Adyen Statistics – Reviews, Market Share, Usage and Features

Page Contents

Introduction

Adyen Statistics: Digital payments which slowly converting into digital currencies such as crypto are changing the face of the world. Various kinds of online payment methods are easing online shopping, airplane ticket booking, daily money transfers, and many other things. Adyen is also one of the platforms that enable online payments to various websites. In this Adyen statistics, we will have insight into its meaning, features, advantages, and disadvantages of using Adyen, general statistics, and a comparison between Adyen and Stripe.

Key Adyen Statistics (Editor’s Choice)

- The total percentage of the male audience for Adyen is 55.22% and 44.78% is for the female audience.

- In terms of website visitors to Adyen.com, the month of October 2022 experienced 41.0 million visits, whereas September recorded 43.3 million visitors.

- maximum usage report is allotted to the age group of 25 years to 34 years resulting in 32.44%.

- Adyen supports more than 250 payment methods as well as has 187 currencies in the database.

- Currently known websites that support Adyen online payment are around 15,05,784.

- According to Adyen retail reports, businesses with food and beverages, hospitality, and retail increased their revenue by 67% after investments in digitalization.

- According to the Adyen Statistics, businesses that have various online payment methods, their revenue is increased by 9%.

- Customers who support Adyen’s payment are Spotify, LinkedIn, Booking.com, Uber, eBay, Microsoft, Etsy, Gap Inc., Evernote, and many more.

- Adyen has 84.82% organic traffic towards their website whereas 15.18% is paid.

- Adyen has around 1.4 million backlinks.

What is Adyen?

Adyen is a Dutch payment company based out of Amsterdam, Netherlands. It offers online payment services, including credit cards, wire transfers, debit card transfers, and real-time bank transfers depending on online banking. In the year 2021, its net revenue was 1 billion euros. There are millions of websites available today with different categories that accept payments from Adyen. It does not only offer online payments but also offline and cross-channel payments. Other services include risk management, authentication, and revenue optimization. Adyen is also specialized in financial activities.

Features of Adyen

- Different checkout gateways can be created using the Adyen platform.

- Adyen gives freedom to the merchant to accept the payment in the way they want.

- Ayden’s platform uses artificial intelligence (AI) to protect customers and merchants from scams and fraud.

- Adyen provides 24/7 support.

- Adyen’s platform also offers a trial account which lets the customer use premium features and make trial payments without actually paying.

- Multiple payment methods and accepted currencies.

- The platform offers automatic verification for sub-merchants.

- Moreover, using Adyen, online and offline payments collaborate for easy use of the payments.

- Local and international accepted payments.

- The Adyen also offers revenue optimization for merchants which reduces the risk of failed transactions.

Advantages and Disadvantages of Adyen

Advantages

- Multiple currencies accepted.

- International payments option available.

- 24/7 customer support.

- Multiple payment methods including online payment, offline payment, and app payment channels.

- No monthly payments.

Disadvantages

- A minimum invoice amount is necessary for checkout.

- No multiple options are available for offline payment options.

- Multiplex pricing model.

- The transaction cost depends on geographic location as well as the payment method.

General Adyen Statistics

- According to Adyen Statistics, payment data is being used by around 28% of companies around the world for making improvements in customer behavior and shopping experience.

- On the other hand, 28% of the merchants use the payment data for the same reason.

- The Adyen retail report says that 45% of customers love suggestions and personalized ads from retailers.

- Likewise, 47% of the customers prefer those sellers who store the customer’s information and their preferences along with the data of previous purchases.

- As per the Adyen retail report, 23% of the companies that provide online purchase and return options in the offline stores are preferred by 61% of the customers.

- According to the Adyen Statistics, businesses that have various online payment methods, their revenue is increased by 9%.

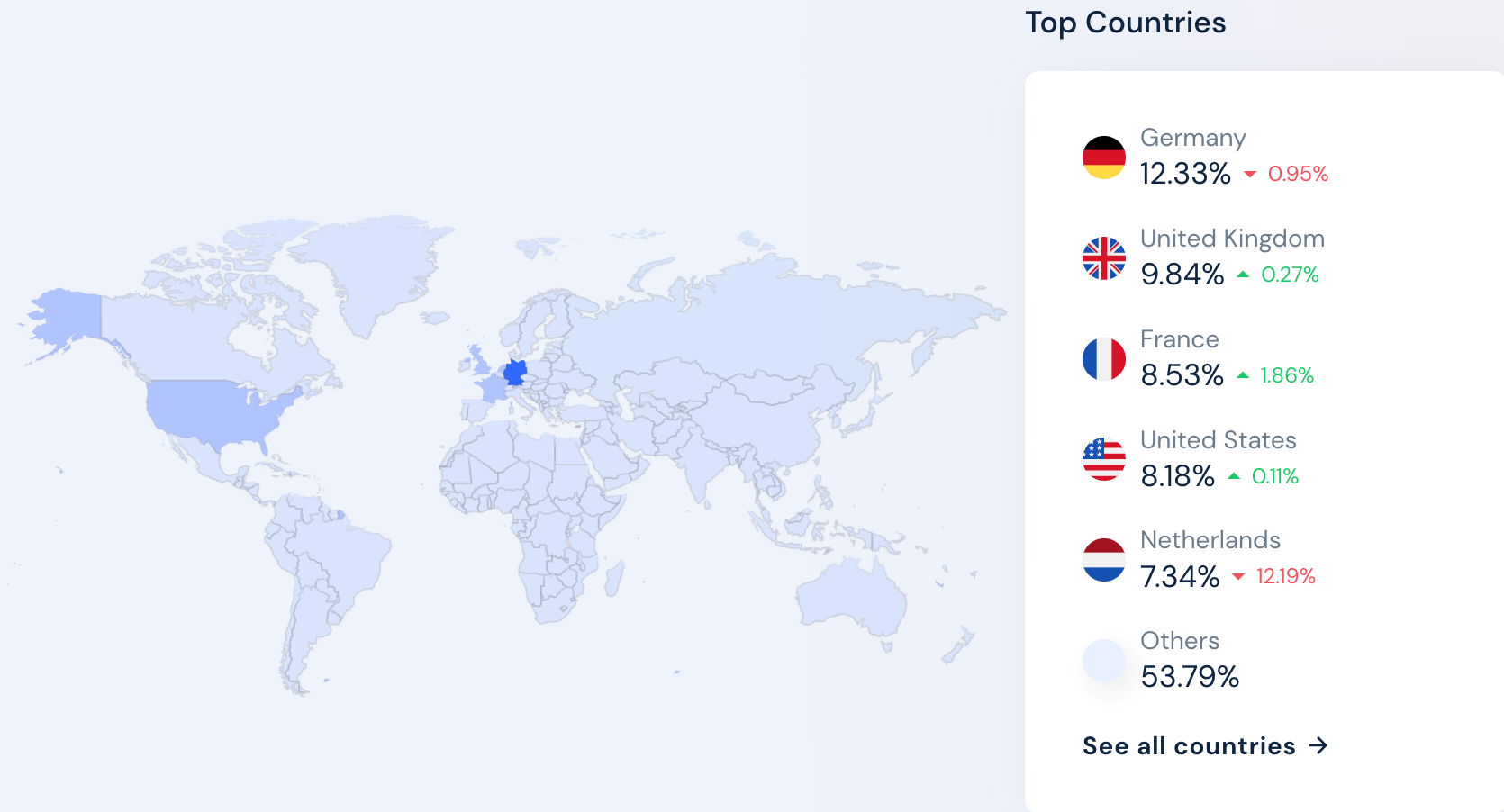

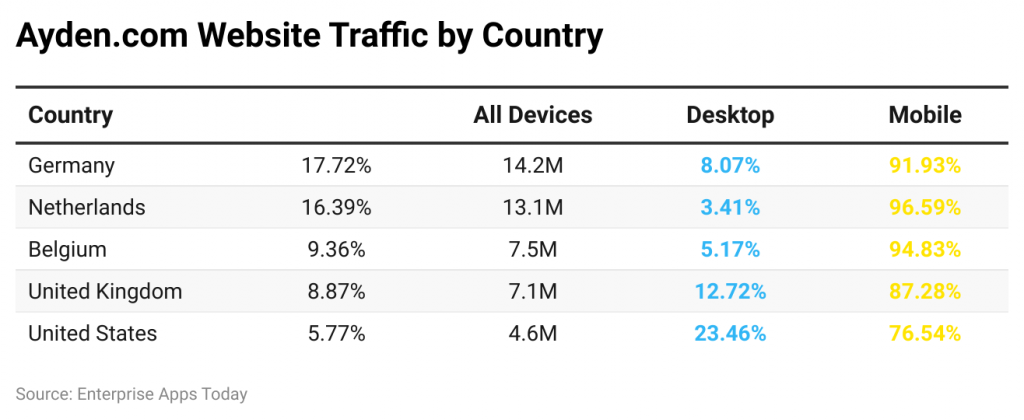

- According to the above map, Germany tops the list for a high number of users with a rate of 12.33%. But on the other hand, the usage has been reduced by 0.95%.

- Whereas, the United Kingdom has around 9.84% of the total population using Adyen for online payment.

- The population in France also has around 8.53% of the total users, with an increased rate of users by 1.86% and 0.27% in the United Kingdom.

- In the United States of America, Adyen is also famous for around 8.18% with an increasing rate of 0.11%.

- Whereas, the Netherlands has 7.34% of the population using the Adyen payment application but with the highest decrease rate of 12.19%.

- Other countries not mentioned in the above list but have a small amount of population using the Adyen are resulting in 53.79%.

- The total percentage of the male audience for Adyen is 55.22% and 44.78% is for the female audience.

- While among these, according to the age group distribution, 22.56% is used by the 18- 24 years group.

- While maximum usage report is allotted to the age group of 25 years to 34 years resulting in 32.44%.

- Population from the age group of 35-44 and 45 to 54 are 20.52% and 12.74% respectively.

- While the baby boomers group is using it for around 7.21% from 55 years to 64 years. Moreover, the population of 65 years plus is contributing around 4.52%.

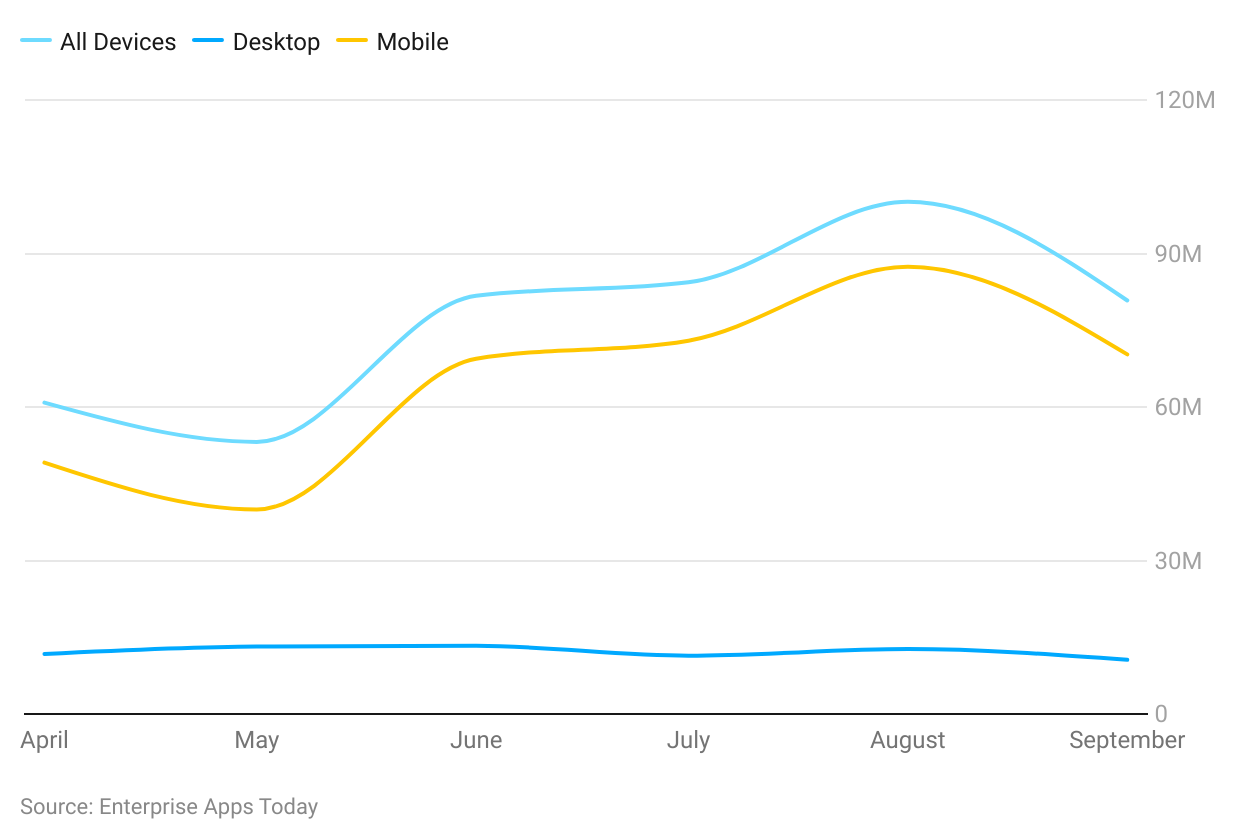

- In terms of website visitors to Adyen.com, the month of October 2022 experienced 41.0 million visits, whereas September recorded 43.3 million visitors.

- The highest number of website visitors was experienced in August 2022 resulting in 47.6 million.

- According to Adyen statistics, in the year 2022 of the first half, the company recorded more than 60% of the value of payment transactions as compared to the year 2021.

- In the first half of the year 2021, the value was 216 billion euros, while. It increased to 300 billion euros by the second half of the year 2021.

- On the other hand, the total value of transactions processed in the first half of the year 2022 was recorded at 325.8 billion euros.

- Customers who support Adyen’s payment are Spotify, LinkedIn, Booking.com, Uber, eBay, Microsoft, Etsy, Gap Inc., Evernote, and many more.

- Adyen has around 12,141 unique domains.

- According to popularity, Adyen ranks 17th in the Netherlands in the payment category, while 15th in Malaysia, 13th in Hong Kong, and 12th most popular payment category in China as well as 5t in Taiwan.

- Currently known websites that support Adyen online payment are around 15,05,784.

- As of August 2023, this payment platform has generated 79.9 million of global traffic.

- In the first half of 2023, Adyen processed 23% higher as compared to early 2022.

- In addition, the company is valued at $21.71 billion as of October 2023.

- Adyen supports more than 250 payment methods as well as has 187 currencies in the database.

- Adyen has 84.82% organic traffic towards their website whereas 15.18% is paid.

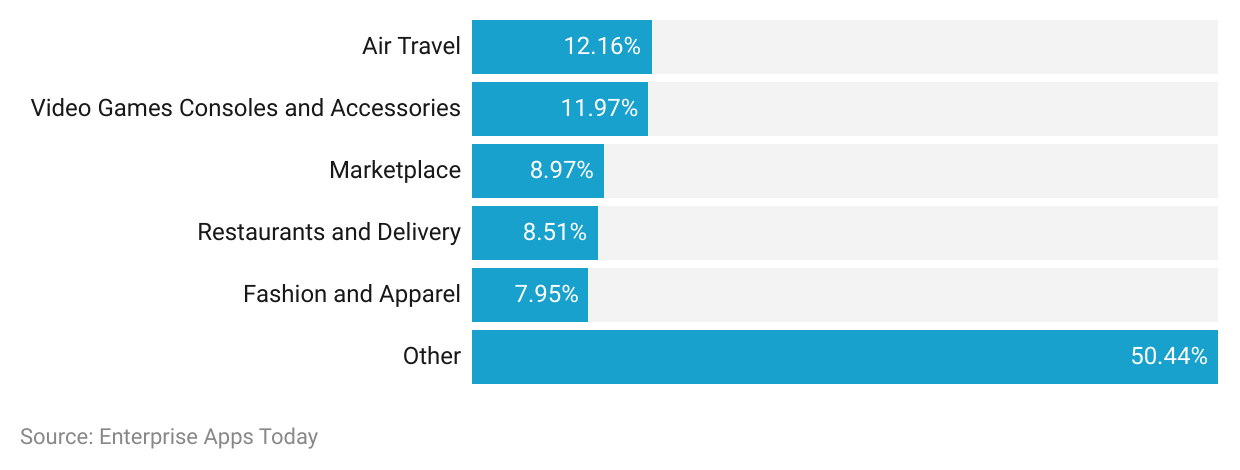

- Adyen’s referral traffic comes mostly from air travel websites resulting in 12.16%.

- While other websites categorized in video game consoles and accessories have referred to around 11.97%.

- Other marketplace websites and restaurants and delivery have contributions of 8.97% and 8.51% respectively.

- The fashion and apparel industry has referred the Adyen’s websites by 7.95%.

- While other sources allocate up to 50.44%.

- Facebook has referred traffic to Adyen resulting in 36.51%, while YouTube and LinkedIn have 26.04% and 12.13% contributed. WhatsApp and Scribd have 6.80% and 4.97% referred traffic through social media respectively.

- Other social media applications are contributing up to 13.54%.

- According to Adyen retail reports, businesses with food and beverages, hospitality, and retail increased their revenue by 67% after investments in digitalization.

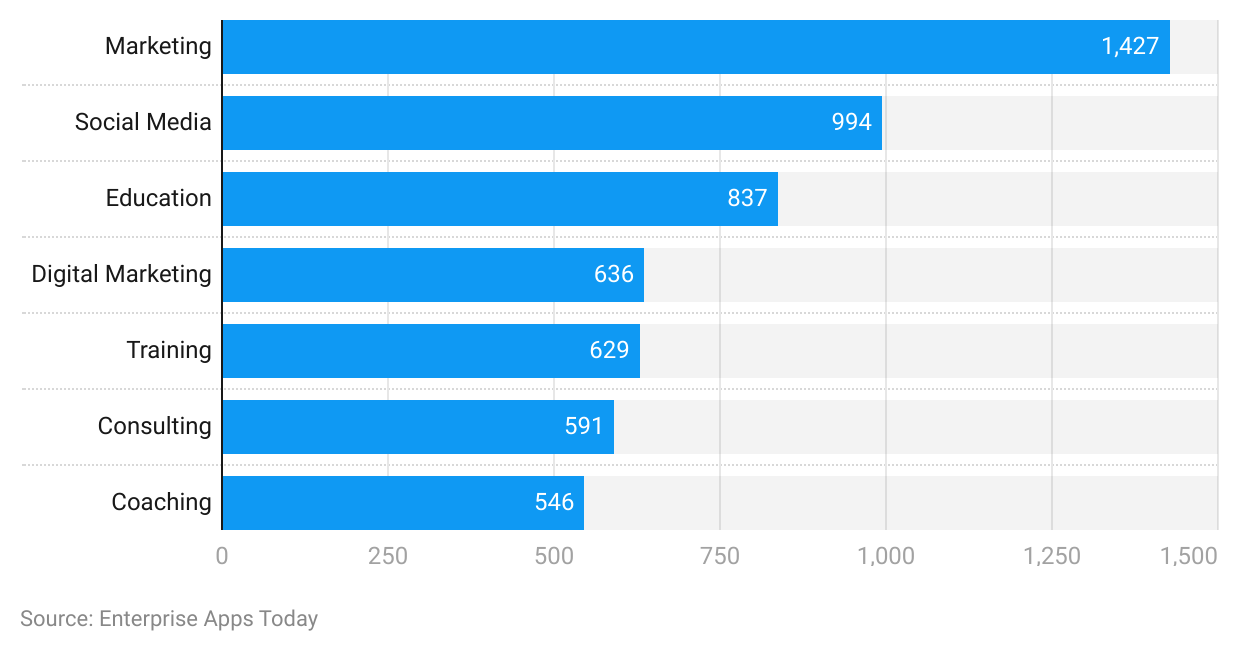

- The above chart shows that the marketing section has supported around 1427 websites for Adyen.

- While some social media and education websites have 994 and 837 websites supporting Adyen payment systems.

- Digital marketing, training, consulting firms, and coaching firms have 636, 629,591, and 546 websites respectively.

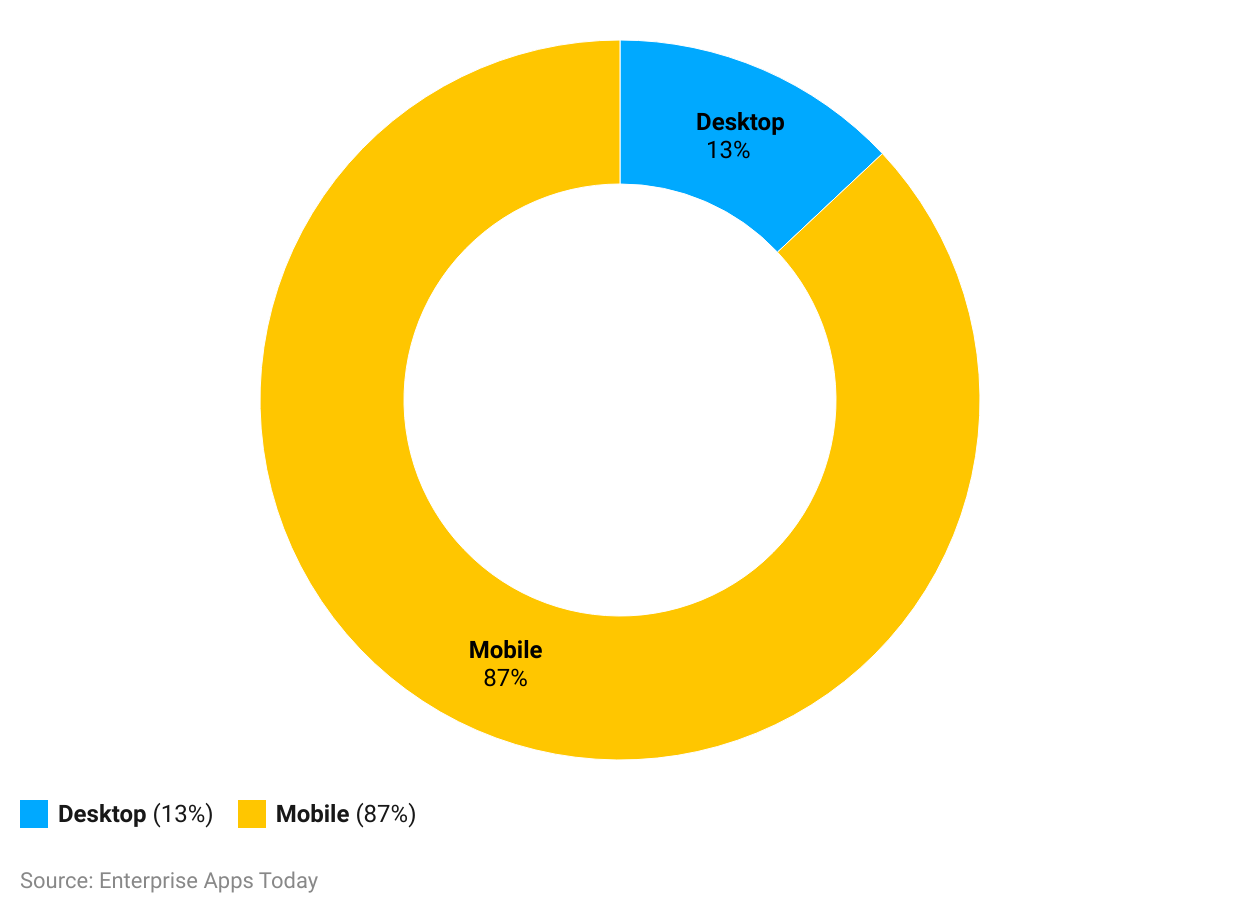

- Considering the customers and their way of visiting the websites,87% of the visitors use mobile and 13% of the users use the desktop version.

- Adyen has around 1.4 million backlinks.

- Marketing channels through which Adyen receives its website traffic, are direct traffic resulting in 8.79%. Referrals with 86.22%.Traffic received from search and social is 2.46% and 1.09% respectively.

- On the other hand, mail and display traffic towards the website is 0.46% and 0.99% each.

(Source: semrush.com)

Over the last 6 months of 2023, the top three countries where the majority of the Adyen users live are Germany, the Netherlands, and Belgium. Moreover, in these top 5 countries including the United Kingdom and the United States of America, users prefer to use mobile devices for payments. The overall number of devices through which payments were made in 2023 was around 79.9 million, out of which mobile devices accounted for 88.4% (70.6 million) and desktop payments contributed by 11.6% (9.2 million).

Adyen Vs Stripe

Stripe

Stripe is an online payment platform that allows local and international payment which includes card payments, ACH payments, multiple local payment methods, and digital wallets. Stripe has a feature to lets merchants set customized payment gateways.

- Stripe is an easy-to-use application.

- The pricing model is also not complex.

- Stripes have options to store cards, subscriptions, and direct payout with the user’s bank.

- It is compatible with all kinds of businesses, small, medium, and large-sized businesses.

- They have 24/7 customer support via email, call, and chat support.

- Stripe is a developer payment platform.

- Multiple currencies accepted, more than 135.

- Always secured payment method.

- Customizable platform.

- There are no monthly charges

- Users have rated it 4.66 out of 5 stars.

- The currency conversion rate is only 1%.

- Supports around 9 credit cards.

- Stripe is supported by 10 industries.

- It has a few frozen accounts complaints.

Adyen

Adyen is a similar online payment platform that provides options as a payment gateway and payment service provider. Adyen uses AI to protect customers’ transactions from fraud and other scams. This platform is a widely accepted online payment method as millions of merchants are integrating their websites with Adyen. Process for international payment is also easy and this platform also has a flexible user interface.

- Multiple payment methods.

- It has merchant support for the sellers with chat, and training in person as well as developer documentation.

- Adyen is also useful for small-scale industries, as well as medium and large-scale industries.

- Accepts payments via, diners club, visa, and V-pay cards, as well as master and maestro cards.

- Access to more than 100 areas of commerce.

- Users have rated it 4 out of 5 stars.

- It is comparatively more difficult to use than Stripe.

- It has customer support via ticket creation.

- Adyen does not accept payment through PayPal.

- Advanced features are available on a paid basis.

- Around 130 currencies are accepted.

- Support around 8 credit cards.

- Available in 29 currencies.

- Supports 20 languages.

- Adyen is supported by at least 5 types of industries.

- It has no frozen account complaint.

Which Is Better?

While taking into consideration both online payment methods, Adyen and Stripe both of the options are both excellent to use. Both have their own distinctive features which enable easy money transfers. But if you are a merchant who focuses on customization then Stripe is a better option for you as it is developer developer-friendly payment platform. On the other hand, Stripe also has a wider international reach than Adyen. However, considering the features of both platforms, Stripe wins. Adyen also has similar features in some cases but loses in terms of charges and supported currencies and payment methods. But both online payment platforms are useful for any kind of business. Therefore, depending on the business requirement, you can choose your own preferred payment method as a merchant.

Conclusion

Technology is evolving day by day and from online transactions, we are going to digital currencies. Platforms such as Adyen is offering multi-currency-based online payment options to ease the daily routine. According to Adyen statistics, it is extremely distinctive from its competitors and has multiple features. Moreover, there are no account opening charges, users can do it for free and only have to pay for transaction costs. There are various online payment platforms and users are using multiple options. It depends on the needs of the customer for which online payment platform is best suited for him/her.

Sources

FAQ.

Adyen is an online payment platform available in offline stores as well which lets the users transfer the money easily while shopping online.

Adyen is extremely safe to use as it uses artificial intelligence based fraud and scam detection which keep the merchants as well as customers protected at all times.

Because it offers all in one payment platform and is distinctive from its competitors

Yes. You can absolutely make international payments using Adyen.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.