Wealth Management Industry Statistics 2024

Page Contents

- Introduction

- Editor's Choice

- Wealth Management Industry Overview

- Wealth Management Trends

- Wealth Management Report

- Four Types of Analytical Capabilities

- Global Wealth Management Market Outlook

- McKinsey Report on U.S. Wealth Management Industry

- Evolving Landscape By EY

- COVID-19's Implications

- Key Industry Players

- Recent Development

- Conclusion

Introduction

Wealth Management Industry Statistics: Wealth Management, in some measures, is a part of the financial industry—officials who work in a piece of combined investment advice with other financial service providers to wealthy customers. The white-collar class in the market discusses their financial situations and goals with the wealth managers and financial advisors and receives valuable investment suggestions from them.

Many financial advisers incorporate financial planning with tax savings services and help the customer make life purchases; some provide detailed plans. Such wealth managers work individually or in a firm. It is evident that wealthier customers need more services, and clients with a below-federal poverty level income can be transactional. In this report, we will be diving deep into the wealth management industry statistics.

Editor's Choice

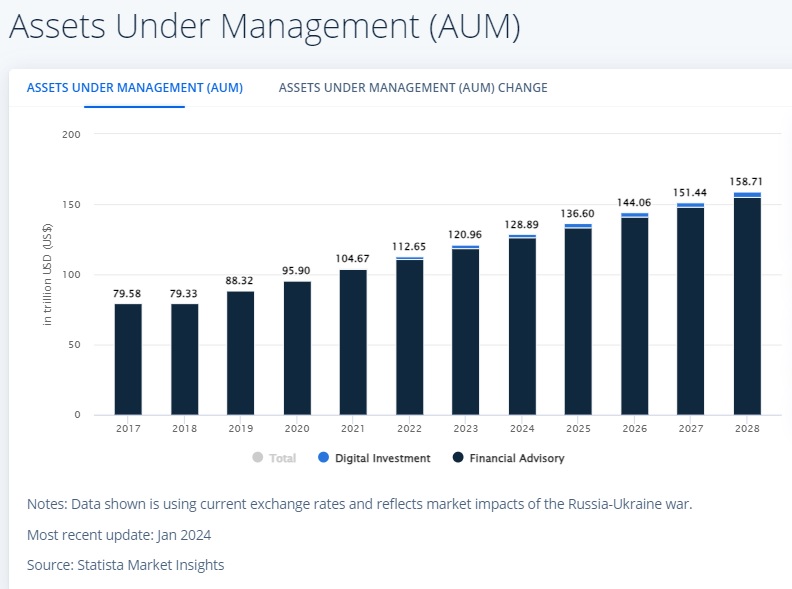

- Worldwide, assets under management (AUM) in the Wealth Management market are forecasted to reach USD 128.90 trillion in 2024.

- Financial Advisory is set to be the dominant segment, with AUM projected at USD 126.10 trillion in 2024.

- AUM is expected to grow at a 5.34% annual rate (CAGR) from 2024 to 2028, reaching USD 158.70 trillion by 2028.

- The trend in the United States focuses on sustainable and impact investing.

- Net investable assets of high-net-worth individuals (HNWI+) globally are set to grow by 25% to nearly USD 70 trillion by 2021.

- A shift towards holistic wealth management, a digitalized business model, is evident, predicted to secure a 30% market share by 2025.

- Traditional wealth managers are expected to phase out, except for those in the United States with international offshore business, due to favorable conditions.

- The industry holds approximately USD 103 trillion in AUM, with over half managed by institutional investors like banks and funds.

- The global wealth management market is expected to grow at an annual rate of nearly 11% from 2023 to 2030.

- Europe's wealth management industry is forecasted to experience the fastest growth rate.

- Asset management services are projected to witness significant growth.

- Fintech advisors are anticipated to lead segmental growth.

- Robo-advisors are expected to show the highest CAGR during the forecast period.

- There's increasing demand for new investments, including hedge funds, private equity, and real estate investment trusts.

- By 2022, the global wealth management market size is expected to reach nearly USD 1.30 trillion, growing to USD 3.48 trillion by 2030.

- 77% of US-Canadian financial advisors reported business losses due to lack of tools for client interaction amid COVID-19.

- Wealth management firms are increasingly partnering with third-party providers to aid transformation, with 85% of business leaders deeming it necessary within 12 to 18 months.

- By 2025, North American wealth managers' AUM is predicted to increase to USD 73.3 trillion, up 26.4% from USD 58 trillion in 2020.

Wealth Management Industry Overview

- U.S. wealth management firms have reported an average growth in revenue of 2.1 percent during the third quarter of 2020.

- In 2020 it is in 2020, the United States, China, Germany along Japan will be the 4 nations with the highest AUM in wealth management.

- In 2025, by the time it is over by 2025, the wealth management industry worldwide will hit $100 trillion in assets.

- From 2012 until 2020 Between 2012 and 2020, 2012 to 2020 the U.S. wealth management industry witnessed 2,892 M and L deals.

- 60% of global wealth management firms have invested in consolidating cryptocurrency-related services.

- Nearly 15.9 percent of all financial managers, not including women, were employed in the U.S. wealth management industry in the year 2019.

- The minimum duration for clients who are involved in wealth management within the U.S. is nearly 9.3 years.

- In 2023, the usage of robo-advisors is expected to grow to $1.26 trillion in the sector of wealth management.

- The minimum rate of return (ROA) for wealth management companies was 77 basis points.

- In the year 2019, the flow of funds into the wealth management sector increased by just 1% when in comparison to the 5% increase in.

- In 2020 the most prestigious 20 private banks worldwide were home to $12.8 trillion AUM.

- About 66% of the privately owned wealth within the U.S. is held by people who are over 60.

- To ensure success for the business 62% of wealth professionals believe that implementing artificial intelligence is crucial.

Wealth Management Trends

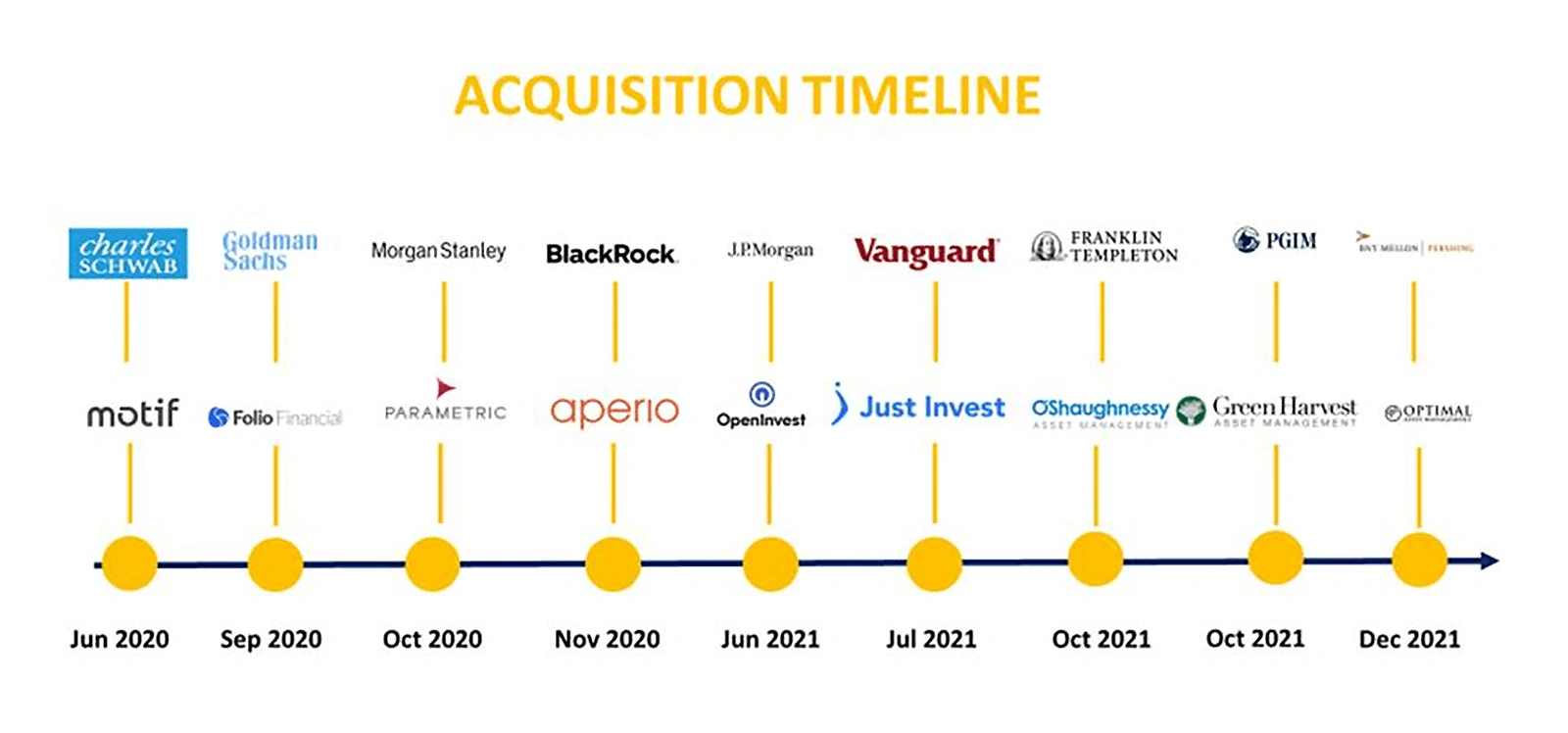

- In 2021, the direct indexing market was valued at $400 billion and is increasing to $730.5 by 2026.

- Investment strategy includes buying the individual stocks that make you an index at a proper weight.

- By 2025, Globally, ESG assets are predicted to top $53 trillion.

- A Reuters survey shows that $649 billion goes into ESG-focused funds in 2021.

- In 2020, ESG-focused funds reached %542 billion.

- As per the survey, 80% to 98% of heirs will not relate with their parents' financial manager.

- As per the survey, by 2025 the direct indexing management accounts will be valued at $1.5 trillion which was $350 billion in 2020.

- In the past 24 months, Vanguard, Morgan Stanley, BlackRock, and Schwab have been direct indexing firms.

- As per a survey done by Accenture, 67% of Millennials want computer-generated wealth management.

- The New York Times estimates wealth transfer will be small to $15 trillion.

- Investment strategy provides more control and autonomy for the investor who owns a mutual fund or ETF. Per year, 1% returns increase, allowing investors to save on tax.

(Source: explodingtopics.com)

- Investors who concentrate upon Schwab will require at least $250,000 to invest in many of the firm's direct index services.

- Many Millennials have already spent on this platform, as you can invest with as little as $1.

- Fidelity's direct index services with limited customization options need a $5000 investment minimum and also charge a 0.40% advisor fee.

- As Baby Boomers hand down an inheritance to the young generation, many in the middle class will soon have an income to invest.

- As per the survey, Wealth Simple is one company that offers financial solutions that fascinate specifically this generation.

- Cerulli Associates predicts $84 trillion of wealth will transfer by 2045.

- In 2024, millennials will double as compared to Baby Boomers to use robo-advising, a market foreseen to reach $1.2 trillion.

Wealth Management Report

- In the year 2022, the world economy went through an enormous decline. This leaves the wealth management industry across the globe facing a myriad of new challenges.

- The year 2022 was the one in which HNWI populations and wealth saw a sharp decline throughout the decade.

- The decline was between 3.6 percent and 3.3 percent when compared to 2021.

- Although the challenges to profit are real, it is important to capture the wealthiest earlier in their lives and increase their wealth when they are HNWI clients.

- Improve revenue and alleviate profit pressure. Furthermore, relationship manager-enabled and similar technology-powered capabilities such as single-window digital work platforms, can be a little complicated.

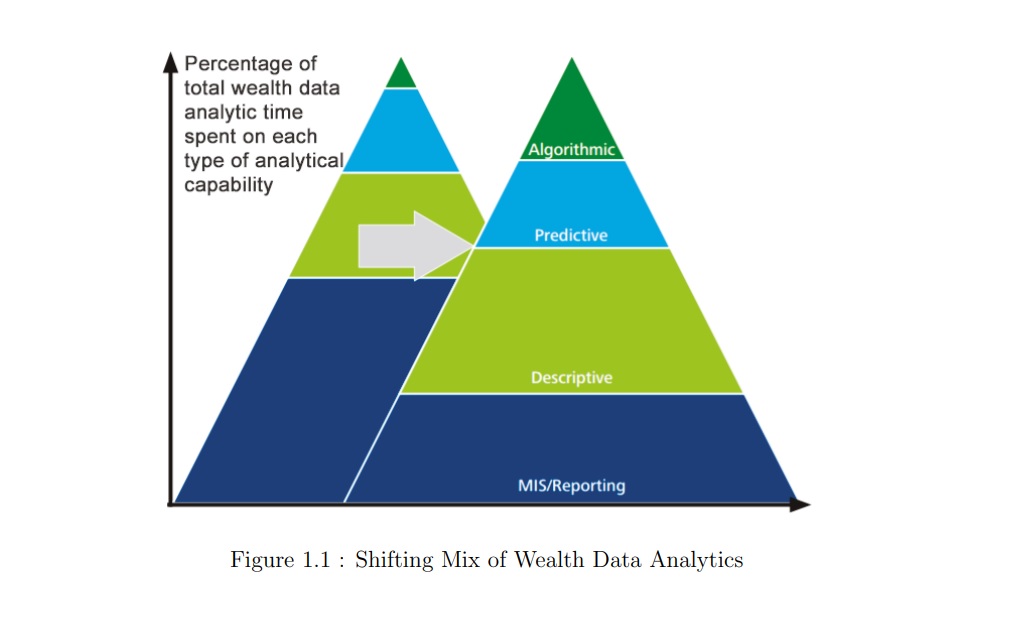

Four Types of Analytical Capabilities

Wealth Management organizations are behind the curve in wrenching big data and inspecting, but this may be composed to make rapid progress in the next several years.

(Source: deloitte.com)

- Algorithmic capabilities: Tracking activity and modifying your organization's responses in real time.

- Predictive capabilities: Initiating data-driven guidance for decisions in uncertainty.

- Descriptive capabilities: Providing a better understanding of business and the impact of customer response.

- Reporting and MIS capabilities: Monitoring everyday financial performance.

Global Wealth Management Market Outlook

- Assets under Management (AUM) are forecasted to reach USD 128.90 trillion in 2024.

- Financial Advisory is identified as the leading segment, projected to manage USD 126.10 trillion in 2024.

- From 2024 to 2028, AUM is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.34%, culminating in USD 158.70 trillion by 2028. This growth trajectory suggests a robust and optimistic future for the Wealth Management sector.

- There is a noticeable shift towards sustainable and impact investing within the wealth management market. This trend underscores the growing importance of socially responsible investment strategies, aligning financial goals with broader environmental and societal objectives.

McKinsey Report on U.S. Wealth Management Industry

Based on the comprehensive analysis provided by McKinsey on the shifting dynamics within the U.S. wealth management industry, several key statistics and insights emerge, highlighting the industry's resilience and the imperative for strategic adjustments to navigate current and future challenges. Here's a summary of significant data points and their implications for industry stakeholders:

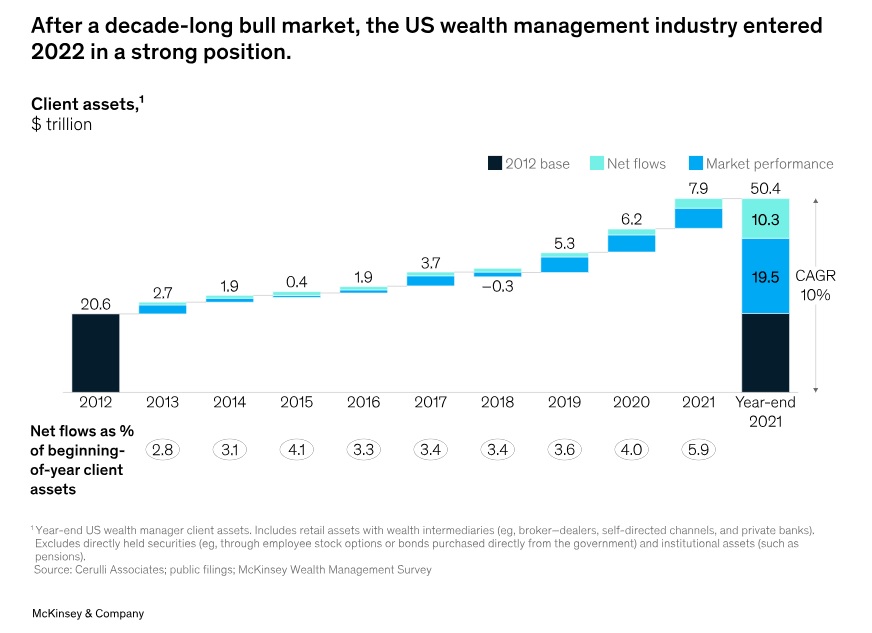

- Decade of Growth Culmination (2012-2021): The U.S. wealth management industry experienced an average annual market growth of 14%, with capital markets performance accounting for 70% of industry-wide asset growth.

- 2021 Industry Highlights: Client assets increased by $7.9 trillion (19%), reaching $50 trillion, with market performance driving 13 percentage points of this growth and net flows contributing six percentage points ($2.5 trillion).

- Profit and Margin Increase: In 2021, industry profits grew by 24% to $58 billion, and margins reached 24%, marking a 1.4-percentage-point increase year-over-year.

- Growth Among Top Performers: Digital-direct wealth managers captured about 41% of total industry net flows from 2016 to 2021, increasing their share of client assets from 21% to 27%.

- RIAs and Broker-Dealers: RIAs saw 22% of total net flows, and regional and independent broker-dealers slightly outperformed the industry average, capturing 25% of total net flows.

- Challenges for Full-Service and Private Banks: Between 2016 and 2021, national full-service wealth managers and private banks captured only 9% and 4% of the industry’s net flows, respectively.

- Advisor Performance Disparities: The top quartile of advisors added 18 new households per year, significantly outperforming their peers in lower quartiles.

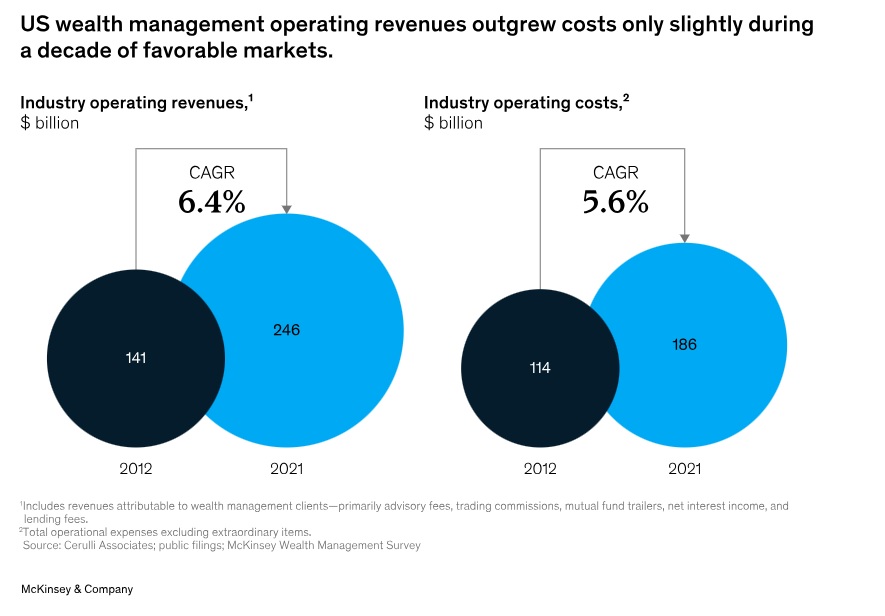

- Cost Growth and Operating Leverage: In 2021, total costs for the industry reached $186 billion, with a significant portion of the cost growth ($25 billion) occurring in that year alone.

- 2022 Market Conditions: Despite a 16% decline in client assets and moderated net flows, the industry saw a 4% revenue growth and a 0.4% improvement in margins, aided by rising interest rates.

- Diverse Experiences Across Models: Private banks, digital-direct wealth managers, national full-service wealth managers, and broker-dealers each faced unique challenges and outcomes in the face of market volatility.

- Client Relationship Deepening: Increasing communication frequency with clients from once or twice per year to monthly can increase customer satisfaction scores by 52%.

- Addressing Structural Cost Issues: The industry's cost base has grown significantly, necessitating a focus on expense discipline and operational efficiency to maintain competitiveness.

These data points underscore the importance of strategic foresight, adaptability, and proactive management in ensuring the continued growth and resilience of wealth management firms. The industry's ability to navigate macroeconomic uncertainties, coupled with a focus on organic growth and operational efficiency, will be critical in maintaining a competitive edge and achieving long-term success. As wealth managers set their sights on the future, investing in technology, enhancing client relationships, and optimizing cost structures will be pivotal in overcoming current challenges and capitalizing on emerging opportunities.

Evolving Landscape By EY

In the evolving landscape of the global wealth management industry, recent developments have underscored the necessity for wealth managers to adapt and innovate to harness the burgeoning potential and ensure long-term survival. Here are key statistics and insights that delineate the current state and future trajectory of this dynamic sector:

- The global volume of net investable assets of high-net-worth individuals (HNWI+) is projected to increase by approximately 25%, reaching nearly US$70 trillion by 2021.

- By 2025, holistic wealth management, a new digitally-oriented business model, is expected to claim a market share of 30%, indicating a significant shift towards integrated financial services.

- Traditional wealth management models are anticipated to largely vanish from the market, replaced by more agile and technologically adept firms.

- In the United States, traditional wealth managers may continue to thrive in the international offshore business, benefiting from increasingly favorable conditions.

- The service offerings of offshore wealth managers are expected to increasingly resemble those of onshore counterparts, signaling a convergence of strategies.

- The current market for net investable assets already surpasses US$55,000 billion, with a forecasted growth to US$69,607 billion by 2021, marking an annual growth rate of 4.7% through 2021.

- North America is poised for the largest growth in net investable assets, with an expected growth rate of approximately 4.4%, despite being a mature market.

- The Asia-Pacific region is forecasted to experience above-average growth at 5.9%, driven by burgeoning entrepreneurship and innovation, particularly in centers like Singapore.

- Africa and the Middle East are identified as markets with above-average future growth prospects, fueled by the export of precious metals, diamonds, and the flourishing trade finance sector.

- Brazil and Mexico are highlighted as key drivers behind growth in Latin America, with a combined increase in net investable assets of US$700 billion.

- Western Europe, with the United Kingdom and Germany at the forefront, continues to be a major contributor to global net investable assets growth, despite challenges such as Brexit.

- Eastern Europe, led by Russia, is noted for its significant number of high-net-worth individuals, contributing to the region's growth in net investable assets.

- Europe, with 8 of the top 20 nations in net investable assets growth, is expected to contribute over 20% to global growth, with Western Europe growing at an annual rate of 4.5% and Eastern Europe at 6.3%.

The wealth management industry is at a pivotal juncture, facing both unprecedented challenges and opportunities. The transition towards digital, holistic wealth management models is indicative of the sector's future direction. Wealth managers who adapt to these evolving market conditions, leveraging technological advancements and aligning with global growth trends, will be well-positioned to capitalize on the expanding wealth management landscape. Success in this rapidly transforming market will require foresight, innovation, and a proactive approach to both regional and global opportunities.

COVID-19's Implications

- For 2021 the industry experienced a steady increase of 11.0 percent, as when compared to 10.5 percent in 2020.

- In 2022, the growing adoption of cloud-based services will likely propel the market to an even higher level.

- According to the Monetary Authority Singapore, the asset managers have adjusted to remote work, which has had minimal influence on their fundraising. Despite the COVID-19 pandemic being a major issue for Singapore, its AUM was up 17 percent in 2020 to reach $ 3.5 trillion by 2020.

Key Industry Players

- SS&C Technologies, Inc. (U.S.): SS&C Technologies stands out as a global provider of financial services software and software-enabled services. Their offerings span across the global financial services industry, including wealth management. SS&C delivers a broad portfolio of technology systems and services that help increase operational efficiency, reduce risk, and improve client service. Their solutions support portfolio management, fund administration, and financial advisory services, making them a critical backbone for wealth managers seeking comprehensive and scalable platforms.

- Fiserv, Inc. (U.S.): Fiserv is renowned for its financial services technology solutions, serving a wide range of clients in the banking and wealth management sectors. The company offers a suite of services designed to facilitate asset management, investment advisory, and risk management. Fiserv's solutions are aimed at enhancing client engagement through digital platforms, optimizing investment strategies, and streamlining operational processes, thereby empowering wealth managers to deliver superior financial advice and portfolio performance.

- Profile Software (Europe): Based in Europe, Profile Software has carved a niche for itself by providing innovative and efficient financial software solutions. The company specializes in banking and investment management software, offering products that cater to the needs of wealth management, asset management, fund management, and private banking. Profile Software's solutions are designed to support end-to-end processes, from client onboarding to portfolio management, enabling wealth managers to deliver personalized services and manage investments effectively.

- Broadridge Financial Solutions, Inc. (U.S.): Broadridge Financial Solutions is a leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds, and corporate issuers globally. In the wealth management sector, Broadridge offers advanced platforms that facilitate portfolio management, compliance, data analytics, and client communication. Their technology enables wealth managers to streamline operations, achieve greater transparency, and enhance the overall client experience.

- InvestEdge, Inc. (U.S.): InvestEdge is a provider of wealth management solutions to advisors serving high-net-worth clients. The company's offerings include tools for portfolio management, performance measurement, client reporting, and compliance monitoring. InvestEdge's platform is designed to help wealth managers integrate data, make informed decisions, and deliver insightful advice, thereby enhancing client relationships and driving growth.

- Temenos Headquarters SA (Europe): Temenos is a market leader in banking and finance software, serving clients globally. The company's wealth management solutions are tailored to meet the needs of private banks, wealth managers, and family offices. Temenos' platform offers robust capabilities for portfolio management, risk assessment, compliance, and client relationship management. By leveraging advanced analytics and digital channels, Temenos enables wealth managers to offer personalized services and manage wealth more efficiently.

Recent Development

- Adoption of Artificial Intelligence (AI) and Machine Learning: The wealth management sector is increasingly leveraging AI and machine learning for pattern recognition and decision-making, enhancing advisors' work and client interactions through customized chatbots and AI-powered communications.

- Integration of Technology Stacks: There's a growing focus on optimizing technology stacks to eliminate redundant data entry and improve operational efficiency. Wealth management firms are meticulously reviewing their tech systems to ensure seamless data integration and distribution.

- Non-AUM-Based Fee Models: The industry is witnessing a shift towards diverse fee models, including hourly, flat, and performance-based fees, challenging the traditional AUM-based structures and reflecting a broader range of client preferences.

- Client-Centric Approaches: Wealth management firms are emphasizing client-centric strategies, involving investors in service expansion and integration to develop holistic and personalized financial wellness offerings. This trend highlights the importance of listening to clients and co-creating services to enhance engagement and satisfaction.

- Holistic Advice Beyond Investments: Investors are increasingly seeking advice that extends beyond traditional investments to encompass financial, emotional, and social goals. This shift necessitates a robust digital and personal engagement model that leverages analytics to meet changing client expectations.

- Focus on ESG and Sustainability: Environmental, Social, and Governance (ESG) considerations are becoming integral to wealth management services. An ESG-focused offering is transitioning from a competitive advantage to a fundamental client expectation, underlining the need for wealth management firms to integrate ESG metrics into their advisory services.

- M&A Activity: Mergers and acquisitions in the wealth management space continue to rise, with a notable increase in deal volume despite a decline in the average value of transactions. This trend reflects the industry's response to inflation, geopolitical concerns, and the high cost of capital, driving firms towards strategic M&A to leverage opportunities and enhance capabilities.

Conclusion

This is a time of notable change and interference for the Wealth Management Industry. New forms of advice and new ways to carry that advice will continue to emerge, and competitive positions will corrode. In contrast, others will strengthen, creating winners and losers all across the industry. While retail investors will surely benefit from all the changes, Wealth Management companies must strategically evolve to adapt to these critical shifting dynamics.

It is expected that the clients demand that the company be able to handle new relations in new ways. Those wealth officers who do so will be able to secure clients and keep them engaged with digital solutions. This article has covered all the Wealth Management Industry Statistics to be studied.

Sources

FAQ.

As per the forecast, the assets under management in this market are predicted to reach $64,390 by 2024.

50% of the global net worth belongs to the 1%. The top 10% of the adults hold 85%, while the bottom has 90%.

As assets and Wealth management have been filling financial gaps, the return from the global financial crisis.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.