Crucial Discover Statistics To Understand Its Growth In The Current Digital Payment Landscape

Discover Statistics: Discover is a credit card product that is supplied by an American financial services firm, which is known as Discover Financial Services (DFS). These credit cards are accessible in the United States. Discover credit cards were launched in 1986 by Sears. When the Discover credit cards were introduced, they had a reduced fee structure and a greater credit limit than other credit cards. These features disrupted the popularity of other credit cards available in the industry at that time.

Discover pioneered the cash-back reward program. Discover payment transactions are handled by the Discover Network payment network. In 2005, Discover Financial Services took over Pulse, which is an automated funds transfer network. Discover Financial Services (DFS) declared that the firm would start providing Discover debit cards to other financial bodies. Here we will discuss some important Discover statistics that will give an insight into its growth as a financial service network over the years.

Key Discover Statistics

- As per the latest Discover statistics, Discover is the third biggest credit card brand in the United States. It is based on the count of cards in circulation in the country. In the US, Visa and MasterCard are the most widely used credit cards. Discover accounts for more than 57 million cardholders in the US.

- The network of Discover Financial Services (DFS) network accounts for more than 280 million global credit card holders.

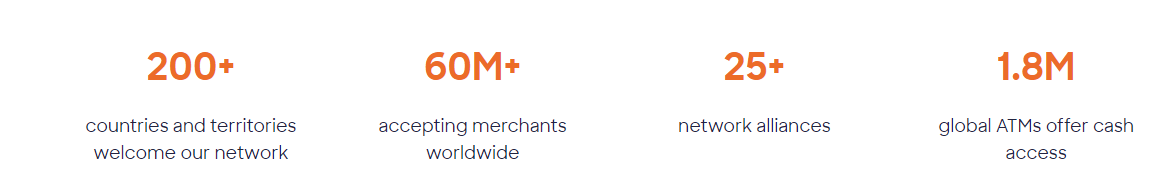

- Discover credit cards are supported across 200 nations and territories around the world.

- As per Discover statistics, spending across the Discover network grew by over $500 billion in 2021.

- Discover Cards can be utilized to withdraw advance cash as well.

- Cardholders can suitably utilize their Discover Cards at restaurants, gas stations, online merchandisers, or at major retail shops for cash-back rewards.

- Discover cards are accepted across nearly 99 percent of places in the US where credit cards are accepted.

- As per the latest Discover statistics, it offers nearly 1.8 million global ATMs (Automated Teller Machines) for cash access.

- Nearly more than 60 million merchants across the world accept Discover cards.

- Discover has around more than 25 network alliances with firms such as Pulse, Diners Club International, and Bcard.

- Discover is a credit card product that is popular for its cash-back rewards initiative and reduced-fee program.

- Discover issues cards directly to its consumers without the involvement of intermediate bank issuers and therefore, Discover earns profits from the interest imposed on their credit card balances directly.

- The revenue of Discover Financial Services (DFS) reached $14 billion in 2022. The firm saw an 18 percent increase in revenue in the financial year 2022 as compared to the fiscal year 2021.

- The net income of Discover Financial Services (DFS) was nearly $4.30 billion. The net income of DFS witnessed a 20 percent drop as compared to the net income in the financial year 2021.

- The Profit margin of Discover Financial Services (DFS) was nearly 31 percent in the fiscal year 2022.

- The profit margin reduced in 2022 as it was nearly 45 percent in the fiscal year 2021. Experts claim that the drop in profit margin was caused by greater expenses and costs.

- As per the latest discover statistics, the revenue of Discover Financial Services (DFS) is expected to grow by 4.2 percent per year on average in the next three years in the US.

- More than 10.64 million merchants in the United States accept discover cards.

- The total Discover card volume saw a 25.2 percent boost reaching $192.76 billion in 2021.

- Discover Credit card cash volume contributed to 5.51 percent of the total volume in 2021.

General Discover Statistics And Trends

#1. Discover accounts for more than 57 million cardholders in the US

Among the four key credit card networks in the United States, Discover has the third highest rate of acceptance among traders domestically in the country.

(Source: valuepenguin.com)

(Source: valuepenguin.com)

#2. As per the latest Discover statistics, Discover is the third biggest credit card brand in the United States.

It is based on the count of cards in circulation in the country. In the US, Visa and MasterCard are the most widely used credit cards.

#3. The network of Discover Financial Services (DFS) network accounts for more than 280 million global credit card holders

As per the latest Discover statistics, more than 2 billion global credit card holders transact on Discover’s network.

#4. Discover credit cards are supported across 200 nations and territories around the world

Discover cards now have a presence across 200 countries and territories around the globe such as the United States, Jamaica, India, Israel, Puerto Rico, the United Arab Emirates, Japan, and across other popular destinations where American businesses and travelers are prevalent.

#5. As per the latest discover statistics, the revenue of Discover Financial Services (DFS) is expected to grow by 4.2 percent per year on average in the next three years in the US

The Consumer Finance industry in the US earlier predicted that the revenue of Discover Financial Services (DFS) will show a 7.6 percent growth in the next three years.

#6. The Profit margin of Discover Financial Services (DFS) was nearly 31 percent in the fiscal year 2022

The profit margin reduced in 2022 as it was nearly 45 percent in the fiscal year 2021. Experts claim that the drop in profit margin was caused by greater expenses and costs.

#7. The net income of Discover Financial Services (DFS) was nearly $4.30 billion

The net income of DFS witnessed a 20 percent drop as compared to the net income in the financial year 2021.

#8. The revenue of Discover Financial Services (DFS) reached $14 billion in 2022

The firm saw an 18 percent increase in revenue in the financial year 2022 as compared to the fiscal year 2021.

#9. Discover issues cards directly to its consumers without the involvement of intermediate bank issuers

Therefore, Discover earns profits from the interest imposed on their credit card balances directly.

#10. Discover is a credit card product that is popular for its cash-back rewards initiative and reduced-fee program

It was Discover that pioneered a cash-back reward program. Earlier, when the Discover credit cards were launched, there was a reduced fee structure and a greater credit limit as compared to other credit cards. These features disrupted the popularity of other credit cards available in the industry at that time.

#11. Consumers across the globe can suitably utilize their Discover Cards for many purposes

Discover card holders can use their payment cards at gas stations, online merchandisers, or at major retail shops and earn cash-back rewards.

#12. Discover Cards can be utilized to withdraw advance cash as well

Discover Card offers fast and stress-free choices to withdraw cash. card holders can withdraw cash with their Discover payment cards via three easy methods such as cash advance into checking, ATMs, banks, and credit unions.

#13. As per the latest Discover statistics, it offers nearly 1.8 million global ATMs (Automated Teller Machines) for cash access

The network of Discover Financial Services (DFS) offers more than 1 million global ATMs to its cardholders to withdraw cash.

(Source: discoverglobalnetwork.com)

(Source: discoverglobalnetwork.com)

#14. Discover cards are supported across nearly 99 percent of places in the US where credit cards are accepted

In the United States, discover card holders can use their payment cards almost everywhere.

#15. As per Discover statistics, the spending across the Discover network grew over $500 billion in 2021

The spending across the Discover network showed significant growth in 2021.

#16. Discover has around more than 25 network alliances with firms such as PULSE, Diners Club International, and Bcard

Discover has partnered with brands such as PULSE, Diners Club International, and Bcard to grow its customer base across the world. Diners Club International launched the first multi-usage card in 1950. It is accepted by 200 nations across the globe and it has issuers in more than 55 countries in the world.

#17. In 2005, Discover Financial Services took over PULSE, which is an automated funds transfer network

PULSE is one of the top debit/ATM networks in the United States. It offers cardholders easy cash access in 143 countries and territories across the globe.

#18. Nearly more than 60 million merchants across the world accept Discover cards

More than 60 million traders across the globe now accept payments via discover payment cards. Discover cards have high merchant acceptance in countries such as Dominican Republic, Argentina, Israel, India, Japan, Puerto Rico, Jamaica, Spain, and Chile.

#19. China, Brazil, and Canada have moderate merchant acceptance of Discover cards

Countries like Germany, Italy, Mexico, Netherlands, Ireland, Costa Rica, United Arab Emirates, South Africa, and the United Kingdom as well have moderate merchant acceptance of Discover payment cards. While Australia, Egypt, France, and Russia have low merchant acceptance of Discover cards.

#20. Bolivia, Iran, Pakistan, Cuba, and most African and the Middle Eastern region have no merchant acceptance of discover cards

There are many other countries in each of these clusters of Discover acceptance.

#21. The Discover it Miles card offers 1.5 miles for each $1 spent by customers and customers earn double rewards in the first year, along with a $0 yearly fee

Discover credit cards are well-matched to the task as no discover card charges foreign transaction fees.

#22. The total Discover card volume saw a 25.2 percent boost reaching $192.76 billion in 2021

The total Discover card volume is a blend of acquisitions of goods and services along with credit card cash advances.

#23. Discover Credit card cash volume contributed to 5.51 percent of the total volume in 2021

It reduced from 7.24 percent of the total volume in 2020.

#24. Discover offers an added incentive to motivate its users to take more loans on their cards as compared to on cards issued by its rivals

Discover is a consumer credit card brand, which is popular for its cash-back rewards policy and cheap fee program. cardholders do not require to pay an annual fee.

#25. Discover Financial Services (DFS) gets interest income from its credit card consumers

It also makes money from payment processing fees charged to the businesses that support Discover cards as a payment method.

#26. As per Discover statistics for 2021, It is the seventh-biggest issuer of cards across the globe.

Conclusion

Now these days, Discover cards are widely supported across the globe. Discover Financial Services offer highly lucrative rates and rewards to its customers. If used carefully, the automatic cash-back match in the first year of the Discover card usage provides its users a rewards rate that is considered to be the best reward available on any other personal credit card, which is available in the market at present.

However, Discover cardholders need to understand that Discover is a direct issuer, and its business model is similar to American Express’s business policy. Discover earns more when consumers borrow more on its cards and are not able to clear their dues per month. Consumers need to be careful of their spending while using Discover cards. Discover is one of the biggest digital banks in the US, that provides a wide variety of products such as including credit cards, personal loans, student loans, home loans, and deposit services. These Discover statistics show that Discover Financial Services (DFS) will be expanding its user base across the globe in near future.

FAQ.

Discover is supported across 99 percent of places in the US that accept credit cards for payments. Globally, around 200 countries accept Discover cards.

Initially, Sears owned Discover. Later it was owned by Morgan Stanley that is a financial services provider. However, in 2007, Discover acquired the status of an independent firm. Now it is a direct issuer just like American Express.

No minimum opening deposit amount is required for Discover. And Discover does not charge any annual fee.

The credit limit of Discover is based on the amount of refundable security deposit of a card holder that can begin at $200 and can go up to as high as $2,500. If customers are permitted an indiscreet Discover card, the detail on their application will show whether they are eligible for a starting credit limit over $500 minimum.

Discover has around 7 kinds of credit cards for different credit and rewards requirements. People who have good to excellent level credit can choose the Discover it Cash Back credit card, it might be a good option for them. Discover also has the Discover it Miles Travel Card, Restaurants Card and NHL Discover it Card, and Discover it Chrome Gas.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.