OTT Platform Statistics 2024 By Types, Market Size and Advertising Platforms

Page Contents

OTT Platform Statistics: Over the last decade, the way we engage with entertainment, especially video content, has undergone a significant transformation. More and more people are turning to the internet not only for entertainment but also for information and education. This change has been largely driven by the rise of Over-The-Top (OTT) video technologies. The OTT service market, specifically for video, is on a growth trajectory and is expected to reach a remarkable $247 billion by the year 2027.

Gone are the days when unlimited entertainment from a handheld device was a mere fantasy. Thanks to rapid technological progress, this is now a reality. In today's competitive landscape, it's crucial for businesses to deliver the highest value to their customers, and OTT platforms have emerged as the most effective and practical method for consuming content.

The widespread popularity of OTT platforms is quite understandable. Reports suggest that an overwhelming 98 percent of Americans are subscribed to at least one streaming service. This high level of engagement is a testament to the effectiveness of OTT as a content delivery method. Furthermore, the COVID-19 pandemic has played a significant role in accelerating this trend. With more people staying at home, there has been a surge in streaming content on OTT platforms, leading to increased demand for these services. This shift underscores the resilience and adaptability of OTT platforms in meeting the evolving needs of consumers in a rapidly changing world.

What is OTT?

OTT, short for “Over-the-Top,” represents a modern method of media distribution that challenges traditional television formats, such as cable or satellite. This technology enables users to stream video content directly over the internet to various devices, bypassing conventional broadcasting methods. There are three primary types of OTT services:

- Subscription-Based Services (SVOD): These are premium platforms where users pay for access to a wide range of content. Examples include Netflix, Disney+ Hotstar, and MAX, where viewers subscribe to enjoy movies, TV shows, and documentaries.

- Ad-Supported Streaming (AVOD): Services like Pluto TV and Amazon Free provide free access to content, supported by advertisements. These platforms do not have premium levels and are accessible to anyone with an internet connection.

- Virtual Multichannel Video Programming Distributors (vMVPDs): These are companies that offer live and on-demand video content over the internet, through multiple channels. YouTube, Hulu +Live TV, and Sling TV are examples of this type, offering a range of channels and content choices similar to traditional cable TV but delivered over the internet.

OTT platforms have become immensely popular due to their convenience and flexibility. They provide viewers with the freedom to watch a diverse range of shows, movies, and documentaries anytime, anywhere, without the need for satellite or cable connections. This flexibility, combined with the option of free and subscription-based content, allows users to trial different OTT apps before deciding on a subscription. Furthermore, many OTT platforms enhance user experience by offering personalized recommendations and a vast library of content, including exclusive original productions, to maintain user engagement and satisfaction.

Different Types of OTT Platforms

The different types of OTT platforms cater to various entertainment needs:

- Video Streaming Platforms: These are perhaps the most recognized OTT services. They allow users to watch a wide variety of video content, including movies, TV shows, documentaries, and other on-demand videos. Mostly available through subscription-based models, popular examples include Disney+, Hulu, and Netflix.

- Music Streaming Platforms: Services like Spotify and YouTube Music fall under this category. They enable users to stream music, create and listen to playlists, enjoy podcasts, and more, all online. This has significantly reduced the reliance on traditional physical mediums like CDs or cassettes. These platforms often offer personalized music experiences with custom playlists and recommendations.

- Live TV Streaming: This type of OTT service focuses on live content. Users can watch events as they happen in real-time, such as live news broadcasts, sports events like football games, and various live entertainment shows. This brings the immediacy and excitement of live TV to the internet.

- Gaming OTT Platforms: A relatively new addition to the OTT space, these platforms combine traditional entertainment content with interactive gaming experiences. Users can both watch shows and play games within the same service. An example of this innovation is Netflix, which in 2021 introduced Netflix Games, specifically catering to mobile users.

The growth and diversification of OTT platforms indicate a significant shift in entertainment consumption, offering users more flexibility, variety, and personalized content across different types of media.

The Over-the-Top (OTT) streaming market is primarily driven by the increasing popularity of subscription-based video on demand (SVOD) services and the widespread use of smartphones, coupled with faster internet speeds. Key players in this market, particularly in North America, include major services like Netflix and Amazon Prime Video.

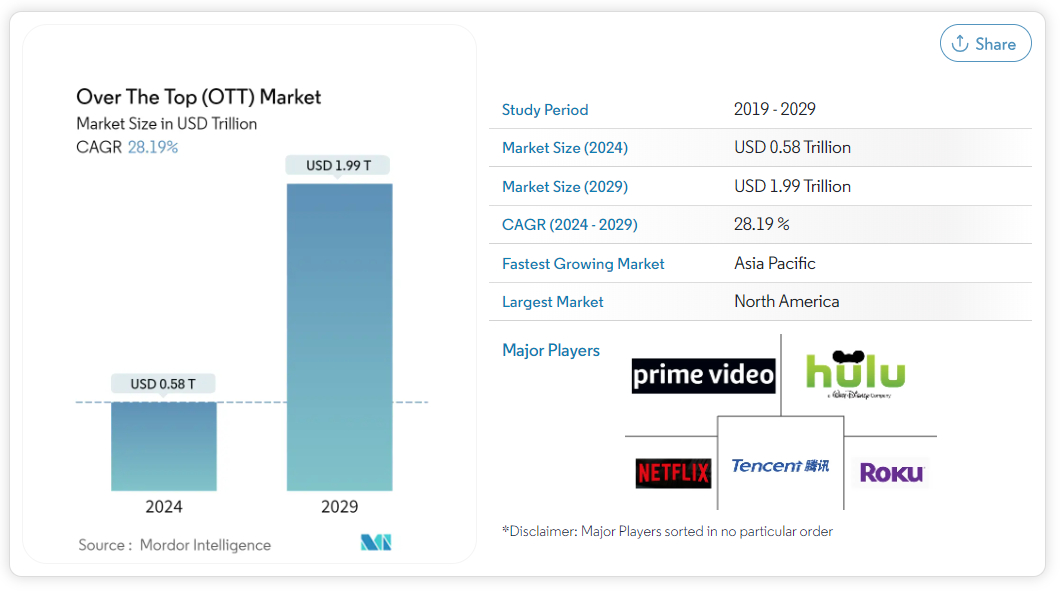

Looking at the market size, the Global OTT Market is expected to surge from USD 0.45 trillion in 2023 to an impressive USD 1.56 trillion by 2028, growing at an annual rate of 28.19% over this period. In 2022, the global OTT market size was around $202.5 billion, and it's projected to reach approximately $434.5 billion by the end of 2027.

In the United States, OTT streaming is becoming increasingly popular. It's estimated that by 2023, 245.3 million Americans, or 72.2% of the population, will use OTT streaming services at least once a month. Netflix, which introduced a new ad-supported tier in 2022, reported gaining over 5 million customers by May 2023. In terms of advertising, US sub-OTT video advertising spending is expected to reach nearly $10 billion in 2023, accounting for a significant portion of digital and video advertising.

Moreover, Connected TV (CTV) advertising in the US is also on the rise, with an expected increase of 49.6% in 2023, reaching $8.04 billion. According to Statista, the number of OTT video users was 3.26 billion in 2022 and is anticipated to climb to 3.51 billion in 2023, and further to 4.22 billion by 2027. User penetration is expected to grow from 45.7% in 2023 to 53.0% in 2027, with an average revenue per user (ARPU) projected to be around US$90.14 in 2023.

North America accounted for a substantial portion of the overall market. Within the US 64 million houses are utilizing OTT and a typical monthly view is greater than 80 hours of OTT data. Additionally, OTT content types mostly associated with games, education, and entertainment are seeing an increase in popularity, with over 60% access to homes that have WIFI.

(Source: mordorintelligence.com)

The”Over-the-Top” (OTT) market is streaming audio, video, and other media content via the Internet directly to the user without the need for traditional distribution channels such as satellite or cable television. OTT platforms offer streaming access to a broad variety of content, such as television shows, movies live events, as well original programming.

The Over-the-Top (OTT) can be described as a movie and television content platform accessible through a high-speed internet connection, not a satellite or cable provider-based platform. OTT adoption has significantly helped music, video, podcast, and audio streaming. The rise in adoption is due to the limited genre options and flexibility in packaging, as well as access to devices, greater internet penetration, and lower cost. In addition, the increasing demand for personalized content has resulted in significant growth in the adoption rate of OTT devices.

The COVID-19 virus has profoundly affected the Over-the-Top (OTT) industry. This global epidemic as well as the measures to lock down the population caused an increase in stream services. It also led to the rapid expansion of the OTT industry in many ways. With many people staying in their homes because of restrictions and looking for entertainment alternatives and streaming options, demand for these services increased dramatically.

(Source: mordorintelligence.com)

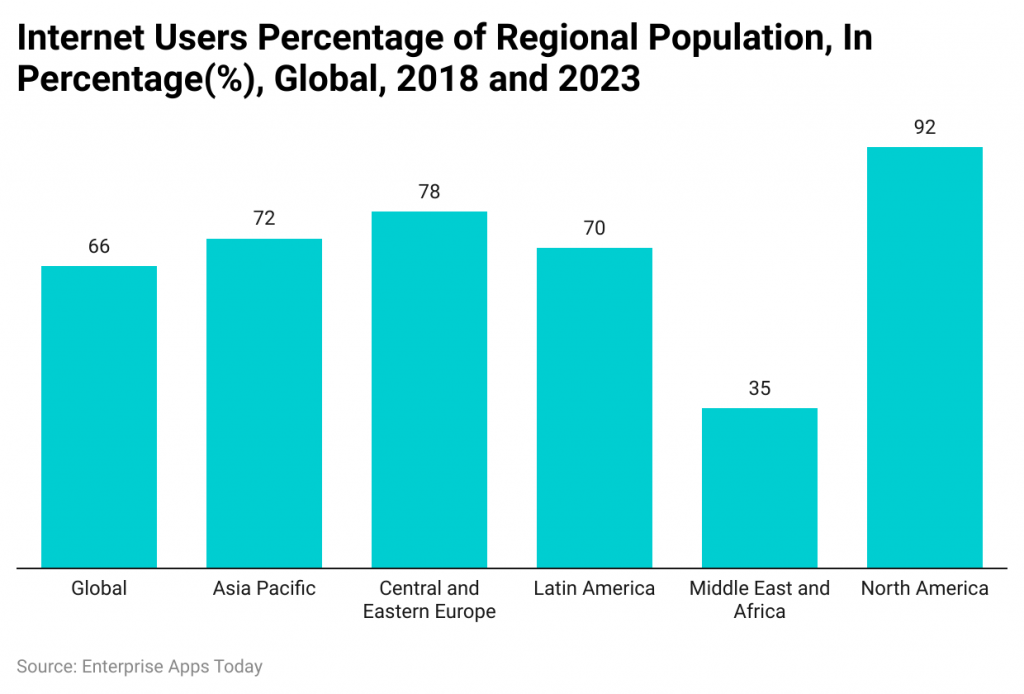

The above figures show the proportion of population in each region in percent, global 2018, and 2023.

We can see that globally 66% of people are Internet users. Asia Pacific is 72% and the population in Central as well as Eastern Europe is 78%

Latin American internet users are approximately 70 70%.

Middle East and African populations utilize only 35% of the internet, which is among the lowest of all.

North American and Western European populations have the highest use of the internet, with 92% and 87 percent respectively.

General OTT Platform Statistics

- The revenue generated by OTT platforms within India is expected to be $2.53 billion before the end of 2022.

- The largest market is video streaming (SVoD) with an estimated market worth $1.07 billion by 2022.

- In the year to come, the average amount of revenue per user for OTT platforms is estimated at $6.38 billion.

Revenues of the Indian segment of OTT platforms have been estimated to be $2.53 billion for 2022. - Based on the top 10 Indian OTT platforms Statistics user participation on OTT platforms by the end of 2022 is

- estimated to be 28.2 percent, which is expected to increase to 36% by 2027.

- The projected market for video OTT market size in 2030 stands at $12.5 billion.

- According to Top Ten Indian OTT Platforms Statistics in 2021, the recorded total number of digital-only content users was around twelve million.

- The most favored OTT platform for watching television and movies that are available in Indian local languages can be found on Amazon Prime Video.

- The estimated audio OTT market to 2030 stands at $2.5 billion.

- The digital segment of India ranks second in the top spot for the highest percentage of industry and media that will dominate the market for television in the near future.

- The top 10 Indian OTT platforms. Statistics indicate that the number of people who have made it through OTT platforms at the time of February 2022 is 658 million people in India.

- In 2027, the number of customers of video on demand in India will be projected to grow up to 178.4 million.

- In 2020, the revenue generated by the OTT market in India was $2.01 billion, which grew to $2.95 billion by 2021.

- In 2026, it is anticipated that the revenues will grow up to $6.73 billion.

- In those years, Disney+ Hotstar, Amazon Prime Video, and Netflix played an important part.

On average, Indian people spend around 70 minutes per day using OTT platforms, with a frequency of use of 12.5 times per week. - It is estimated that there exist approximately 45 OTT providers operating within India.

- According to the Top 10 Indian OTT Platforms Statistics, India currently has approximately 45 million over-the-top (OTT) users on platforms, which include diverse platforms and services.

- In 2023 by 2023, the OTT market will be the size of Rs12,000 crore with an increase of 36 percent.

For India, 55 percent of viewers reside in the top five metro cities, and 34% of users reside in the tier one cities.

The Top 10 Indian OTT Platforms

#1. Disney+ Hotstar

- Current subscribers: 61.3 million as of October 20, 2022.

- Present market share as of April 20, 2022, 55%.

- Revenues generated from the Indian continent 16.7 billion.

Disney+ Hotstar is India's top platform since it concentrates on sports and is also the children's channel that is most loved by Disney. It is controlled by Walt Disney Company India and Star India. Disney+ Hotstar also offers trial trials for free and free movies but with restrictions. The platform comes with a device plan for Rs 499 per year that includes movies, TV series as well and Hotstar specials. The second plan comes with 2 devices at Rs 899 per year, which includes advertisements. A third plan, a Premium option offering a price of Rs 1499 for the year with all content without ads.

#2. Netflix

- Present Customers: 36.23 million.

- Present market share in the month of April 2022 is 8.8%.

- Revenues coming from the Indian continent are 16.7 billion.

Another top-grossing platform for over-the-top sales according to the Top Ten Indian OTT platforms is Netflix. It offers millions of films and series and Netflix original content that is available in multiple languages. The basic plan begins with mobile devices for just the price of Rs.149. Then, it increases to Rs. 499, 199 and 649 for a monthly subscription. In accordance with the plan, there are a variety of different devices that could be altered. Netflix allows sharing accounts with family members and friends.

#3. Sony Liv

- Present Subscribers: 32.7 million.

- Current market share in April 2022 2006: 6 percent.

- Revenues generated from the Indian continent were $1.7 billion.

Sony Liv Is famous for broadcasting CID and Taarak Mehta Taarak Mehta Ooltah Chashmah. There are many customers who have created paid accounts to watch these shows only. The plans start at just Rs. 299 for a year. The plan goes up to Rs 699,999 which offers device options according to the pricing for annual or monthly subscriptions.

#4. Amazon Prime Video

- The number of current subscribers is 27 million.

- Present market share as of April 2022: 9.9%.

- Revenues generated from the Indian continent were $6.38 million.

Similar to Netflix, Amazon Prime Video is also among the top OTT platforms according to the top 10 Indian OTT platforms Statistics. It has been on the top of the list since its launch due to its unique features. A single membership with the Amazon Prime service gives you several additional Prime choices, such as music, videos, and one-day delivery, as well as early access to the internet, and other features. Monthly plans start at Rs 179, and you can also get an annual plan of Rs 459. The annual plan costs about 1499 rupees.

#5. Zee5

- The number of subscribers currently on the list is 48.11 million.

- The current market share in April 2022 is 5 %.

- Revenues coming from the Indian continent The Indian continent's revenue is The Indian continent: 549.6 crore.

The platform is backed by the Essel group, which also has an affiliate with Zee Entertainment Enterprises. The platform hosts approximately 12 Indian languages that are supported in the films and episodes. The annual plan starts at 499, with a limited-time offer. Other plans that offer unlimited offers start at Rs 999 per year, while the Rs 299 plan is for three months. Based on the plan subscription and the device to view on the go are readily available.

#6. Voot

- Present Subscribers: 1,000,000.

- Present market share on April 20, 2022, 5.5%.

- Revenues generated from the Indian continent were $2.1 billion.

Voot is well-known for its episodes like Big Boss, Splits Villa, and Roadies. Additionally, Voot has Vootkids where every 1990s cartoon is packed with fun particularly, Pokemon, Tom and Jerry, Bob the Builder, etc…

Voot's plans start at Rs 499 for the basic plan, but there is a yearly one. A plan for a year with more advanced content can be purchased for just Rs. 999 per year.

#7. TVF Play

- Present Subscribers: 11.3 Million.

- Present market share in the month of April 2022 is 4.4%.

- Revenues generated from Indian continent $5.72 Million.

TVF Play is well-known in India for its shows like Kota Factory, Permanent Roommate, Flamer, etc. It began as YouTube was launched, and later, it was acquired by the Contagious Online Media Network Pvt. Ltd. The monthly costs start at just Rs 99.

#8. MX player

- Current subscribers: 78 million.

- Present market share in the month of April 2022 is 2.6 percent.

- Revenues generated from the Indian continent were $103.9 million.

MX player is the longest-running OTT platform with more than 150,000 titles in its library. It supports more than 12 languages. MX players don't charge an annual subscription fee. it's free but it also has Ad advertisements in the form of episodes and movies.

#9. Eros Now

- The number of current subscribers is 36.2 million.

- Present Market Share on April 20, 2022, 6 %

- Revenues coming from the Indian continent are 19.3 million.

Eros now belongs to Eros Media World. It is also one of the most widely used OTT platforms in the world and also in India. A majority of the films on this platform have Eros currently associated. The platform offers more than 11,000 films and TV shows that are available in various languages. Eros's plans start at 99 per month, and 399 per year for a single device per.

#10. ALTBalaji

- Present Subscribers 35 million

- Current market share on April 20, 2022, 4.4%

- Revenues coming from the Indian continent are 36.8 million.

ALTBalaji was operated by Balaji Telefilms Ltd. It also hosts millions of films and TV shows. Basic subscription plans for three months begin at 100 rupees. Another plan that lasts for six months is priced at around Rs 180. The platform costs $300 for a year-long plan. The amount of devices available will depend on the selected subscription plan.

The Benefits of OTT Platforms

It's believed that 245.3 million people living in the US will stream OTT streaming services for at most one time a month by 2023, according to Insider Intelligence's April 2023 figures. This is 72.2 percent in all of the US total population. While the growth rate of OTT isn't as rapid the penetration rate is at an all-time high, and it's only going to increase. Advertising on an OTT service provides marketers with an increased chance of having their advertisement noticed.

- Wide Variety of Content – Wide Variety of Content OTT platforms can provide a vast selection of content including TV shows, films documentaries, documentaries, and other original programming. The variety of content available caters to a variety of preferences and tastes and makes it easier for users to find the most appealing content.

- No Ads or Limited Ads – There are no ads or only limited Ads OTT platforms provide ads-free or limited experiences which provide a more seamless watching experience. Viewers can stream their favorite content without interruptions or distractions due to ads, resulting in the most enjoyable viewing experience.

- Cost-effective – Cost-effective OTT platforms are usually more affordable than traditional satellite or cable TV subscriptions. Users can select from a variety of subscription plans, such as annual or monthly plans that are typically less expensive in comparison to conventional TV plans. In addition, users are able to subscribe to a variety of OTT platforms, which allows viewers to access a wider selection of content without the cost associated with traditional subscriptions to TV.

- Personalization – OTT platforms provide individual recommendations based on the viewer's history of viewing and personal preferences. This helps viewers to find new entertainment they can enjoy. Certain OTT platforms have customizable profiles, which allow more viewers to share the same account, while also receiving individual recommendations.

- Flexible and Convenience – OTT platforms provide users convenience and flexibility. They allow users to access online content using an internet connection any time at any time, from anywhere, and with any device. It means that viewers can stream their most loved films, TV shows, or documentaries while on the road, while on the go, or while relaxing at home. Furthermore, OTT platforms offer the ability to pause, rewind, or speed-forward the content to provide a more personalized watching experience.

- Original Content – The majority of OTT platforms create original content, including movies and TV shows only available on their platform. Original content is frequently highly acclaimed and has been awarded many awards, giving viewers access to premium content that is not available anywhere other.

The Top OTT Advertising Platforms

From all of the most popular OTT streaming platforms, Netflix, Amazon Prime Video as well and Hulu are among the top for their viewership as per Insider Intelligence's projection. It is reported that the Roku Channel, Tubi, as well as Pluto TV, take the top places in FASTs. While they're not even a tiny portion of the total viewership on sub-OTT's biggest platform, FASTs has accumulated thousands of new customers, including The Roku Channel, Tubi as well and Pluto TV all gaining over 50 million users.

YouTube TV is the top video-on-demand service and the access it provides to NFL Sunday Ticket will bring up to 2 million cord-cutting sports watchers in line with Insider Intelligence's prediction. Due to the expense of implementation, they are also the least expensive segment in OTT services.

- Insider Intelligence expects US sub-OTT advertising on video to reach 10 billion dollars and will make up 3.4 percent of the total advertising on the internet–and 10.2 percent of the total advertising on video by the year 2023's end.

- US Sub-OTT CTV advertising has also been increasing and is expected to grow by a rise of 49.6 percent in 2023. This will be $8.04 billion. This is due in major part to streaming platforms such as Netflix or Disney+ increasing the ability to offer ad levels.

- CTV advertising is an extremely effective marketing channel as well Insider Intelligence forecasts it will rise to $26.92 billion by 2023.

Conclusion

Viewing videos on OTT platforms is now the norm for 70% of the population around the world. When you consider the size of the industry and the rapid growth rate now, it's a great time to consider this trend.

The first step is to select the OTT streaming platform that will manage your streaming service. One of the best ways to choose the best OTT streaming system is by offering free trials. This way you can examine the various specifications of the platform, and as well determine whether the OTT platform meets your expectations.

We have access to a vast variety of entertainment across the globe This is created through the most well-known OTT streaming platforms. From Netflix to Amazon Prime Video, these streaming services are continuously changing and offering new ways to stream the most popular shows and films.

OTT platforms are becoming more popular in recent years, and there are many choices for users to select from. The most popular OTT platform, nevertheless, is certainly Netflix. With its vast library of content as well as its easy-to-use interface, there's no reason to wonder why Netflix is now the preferred choice for a lot of people across the globe.

Sources

FAQ.

Which ott platform has the highest subscribers in world? With 231 million subscribers Netflix is the only OTT platform that has the highest subscribers in the world. Amazon Prime comes on second number which has 200 million subscribers in 2023.

OTT Apps face various challenges in effectively delivering content to users. The biggest challenge is high data consumption due to HD video streaming. This can lead to buffering issues and poor video quality, especially for users on mobile networks.

By offering a mix of free and paid content, platforms can attract a large audience, while also generating revenue from advertising and paid content. The market growth of Hybrid OTT revenue model is positively impacted by the increased adoption of streaming services and the growing number of connected devices.

Now OTT platforms has a limit of funds. If a movie is produced on a budget of 15 Crore and producers are looking for some profits also, say 50% of the investment, then OTT platform would require to pay the producers somewhere around 22–23 Crore and that is a huge amount.

The largest market segment within OTT Video market is OTT Video Advertising, which is expected to have a market volume of US$176.60bn in 2023. In comparison to other countries, in the United States is projected to generate the highest revenue with US$126,500.00m in 2023.

The global over the top (OTT) market size was valued at US$ 200 billion in 2022 and it is expected to hit around US$ 2057.47 billion by 2032, registering at a CAGR of 26.30% from 2023 to 2032.

Indian OTT platforms are now subject to government regulation; they will be regulated by India's I&B or Information and Broadcasting ministry. These regulations do not apply only to the OTT platforms but also apply to online news platforms, social media platforms, and other content on online platforms.

Over-the-Top/OTT Market size was valued at USD 150.51 billion in 2021 and is poised to grow from USD 190.32 billion in 2022 to USD 1241.6 billion by 2030, growing at a CAGR of 26.42% in the forecast period (2023-2030).

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.