Authorize.Net Statistics – Market Share, Users and Web Usage

Page Contents

Introduction

Authorize.Net Statistics: Unlike a few years ago, when we were carrying bundles of cash just to go shopping, today it has become easier with online payments. We don’t need to carry any cash. We can use various cards and different online payment platforms available on mobile phones.

Likewise, Authrorize.net is also one of the most used apps in the United States of America. It also provides a seamless online money transfer option. Authrorize.net has various 37 features to use, unlike other applications. In this Authrorize.net statistics, we will have some insight into its meaning, some general statistics, and a comparison between the biggest players of the online payment platforms – Authrorize.net Vs Stripe Vs PayPal.

Key Authorize.Net Statistics (Editor’s Choice)

- On average merchants handle more than $149 billion of transactions every year.

- United States of America has around 93.45% of the population using the Authorize.Net platform.

- The website has 94.70% of the organic traffic and 5.30% of the paid traffic.

- Net platform has around 37 features.

- net has 29.1. million backlinks with an increased percentage of 6.2%.

- The platform has over 4,45,00 merchants.

- On average, the platform has 46.2% of the total mobile visits and 53.8% of the desktop visits.

- The average time spent on the website is 07:55 minutes.

- According to Authorize.net statistics, 48.39% of the users are female and 51.61% of the users are male.

- United States of America has 3.5 million website traffic resulting in 93.01%.

- As of July and August 2023, this payment management platform generated 2.4 million and 1.8 million of global traffic. Unfortunately, in August the rate of total visitors reduced by 24.5%.

What is Authorize.Net?

Authorize.net is an online payment gateway service provider based out of Foster City, United States of America. Authorize.Net allows users more than 39 features to pay online including for various merchants over the world. The company was incorporated in the year 1996 and has become a subsidiary of Visa Inc. The United States has a wide range of customer databases for the Authorize.Net platform than any other country around the world.

Features of Authrorize.net

- Authrorize.Net statistics The platform uses advanced fraud detection to protect customers from fraud.

- Recurring monthly payments are possible with Authrorize.net.

- It has a simple checkout option with a flexible user interface.

- Invoicing can be performed using the platform.

- International and local payment from anywhere and anytime.

- Other than payment processing Authrorize.net offers features such as transaction monitoring, eCommerce management, returns management, real-time data analysis, ordering automation, loyalty program, mobile payments, electronic signature, credit/debit card processing, ACH payment processing, and many more others.

General Authorize.Net Statistics

- Net has around 12,176 unique domains.

- The platform has over 4,45,00 merchants.

- On average merchants handle more than $149 billion of transactions every year.

- Net has the ability to accept payments from Mastercard, American Express, PayPal, Discover, Visa, JCB, Apple Pay, and eCheck.

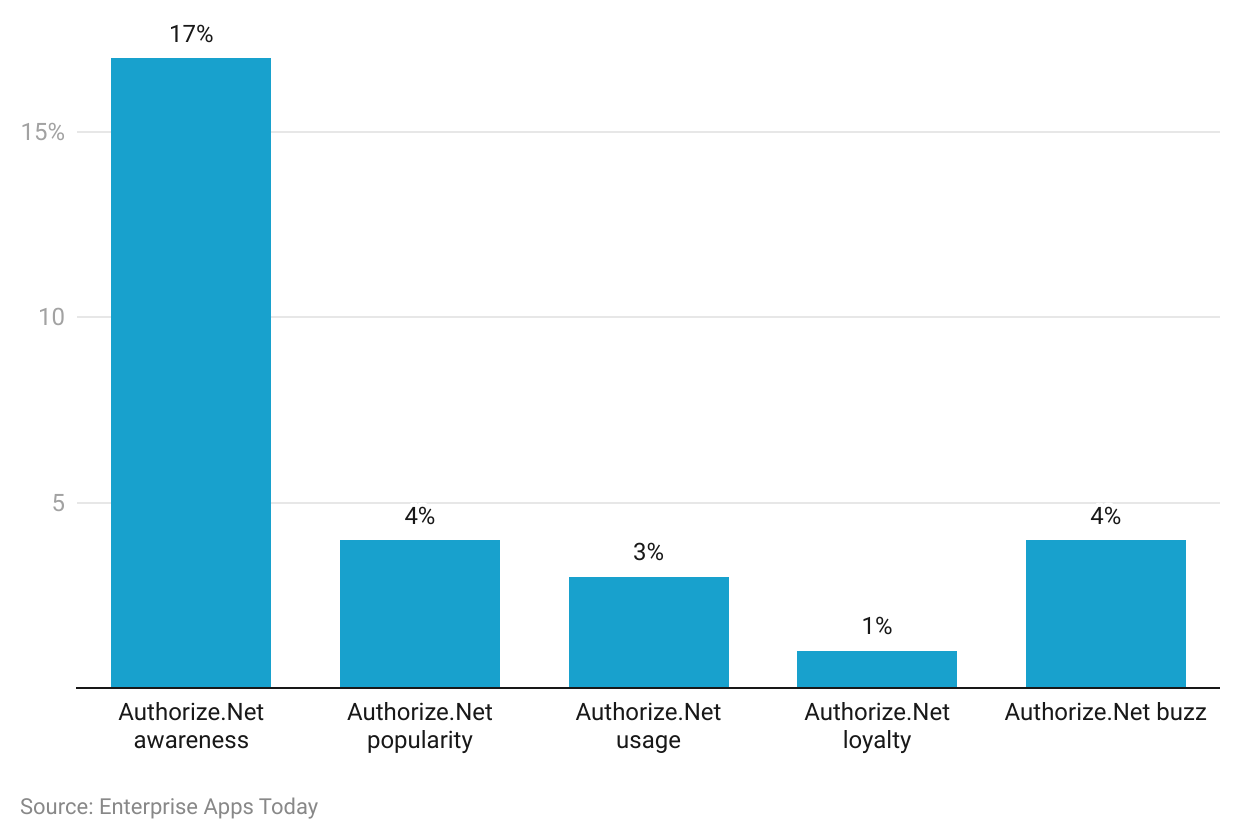

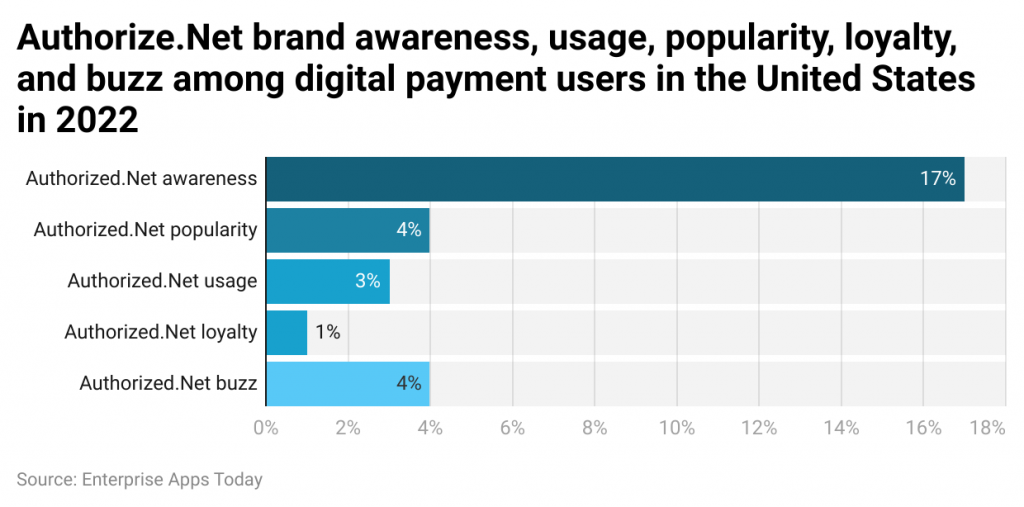

- The above chart shows the various factors considered in the United States of America, where around 17% of the population has brand awareness about Authorize.Net.

- On the other hand, Authorize.Net is only popular with a 4% rate in the United States of America in the year 2022.

- Moreover, the chart shows that total app usage is only 3% in the year 2022.

- Only 1% of people are loyal to the brand Authorize.Net

- In the month of August 2022, considering the advertisement and marketing, 4% of the digital payment users heard about the Authorize.Net platform associated with social media and other offline media.

- 17% of the people in the United States of America can recognize the brand name just by looking at it.

| United States | 93.24% |

| Canada | 1.74% |

| Sweden | 0.34% |

| Palestine | 0.33% |

| Korea, Republic of | 0.32% |

| Other | 4.03% |

- On the other hand, in the United States of America around 93.45% of the population uses the Authorize.Net platform, but it shows a decline in the total number of users by 2.29%.

- The United States of America has the highest number of total users in the world.

- Canada and Sweden also participate in the total usage list resulting in 1.74% and 0.34% total users. Both of the countries have shown a decrease rate of users by 24.50% and 13.89% respectively.

- Similarly, Palestine and other countries have almost the same percentage of total users with 0.33% and 4.03% respectively. Palestine has around a 7.30% reduction in the total number of users.

- However, Korea has 0.32% of the users but this has shown an increase in the total number of users by 5.00%.

- Authorize.Net statistics show that what audience is mostly interested in banking, credit and lending, programming and developing software, and news and media publishers.

- Net platform has around 37 features.

- The platform supports 14 currencies.

- On average, the platform has 46.2% of the total mobile visits and 53.8% of the desktop visits.

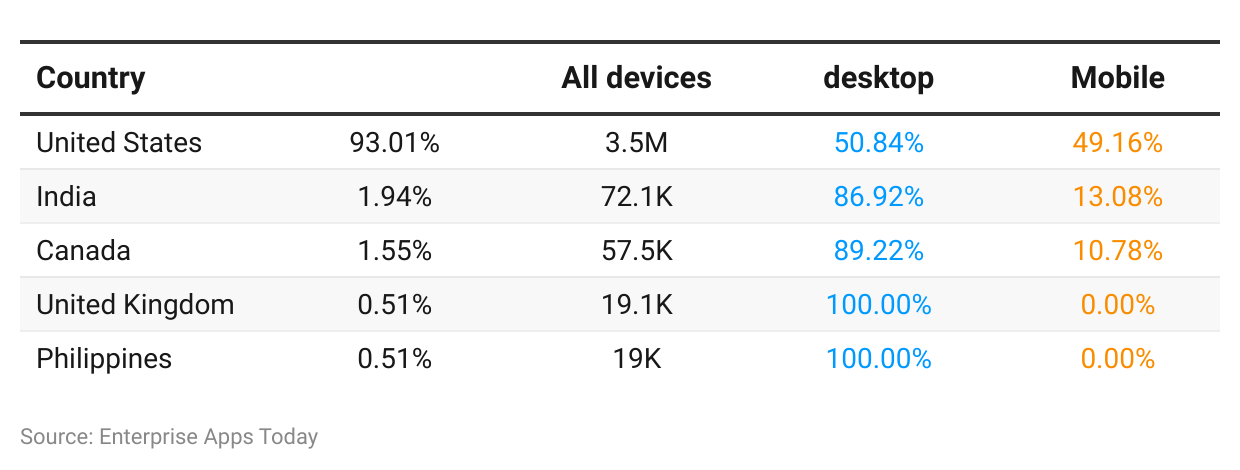

- As per the above comparison, the United States of America has 3.5 million website traffic resulting in 93.01%. 50.84% of the traffic visits the website from a desktop and 49.16% of the users prefer mobile applications.

- Considering India and Canada, both users have around 1.94% and 1.55% of the total share in website traffic respectively. Whereas users in India are 72.1K out of which 86.92% prefer the desktop version and 13.08% prefer the mobile version.

- Canada has around 57.5K total users. Out of which 89.22% of users' traffic comes from desktop and 10.78% of traffic comes from mobile.

- The United Kingdom has only 0.51% traffic which is similar to the Philippines. United Kingdom has 19.1K users accessing the website from a desktop and with a minor change in the number Philippines has 19K users.

- The United Kingdom and the Philippines do not use mobile applications for payment services in terms of Authorize.net

- In the month of September 2022, Authorize.net had 3.7 million website visits from around the world.

- Whereas, in the month of August, the total number of visitors was 3.2 million.

- However, July month shows the highest number of site visitors with 5.5 million.

- According to Authorize.net statistics, 48.39% of the users are female and 51.61% of the users are male.

- The website has 94.70% of the organic traffic and 5.30% of the paid traffic.

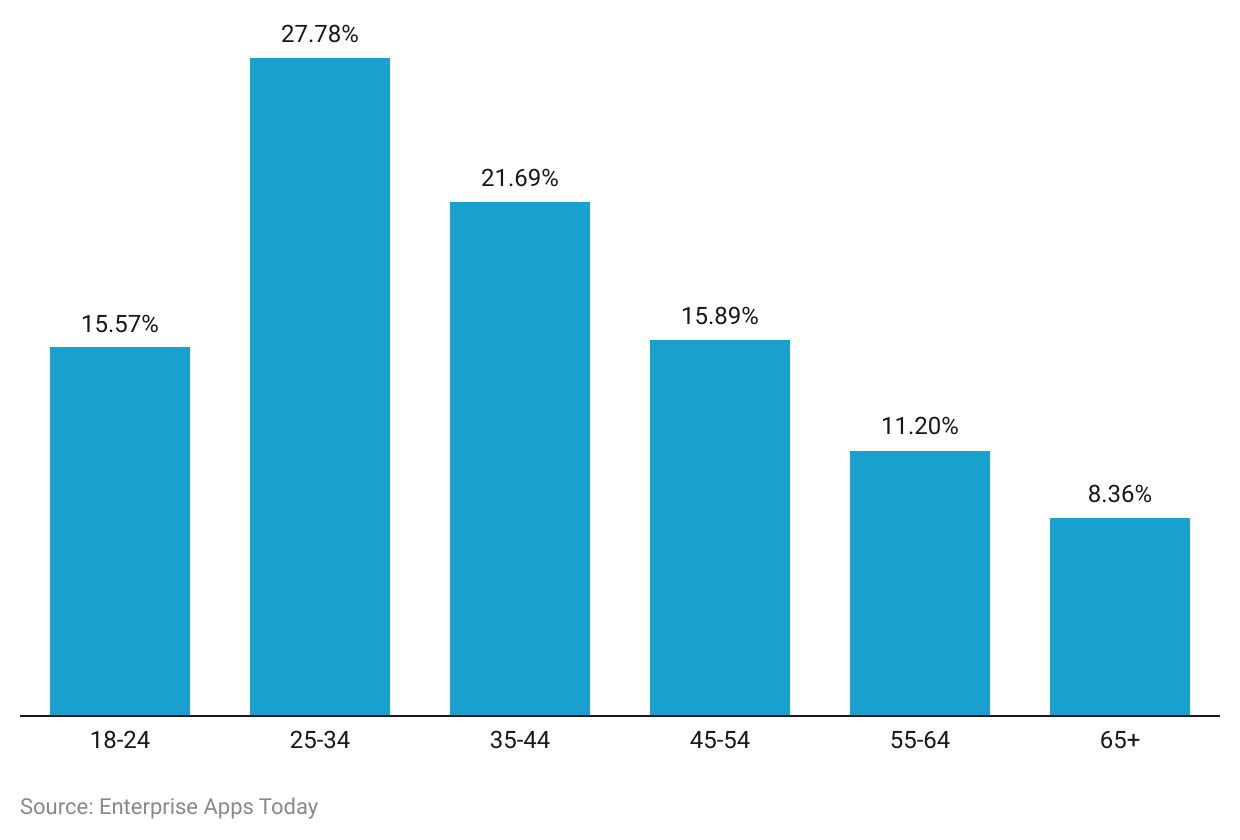

- Age-wise distribution of the users tells that users from the age group of 18 to 24 years are around 15.57%.

- The maximum usage report is recorded from the age group people of 25 years to 34 years with a percentage of 27.28%

- On the other hand, 21.69% of users are from the age group of 35 years to 44 years.

- Whereas baby boomers' age groups of 45 to 54 years and 55 to 64 years are around 15.89% and 11.20% respectively.

- Surprisingly, people above the age of 65 are also contributing up to 8.36%.

- net has 29.1. million backlinks with an increased percentage of 6.2%.

- For the purpose of social marketing, Authorize.net has received organic traffic from YouTube resulting in 37.69%.

- Facebook and Twitter referred traffic around 29.78% and 17.20% respectively.

- Reddit and LinkedIn have contributed to organic traffic to Authorize.net by 11.29% and 2.99% each.

- Whereas other social media includes around 1.04% of the traffic contribution.

- The average time spent on the website is 07:55 minutes.

- On average, a user checks 5 pages on the website for every visit.

- The website has a 38.91% bounce rate.

- net has ranked 15,927 on the global rank and 3,290 in county rank for the United States of America. On the other hand, the global rank has been reduced by 355 numbers and the country rank has also been reduced by 91.

- In the category rank, the website has 18th place in the financial planning and management category for the United States of America.

- As for the marketing distribution channels, Authorize.net uses 55.83% of direct channels whereas 36.89% are used for referrals.

- 95% are being used for search options while social media channels allocate 0.25%.

- Mail and display marketing channels distribution have 2$ and 0.07% of the contribution.

Brand Profile in the United States of America in 2022

(Source: statista.com)

(Source: statista.com)

As of 2022, only 17% of the residents in the United States of America knew about this payment management system. Out of which merely 3% were using it and 1% were loyal to this payment platform.

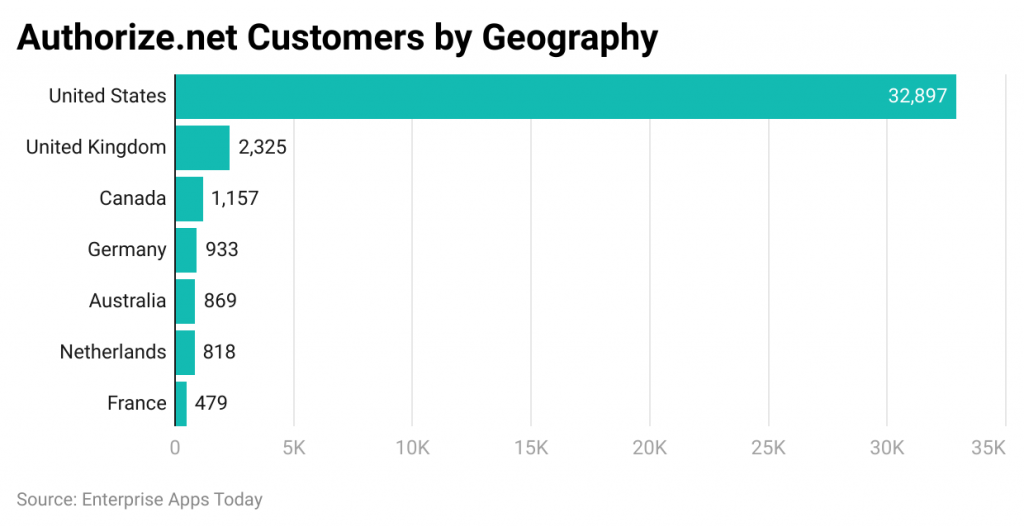

Authorize.net Statistics by Total Customers

(Source: 6sense.com)

(Source: 6sense.com)

Around 75.16% of the users in the United States of America are using this platform having 32,721 databases, while it is 2,319 for the United Kingdom (5.33%) and 1,158 for Canada (2.66%).

Authorize.net Vs Stripe Vs PayPal

Stripe similar to Authorize.net and PayPal is helping big businesses to run their transactions online. Stripe is widely accepted online payment method than any of these two.

Stripe

- Widely accepted payment method.

- It offers transaction fees for merchants situated in the United States of America.

- More than that, 0.5% are charged for recurring payments.

- Customers who are located in the United States of America and who have more than $1,00,000 of payments in a month are offered huge discounts.

- It doesn’t have a monthly fee.

- Merchants in the United States of America get their payout in 2 daily periods.

PayPal

Another biggest competitor in the online payment platform is PayPal. PayPal was launched in early 2000 and it has millions of supported websites and customers. PayPal allows direct credit card transactions which makes online payments easier.

- Payments made using debit and credit cards with advanced versions are charged at 2.89% plus $.49 for every transaction.

- Normal payments completed through PayPal are charged 3.49% plus $.49 for every transaction.

- Merchants who have more than $2,50,000 of transactions every month are charged less.

- Merchants receive their payout immediately after they have been processed.

- If a recurring and automatic billing cycle is established, then merchants can’t change the billing date or billing cycle.

- If the merchant is using Payment Pro, then they are required to complete the Self-Assessment questionnaire and attestation of compliance.

- PayPal has two choices PayPal Checkout and PayPal Pro. PayPal Pro is an advanced version.

- PayPal Pro offers direct debit from the credit card.

Authorize.net

As seen in the Authorize.net statistics, currently there are more than 90% of customers using Authorize.net than any other country around the world. It has similar features to PayPal and Stripe. Authorize.net has the option to connect bank accounts in a traditional way.

- Transaction fees depend on the contract made with the merchant and the account provider.

- net offers direct account creation even if a business has no merchant account with an all-in-one service option.

- Merchants are required to be located in the United States of America, the United Kingdom, Canada, Australia, and Europe to receive the money, but they can accept the amount from any part of the world.

- Merchants are able to receive their payments in 2 business days.

- If the recurring payments are failed, then the system automatically retries the payment.

- The transaction fee is charged at 2.9% plus $.30 for every transaction.

- A monthly fee is also required to pay up to $25.

- $49 is required for the one-time account setup fee.

Which One Is Better?

Considering the above-mentioned features, the best one to fit any kind of business is PayPal which transfers money immediately. Moreover, it has low overall transaction charges. Authorize.net requires merchants to pay fees for everything they do. Moreover, even though Authorize.net can receive payment from anywhere around the world, merchants are required to be located in the area of the United States of America. Such kind of terms are not applicable to PayPal and Stripe.Authorize.net can be a good option for businesses running on a wider level and having more profits in their accounts. PayPal seems to operate on a medium level where it is a good option for small-scale industries as well as medium and large-scale industries. All of these online payment options have some differences and one is better than another, but it is up to the merchant to choose the method he wants to use.

Conclusion

Looking at the Authorize.net statistics, other than in the United States of America, people are less aware of the platform. But as it provides an easy online shopping experience it will slowly create awareness around the world. Technology is involved in many aspects of our life today. There are many other similar online payment platforms that help us ease our lives.

Yet, there’s very little competition between these many online payment platforms, but as the world will in the coming years shift to paperless transactions, then it will great cutthroat competition for everything. As the statistics say, Authorize.net is useful for any kind of business, it completes the minimum requirement of online payment. Therefore, it depends upon the requirement of the business which app to use for such online payments.

FAQ.

It is an online payment platform which offers easy money transfer from anywhere around the world.

Yes. Authorize.net uses advanced protection technology to save the customer from fraud their keep them protected.

Click on the Account then settings. Then go to general security settings and click on API credentials and Keys. Look for Create new keys and click on new transaction key or new signature key. After which as a final step, click on submit.

For merchant accounts it charges $25 every month but it has no account setup charges.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.