Student Loan Statistics By Country, University, Degree and Demographics

Page Contents

- Introduction

- Editor’s Choice

- Facts About Student Loans

- What is a Government Student Loan?

- What is a Private Student Loan?

- General Student Loan Statistics

- Average Student Loan Statistics

- Student Loan Statistics by University

- Student Loan Statistics by Degree

- Total Federal Student Loan Statistics

- Total Private Student Loan Statistics

- Student Loan Statistics by Demographics

- Student Loan Statistics During the Pandemic

- Impact of Student Loans on Borrowers and The Economy

- Student Loan Default Delinquency and Forgiveness

- Student Loan Forgiveness

- Conclusion

Introduction

Student Loan Statistics: Student loans provide one form of financial aid that assists students in funding their education: both undergraduate and graduate students are eligible to apply for loans offered by government-backed and commercial lenders. Though student loans can provide essential funding, they also carry a significant debt load that could potentially impact the future financial plans of the borrower.

Statistics released in 2021 show that outstanding student loan debt in the US had hit an astounding $1.7 trillion as of 2021, setting new records in debt accumulation. Over 44 million borrowers are responsible for this debt with each borrower typically owing around $32,000 on average.

Tuition increases are one of the primary drivers behind student loan debt issues. Over the last decade, college costs have seen significant hikes – over 25% overall over inflation and income growth! Students needing additional loans in order to afford their education are forced to take out extra loans – increasing debt levels considerably.

Student loan interest rates can be costly. Borrowers could face interest rates of 4-7 percent over the life of their loan, which could quickly add thousands of dollars in debt. Furthermore, many borrowers experience financial issues which prevent them from meeting loan payments on time, leading to default and further aggravating the situation.

Student loan debt is an issue affecting millions of Americans, yet initiatives like income-driven repayment plans and loan forgiveness programs do little to address it. Further steps must be taken in order to guarantee future generations access to affordable education without crippling debt burdens.

Editor’s Choice

- Americans owed approximately $1.76 trillion in combined federal and private student loan debt as of the fourth quarter of 2022, representing a decrease of 0.6% year-on-year from their third-quarter totals. By September 30th, 2022, private student loan balances had totaled $127.2 billion.

- Parents and students borrowed an estimated $94.7 billion during the academic year 2021-2022, with federal loans accounting for 46%; federal PLUS loans comprised 13%; private/other nonfederal loans contributed 13% and Parent PLUS loans were responsible for 11%.

- 54% of bachelor's degree graduates from four-year public and private nonprofit institutions in the class of 2021 had outstanding student loan debt when they completed college – on average totaling about $29,100 across both federal and private student loans.

- Graduates from private nonprofit institutions owed $33,000; compared to $27,400 for those who attended public universities.

- 55% of graduates from private schools compared to 53% of graduates from public schools left school with debt.

- In the fourth quarter of 2022; 0.87% of student loans were 90 days or more past due. This is lower than the 3.92% in the previous quarter and the 10.75% at the beginning of the COVID-19 pandemic in the first quarter of 2020.

- Since March 2020; the suspension of payments on federal student loans held by the government has been prolonged eight times. As soon as a decision about student loan forgiveness is made; it will stop. If not; payments will resume after June 30, 2023; 60 days later.

Facts About Student Loans

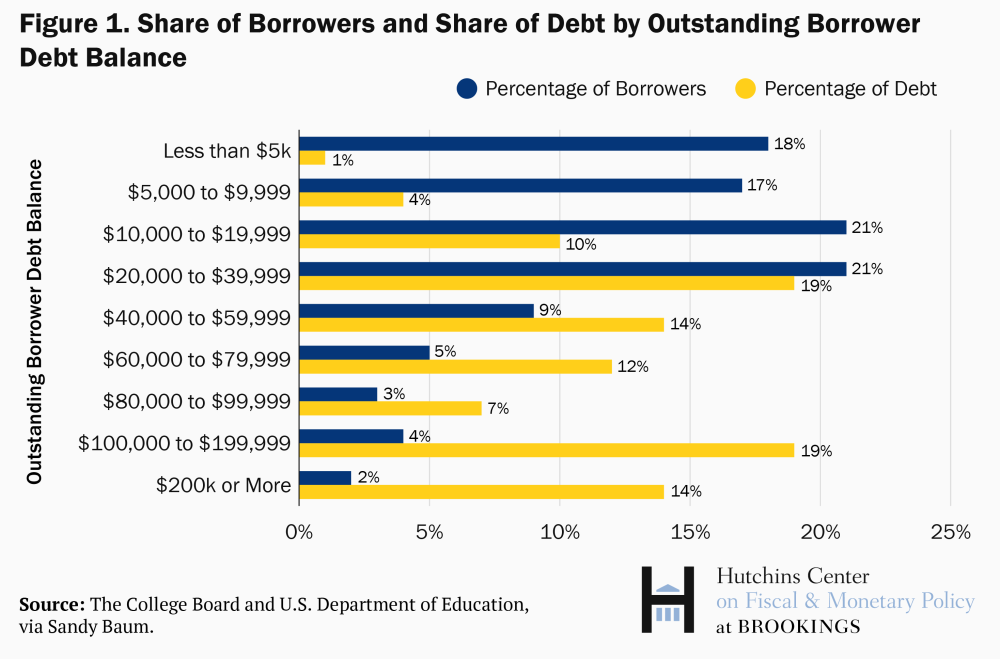

- A small group of student loan borrowers have really big loans.

- 6% of these borrowers owe more than $100,000.

- Among them, 2% owe more than $200,000.

- This 6% group is responsible for one-third of the total student loan debt which is $1.5 trillion.

- On the other hand, 18% of borrowers owe less than $5,000.

- This 18% group only owes 1% of the total outstanding debt.

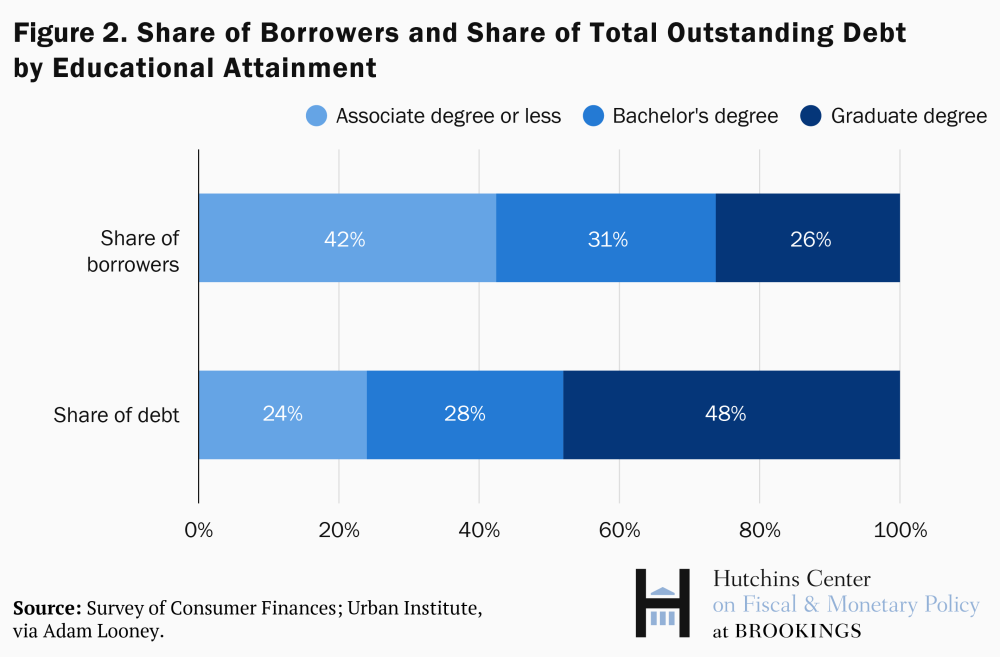

- Around 25% of people with student loans, who have about 50% of the total debt, borrowed money for post-graduate studies.

- Only 26% of households with student debt are led by someone with a post-graduate degree.

- Despite being a small percentage, these households with post-graduate degrees owe half of the total student loan debt.

- On the other hand, 42% of households with student debt are led by people without a bachelor's degree.

- This 42% group only has to pay back 25% of the total outstanding debt.

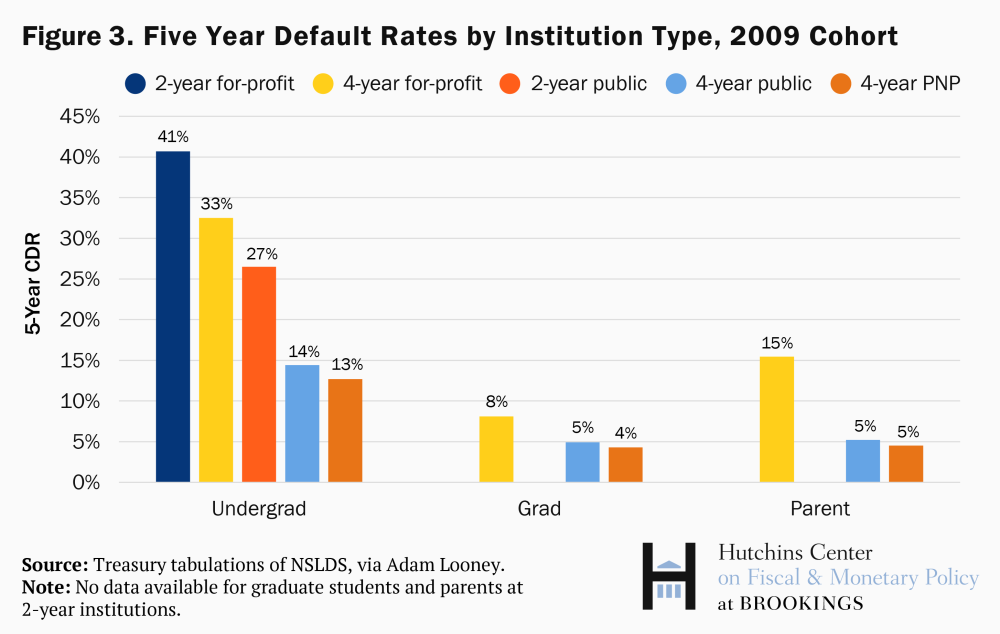

- The people who owe the most money are usually not the ones who fail to pay back their loans.

- People with post-graduate degrees, who have about half of all student debt, are less likely to default on their loans.

- Students who studied at for-profit schools often have higher default rates.

- 40% of borrowers from two-year for-profit programs fail to pay their loans within five years of starting repayment.

- 32% of borrowers from four-year for-profit programs also fail to pay their loans in the same time frame.

- About 25% of students from public community colleges default on their loans within five years of starting repayment.

- Students who borrowed money for public or private non-profit four-year schools are less likely to default on their loans.

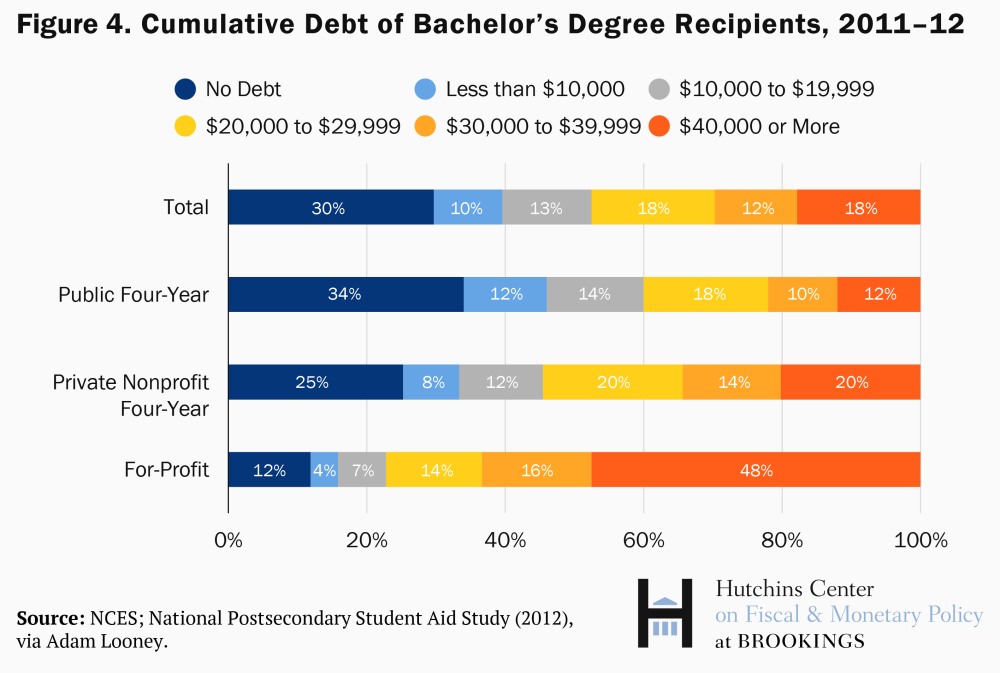

- Most students who earn a bachelor's degree graduate with little or no debt.

- 30% of students with bachelor's degrees finish school without any debt.

- Another 23% of these students finish school with less than $20,000 in loans.

- Less than 20% of all borrowers owe more than $40,000.

- Almost half of all borrowers from for-profit schools owe more than $40,000.

- Only 12% of students who attended four-year public colleges owe the same amount.

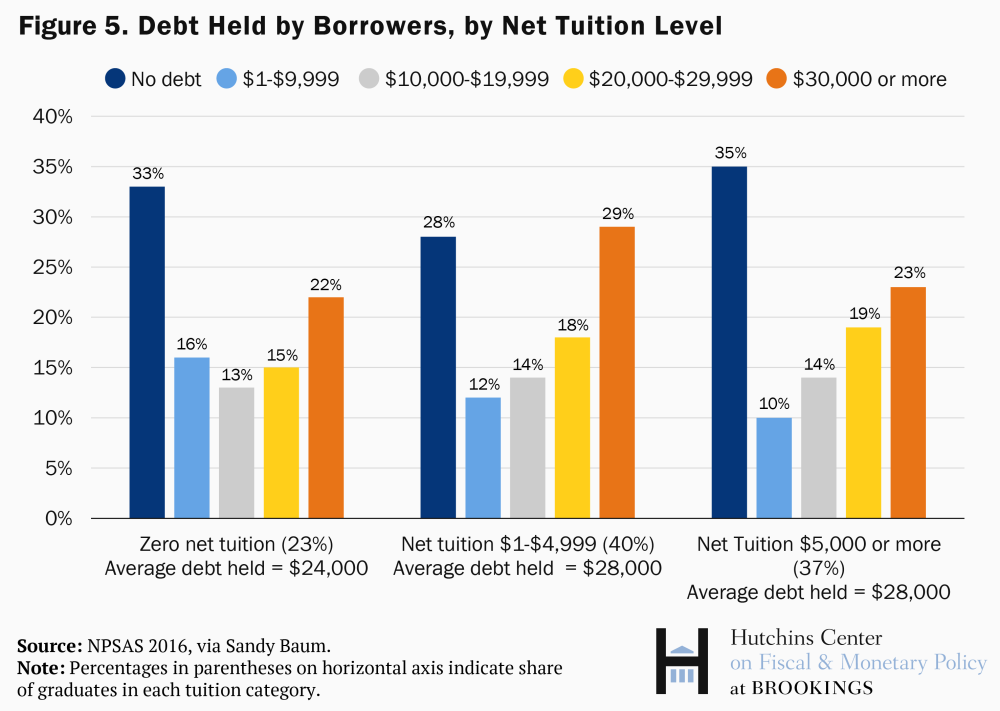

- Even when their tuition is fully paid by financial aid, many students still take out loans for living costs.

- Students often borrow money not just for school fees, but also to afford their living expenses while studying.

- Even when tuition is covered by scholarships or grants, students' borrowing habits don't change much.

- Among students at public universities who don't need to pay tuition (it's covered by aid), 22% borrow $30,000 or more. They borrow, on average, $24,000.

- Meanwhile, 23% of students who have to pay a net tuition of more than $5,000 also borrow $30,000 or more. They borrow, on average, $28,000.

What is a Government Student Loan?

The federal government provides several kinds of student loans, including Direct Subsidized, Unsubsidized, and PLUS Loans to aid students with financing their education. These loans are provided through the Department of Education and have specific criteria including set interest rates and payback plans.

As of 2021; approximately 30 million individuals had taken out approximately $1.4 trillion in federal student loans with no outstanding balance owed. Over 90% were distributed via Direct Loan programs while 10% went through more traditional means such as Federal Family Education Loan (FFEL) programs.

Undergraduate students who can demonstrate financial need can apply for Direct Subsidized Loans. While attending school at least half-time, no interest will be charged on these loans, while during various forbearance and deferral periods, the government covers this charge – the interest rate on Direct Subsidized Loans as of 2021 was 3.73%.

Undergraduate and graduate students alike may qualify for Direct Unsubsidized Loans, which do not require them to prove they need the money. Once loan funds have been disbursed, interest begins accruing; both interest and principal must be repaid in equal measures by borrowers. As of 2021, undergraduate interest rates were 5.28% while for graduate students it stood at 6.28%.

Graduate students and parents of dependent undergraduate students needing extra funding for school expenses not covered by existing financial assistance can apply for Direct PLUS Loans. Once the loan has been disbursed, interest accrues; as of 2021, Direct PLUS Loans had an interest rate of 6.28%. Responding to student loan debt problems, the government has developed several initiatives designed to assist borrowers in managing their obligations more easily. These include debt forgiveness programs tailored for certain occupations such as public service and income-driven repayment plans that allow borrowers to make repayment payments based on their salary and family size. Unfortunately, however, such applications have come under criticism due to being difficult for users and providing insufficient information.

Government statistics on student loans demonstrate how seriously student debt impacts both people and the economy as a whole. Although efforts are being made to resolve this problem; additional work needs to be done so that future generations have access to affordable education without incurring massive debt burdens.

What is a Private Student Loan?

Banks, credit unions, and other financial organizations provide private student loans as an aid for funding higher education. While private loans may offer lower interest rates than their government-backed counterparts, they often come without borrower protections or repayment options as available through other avenues; private loans could become necessary when other options have been exhausted, yet may increase debt levels and cause other financial challenges for those taking out these private loans.

As of 2021, over four million borrowers in the US had outstanding private student loan balances totaling more than $138 billion. Average debt levels among this population range between $35,000 and $50,000 with rates ranging between 3-12%.

Due to their increased risk, private student loans often carry higher interest rates than government loans. Furthermore, unlike government loans which don't require a credit check or co-signer approval process before approval, obtaining private loans may require passing a credit check and receiving approval with co-signers – making it more difficult for those without established credit histories or bad credit ratings or no history at all to secure one or face higher rates than government ones. Finally, unlike federal loans which provide borrower safeguards such as forgiveness programs or income-based repayment schedules or flexible repayment choices such as forbearance or postponement than federal ones do.

Private loans have come under scrutiny due to their lack of transparency and misuse potential, prompting accusations that certain lenders use predatory lending techniques, charge excessive fees, or misinform consumers regarding the terms of their loans. Issues associated with debt accumulation and repayment can wreak havoc on an individual's finances, as evidenced by statistics on private student loans used for payment of tuition expenses. Students dependent on private student loans experience substantial difficulties when using them to cover tuition expenses. Private loans carry significant risks and don't provide as many borrower protections as government loans do, yet can still be an invaluable financial tool for some borrowers. Students considering taking out such loans should carefully weigh all available options before making this decision and seek financial advice before proceeding with them.

General Student Loan Statistics

Student debt has reached $79 billion this year alone. Student loan balances have ballooned to 4.7 million people–whether government or private–having an unpaid amount that must be paid back. Not all debts are created equal; depending on a borrower's socioeconomic circumstances, the degree they wish to pursue, the institution/college they will attend, and loan amounts; they could all differ significantly.

- Student loan debt will reach $1.56 trillion by 2020 – more than three times what was owed by Americans 10 years earlier.

- 7 million Americans owe college loans. Student loan debt now makes up the second-highest debt category, reaching $79 billion overall and $29 billion during just the first three months of 2019.

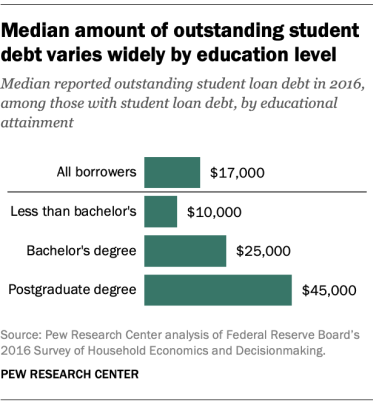

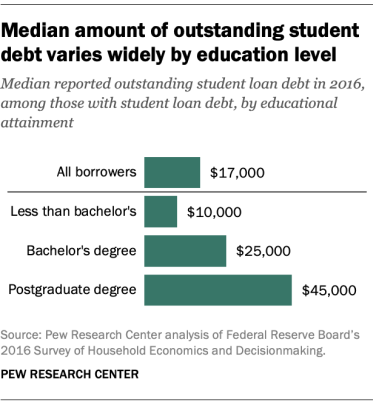

- The median and average student loan debts are $17,000 and $32,731, respectively. Federal loans make up 92% of student loan borrowing versus private ones. Around 2.8 million students have debts of $100,000 or higher and 25% hold loans between $10,000-25,000 as personal debt.

- Undergraduate students accounted for 88.15% of total student debt in 2019; while graduate students represented 11.85%.

- Between 1997 and 2016, Boston University graduates saw their average federal student debt load skyrocket from $5,600 in 1997 to $25,625 by 2016.

- There are 9.4 million debtors with between $20K-$40K worth of college debt.

- American college graduates incur an average student loan debt of $37,584.

- By 2021's end it is anticipated that there will be two trillion in student loan debt and as early as 2030 it could even surpass three trillion dollars.

Average Student Loan Statistics

As of 2021, the average student loan debt in the United States stood at an estimated $38,000 per borrower – representing significant financial strain for many borrowers and an increase from previous years. Debt can vary significantly depending on factors like school attended and degree sought as well as an individual's circumstances; average debt figures can differ drastically.

Graduate or for-profit college students tend to incur higher debt levels than undergraduate or public university students, such as attending for-profit institutions with debts of approximately $50,000 compared to $84,300 among graduate degree seekers.

Dependent upon loan type and lender, interest rates on student loans may also vary significantly. Private loans offered by banks and financial organizations tend to have higher interest rates than federal student loans from the government, typically ranging from 2.75%-5.30 % and 4.30-6.00% for undergraduate and 4.30%-6.00% respectively for graduate loans respectively; on private loans, interest may range between 3-12%.

The time it takes to repay student loans depends on your individual financial situation and repayment strategy. Repay times may extend up to 25 years, or alternatively enroll in income-driven repayment plans which tailor monthly payments according to income or family size; typically the repayment period for federal loans is 10 years.

Many borrowers struggle to repay their debts despite available repayment programs. As of 2021, 11% of student loans had defaulted meaning more than 270 days of payments had gone unmade by their borrower – this can have serious repercussions such as damage to credit ratings, income garnishment, and legal action against them.

Average student loan statistics highlight the difficulty borrowers encounter when navigating student loan debt. Although options exist for repayment and relief such as income-driven repayment plans and loan forgiveness programs; they may not be sufficient to address America's growing problem of student loan debt. Therefore, it is imperative for borrowers to carefully consider their options and seek professional financial guidance prior to taking on student loan debt.

Student Loan Statistics by University

The average amount of debt per borrower at universities varies widely depending on factors like tuition costs, available financial aid/scholarships/assistance programs, and the socioeconomic background of their student body – these factors all play a part in how much debt someone incurs over their academic careers.

- According to research by the Institute for College Access & Success (TICAS), average student loan debt at public colleges was $28,800 while private nonprofit universities saw average debt levels of around $33,500 on average for every borrower – although amounts vary greatly by state and school.

- Average federal student loan debt among individuals holding an associate's degree as their highest level of schooling is $23,500, and $34,800 on average among people holding bachelor's degrees.

- On average, graduate students carry federal student loan debt in excess of $90,170.

- 5% of graduates with undergraduate debt also hold federal student loan debt, accounting for 54.2% of all graduates who owe graduate school debt. Outstanding federal loans remain outstanding with 52.8% of master's degree holders for graduate school studies and 60.0% for undergraduate education studies.

- Federal student loan debt is held by 73% of those holding professional doctorates and 74% for undergraduate studies.

- For example, the University of California system had an average debt per borrower of $21,300 while New York universities were $43,600. Meanwhile, Northwestern University averaged an average debt per borrower of $52,000 while Arizona State University saw $22,700 debt per borrower.

- Nationally, default rates average 11%; however, some institutions can see much higher default rates; Harvard University sees only 1% of students default while 51% do at California's Everest College.

Students struggling to manage student loan debt are underscored by data broken down by the university. While there may be solutions such as income-driven repayment plans and loan forgiveness programs available; these initiatives may not be enough to stop an ever-increasing student loan debt crisis.

Student Loan Statistics by Degree

Student loans are an increasingly common way to higher education costs, with debt loads often depending on which degree program a student chooses.

- Bachelor's Degree: Graduates with a bachelor's degree typically leave with an average student loan debt of $38,792, which applies to graduates from the class of 2020. Actual debt varies based on major, with engineering/computer science majors typically incurring lower amounts compared with social work/teaching majors.

- Master's Degree: Students who hold master's degrees typically owe an average student loan debt of $66,000; however, this number varies wildly based on the topic of study and can even exceed $100,000 when considering MBA students compared with individuals pursuing education or social work master's degrees.

- Doctorates: Students who have earned a doctorate typically owe around $106,000 in student loans, though this amount may differ depending on their subject of study – law and medicine students often carry larger debt loads than students in social work or education fields.

- Professional Degree: On average, those pursuing professional degrees such as law, medicine, or dentistry accrue an average student loan debt of $161,772. Due to high tuition costs and lengthy completion times for these degrees, these tend to be among the more costly choices available to students.

Total Federal Student Loan Statistics

The U.S. Department of Education provides details about all outstanding federal and private student loans due, such as federal Family Education Loan Program loans (FFEL) and Perkins loans, which have seen their total outstanding balance decrease by nearly 50 percent since 2013.

Questioning how there could possibly be more outstanding student loan debt since 2013, you may wonder. One reason might be due to more direct loans coming due. Since 2013, these have increased by 133% – this may explain your confusion.

- Federal and private loans; combined account for $1.75 trillion in outstanding student loan debt. On average; each borrower owes approximately $28,950. About 92% of this student debt comes from federal loans while the remainder is made up of private student loans.

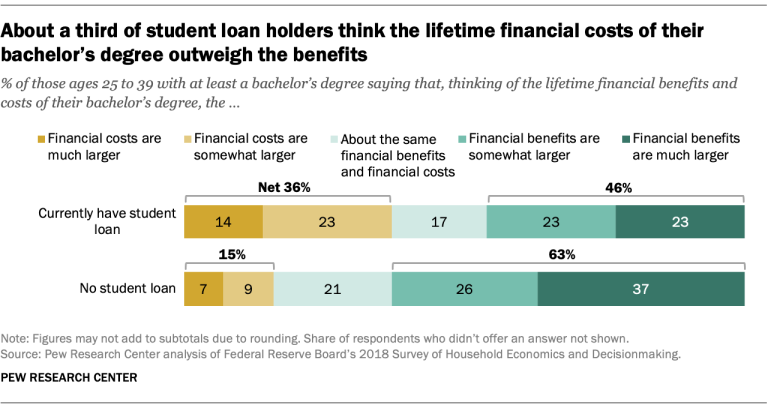

- 55% of students at four-year public universities had student debt; 57% owed student loan debt at four-year private nonprofit universities. 9.2 million Americans collectively owe $207.8 billion in Federal Family Education Loans (FFEL).

- 32 million American are owed $3.9 billion in Perkins Loan debt and 37.8 million owe $1.4 trillion for direct loans.

Total Private Student Loan Statistics

While some websites provide information about both federal and private student loans, others only include private student loans.

- By the third quarter of 2022; Americans owed private student lenders an estimated $127.2 billion; accounting for 7.2% of all outstanding federal and private student loan debt.

- Interval Analytics published a report detailing how $56.6 billion out of $127.2 billion total was contributed by twelve organizations: Citizens Bank; Discover Student Loans, Navient, PNC Bank, Sallie Mae College Ave Student Loans Navy Federal Credit Union South Carolina Student Loan Vermont Student Assistance Corporation VSAC INvestEd North Carolina State Education Assistance Authority NCSEAA Network

- These 12 donors hold outstanding loans totaling $92,500,000; of this sum; undergraduate loans represent 89% while graduate loans make up 10%.

- As of the third quarter of 2022; 74.9% of private student loans owned by contributors had been repaid; 17.3% were postponed and 6.5% graced while 1.3% were being put on forbearance.

- By the third quarter of 2022, 1.6% of private student loans had become 90 days past due, an increase from 0.9% the prior year. Cit Cosigners was required for 90.8% of undergraduate and 65.9% of graduate private student loans during the 2022-2023 academic year.

Student Loan Statistics by Demographics

Who exactly are the borrowers? They encompass a diverse range of backgrounds and ages, spanning from 18 to 60 years or older. Despite certain regions having a higher concentration of borrowers with significant student loan debt, they are spread across the United States. To delve deeper into the topic, examine the data provided below, including statistics on student loans categorized by race.

AGE

- The age range for borrowers ranges between 18 to 29 (representing 34%), 22% between 30 to 44, 7% from 45 to 59, and one over 60 years old – representing 15% of America's adult population.

- As of 2020, Gen Z held 13% of student loan debt in the US; 11% went to millennials while Gen Xers held 5%.

- One in four Gen Zers has student loan debt. Generation Xer's average student debt is $34,075, followed by Gen Z with $15,798 of debt, and then millennials at an average debt level of $21,367.

GENDER

- 57% more women are earning bachelor's degrees than males. Women typically owe $2,700 more in college loan debt than their counterparts do – though in black women's cases, it exceeds $30,000.

- As opposed to 39% of parents of all females, nearly 50% of parents of all boys save for college expenses. While only 21% of males struggle to repay their student loan debt after graduating, 23.2% of women struggle with this repayment obligation after graduation.

- Women whose parents held high school diplomas often borrowed more than those whose parents held bachelor's degrees. On average, those borrowing with parents with bachelor's degrees typically borrowed $4,145.80 more.

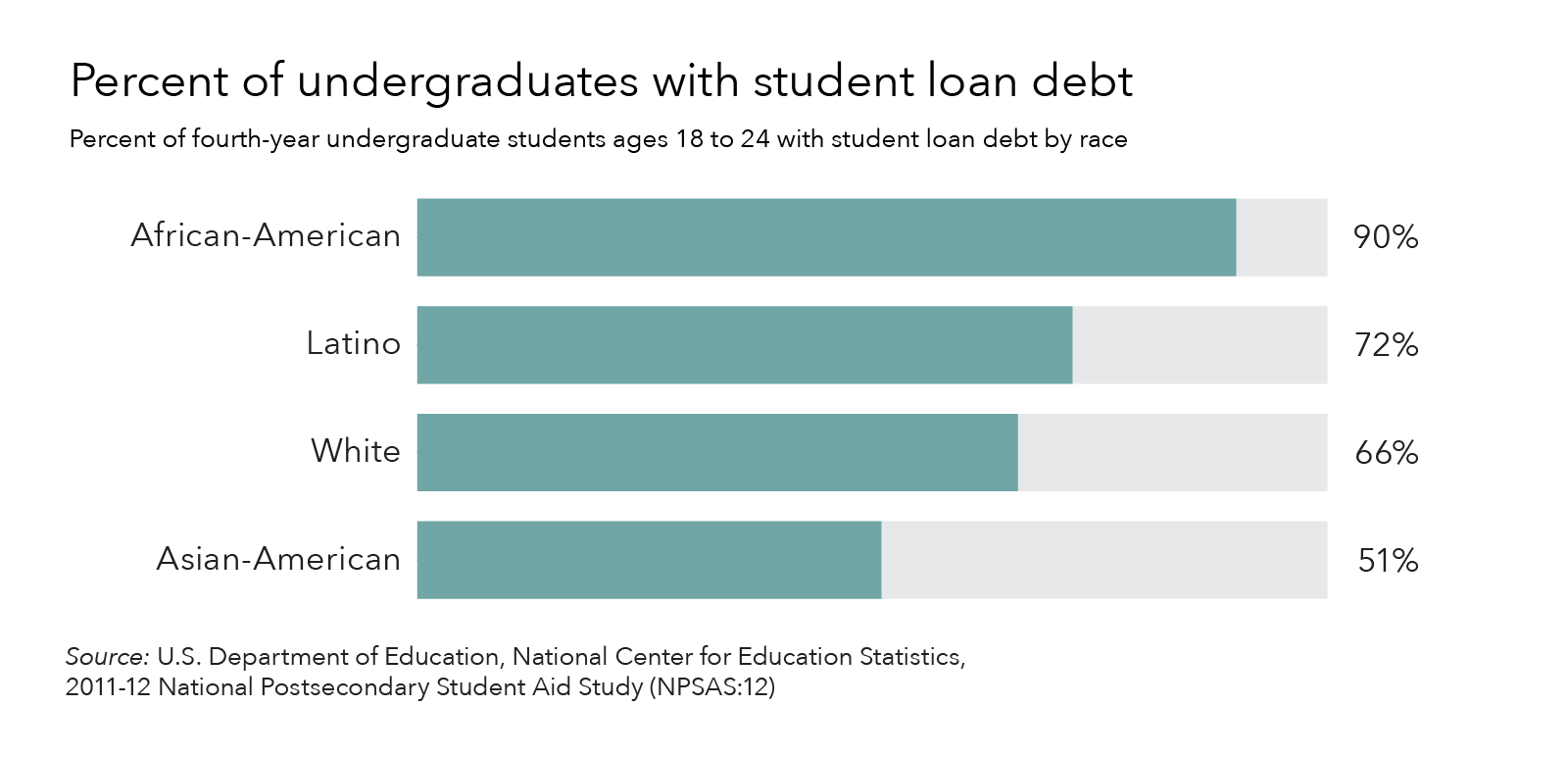

RACE

- African-American college graduates; typically incur $25,000 more student loan debt than their white counterparts.

- White and Caucasian students; (40.6% of the student body) took out loans ranging from $0 to $9,999 on average for their undergraduate educations.

- 6% of African American borrowers default on their loans compared with only 2.4% among Caucasians. Furthermore; 21% of African-American and Hispanic individuals who took out student loans had fallen behind on payments by default.

- 28% of African-Americans between 18 and 29 who borrowed money for schooling in the US reported falling behind on payments for four-year institutions; while 59.9% of white students obtained funds from federal sources for such education loans.

INCOME

- More than half of households; earning $75,000 or less annually are comprised of recent college graduates who have taken out loans to pay for their education.

- Approximately one-fifth of households earning less than $40,000 annually are comprised of college-educated individuals.

- It was estimated that White families had a median income of $69,823.

- The median income for families in Black households was approximately $43,862.

- Households that earn over $74,000; accounting for 40% of the highest-income households; are responsible for nearly 75% of payments on student loan debt.

- Meanwhile; a significant proportion of households with the lowest incomes—40% to be exact— pay back less than 10% of their outstanding student loans.

STATE

- Northeastern states typically experience higher student debt rates; New Hampshire, Pennsylvania, Connecticut, Rhode Island, and Delaware all had the highest levels of student loan debt for 2019.

- Western states tend to have lower student debt. Utah, New Mexico, Nevada, California, and Wyoming were the top five debt-free states for the Class of 2019. Meanwhile, in New Hampshire, the average student debt for this class of 2019 was estimated to be $39,410.

- In 2019, student loan debt in New Jersey increased three times faster than inflation.

- Arizona graduates' debt levels, on the other hand, rose in tandem with inflation. Average student loan debt in 2019 in Arizona reached $24,700 – an increase of 36% since 2004's estimate of $18,150. Federal student loan debt amounts to an average total of $31.4 billion across all 50 states and territories.

- 7% of borrowers had student debts of more than $100,000 as of June 2020.

|

Rank

|

State

|

% of Residents with Debt

|

Average Debt

|

|---|---|---|---|

| 8 | Alabama | 50% | $31,899 |

| 40 | Alaska | 46% | $25,682 |

| 44 | Arizona | 54% | $23,967 |

| 34 | Arkansas | 55% | $26,799 |

| 46 | California | 50% | $22,785 |

| 36 | Colorado | 52% | $26,530 |

| 1 | Connecticut | 57% | $38,510 |

| 5 | Delaware | 62% | $34,144 |

| 15 | District Of Columbia | 46% | $30,775 |

| 43 | Florida | 50% | $24,041 |

| 25 | Georgia | 57% | $28,653 |

| 42 | Hawaii | 49% | $25,125 |

| 35 | Idaho | 61% | $26,675 |

| 24 | Illinois | 61% | $29,214 |

| 22 | Indiana | 57% | $29,561 |

| 20 | Iowa | 63% | $29,859 |

| 29 | Kansas | 59% | $27,720 |

| 27 | Kentucky | 64% | $28,447 |

| 31 | Louisiana | 48% | $27,210 |

| 10 | Maine | 56% | $31,364 |

| 23 | Maryland | 56% | $29,314 |

| 7 | Massachusetts | 59% | $32,065 |

| 11 | Michigan | 58% | $31,289 |

| 9 | Minnesota | 68% | $31,734 |

| 18 | Mississippi | 58% | $30,439 |

| 32 | Missouri | 58% | $27,108 |

| 26 | Montana | 59% | $28,466 |

| 39 | Nebraska | 54% | $25,750 |

| 48 | Nevada | 49% | $22,064 |

| 4 | New Hampshire | 74% | $34,415 |

| 6 | New Jersey | 61% | $32,247 |

| 49 | New Mexico | 54% | $21,237 |

| 13 | New York | 60% | $30,931 |

| 37 | North Carolina | 57% | $26,526 |

| – | North Dakota* | – | – |

| 17 | Ohio | 62% | $30,629 |

| 38 | Oklahoma | 49% | $25,952 |

| 28 | Oregon | 56% | $27,885 |

| 2 | Pennsylvania | 67% | $36,854 |

| 3 | Rhode Island | 64% | $36,250 |

| 14 | South Carolina | 58% | $30,891 |

| 12 | South Dakota | 74% | $31,275 |

| 41 | Tennessee | 56% | $25,252 |

| 33 | Texas | 55% | $26,824 |

| 50 | Utah | 38% | $18,838 |

| 16 | Vermont | 60% | $30,651 |

| 19 | Virginia | 56% | $29,887 |

| 45 | Washington | 52% | $23,936 |

| 30 | West Virginia | 74% | $27,505 |

| 21 | Wisconsin | 64% | $29,569 |

| 47 | Wyoming | 47% | $22,524 |

Student Loan Statistics During the Pandemic

Student loan debt has been significantly affected by the COVID-19 epidemic.

- In March 2020; the federal government stopped collecting payments and accruing interest on student loans issued under federal loan programs; with January 2021 and September 2021 being added as additional stops. Unfortunately, many debtors struggling with financial difficulties related to an epidemic outbreak such as these debtors had difficulty making their monthly payments on time due to this solution – though only short-term relief.

- During the epidemic; several governments and colleges developed student loan relief initiatives such as loan forgiveness plans or emergency grants for pandemic-impacted students.

- Even with these assistance programs in place; the epidemic has driven student loan holders' default rates up. According to data provided by the Department of Education; federal student loan default rates increased from 9.7% in 2019 to 11.5% in 2020 – this number reached its peak in 2015.

- The Federal Reserve Bank of New York; reported that US student loan debt; increased from $1.59 trillion in the first quarter of 2020 to an estimated total debt balance of $1.71 trillion by the first quarter of 2021; one factor contributing to this surge was interest being suspended on government loans during a public health outbreak; thus allowing accrued debt balances to continue growing during that time.

- Recent college graduates are feeling the ripple effects of this epidemic as they enter an increasingly competitive employment market. Many are having trouble securing work while facing financial strain that makes repaying student loan debt difficult.

Impact of Student Loans on Borrowers and The Economy

Impact on Borrowers:

- Financial Harm: Student loan debt can be an immense financial strain for borrowers with large debt loads and limited incomes, especially those living on fixed incomes. Repaying student loan obligations could prevent people from starting businesses, buying homes, or saving for retirement as planned.

- Mental Health: Borrowers' mental health may suffer as a result of their student loan debt, potentially leading to stress, worry, and despair as well as reduced productivity at work and other negative side effects.

- Delayed Life Milestones: Student loan debt may delay crucial life milestones such as marrying, starting a family, and buying a home, all of which may have lasting negative repercussions for both financial security and well-being.

Impact on the Economy:

- Reduced Economic Growth: Student loan debt may impede economic development by restricting borrowers' capacity to establish businesses, buy homes or make other economic investments that could boost growth within an economy. As a result, other areas could also be negatively impacted.

- Student loan debt exacerbates economic inequality by dissuading low-income individuals from attending college due to large debt loads they cannot afford, potentially impeding social mobility and perpetuating cycles of poverty.

- Student loan debt increases the likelihood of default, which has serious repercussions for the economy as a whole. The default can make credit less readily available and cause consumer spending to decline – both of which impede economic development.

Student Loan Default Delinquency and Forgiveness

Student loan systems consist of several key components: default, delinquency, and forgiveness.

Student loan default

Borrowers enter default when they miss payments on their student loans on multiple occasions, typically after 270 days have gone by with unpaid balances on federal student loans. Effects of student loan default include damage to their credit rating, wage garnishment, and legal action taken by the federal government against them as well as late fines, collection costs, and other expenses which increase its overall cost significantly.

Student Loan Delinquency

Delinquency for student loans occurs when payments are late; federal student loans become delinquent if an obligation to make payment slips through. Delinquent borrowers may incur late fees, experience credit score deterioration, and receive collection calls as a result

Student Loan Forgiveness

Through various programs, borrowers may be eligible to have some or all of their outstanding student loan debt forgiven or dismissed. Income-driven repayment plans, public service loan forgiveness programs, and teacher loan forgiveness initiatives all exist as options that could potentially assist those experiencing difficulty repaying student loans due to financial difficulty or other obstacles.

Delinquency and default are major problems for borrowers and can have lasting repercussions for their finances. Borrowers struggling to repay student loans may find relief through loan forgiveness programs; however, these might not always be accessible or useable effectively. Policymakers must address these challenges to facilitate access to affordable higher education while protecting borrowers from hardship.

Conclusion

Student loan debt is a growing concern for millions of individuals today. Higher education costs have become much more costly in recent years, increasing debt loads on student loans owed. Borrowers may find their efforts hindered in starting businesses, saving for retirement, or purchasing homes as a result of this debt burden; high amounts could even impede economic development by contributing to more economic inequality and slow growth.

The COVID-19 pandemic has highlighted the difficulties associated with student loan debt. Due to job loss and other financial hardships, many borrowers are finding it hard to make their payments on student loans they borrowed through federal programs – so the federal government has implemented steps to assist borrowers during such times of emergency by temporarily suspending both payments and interest on these federal student loans.

Going forward, policymakers must continue addressing student loan debt problems and developing regulations that enable affordable higher education at a reasonable cost while protecting borrowers from hardship. This may involve expanding loan forgiveness initiatives, creating income-based repayment schemes, and attacking the factors driving up tuition prices – ultimately solving this debt dilemma will provide financial security and economic expansion to millions of students as well as help national economic expansion.

Sources

FAQ.

Banks often lend up to 90% or even 100% of educational costs as loans; other factors, including income of parent/legal guardian(s), the collateral value offered, academic standing of the applicant(s), etc, all can affect how much loan an applicant qualifies for.

Based on an institute's cost structure and schedule, tuition and hostel fees must be paid directly to them via the draft. Other loan components may cover lab supplies, laptop computers, uniforms and travel

Under Section 80E of the Income Tax Act, loan borrowers may take advantage of a Section 80C deduction of Rs 150,000 when repaying interest on college loans; once this process begins the borrower can begin reaping tax advantages for up to eight years until all interest has been repaid in full.

Some banks perform independent verification of the employment records of loan cosigners - usually their parent/guardian or spouse of the student applying for an education loan. If their information cannot be verified, their loan application could be rejected by potential lenders.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.