Utilizing Generative AI in Insurance Claims: Exploring Its Applications

Page Contents

- Understanding Generative AI

- What is Generative AI?

- How Generative AI Works?

- Understanding Top Generative AI Tools

- How Generative AI Helps the Insurance Industry?

- Challenges of Generative AI

- How Generative AI Helps the Insurance Industry?

- Generative AI In Insurance Market Growth And Forecast

- Things to Keep in Mind About Generative AI

- Final Thoughts

Understanding Generative AI

Insurance firms can tap into Generative AI to learn more about what their customers want and how they behave. This technology uses advanced learning systems like deep learning and neural networks to examine large amounts of data, spotting patterns and trends. With these insights, companies can create products or services that are perfectly suited to what their customers need, making their customers happier and more loyal.

This kind of technology is becoming super important for insurance companies. When we look at all the tech in insurance, Generative AI stands out as one of the most advanced. It provides valuable insights and helps companies in the insurance world better understand and meet their customers' needs.

What is Generative AI?

Generative AI is a kind of artificial intelligence technology that can create a wide range of content like documents, images, sounds, and artificial data. The growing interest in Generative AI has been sparked by its user-friendly interfaces that make it simple to quickly produce high-quality text, visuals, and videos. This newly uncovered potential has opened doors to opportunities like better movie voiceovers and comprehensive educational materials. However, it has also caused concerns about misinformation, digital manipulation of images or videos, and damaging cyberattacks on businesses, like deceptive emails that convincingly impersonate a team leader.

An essential part of Generative AI is Transformers and the language models they enable. Transformers is a type of machine learning model that lets researchers train bigger and bigger models using unlabeled data first. This way, new models can be trained using billions of pages of text, resulting in more comprehensive responses.

How Generative AI Works?

Generative AI starts with an initial prompt, which could be a message, image, sound, or any input that the AI system can interpret. Responding to this prompt, the AI uses different algorithms to create new content. This new content can take the form of essays, solutions to problems, or even realistic imitations generated from pictures or sound clips of a person.

Earlier iterations of Generative AI relied on data being fed through an API or a complicated procedure. However, those leading the field of Generative AI are now developing improved user experiences, which let you put in a request in a straightforward manner. After receiving an initial output, you can fine-tune the results by giving feedback on aspects such as style, tone, and other characteristics that you'd like the generated content to embody.

Understanding Top Generative AI Tools

Company leaders have started to use learning models that can understand massive amounts of unlabeled data and find patterns for different tasks, all to stay ahead in their field. A few of the notable Generative AI tools are:

- ChatGPT: This is a chatbot that can generate text, developed by OpenAI. ChatGPT has become quite popular as it can create content, code, and more from short text prompts, which helps increase productivity and efficiency. The latest version of this language-writing model, GPT-4, has made ChatGPT even better. It can write text that feels more natural and smooth compared to the model it used to use.

- Dall-E: Dall-E is a more advanced version of Image GPT, a concept first introduced by OpenAI in June 2020. The initial idea was to demonstrate how a neural network can create high-quality images. But with Dall-E, OpenAI took this concept further, allowing users to make new images from text prompts, similar to how GPT-3 can generate new text from text prompts.

- Bard: This is a chatbot developed by Google, designed for conversations. The key difference between Bard and ChatGPT is that Bard uses data gathered from the internet. While some of these models were made open-source for researchers, they have not yet been made publicly available. Microsoft's decision to use GPT in Bing led Google to launch Bard, a chatbot for general use.

How Generative AI Helps the Insurance Industry?

Generative AI has many practical uses in the insurance industry, such as personalized marketing, employee assistance through chatbots, automating claims processing, creating new insurance products, spotting fraudulent claims, and customer service via chatbots. Here's how these benefits work:

- Understanding Customers: Generative AI can analyze data to spot patterns and trends, such as what kind of claims customers file and when. This helps insurance companies better understand what their customers need. It can also help in creating new insurance products or in planning marketing strategies.

- Personalized Services: Generative AI can also help to personalize services for customers. By analyzing customer data like demographics and policy preferences, insurance companies can create tailored policies for individual customers. It can also make recommendations based on the customer's claim history and preferences, making the whole process more convenient.

- Improving Business Personalization: Companies are using Generative AI to personalize their services better. Machine learning algorithms can study a customer's buying habits and online behavior to improve product recommendations or even create personalized content. This can help marketers in their campaigns, salespeople in their presentations, and even trainers in their training sessions. Generative AI can serve as a research assistant, providing content that is tailored to an individual's learning style.

- Enhancing Customer Support: In industries where customer service is a priority, such as consulting, Generative AI can be very beneficial. It can gather and process research data on specific topics, find patterns, and provide insights. This can help businesses develop strategies for their clients.

- Aiding Decision Making: Generative AI tools can be used where managing knowledge is critical. These tools can access and simplify data collections, making the research process easier. Future advancements are expected to further this capability, providing more insight from the data. Tools like conversational AI are becoming more common in industries like healthcare, finance, and insurance for managing knowledge, and Generative AI has the potential to revolutionize this field.

Challenges of Generative AI

One challenge with machine learning models, including Generative AI, is something called hallucination. This is when the AI makes up false information with confidence. Right now, there's no perfect solution to this problem. This means that we shouldn't look at replacing humans with these models. Instead, we should focus on having humans and AI work together for the best outcomes.

Another big issue is security. Setting up advanced Generative AI models in a dedicated cloud or on-site system isn't practical because they're usually owned by specific companies like OpenAI or Cohere. Controlling how data flows in these models is difficult because of this.

There are also concerns about sharing sensitive data with these AI models, like customer details or company secrets. Rules and regulations are still catching up with these new technologies. So, when experimenting, it's better to use data that isn't sensitive, whether it's from within the company or publicly available.

How Generative AI Helps the Insurance Industry?

Generative AI can produce new, relevant examples by learning patterns from a dataset. This can make insurance services faster and more efficient.

- Faster Claims Processing: Generative AI can look at past insurance claims and spot new ones that are similar. When a claim matches certain criteria, the AI can handle it automatically. This makes the process faster, freeing up time for claim administrators.

- Spotting Fraud: Generative AI can also help identify potential fraud. It does this by spotting patterns or oddities in claim data, such as long-term worker's compensation with no improvement, overuse of medical resources, or inconsistent injury reports. Investigators can then look into these suspicious cases more closely.

- Improving Job and Customer Satisfaction: Generative AI can make jobs less tedious by automating repetitive tasks, reducing employee turnover. It can also improve customer interactions, with AI bots answering customer questions in a more human-like way. By studying conversations between agents and customers, the AI can suggest resources and products to improve customer engagement.

- Smarter Underwriting: Generative AI can help insurance underwriters by finding important documents and pulling out key information, allowing them to focus on more complex tasks. It can even automate the data collection process for underwriting, saving professionals time.

- Managing Data: Generative AI works best with lots of data from different sources. Insurance companies need to organize their internal data to quickly generate insights and make decisions. They also need to access valuable external data, which can be costly and difficult to find in a diverse data ecosystem.

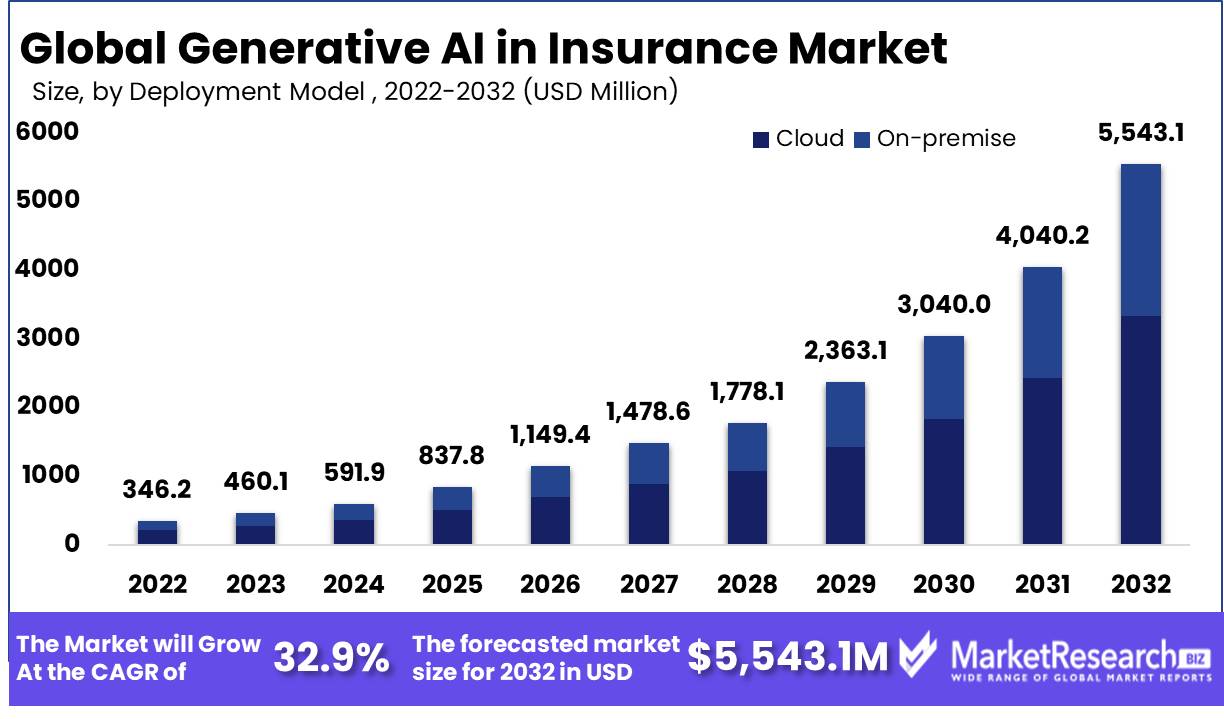

Generative AI In Insurance Market Growth And Forecast

As per a report by MarketResearch.Biz, the worldwide market size for Generative AI in the insurance sector is anticipated to increase significantly. It's projected to grow from a value of USD 346.3 million in 2022 to an impressive USD 5,543.1 million by 2032. This shows a robust growth rate of 32.9% from 2023 to 2032.

Key factors that boost the growth:

- Automation and Efficiency: Generative AI can automate many insurance tasks, leading to increased efficiency. It speeds up processes and reduces the chance of human error, making operations smoother and more effective.

- Rising Complexity and Data Volume: There's a growing amount of data in the insurance sector. Generative AI can handle this increase and complexity, making sense of vast amounts of data and deriving useful insights. This ability to manage and utilize large data sets is driving the growth of Generative AI in the insurance market.

Factors that might hinder growth:

- Concerns over Data Privacy and Security: While Generative AI can handle massive amounts of data, it also raises concerns about data privacy and security. People are increasingly aware and cautious of how their information is used and protected, which could slow the adoption of Generative AI in insurance.

- Difficulty of Implementation and Integration: Implementing and integrating Generative AI into existing systems can be complex. This technical challenge might limit its growth in the insurance industry, as companies might be reluctant to invest in new, complicated technologies.

Things to Keep in Mind About Generative AI

Before using Generative AI in your insurance company, you need to think about a few things to make sure it runs smoothly and doesn't cause any problems.

You'll need good technical and architectural knowledge to pick the right Generative AI technology and model. It's crucial to understand the differences between the many technologies available so you can make a wise choice.

The size of your dataset is a key factor in choosing your Generative AI technology. If you have a large dataset, you might need a powerful computing framework like Apache Spark to process the data effectively.

Data security is a big issue with Generative AI systems because they often use large datasets that may contain sensitive information.

In some situations, like real-time claim processing or virtual advising, you might need your Generative AI model to work very quickly. In these cases, you might need to use a Generative AI solution that focuses on speed, like lightweight models or optimized code.

Final Thoughts

The winners in the insurance industry will be those who use advanced analytics and tools to create innovative solutions, tapping into insights from vast data sources at reduced costs. Generative AI can be a game-changer for the insurance sector. It can help insurance providers understand their customers' habits and preferences more clearly. Moreover, providing customers with highly personalized products and services can greatly boost their reputation and the customer experience. Insurers have the flexibility to choose from different Generative AI frameworks based on their specific needs.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.