Insurance Industry Statistics By Market Size, Countries, Salary, Life Insurance, Age, Gender, Company Types and Region

Page Contents

Introduction

Insurance Industry Statistics: As of the report the market size of the insurance sector across the world is expected to reach $1.164 trillion by the end of 2023. The Insurance sector has grown effectively and has proven an essential instrument of every business and individual as it allows for reducing the chances of losses and unforeseen occurrences. The insurance sector is segmented into two important segments General and life insurance which includes a variation of subcategories.

These Insurance industry statistics include insights from various aspects that will allow in providing light on why Insurance is an effective instrument in today’s world.

Editor’s Choice

- In 2022 the global insurance market size has expanded well which resulted in $5,946.74 billion and it is expected to cross $6,466.23 billion by the end of 2023.

- As of 2023, the United States insurance industry is expected to reach 7.60% CAGR from 2022-2026 which has been predicted to be $261.59 billion by the end of 2026.

- By the end of 2025, the global cyber insurance market is expected to reach over $20.4 billion.

- The commercial auto insurance market size of the United States is supposed to be 453.1 billion in 2023.

- Whereas, the value of commercial market size in the United States was reported at $136.6 billion by the end of 2022 and is expected to grow by 10.1% of CAGR by 2027 resulting in $221 billion.

- On the other hand, the value of the U.S. bond insurance industry was $16.07 billion and by the end of 2027, it is expected to be $25.18 billion.

- Across the world in 2022 premiums generated by direct life insurance were more than $160 billion.

- In the United States as per the survey of Forbes Advisor, out of people have some form of life insurance in 2022.

Facts About Insurance Industry

- In 2022, the global premiums of life and non-life insurance have grown by 1.1% from last year, which is expected to be the same growth of 1.1% in 2023 and by the end of 2024 the premium volume will rise by 1.7%.

- As of 2022 to July 2023, the premium performances of non-life or general insurance were better with a 5.8% increase rate whereas, the premium rates have declined by 4.5% in life insurance due to the impacts of inflation.

- In 2022 most insurers have experienced investment losses in many countries of the world that were engaged in both activities of life and general insurance.

- The premiums of property/casualty and life/annuity insurance were $776.7 billion and $698.5 billion respectively in 2022.

- By the end of 2022, the revenue of life insurance premiums was $165.1 billion which the growth rate has increased by 3.5% from last year.

- The revenue earned by Annuity premiums and deposits was $343.3 billion with a growth rate of 20.1% from 2021.

- On the other hand, revenue earned from Accident and health premiums was $188.7 billion by the end of 2022 where the growth rate has decreased by 0.3%.

- The global insurance market share of automobiles resulted in $817 billion in 2022 and is expected to reach 7.1% of CAGR by the end of 2032 with $1,616.2 billion. Whereas, the share of North America was 38%, East Asia (8.1%), and the United States (5.8%)

General Insurance Industry Statistics

- In the United States, there were more than 5,929 insurance companies in 2022 and the total number of employees was 2.86 million employees in 2022.

- The total GDP achieved by the insurance industry was 3.1% in the United States.

- Across the world, the gross premium written by the insurance industry over time was $7 trillion by the end of 2022.

- The average profit margin earned by the insurance industry was about 3% to 5%.

- Across the United States as of 2023, there are almost 5,954 insurance companies and the top insurance companies were found in New York with 577 companies.

- The other states of the United States with total number of insurance companies is followed by Florida (437), Texas (403), Illinois (337), Wisconsin (334), Pennsylvania (254), Ohio (245), Lowa (220), Missouri (178), Minnesota (152), Indiana (149), Delaware (146), California (132), Michigan (127), New Jersey (118), and Arizona (117).

- The total spending accounted for the sector of private health insurance was around 28% of national health expenditure in the U.S., in 2022.

- Travel insurance was purchased by 38% of American people.

by Market Size

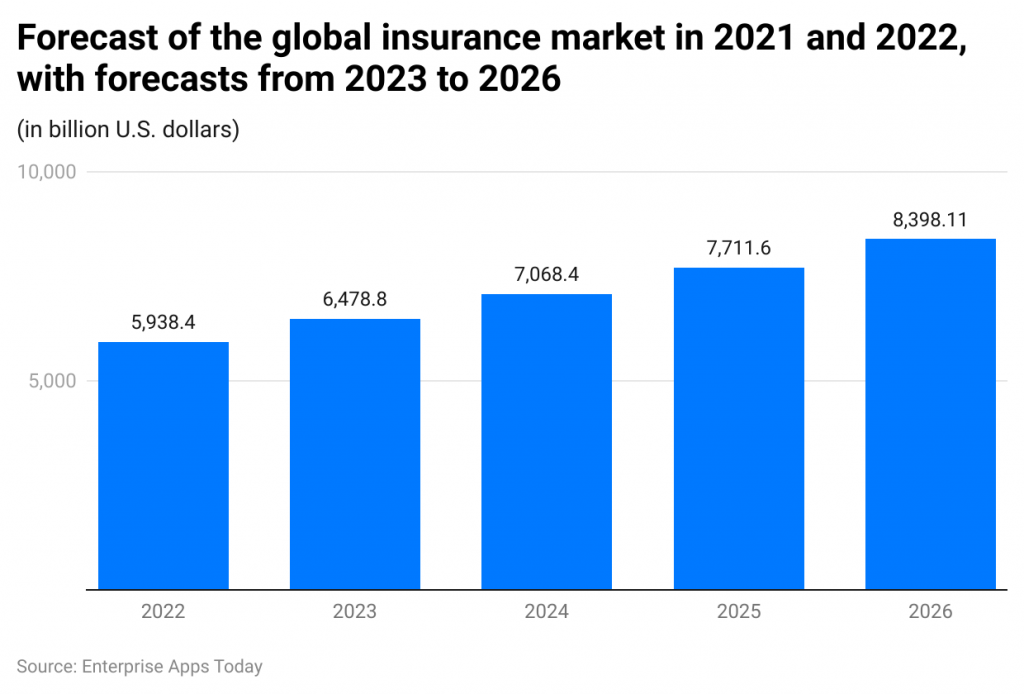

(Source: statista.com)

(Source: statista.com)

- In 2022 the global industry market size has grown 10% from last year which resulted in $5,938.4 billion and is expected to reach $6,478.8 billion by the end of 2023.

- Furthermore, the market size of this industry is predicted to increase by 9% of CAGR in every coming year.

- Followed by $7,068.4 billion, which is going to reach in the year 2024, $7,711.6 billion (2025), and $8,398.11 billion (2026).

by Countries

(Source: reportlinker.com)

- In the year 2022, the top country that paid total gross insurance premiums across the world was the United States with $2.83 million with a YOY growth of 7.54% from last year.

- Following insurance premiums by other countries with YOY growth was the United Kingdom = $437K (5.94%), Japan = $400K (5.17%), Germany = $347K (7.33%), France = $341K (6.52%), South Korea = $205K (7.74%), Italy = $161K (5.92%), the Netherlands = $90K (8.45%), Canada = $87K (5.42%), and Spain = $75K (5.62%).

- In the United States, the salaries and wages in insurance are expected to be $170.529K by the end of 2023.

- By the end of 2022, the top global market share of the insurance industry was the United States with 43.7% which is followed by China (10.3%), the UK (5.4%), Japan (5%), Germany (3.6%), France (3.9%), South Korea (2.7%), Italy (2.4%), Netherlands (1.25), Canada (2.5%), and Spain (1%).

by Salary

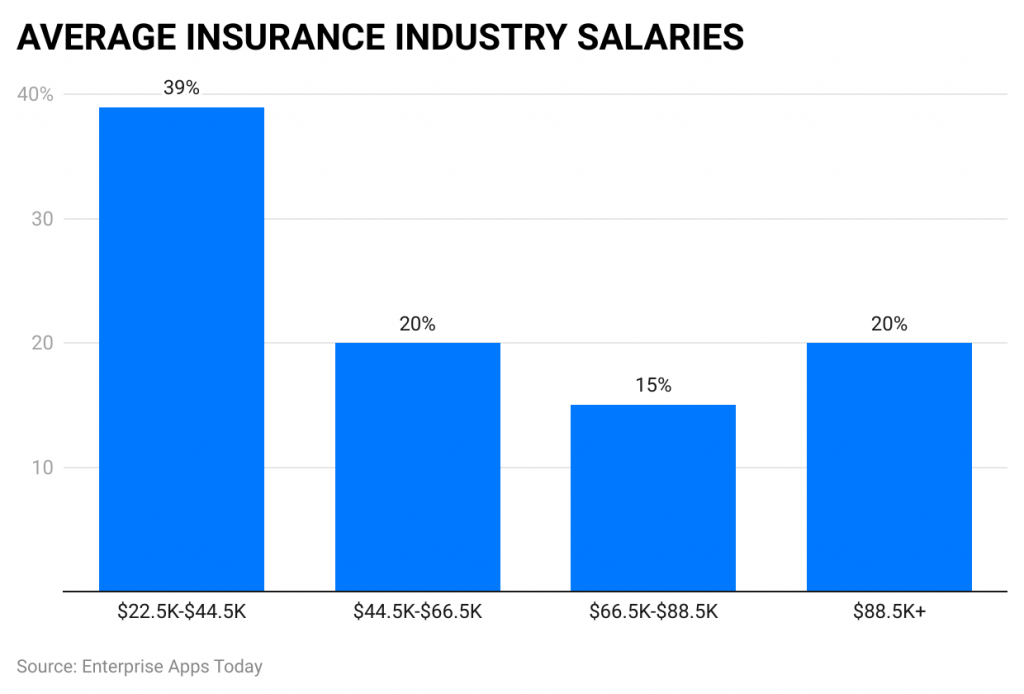

(Source: zippia.com)

(Source: zippia.com)

- As of May 2022, the average earning of an employee in the insurance industry was $67,421 annually which is mainly based on experience, category, location, and education.

- Across the world, almost 39% of the employees have earned $22.5K to $44.5K yearly and this is termed as the actual range.

- It is followed by 20% of people earning $44.5K-66.5K whereas other 20% of people earning above $88.5K per year and 15% of people having $66.5K to $88.5K per year.

by Life Insurance

- In 2022 mostly women lacked life insurance policies 22% and males by 11%.

- According to the survey by Forbes Advisor 46% of white and 37% of black respondents have invested in life insurance for protecting their families from unpaid debts.

- As of 2023, American people having life insurance policies are about 52% and by the end of 2022 around 106 million people didn’t believe in life insurance coverage.

- In 2022, the amount of life insurance coverage was three times more for white Americans ($150,000) than black Americans ($50,000).

- Main people of people across the world investing in life insurance were paying life end and burial expenses (83%), coverage of lost income after the death of the primary wage earner (68%), and enabling transferring wealth from one to the next generation (63%)

- Effective reasons for not buying life insurance policies were costs (60%), not a financial priority (55%), and not having confidence about insurance policies (53%).

by Age

Overall Life Insurance Coverage:

- People aged 18-25: 25% have life insurance (from both work and individual policies).

- People aged 26-41: 18% have life insurance.

- People aged 42-57: 20% have life insurance.

- People aged 58-76: 5% have life insurance.

- People aged above 77: 25% have life insurance.

Life Insurance through Work:

- Among those aged 18-25: 23% have insurance through their jobs.

- Among those aged 26-41: 26% have insurance through their jobs.

- Among those aged 42-57: 22% have insurance through their jobs.

- Among those aged 58-76: 23% have insurance through their jobs.

- Among those aged above 77: 1% have insurance through their jobs.

Individual Life Insurance Policies:

- For individuals aged 18-25: 38% have individual life insurance policies.

- For individuals aged 26-41: 33% have individual life insurance policies.

- For individuals aged 42-57: 30% have individual life insurance policies.

- For individuals aged 58-76: 30% have individual life insurance policies.

- For individuals aged above 77: 44% have individual life insurance policies.

No Life Insurance Coverage:

- People aged 18-25: 9% do not have any life insurance policies.

- People aged 26-41: 13% do not have any life insurance policies.

- People aged 42-57: 19% do not have any life insurance policies.

- People aged 58-76: 39% do not have any life insurance policies.

- People aged above 77: 25% do not have any life insurance policies.

These statistics show the percentage of people in different age groups who have life insurance through various means and those who do not have any life insurance coverage.

by Gender

- In the United States most males have life insurance policies to date, life insurance through an employer and individual policies with 18% male and 16% female.

- Followed by only employer insurance policies: Male = 33%, and female = 19%

- People having only individual insurance policies: Male = 34%, and female = 33%

- Only insurance policies till now: Male = 11%, and female = 22%

Property/Casualty Insurance Statistics by Company Types

Top Companies in the U.S.:

- ‘State Farm' led the way with the highest Direct Premiums Written (DPW) of $78.6 billion, capturing a significant market share of 9.2%.

Following Close Behind:

- ‘Berkshire Hathaway Inc.' came in second place with $55 billion in DPW and a market share of 6.6%.

- ‘Progressive Corp.' secured the third spot, boasting $52 billion in DPW and a market share of 6.1%.

- ‘Allstate Corp.' ranked fourth with $45 billion in DPW and a market share of 5.3%.

- ‘Liberty Mutual' claimed the fifth position, with $43 billion in DPW and a market share of 5.1%.

Other Notable Players:

- ‘Travelers Companies Inc.' had $34 billion in DPW and a market share of 4%.

- ‘Chubb Ltd.' held $29 billion in DPW and a market share of 3.4%.

- ‘USAA Insurance Group' managed $26.8 billion in DPW, securing a 3.1% market share.

- ‘Farmers Insurance Group of Companies' reached $26.4 billion in DPW, also with a 3.1% market share.

- ‘Nationwide Mutual Group' contributed $20 billion in DPW and held a 2.4% market share.

These statistics outline the leading property/casualty insurance companies in the United States, detailing their Direct Premiums Written (DPW) and respective market shares in 2022.

Life/Annuity Insurance Statistics by Company Types

Leading Company:

- ‘MetLife Inc.' emerged as the top company in the United States, generating Direct Premium Written (DPW) of a substantial $111 billion and holding a significant market share of 12.1%.

Other Key Players:

- ‘Equitable Holdings' secured the second position with $75 billion in DPW and an 8.2% market share.

- ‘New York Life Insurance Group' ranked third, contributing $47 billion in DPW and capturing a 5.2% market share.

- ‘Massachusetts Mutual Life Insurance Co.' followed closely with $46 billion in DPW and a 5% market share.

- ‘Prudential Financial Inc.' held a notable $44 billion in DPW and a 4.9% market share.

- ‘Athene Holding Ltd.' recorded $36.4 billion in DPW, constituting a 4% market share.

- ‘Nationwide' contributed $36.1 billion in DPW, also commanding a 4% market share.

- ‘Western & Southern Financial' managed $35.5 billion in DPW, holding a 3.9% market share.

- ‘Corebridge Financial' achieved $26.7 billion in DPW and had a 2.9% market share.

- ‘Lincoln Financial' rounded out the list with $26 billion in DPW and a 2.9% market share.

These statistics highlight the prominent companies in the life/annuity insurance sector in the United States at the conclusion of 2022, illustrating their Direct Premium Written (DPW) figures and respective market shares.

by Revenue

- According to Emergen Research, the top worldwide insurance companies have led the highest market share in 2022.

- It has been expected that by the year 2028, the growth rate of overall industries will reach 6.2% of CAGR resulting in $8,921.88 billion.

Leading the Pack:

- ‘Berkshire Hathaway' in the United States generated the highest revenue at an impressive $714 billion.

Other Notable Global Players:

- ‘Ping An Insurance' from China earned $141 billion in revenue.

- ‘AIA Group' based in Hong Kong secured $123 billion in revenue.

- ‘China Life Insurance' also from China reached a revenue of $106 billion.

- ‘Allianz' headquartered in Germany earned $89 billion in revenue.

Additional Companies:

- ‘Cigna' in the U.S. garnered $76 billion in revenue.

- ‘Zurich Insurance' from Switzerland achieved a revenue of $67 billion.

- ‘AXA' based in France recorded $65 billion in revenue.

- ‘Humana' in the U.S. earned $55 billion in revenue.

- ‘Munich Re' from Germany rounded out the list with $39 billion in revenue.

Leading Health Insurance Companies:

- ‘UnitedHealthcare' stood at the top in the United States, with a substantial revenue of $286 billion.

- ‘CVS' followed with $136 billion in revenue.

- ‘Anthem' achieved $109 billion in revenue.

- ‘Cigna' earned $76 billion in revenue.

- ‘Humana' recorded $55 billion in revenue.

- ‘Centene Corporation' had a significant $48 billion in revenue.

- ‘Molina Healthcare' reached $18 billion in revenue.

- ‘Bright Health Group' and ‘MultiPlan Corporation' both earned $2 billion in revenue.

- ‘Alignment Healthcare' achieved $1.6 billion in revenue.

These statistics provide an overview of the top revenue earners among publicly traded non-health insurance and health insurance companies, showcasing their impressive financial performances in 2022.

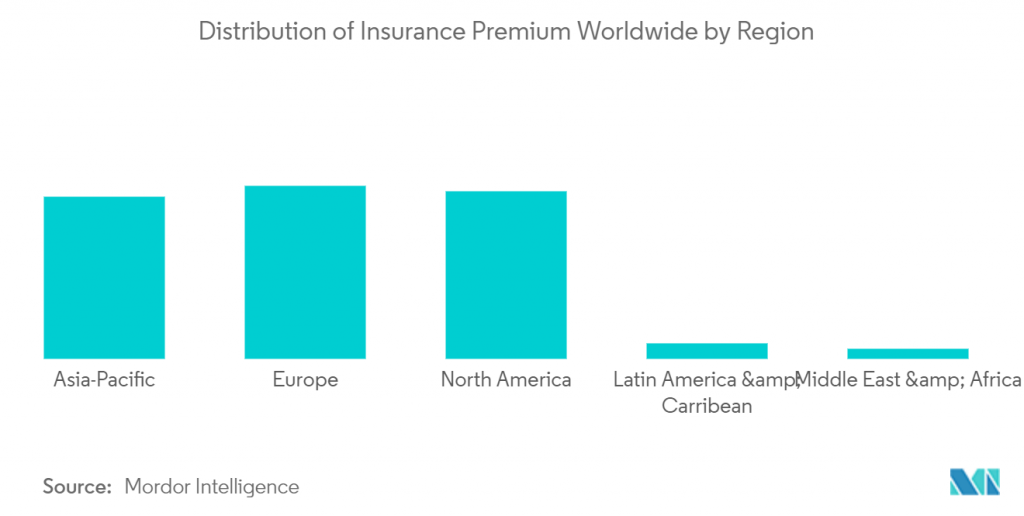

by Region

(Source: mordorintelligence.com)

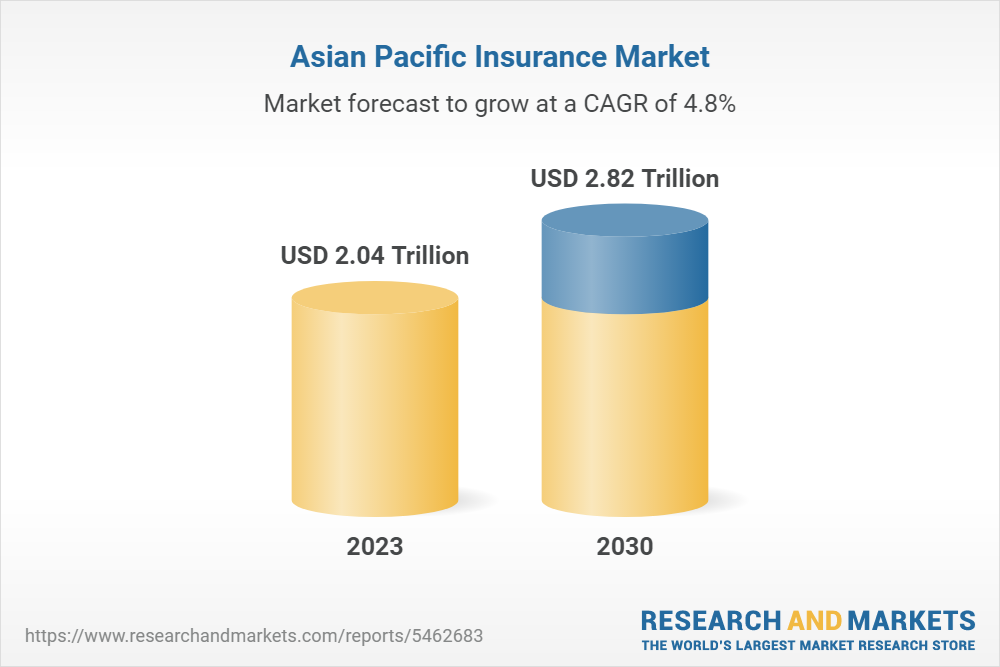

Asia Pacific

(Source: researchandmarkets.com)

- As of 2023, the overall Insurance market share of the Asian Pacific region turned $2.04 trillion and by 2020 it is expected to be 42.82 trillion with a CAGR of 4.8%.

- The embedded insurance industry of the Asia Pacific region has reached $24,127.3 million in 2022 with a growth of 32.3% from last year and is expected to be 471,855.4 million by the end of 2029.

- Asia Pacific is termed the largest embedded market in the world and is one of the fastest-growing economies, especially China and India.

Europe

(Source: mordorintelligence.com)

(Source: mordorintelligence.com)

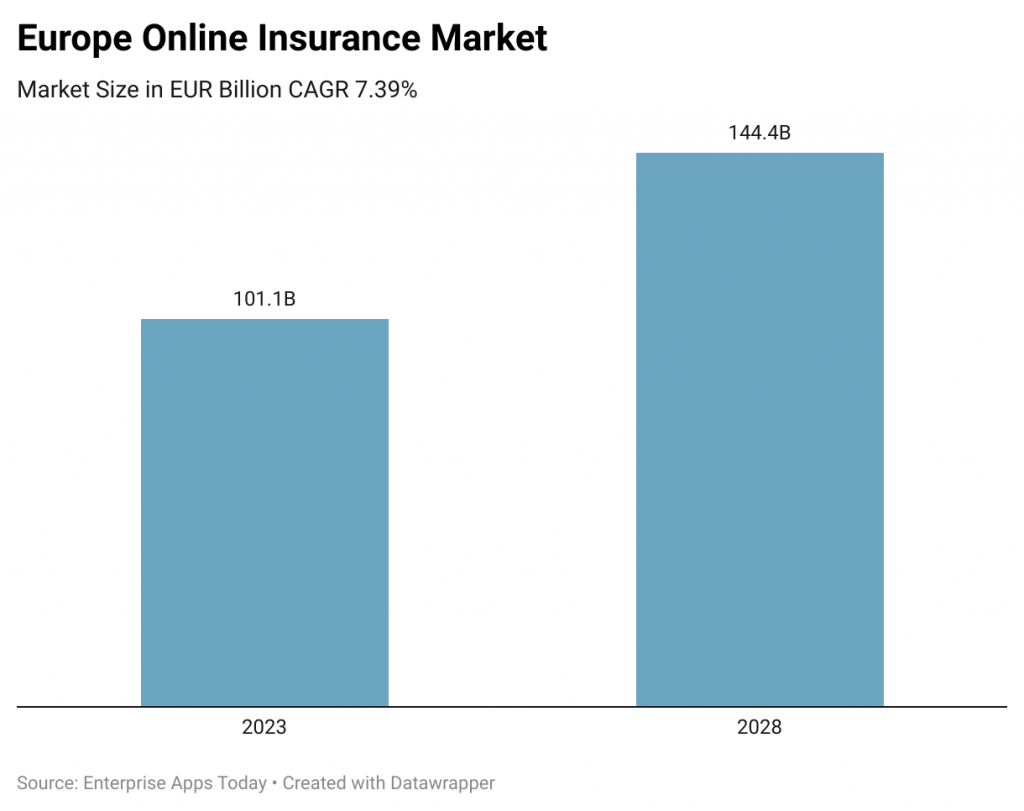

- The market size of the Europe Online Insurance market size is expected to reach EUR 101.07 billion by the end of 2023 which is expected to cross EUR 144.35 billion in 2028 which is 7.39% of CAGR.

- Whereas the market size of trade credit insurance covered $9.2 billion in 2022.

- By the 4th quarter of 2022 investment value of France remained highest with EUR 533.3 billion (life insurance), EUR 214.43 billion (non-life insurance), and EUR 1,180.79 billion (others).

- Followed by other countries in a pattern of (life insurance, non-life insurance, others): Germany (EUR 829.69 billion, EUR 521.09 billion, EUR 375.64 billion), Italy (EUR 144.63 billion, EUR 17.23 billion, EUR 515.55 billion), Denmark (EUR 165.16 billion, EUR 19.99 billion, EUR 128.57 billion).

America

(Source: bls.gov)

(Source: bls.gov)

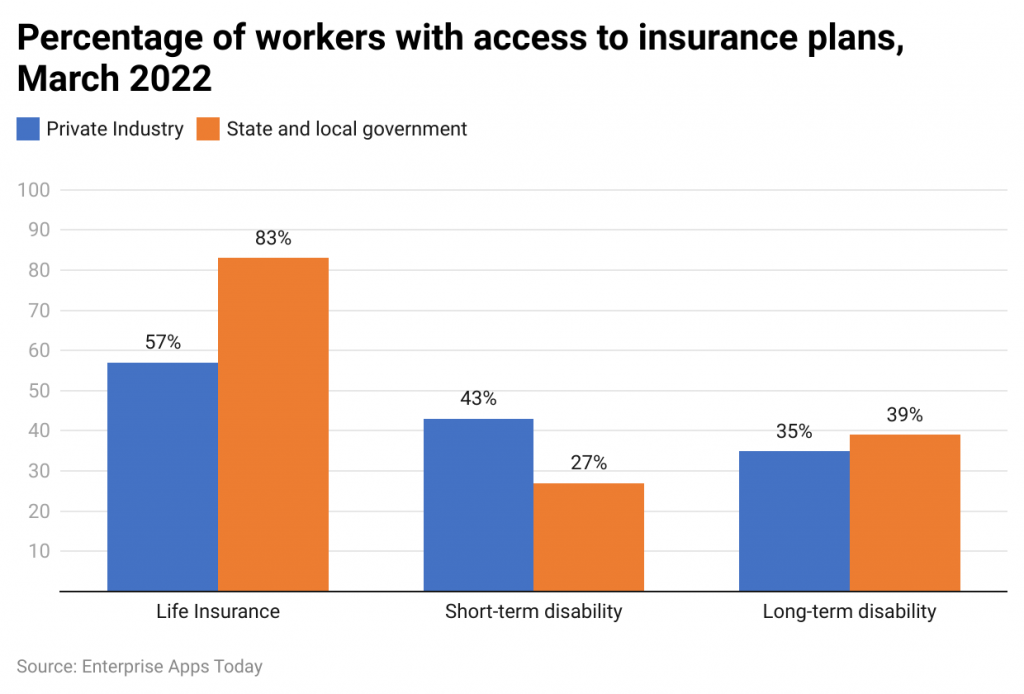

- As of March 2022, workers accessed insurance plans from private industry and state and local government bodies.

- According to the reports of the U.S. Bureau of Labor Statistics, life insurance was available to 57% of private industry workers including which service holders (27%), and management professionals (79%) in 2022.

- Whereas, only 43% of short-term disability insurance is available in private sectors of which 37% are from the southern region and 67% are from the Northeast region.

- Lastly, 35% of long-term disability insurance is available in the private sector.

- The state and local governments have covered 83% of life insurance, 39% of long-term disability insurance, and 27% of short-term disability insurance.

Middle East/Africa

- In 2022 the embedded industry of insurance in the region of Asia Pacific region grew by 40.2% from last year which resulted in $2,329 million.

- Whereas, by the end of 2029 the revenue rate is supposed to increase by $7,763.3 million with a growth of 24.9% of CAGR FROM 2022-29.

- Countries with the highest insurance assets are Turkey ($110.9+$24.6+$3.7 billion), Israel ($82.7+$74.8+$34.6+$11.7 billion), South Africa ($51.8+$41.9+$11 billion), and many others.

Conclusion

As of now after completing the article on Insurance industry statistics it can be stated that insurance is an essential part of the current scenario. This industry provides effective financial protection to several businesses and people across the world which allows for generating enormous revenue rates, economic growth, and government burdens. This article includes many important statistics; hope the above information will help you gain basic knowledge about the topic based on current dates.

FAQ.

As of current date the biggest challenge faced by people across the world is the ever changing cost of healthcare as after the COVID-19 the premium cost has enhanced that have caused financial strains.

Statistics allow in evaluating predictive analytics along with determining and comparing factors with other countries, events, and information so that insurance companies can enable fair premium for customers.

According to experts there are four important insurance are currently available that provide better coverage are life, health, long-term disability, and auto insurance.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.