Employee Theft Statistics By Industry, Country and Demographic

Page Contents

- Introduction

- Editor’s Choice

- What is Employee Theft and Why it Takes Place?

- Employee Theft Occurs For Various Reasons.

- Types of Employee Theft

- General Employee Theft Statistics

- Cost of Internal Theft Statistics

- Employee Theft Statistics by Industry

- Employee Theft Statistics By Demographic

- Employee Theft Statistics By Company

- Employee Theft Statistics By Country

- US Employee Theft Statistics

- Retail Employee Theft Statistics

- Impact of Employee Theft

- Employee Theft Statistics- Trends and Predictions

- Final Words

Introduction

Employee Theft Statistics: Employee theft can be a major source of anxiety for businesses in a range of sectors. Employee theft affects both financial performance and workplace trust; recent statistics demonstrate this with employee theft accounting for an enormous portion of overall corporate losses; an Association of Certified Fraud Examiners study revealed this costing firms worldwide five percent of their yearly income – this amounts to losses totaling billions annually.

Studies also revealed that staff theft schemes often went undetected for 16 months on average, suggesting significant financial losses over a longer period. Employee theft can take many forms such as embezzlement, inventory shrinkage, and cash theft as well as fraudulent operations; businesses should establish effective internal control measures, including regular audits, security protocols, and staff training programs, to decrease theft risks and safeguard assets against it. Proactive steps taken against employee theft will protect businesses' financial well-being.

Editor’s Choice

- Businesses annually lose $50 billion due to employee theft.

- Insiders from the firm, outsiders, or both are responsible for 57% of fraud that takes place within businesses.

- 22% of owners of small businesses have experienced staff theft.

- Insiders at companies are responsible for approximately 20% of data breaches.

- Employers lose over $1,551.66 annually as a result of dishonest retail employees.

- Losses due to embezzlement incidents average around $357,650 annually.

- 43% of workers lie about how many hours they actually worked.

- Only 56% of businesses investigate any fraud incidents that have taken place within their company.

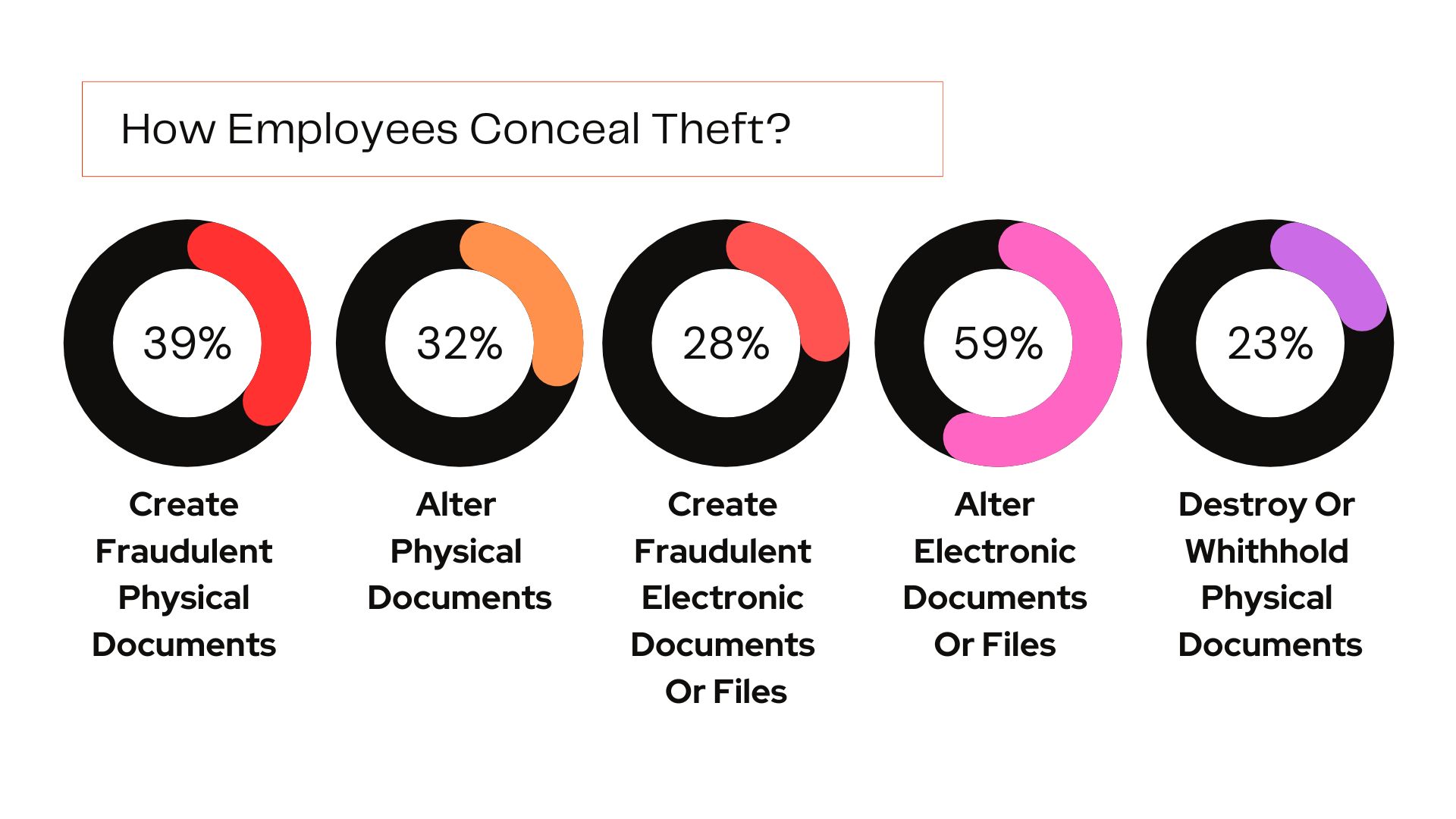

- Employees typically conceal fraud through falsified documents.

- Fraudulent employees typically come from management positions.

- 75% of employees admit to robbing their employer at least once.

- Employers could lose up to $50 billion annually due to employee theft.

- Employee theft affects 95% of U.S. organizations.

- 80% of thieves were penalized after their crime had taken place, either directly or indirectly.

- Internal tips account for 43% of initial theft detections.

What is Employee Theft and Why it Takes Place?

Employee theft refers to any illegal act committed by employees against their employers' property, money, or sensitive data. It can take many forms such as intellectual property theft, financial theft, inventory shrinkage, and embezzlement. Employee theft poses a significant threat to organizations as it can result in significant financial losses as well as reputational damage and breaches in trust within their business environment.

Employee Theft Occurs For Various Reasons.

- Financial Strains: Employees suffering a personal financial strain, such as debt or unexpected bills, may resort to theft as an escape route, driven by feelings of helplessness and despair.

- Lack of Job Satisfaction: Employees who experience undervaluation, underpayment, or dissatisfaction in their workplace may steal as retaliation or to make up for perceived injustices in order to correct imbalances and make amends for perceived inequities. They may justify this behavior as taking back what is owed them in an effort to “balance out the scales”.

- Opportunities and lax Controls: Employee theft often takes place due to inadequate internal monitoring and controls within organizations, providing employees with an opportunity for theft without detection. Employees may find it easier to commit fraud if there are inadequate monitoring systems, low-security precautions, and few checks and balances available.

- Employees frequently rationalize their theft by downplaying its repercussions, justifying their behavior, or convincing themselves they deserve the stolen property. Sometimes due to entitlement or grievance issues, employees could believe their theft won't be discovered or that it won't harm anyone.

- Absence of Strong Ethical Beliefs and Moral Values: People may lack these characteristics, leading to dishonest acts. Employees without moral character or personal responsibility might justify theft as easier.

Businesses should implement effective internal control mechanisms to combat employee theft. Such controls include segregating roles, frequent audits, and security regulations to detect any fraudulent activities and stop theft by employees. As previously noted, addressing issues related to job satisfaction and motivation, creating a healthy work environment, paying fairly, and encouraging open communication are all ways that can reduce the chance of theft.

Employee theft can be effectively minimized by thorough hiring procedures and ongoing training sessions on moral principles and the consequences of theft. Organizations may reduce employee theft rates while protecting assets and maintaining their reputation by addressing their underlying causes and taking preventative steps.

Types of Employee Theft

Employee theft takes many forms, each presenting its own set of characteristics and impacts on companies.

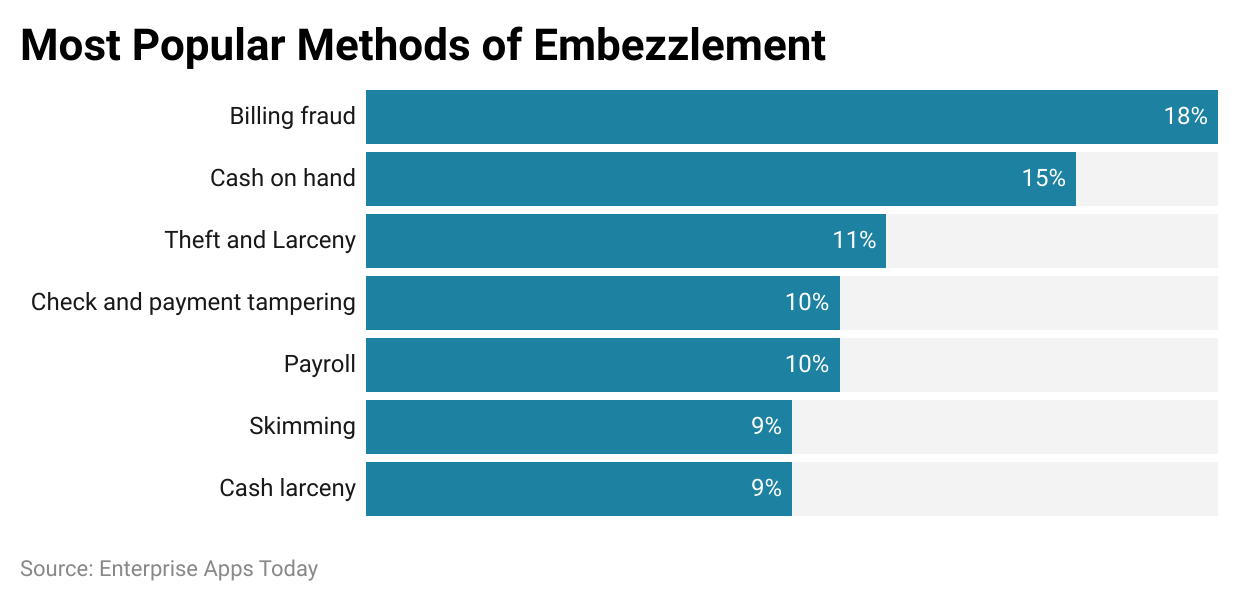

- An employee engaging in embezzlement commits the act by misappropriating or diverting money or assets entrusted to them by their employer and misappropriating or diverting it for personal gain – often falsifying invoices, altering accounting records or diverting cash entrusted for safekeeping for their own gain, thus leaving their firm suffering huge financial losses as a result.

- Inventory shrinkage refers to stock lost due to employee theft. Examples of employee theft can include the theft of goods, supplies, or raw materials from workplaces; similarly, employees could hide stolen products by underreporting damaged ones or falsifying inventory records to cover up their tracks and hide their tracks from being discovered by management. Stockouts, inaccurate forecasts, and decreased profitability can all result from inventory shrinkage which in turn impacts inventory management negatively.

- Employees committing cash theft often take money from business safes, cash registers, or petty cash accounts by engaging in dishonest transactions, siphoning off payments from accounts without authorization, or mismanaging cash handling procedures. Not only does cash theft deplete company resources but it can also compromise financial records accuracy and undermine employee trust in management.

- Employees may engage in fraudulent acts to defraud the business for personal gain. These may include creating false suppliers or customers, filing fake expenditure claims, forging signatures, or altering financial accounts – with potentially devastating repercussions such as financial losses, legal fines, and reputational harm as a result of such behavior.

- Employees that steal intellectual property from their company typically take secret data such as trade secrets, client lists, product designs, and corporate information – trade secrets being among the more vulnerable assets to theft. Such intellectual property theft threatens an organization's innovation capabilities while jeopardizing its competitive edge as well as creating legal challenges when exploited by competing businesses.

- Employees who falsify timesheets to falsely report hours they did not work or engage in nonwork-related activities during working hours are considered time theft. Examples may include taking long breaks for personal purposes or buddy punching (clocking in or out on behalf of another coworker). Time theft negatively impacts workplace relationships while decreasing productivity and wasting resources from the organization.

(Reference: screenandreveal.com)

General Employee Theft Statistics

Employee theft is a pervasive issue that creates serious challenges for companies worldwide. Here are some statistics regarding employee theft that shed light on its severity and repercussions.

- According to research conducted by the Association of Certified Fraud Examiners (ACFE), employee theft costs firms across the globe 5% of annual sales – amounting to billions of dollars lost each year.

- ACFE research indicates that staff theft schemes typically went undetected for 16 months on average before becoming obvious – showing how these thefts may take place over an extended period of time and cause substantial financial loss.

- Employee fraud refers to any acts committed by employees against their employers through deceptive, false, and misleading conduct, often including theft by employees. According to the ACFE's “Report to the Nations”, losses attributed to occupational fraud incidents averaged $150,000 per incident in 2016.

- Employee theft has caused issues in 95% of organizations.

- An organization typically reports six instances of fraud each year.

- Over three-fourths of all cases of occupational fraud occurred in these sectors. High-risk divisions include Operations (15%), Financial (14%), Executive/Upper Administration (12%), Commercial (11%), and consumer service (9%).

- Three out of every ten embezzlers were employed in accounting or finance departments, or 33%.

- In 25% of instances, credentials belonging to privileged users were compromised and stolen.

- Employee time theft costs US companies 20% of every dollar made.

- Businesses of all sizes are negatively impacted by employee theft. According to a Hiscox poll conducted in 2022, small firms in the US lost an average of $1.13 million annually due to employee theft; similarly, University of Cincinnati research concluded that employee theft cost major US firms an additional average annual loss of $1.13 million from employee theft.

- Employee theft is more prevalent in some industries than others. Industries like banking and financial services, retail, healthcare, manufacturing, and hospitality tend to experience the greatest instances of employee theft due to having large quantities of merchandise, sensitive data, or costly assets that make these industries prime candidates for employee thievery.

- Different factors could serve as motivators for employee theft. Employee theft may occur for financial needs, dissatisfaction with pay or work conditions, addiction disorders, financial strain, personal financial difficulties, and lack of ethical principles as motivations for theft by an employee.

- According to an ACFE survey, tips are responsible for over 40% of employee theft detections. Internal audits, management reviews, monitoring, and accidental discovery are other techniques for detection.

- Employee theft has far-reaching repercussions that extend far beyond financial losses alone. It can adversely impact a company's bottom line, internal trust levels, and employee morale as well as have an adverse effect on clients, partners, and stakeholders of its target company.

Cost of Internal Theft Statistics

Finding accurate and complete figures on the cost of internal theft can be difficult due to companies often keeping this information hidden from the public view. Studies and surveys can, however, offer insight into its financial effects on firms.

- According to the Centre for Retail Research's worldwide Retail Theft Barometer report, internal theft would likely account for 34% of overall shrinkage in 2022 for the retail industry globally – this includes fraud, inadvertent administrative mistakes, and staff theft losses.

- According to the National Retail Federation's (NRF) National Retail Security Survey, staff theft would account for 35.7% of losses nationwide by 2022 – making it the leading source of inventory shrinkage. On average, each incident of employee theft cost an average of $1,203 according to this report.

- Small firms, with limited resources and procedures, are particularly susceptible to internal theft's financial effects. According to the Hiscox Small Business Employee Theft Study conducted in the US, small firms could lose an estimated annual average loss of $289,864.

- A poll with 5,000 participants totaled $42 billion in reported fraud losses.

- Businesses lose an average of 5% of their annual earnings to employee theft and misconduct, with each case costing an average of $1,509,000 and the median loss per case ranging between $122,500 and $15,09,000.

- An embezzlement case typically caused a loss to firms of an average of $357,650; only 39% was typically recovered through settlements, restitution, or insurance claims.

- 29% of businesses dismissed workers after discovering employee theft. 27% increased audit spending, 26% lost clients and wasted time talking about security and audit needs with customers and auditors, 25% decided to purchase new insurance or improve existing coverage, while 24% switched auditors.

- Internal theft costs vary significantly across industries. Retail, which often handles large sums of cash and easily-theft able goods, experiences devastating financial losses as a result of internal theft; an NRF study estimated its average cost per internal theft event as $2,884.

- Internal theft has far-reaching repercussions for businesses that extend well beyond immediate losses. Investigations, legal actions, security precautions, and their possible effect on staff morale and attrition all represent additional expenses that cannot be precisely predicted but increase the overall financial consequences of internal theft significantly.

Note that these figures represent general trends and may fluctuate based on various variables such as business size, industry sector, location, and specific details of each incident of internal theft. As the true cost of internal theft may not match up exactly with the information provided here, businesses should implement strong internal controls, perform regular audits, provide ethical training courses, and establish anonymous reporting mechanisms in order to mitigate its financial repercussions and safeguard their assets against internal theft losses. Businesses can reduce financial losses and protect assets by adopting proactive steps against this type of theft.

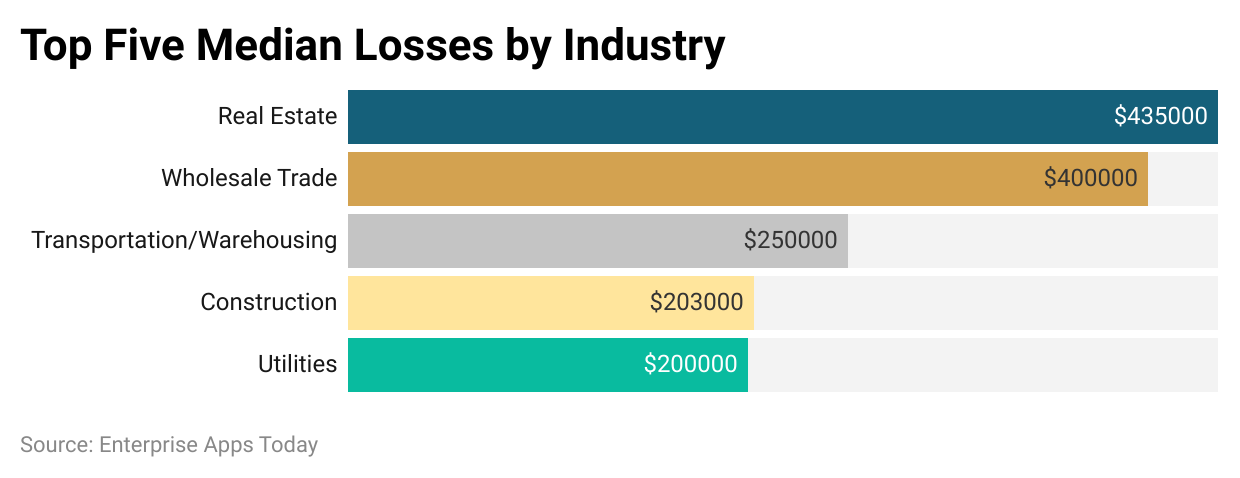

Employee Theft Statistics by Industry

Although employee theft can be an issue for businesses of all kinds, its prevalence and effects might differ depending on your industry.

- Retail industries are particularly vulnerable to staff theft due to their large financial transactions and easily stolen merchandise, so staff theft accounts for 35.7% of inventory shrinkage according to the National Retail Security Survey; it costs retail companies an estimated annual estimated loss of billions of dollars in employee theft losses.

- Banks and credit unions that offer financial services are susceptible to staff theft and fraud, according to research conducted by the Association of Certified Fraud Examiners. On average, occupational fraud caused a median loss of $220,000 per incident in this industry sector – such as making unlawful purchases, falsifying documents, or transferring money illicitly.

- Employee theft occurs across many industries, including healthcare. A study published by the Journal of Healthcare Management estimated employee theft cost healthcare companies an average of $25,000 each year in employee costs due to prescription diversion, billing fraud, and theft of medical supplies as common forms of employee theft in this sector.

- Mining was identified as the industry that experienced the highest median theft losses from 26 occurrences, totaling an average loss of $475,000.

- Insurance sector employees experience the least employee theft with an estimated median loss of $70,000 across 85 incidents.

- Employee theft threatens manufacturing industries through stolen equipment, intellectual property, and raw materials that are stolen by employees. Internal theft played a part in 26% of cases within this sector, as reported by Kroll Global Fraud Study, leading to financial losses, decreased product quality, and diminished competitive advantage for manufacturers.

- Employee theft in the hospitality sector takes many forms, from taking money from cash registers and taking merchandise without authorization to giving unapproved discounts to friends and family without proper authorization. According to the U.S. Chamber of Commerce, employee theft costs hospitality firms billions every year in losses associated with employee theft.

- Theft of intellectual property, data breaches, and insider threats pose risks to IT sectors. Employees with access to sensitive data or system credentials could use them for personal gain or sell sensitive information to rivals – according to Ponemon Institute's 2022 Cost of Insider Threats Report this type of attack costs on average an estimated annual amount of around $11.45 Million dollars in annual losses for IT industries.

(Reference: synovus.com)

Employee Theft Statistics By Demographic

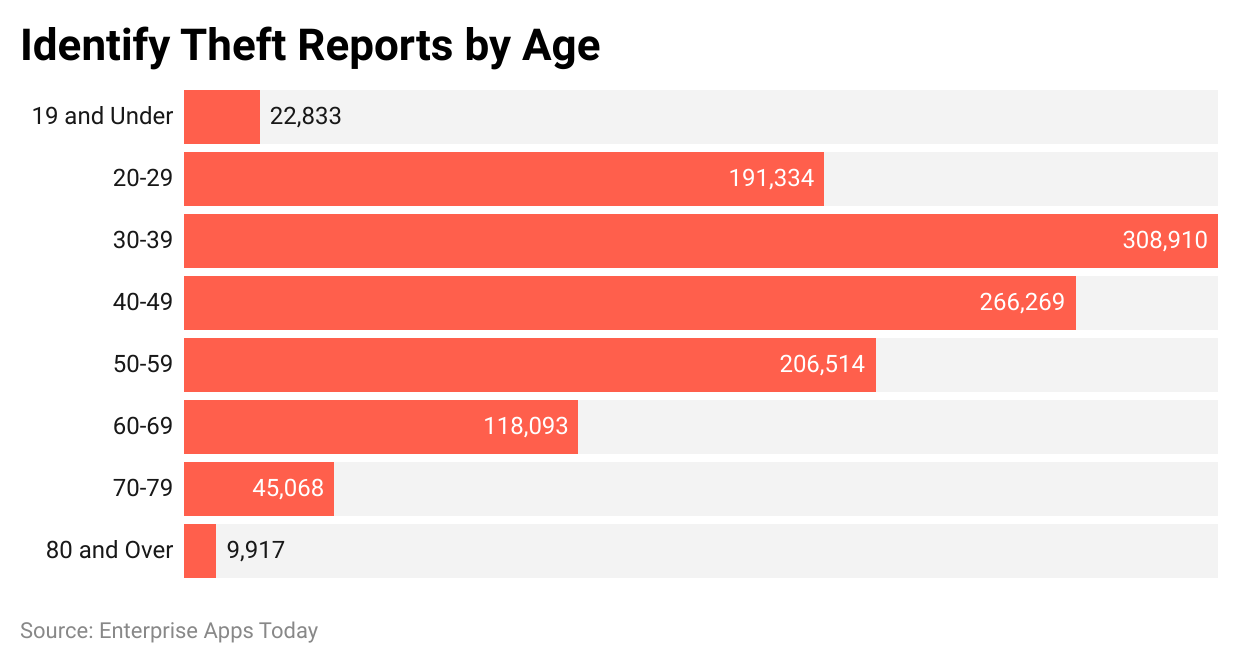

AGE

Finding exact data on employee theft by age group may be challenging due to it not being collected or regularly reported; however, studies and polls can provide valuable insight into the relationship between employee theft and age.

- Studies suggest that younger workers could be more prone to employee theft. Employees under 30 accounted for around 40% of occupational fraud incidents according to the Association of Certified Fraud Examiners (ACFE) “Report to the Nations.” Financial constraints, lack of job satisfaction or ignorance regarding consequences could all play a part.

- According to research conducted by the ACFE, employees who have recently joined or are just entering their profession may be more prone to engaging in theft. A significant proportion of theft incidents were perpetrated by employees with less than one year of service – although tenure and age should not necessarily be taken as causal factors in such instances.

- 53% of fraudsters, according to this same study, were between 31 and 45 years of age.

- An average perpetrator is 48 years old.

- Employee theft may be more prevalent among younger workers, but it can affect any worker of any age. An ACFE analysis revealed that a significant share of occupational fraud cases involved workers aged 40-50 – this may be caused by increased access to corporate resources, more demanding duties, or growing financial demands.

- Employee theft can result from multiple factors beyond age alone. Financial strain, discontent with pay, or personal finances issues, as well as moral violations, may all play a part. Therefore, rather than using age as the only criterion to judge employee theft risk, it's crucial to take into account each individual's unique circumstances, goals, and risk factors related to employee theft.

- Preventative measures and detection systems are essential in combatting employee theft of any age. Businesses should implement effective internal controls, conduct periodic audits, provide ethical training programs, and promote anonymous reporting systems as prevention measures against theft by their employees.

(Reference: comparitech.com)

GENDER

Finding accurate data on employee theft by gender may be challenging given its limited availability; however, research and polls offer insight into how employee theft relates to gender. Here are a few important things you should keep in mind.

- Although no definitive data exist regarding how employee theft breaks down by gender, research suggests that males may be more prone than females to commit theft. According to ACFE's “Report to the Nations”, more males than females were involved in occupational fraud cases than vice versa.

- In 2022, male-caused losses surpassed female-caused losses by 72%.

- Employee theft has many different motivations that go far beyond gender.

- Financial strain, work unhappiness, personal financial issues, and an absence of ethical principles and opportunities all play a part. Although male and female perpetrators may employ different techniques and objectives when engaging in employee theft, each is affected differently by unique aspects that have nothing to do with gender alone.

- 72% of professional fraud is committed by male perpetrators, according to the 2022 Global Study on Professional Fraud and Abuse.

- Employee theft occurs among 59.1% of men and 40.9% of women.

- ACFE research highlights that employee theft incidents – including occupational fraud – involve multiple demographic characteristics including gender, age, and other demographic aspects. Therefore it emphasizes the need to take each individual's circumstances, reasons for stealing, and risk factors into consideration rather than using gender as the sole criterion for determination.

(Source: jwsuretybonds.com)

EDUCATION

Due to limited data on theft classification by degree, obtaining accurate employee theft statistics by education level can be challenging. Luckily, studies and polls can provide some insight into how education may influence employee theft behavior.

- Studies suggest that higher education levels may be linked with reduced staff theft rates. Highly-educated people often have access to better employment options and career pathways with greater prospects, thus decreasing their propensity to steal.

- The Association of Certified Fraud Examiners (ACFE) published their “Report to the Nations”, emphasizing employee theft including occupational fraud as being comprised of multiple components, including education. According to this study, individuals with more education were more likely to hold leadership roles inside firms, which can increase potential fraud losses when theft does occur.

- Only 4% of fraudsters had previously been convicted for their scam.

- Higher education can aid the development of ethical consciousness and professional responsibility. Ethics education can promote an ethical culture in the workplace by helping employees to comprehend the potential consequences associated with employee theft.

- Fraudsters who had worked at their company for more than 10 years typically took home an average sum of $200,000.

- 49% of thefts committed by employees with university degrees involved university graduates as the perpetrators.

- Numerous variables – financial constraints, individual circumstances, work unhappiness, and opportunities – contribute to employee theft. While education can have an effect on behavior, it's more effective to take into account each person's goals and environmental influences in predicting employee theft than just education alone.

Employee Theft Statistics By Company

Accessing company-specific employee theft statistics may be challenging due to such information not typically being made public. Exposing such details could tarnish their corporate image and affect stakeholder trust in an organization, though studies and surveys can shed light on its prevalence and effects across an enterprise as a whole.

- Small firms lack resources and procedures that protect them against employee theft, making them particularly susceptible to employee thievery. According to a Hiscox Small Business Employee Theft Study conducted in the US, small firms averaged losses of $1.13 million from employee theft between 2022-2025 – with 42% of incidences including multiple workers working together on theft schemes.

- Employee theft can have severe financial implications for larger businesses. According to research from the University of Cincinnati, employee theft costs major US firms an average annual average of $1.13 million due to employee theft.

- Employee theft has different effects depending on the industry. Retail is particularly susceptible, due to cash transactions and easily pilfered goods – according to the National Retail Security Survey, 35.7% of inventory shrinkage occurred due to staff theft in US retail shops alone!

- Employee theft, which constitutes occupational fraud, can cost businesses dearly. The “Report to the Nations” from the Association of Certified Fraud Examiners provides details about its effects. According to their research, average losses per instance averaged out to $150,000 per case; furthermore, persistent cases often go undetected for extended periods before identification occurs.

- Companies use various techniques to detect employee theft. According to a survey by the Association of Certified Fraud Examiners, tips account for over 40% of instances when employee fraud is discovered; other detection strategies include surveillance, management reviews, internal audits, unintentional discovery, and unplanned discovery.

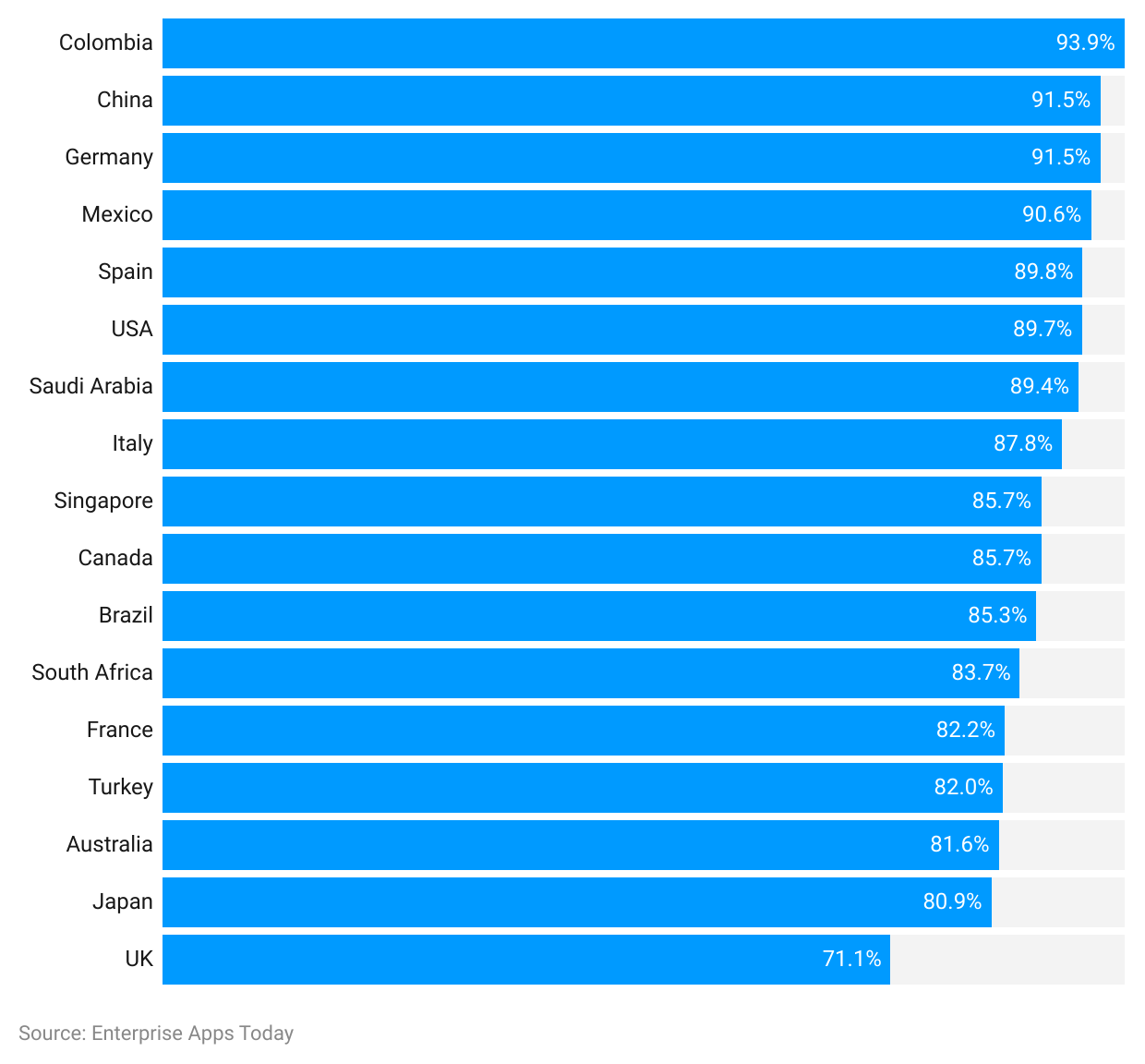

Employee Theft Statistics By Country

Statistics on employee theft vary considerably across nations due to differing reporting procedures, governing laws, and cultural considerations. Here are some details regarding employee theft statistics for several nations; complete and up-to-date data may not be accessible for every nation.

- United States: Employee theft has long been studied in the U.S. According to research conducted by the National Retail Federation's National Retail Security Survey in 2022, inventory shrinkage at retail establishments was caused by staff theft in 35.7% of cases; according to Global Retail Theft Barometer estimates employee theft will cost merchants $14.93 billion by 2022.

- United Kingdom: Employee theft accounted for 34% of retail losses in 2022 according to the British Retail Consortium's Retail Crime Survey, costing an average of PS1,203 per incident.

- Australia: According to estimates by the Australian Retailers Association, employee theft costs Australian businesses billions each year. A study by Ernst & Young indicated that 57% of merchants reported staff theft incidents with an average loss per event of AU$ 2,547.

- Canada: According to a Canadian Retail Security Survey conducted by the Retail Council of Canada, staff theft will account for 18.4% of retail loss in 2022 in Canada; each employee theft event costs on average approximately $1,289 Canadian dollars.

- South Africa: Staff theft in South Africa is an epidemic, according to research from the University of South Africa, with 778 out of 1,000 merchants surveyed reporting instances. On average, each theft event resulted in losses totaling ZAR 2,857 per instance.

- Japan: According to the Japan Fraud Management Association; instances of employee theft increased by 15.6% in 2022 when compared to the previous year. While the report; did not provide exact financial information; it did indicate that several types of businesses; experienced an uptick in employee theft cases.

(Reference: comparitech.com)

US Employee Theft Statistics

Employee theft is a serious issue in the US and has serious repercussions for companies across various industries. Here are some notable findings on employee theft within America; exact and current numbers may differ slightly.

- National Retail Federation's National Retail Security Survey projected that staff theft accounted for 35.7% of inventory shrinkage within the U.S. retail industry in 2022; employee theft cost merchants nearly $14.93 billion that year alone.

- Employee theft occurs across a number of sectors in the US, such as retail, hospitality, manufacturing, banking, and healthcare. Due to easy access to money, goods, and client contacts in retail shops, theft of staff has a particularly high incidence in that sector; yet internal theft also results in losses for other sectors.

- Employee theft in the US often takes various forms; from taking goods and manipulating documents to conducting fraudulent operations. Financial strain; individual financial issues, drug addiction, or perceived opportunities often serve as motivations behind employee theft.

- NRF poll results cite internal techniques, including monitoring sales transactions and auditing, as the most frequently employed means for detecting employee fraud in American retail industries. An employee's inside knowledge and consumer data were also considered vital tools for finding theft incidents.

- Small firms are especially vulnerable to employee theft due to a lack of resources and regulations, according to the Hiscox Small Business Employee Theft Study. Small firms in the US lost an average of $289,864 due to internal theft in 2022.

- Employee theft may lead to legal repercussions for both employees and employers alike, leading them to file suit in order to recoup damages or seek compensation, incurring further legal bills and court costs along the way.

These figures illustrate the severity of employee theft in the US and underscore its prevalence; therefore it is essential for companies to implement prevention and detection measures for employee theft in order to mitigate its financial effects and protect themselves. Solid internal controls, regular audits, ethics training courses, as well as cultivating an environment characterized by integrity and responsibility is a vitally important elements.

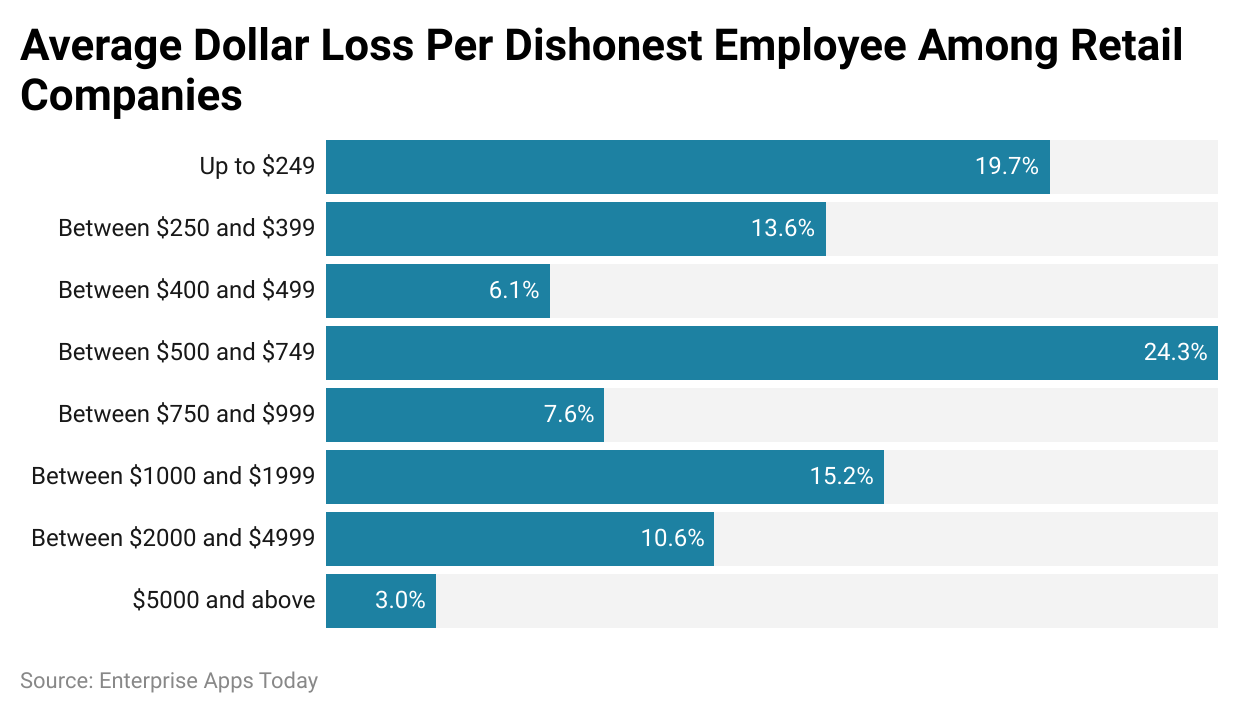

Retail Employee Theft Statistics

Retail employee theft presents significant difficulties and financial ramifications for firms. While there may not be many current or detailed statistics on employee theft in retail settings, research and industry publications provide significant insights into its frequency and consequences.

- Employee theft is one of the primary contributors to inventory shrinkage in retail. Employee theft accounted for 35.7% of inventory shrinkage nationwide according to NRF's National Retail Security Survey in 2022.

- Businesses experience serious financial impact as a result of employee theft at retail businesses. According to the Global Retail Theft Barometer, staff theft will cost the global retail sector $21.48 billion by 2022.

- Retail personnel have been known to steal money from registers, take items without authorization and use fake returns and discounts improperly as well as conspire with third parties – all forms of crime which cause large financial losses for retailers.

- According to an NRF poll, internal techniques such as monitoring sales transactions and conducting audits were most often used by retailers to detect employee theft in retail settings. Furthermore, staff and customer tips proved extremely valuable for pinpointing theft events.

- Retail employees at all levels can become involved in the theft. Although employee theft data do not break out theft by job function, research indicates both administrative and frontline employees have been implicated.

- Employee theft in retail can be caused by many different issues: low pay, financial strain, insufficient training and supervision issues, poor security measures, or weak internal controls are just a few factors to consider. Addressing these underlying concerns will help lower employee theft incidents.

- Retailers employ various strategies to prevent employee theft and preserve a pleasant work atmosphere. Some ways of deterring this include installing surveillance systems, employing electronic item surveillance (EAS) tags, conducting pre-employment checks, setting clear policies and processes, offering ethical training courses, and building pleasant work environments.

(Reference: screenandreveal.com)

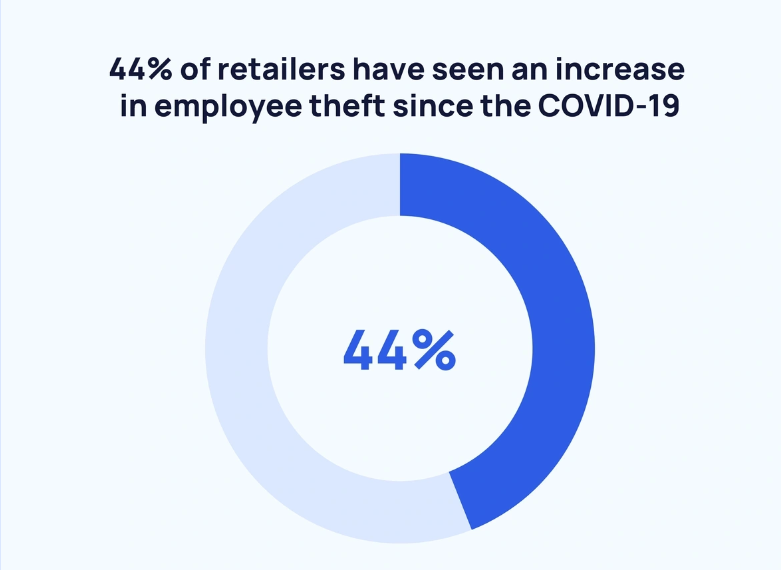

Impact of Employee Theft

The COVID-19 epidemic has brought greater awareness of employee theft and its consequential impact on our economy.

- Employee theft threatens firms' profitability and economic health by contributing to financial losses. According to the National Retail Security Survey; employee theft caused 35.7% of inventory shrinkage across U.S. retail establishments in 2022 alone – having an immense financial implication that may lower tax receipts; prevent corporate expansion efforts; or lead to employment reductions.

- The COVID-19 epidemic has created new difficulties and intensified existing aspects of employee theft. Incidents of employee theft may have increased due to economic disruptions; financial hardships; and rising demands of the pandemic; while increased job instability, diminished monitoring due to remote work arrangements, and resource limitations could present opportunities for traditional and cyber theft.

- Employee theft may have various ramifications on both the economy and the pandemic. Staff theft in particular has had serious financial repercussions in retail businesses which were particularly susceptible. Shop closures, reduced foot traffic and an increasing reliance on internet sales only further added burdens for this industry that may have had an effect on staff theft dynamics.

- Employee theft during a pandemic could impede efforts at economic recovery. Financial losses caused by employee theft may limit firms' capacity to invest, expand, or hire additional staff while trying to recoup and create job prospects – effectively impeding economic development and the recovery process as a whole.

- Employee theft strains government resources in numerous ways. Businesses experiencing theft-related losses may find it more difficult to collect taxes, leading to reduced funds available for infrastructure and public services. Furthermore, law enforcement and government organizations might need to dedicate additional resources to investigating and prosecuting employee theft cases.

- Employee theft can erode consumer trust, leading to changes in purchasing behaviors. Customers may become wary of doing business with firms and sectors affected by employee theft events that become well-publicized; this could result in lower spending by consumers, which would subsequently impact the economic success of these impacted entities.

(Source: explodingtopics.com)

Employee Theft Statistics- Trends and Predictions

Statistics on employee theft provide us with insights into its causes and effects, revealing patterns. Although precise forecasting of future statistics may be difficult, we can observe present patterns to make generalizations and predictions about employee theft.

- Trends in employee theft have evolved over time to adapt to rapidly evolving technologies and workplace environments. Employee theft may take the form of data breaches, intellectual property theft, or abuse of firm information as organizations increasingly rely on digital systems and remote labor. Patterns of employee theft could even be affected by the surge in e-commerce transactions.

- Employee theft may be affected by the state of the economy. When economic pressures mount or people struggle financially, theft incidents may increase significantly; on the other hand, as economies flourish more generally employee theft may become less frequent.

- Technology development can have both positive and negative consequences on employee theft. On one hand, technical innovations may aid in detecting theft more successfully through surveillance systems, inventory management systems, and data analytics; on the other hand, technological developments may create new avenues for employee theft to occur through cybercrime or illegal access to digital assets.

- Employee theft may be reduced by creating an employee-centric workplace culture and engaging employees more fully. Employee theft should become less frequent at organizations that promote trust, open dialogue, and fair treatment compared to companies with poor employee morale or insufficient management that may be more prone to theft.

- The COVID-19 epidemic has disrupted working conditions and brought forth new difficulties that may influence employee stealing patterns. Changes may be affected by factors like remote employment, layoffs, and financial strain experienced during this epidemic, all of which can have an effect on theft patterns among employees. It's important to keep in mind that it may take some time before we are able to assess its full effects on employee theft.

- Businesses are taking steps to address employee theft by adopting innovative technology, data analytics, and AI-driven systems. Such cutting-edge strategies have the power to lower theft incidences and limit financial losses when coupled with extensive training programs and ethical awareness activities.

Though making exact forecasts is difficult, employee theft will likely continue to be a problem for firms. With time, technological innovations, a stronger emphasis on preventative measures and an ethically sound culture may help decrease employee theft incidents and their associated financial impact. Businesses should maintain vigilance, adapt to shifting patterns, engage in effective preventative techniques, and practice regular audits as a means to combat employee theft as well as foster an integrity culture within firms.

Final Words

Employee theft is a significant threat to companies across many different sectors. Statistics about employee theft provide insight into its frequency, consequences, and changing patterns. According to research conducted on employee theft, it can contribute to inventory shrinkage and financial losses for firms, having an adverse impact on business climate, economy, consumer trust, and confidence in general. Although figures may differ depending on factors like nation, sector, or other criteria, overall the situation indicates how urgently businesses must act to mitigate this threat. To minimize the financial effects of employee theft, it is vital to implement preventive measures. Such steps include tight internal controls, frequent audits, and staff training programs; theft incidence can also be reduced through cultivating an environment of support and ethical work culture.

COVID-19's difficulties and risks have underscored the significance of employee theft management even further. Remote work arrangements, economic shocks, and tightened financial constraints all play a part in theft dynamics – emphasizing the necessity of adaptable preventative solutions. Businesses can prevent employee theft from happening by being aware of facts and patterns surrounding it – not only protecting their financial stability but also creating an atmosphere of trust amongst employees as a whole while fostering stronger business climates, more vibrant economies, and higher customer trust levels by effectively managing employee theft issues.

Sources

FAQ.

One common form of white-collar crime involves stealing assets entrusted to another individual. Typically, those engaged in embezzlement gain access to funds legitimately but use them illegally for personal gain.

Time theft occurs when an employee receives payment for work or labour they should complete but do not. This practice takes many forms: buddy punching is one such form; taking excessively long breaks or using internet time illegally are two examples; in addition, timecard fraud by overstating hours worked and adding too many personal days counts as time stealing as well

Employee theft occurs more often than you might realize. Nearly two-thirds of US-based small firms experience employee theft at some point. Fraudsters commonly employ asset theft, corruption and financial statement fraud as methods to deceive their employers.

According to financial experts, employee theft costs businesses of all sizes and sectors worldwide approximately five per cent of annual sales - which amounts to worldwide financial losses of more than $4.5 trillion each year. Based on data and cases of employee theft from 2020 alone, businesses reported losing an average of $150,000 through occupational fraud losses.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.