting errors in Fiscal Year (FY) 2020 alone, emphasizing the need for accurate reporting and vigilant fraud prevention measures.

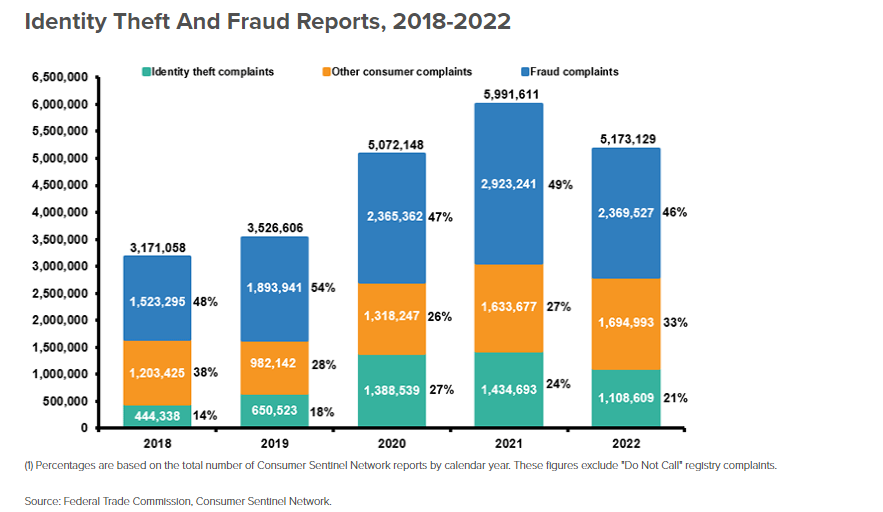

Moreover, the alarming 290% increase in identity theft reports related to “government documents or benefits fraud” from 2019 to 2020 illuminates the growing sophistication and frequency of these scams. Efforts to combat these activities are substantial, with the Social Security OIG allocating approximately USD 102.8 million in FY 2020 towards investigating fraud, illustrating the financial commitment towards protecting the system and its users. The legal outcomes, including 783 convictions in 2019 related to Social Security fraud, demonstrate the effectiveness of these investigative efforts.

These statistics serve as a stark reminder of the pervasive nature of Social Security fraud and the continuous efforts required to safeguard beneficiaries from exploitation. The data not only highlights the financial impact of these fraudulent activities but also reinforces the importance of awareness, reporting, and prevention strategies to mitigate risks and protect the integrity of Social Security benefits.

Sources

FAQ.

In one’s personal Social Security account, one can elect to receive courtesy notifications by email, so if we send emails when we deliver new messages only to Social Security accounts.

Yes, the number can be changed. Suppose you show that you are in danger because of domestic violence or any other abuse, or even if you are experiencing ongoing financial harm due to identity theft. In that case, a new Social Security number can be assigned.

No, it’s not safe. Never shall we type our SSN into an email or instant message and send it. The maximum number of messages can be intercepted and read. Also, dto’t share a voicemail that includes your personal SSN.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.